Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is all the information I have for this problem. A Form 1040, Schedule 1, Schedule 2, Schedule 3, Schedule A, Schedule B, Schedule C,

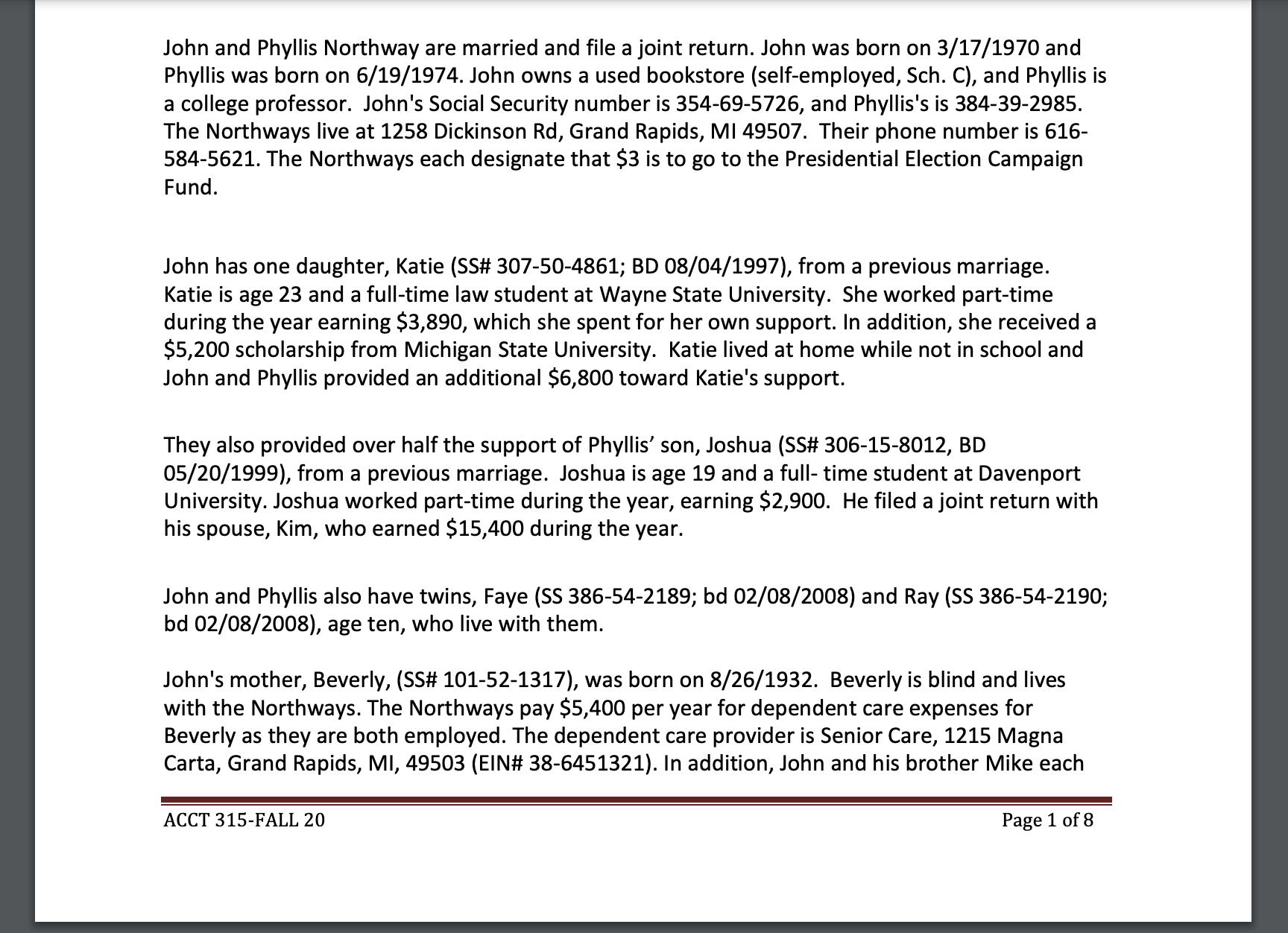

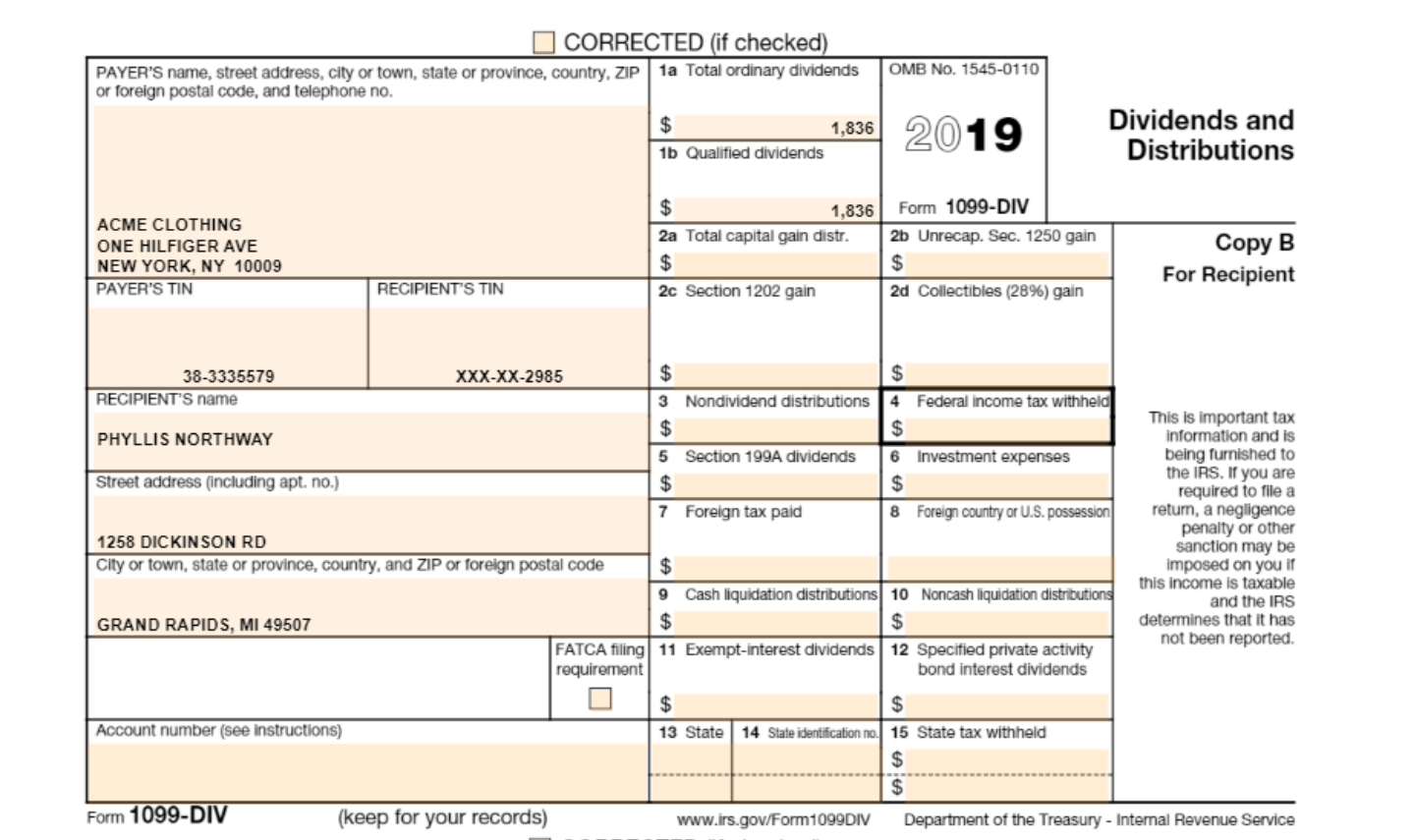

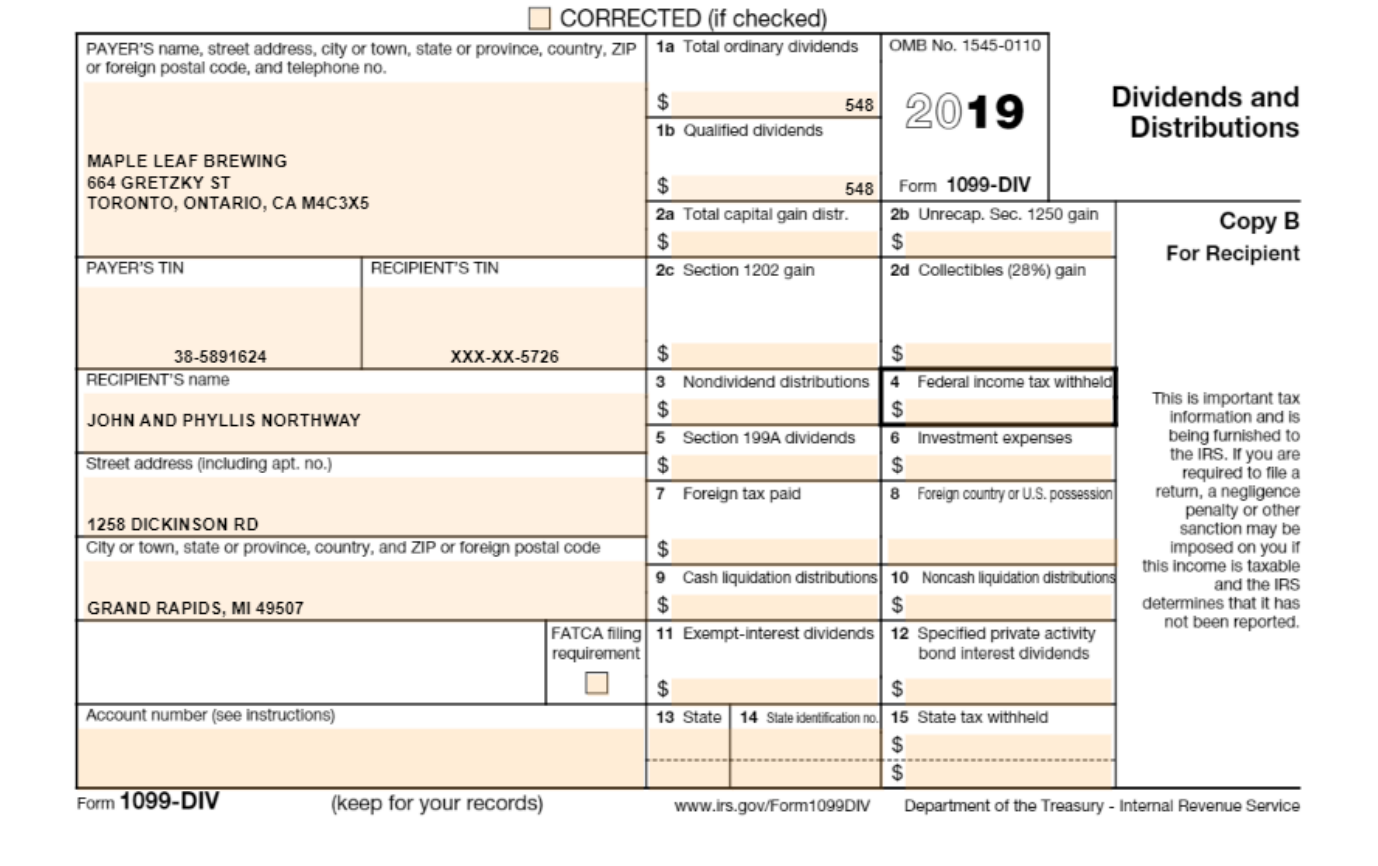

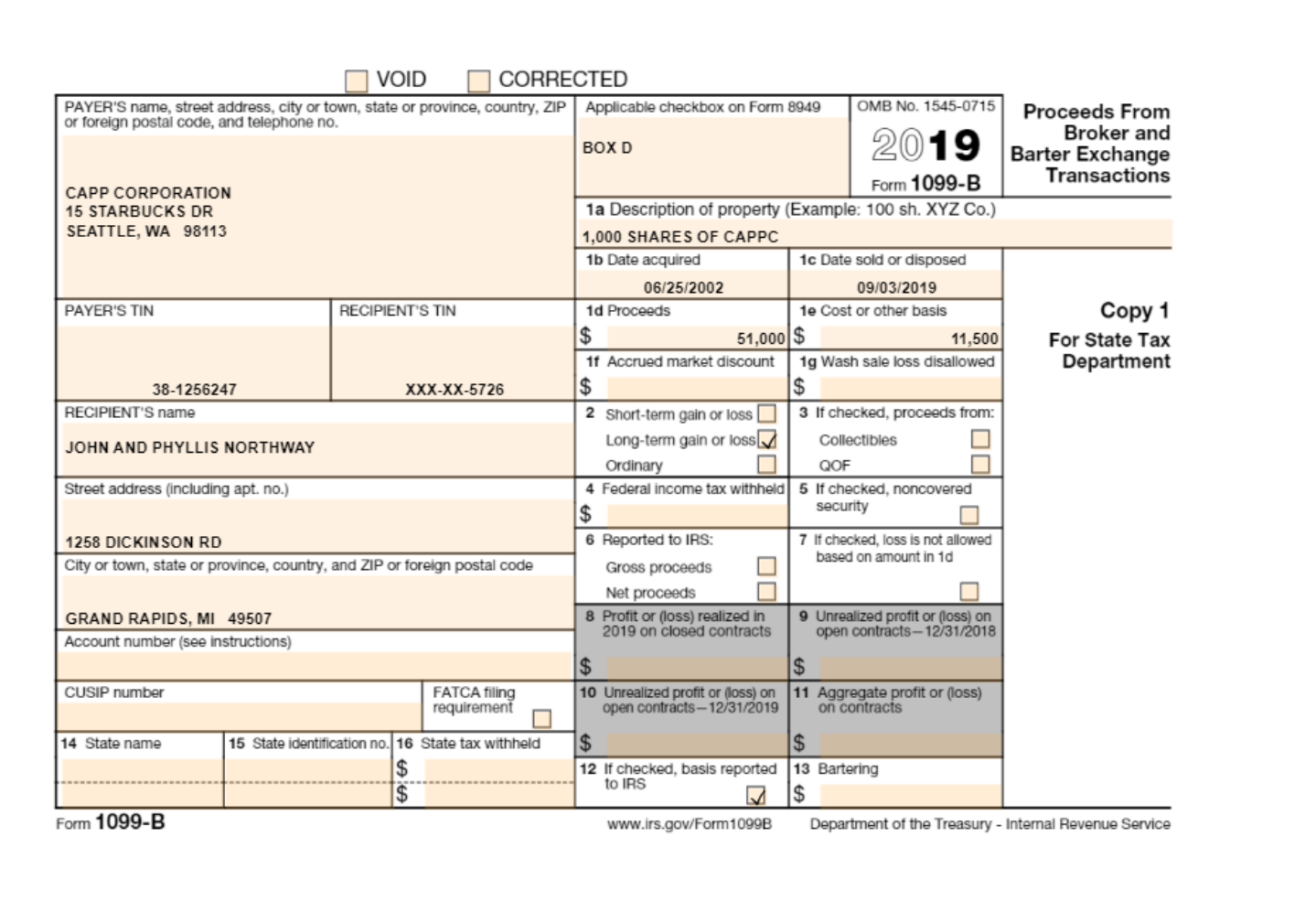

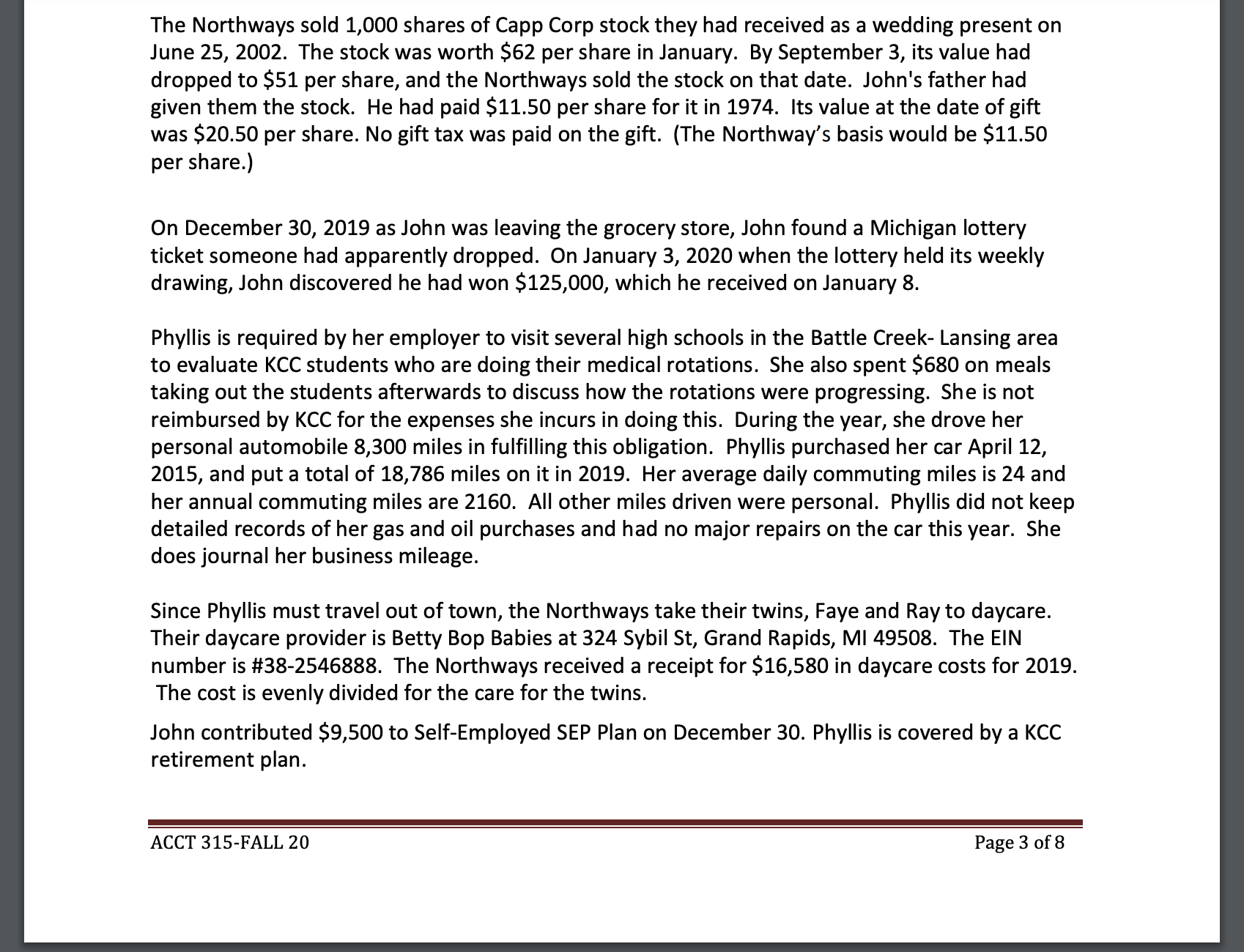

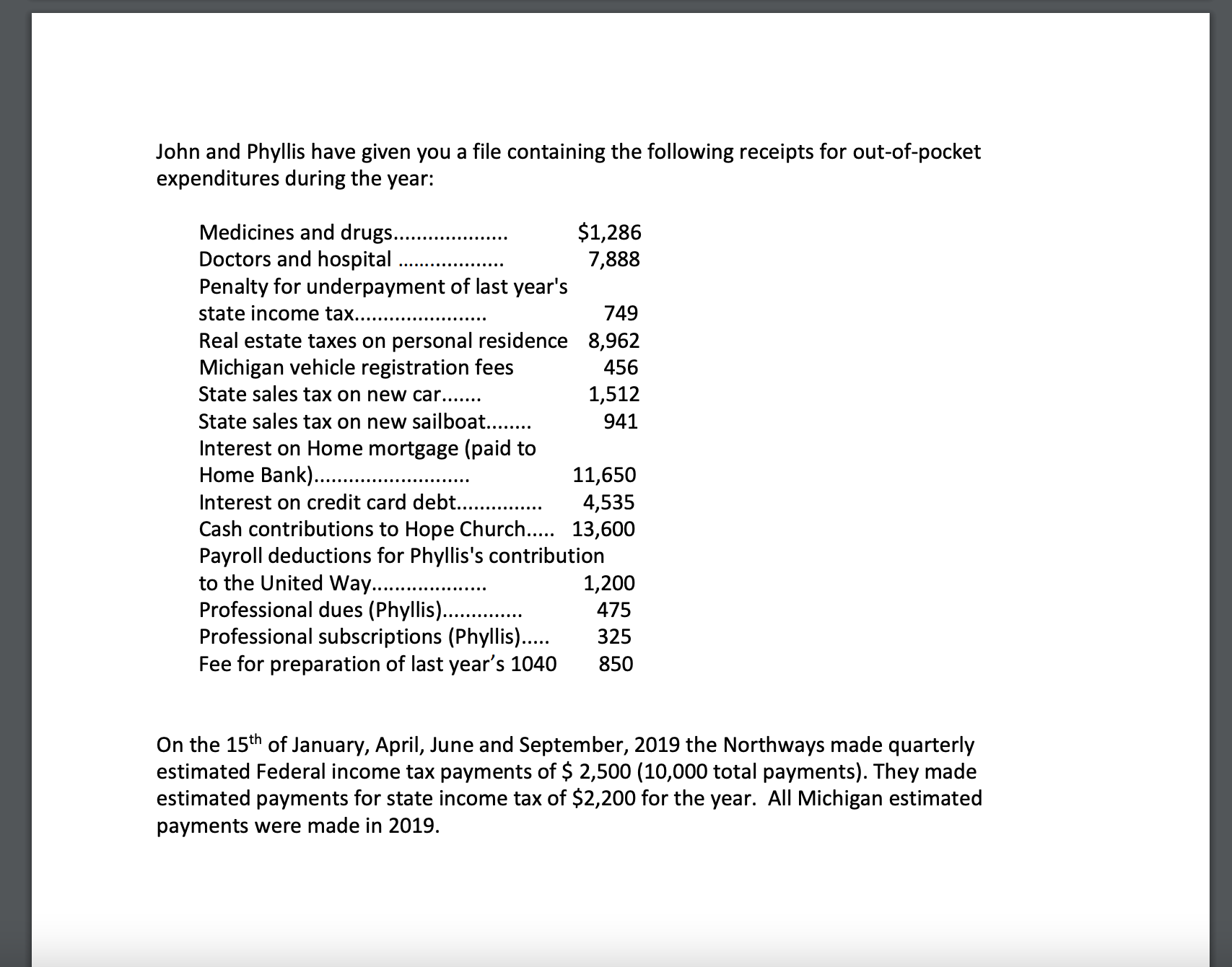

This is all the information I have for this problem. A Form 1040, Schedule 1, Schedule 2, Schedule 3, Schedule A, Schedule B, Schedule C, Schedule D, Schedule E, Schedule SE and Forms 2441, 4562, 8995, and 8949 are required of me to be filled out based on this information. I need help filling out the Schedule D and Form 8949.

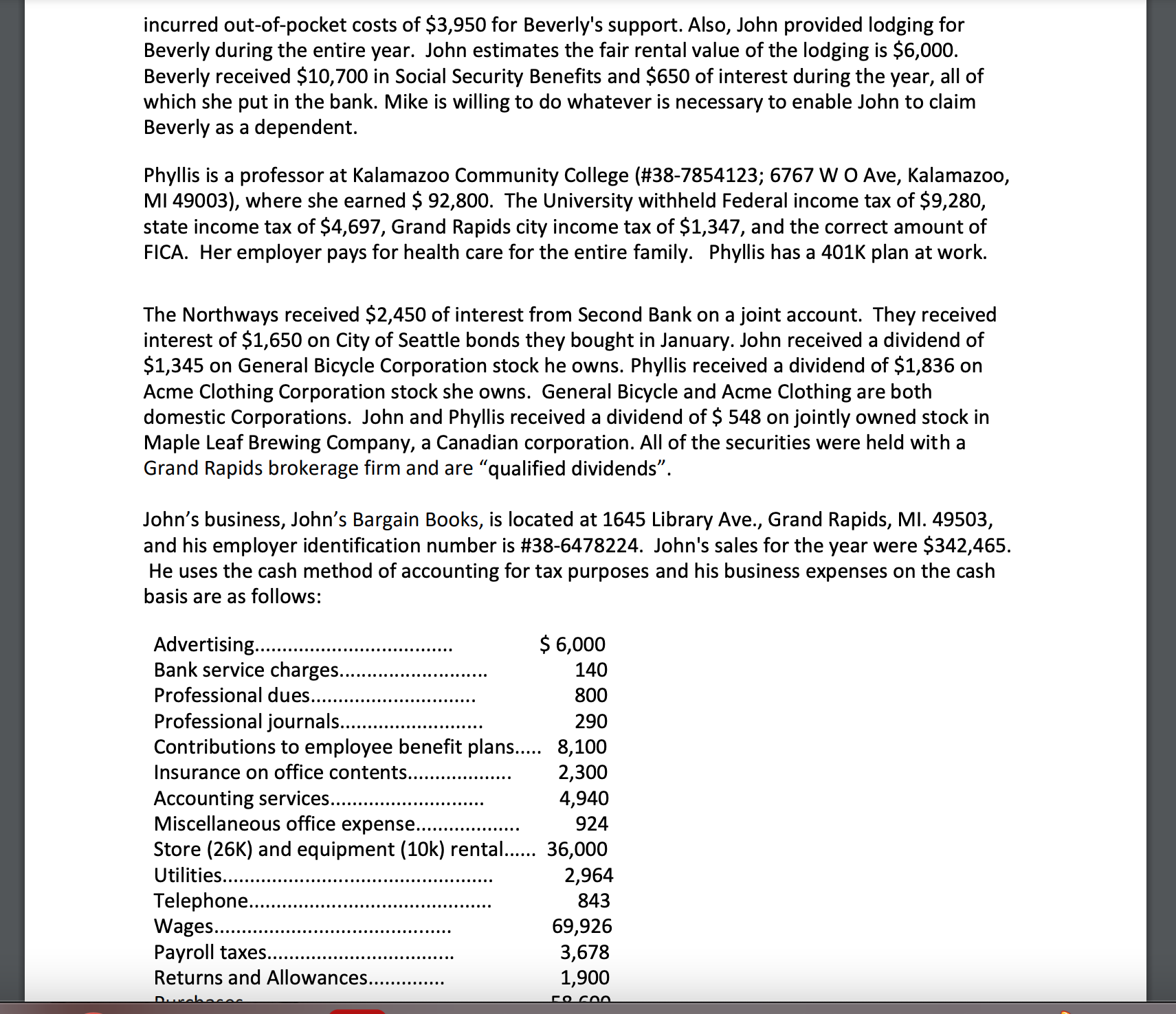

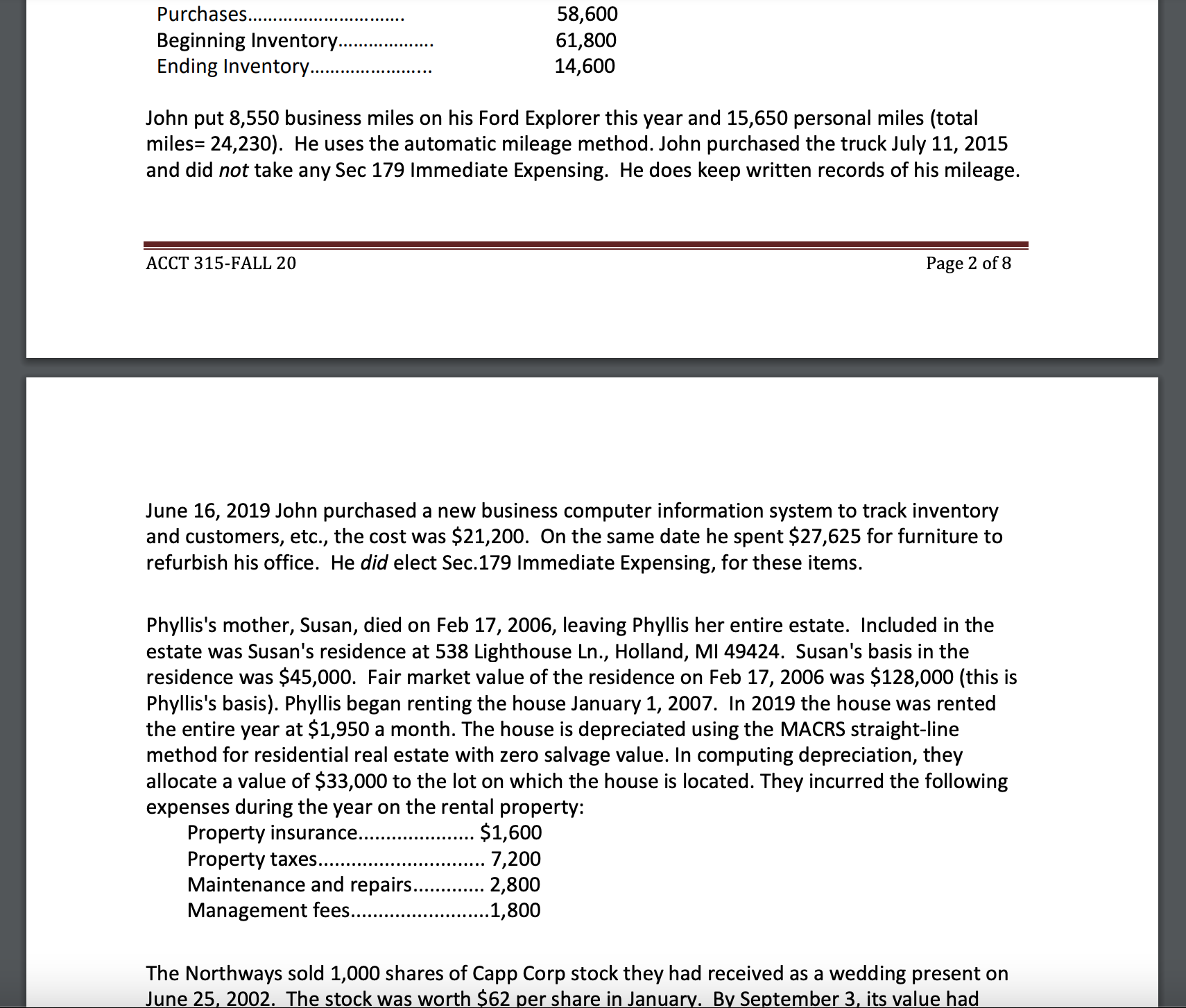

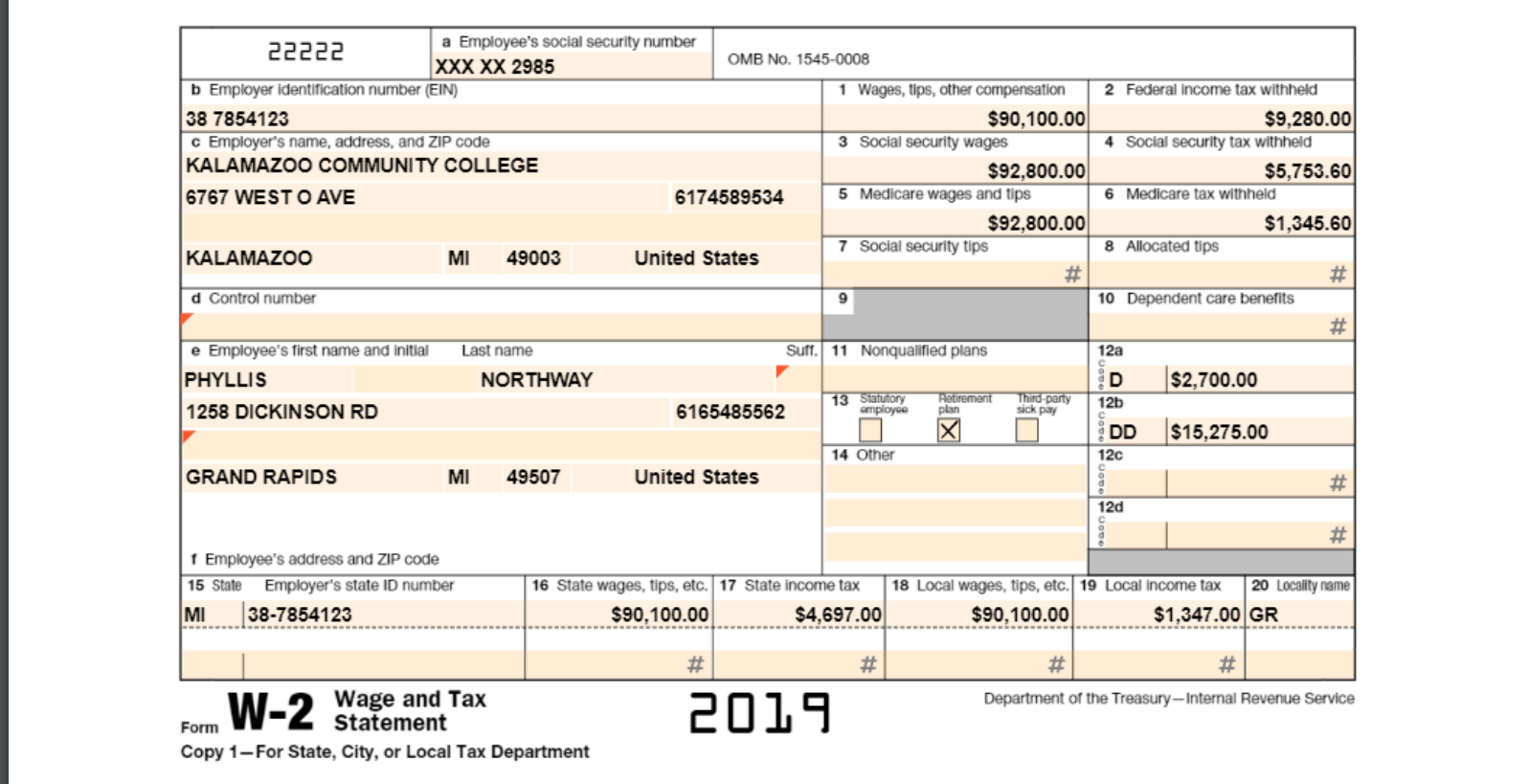

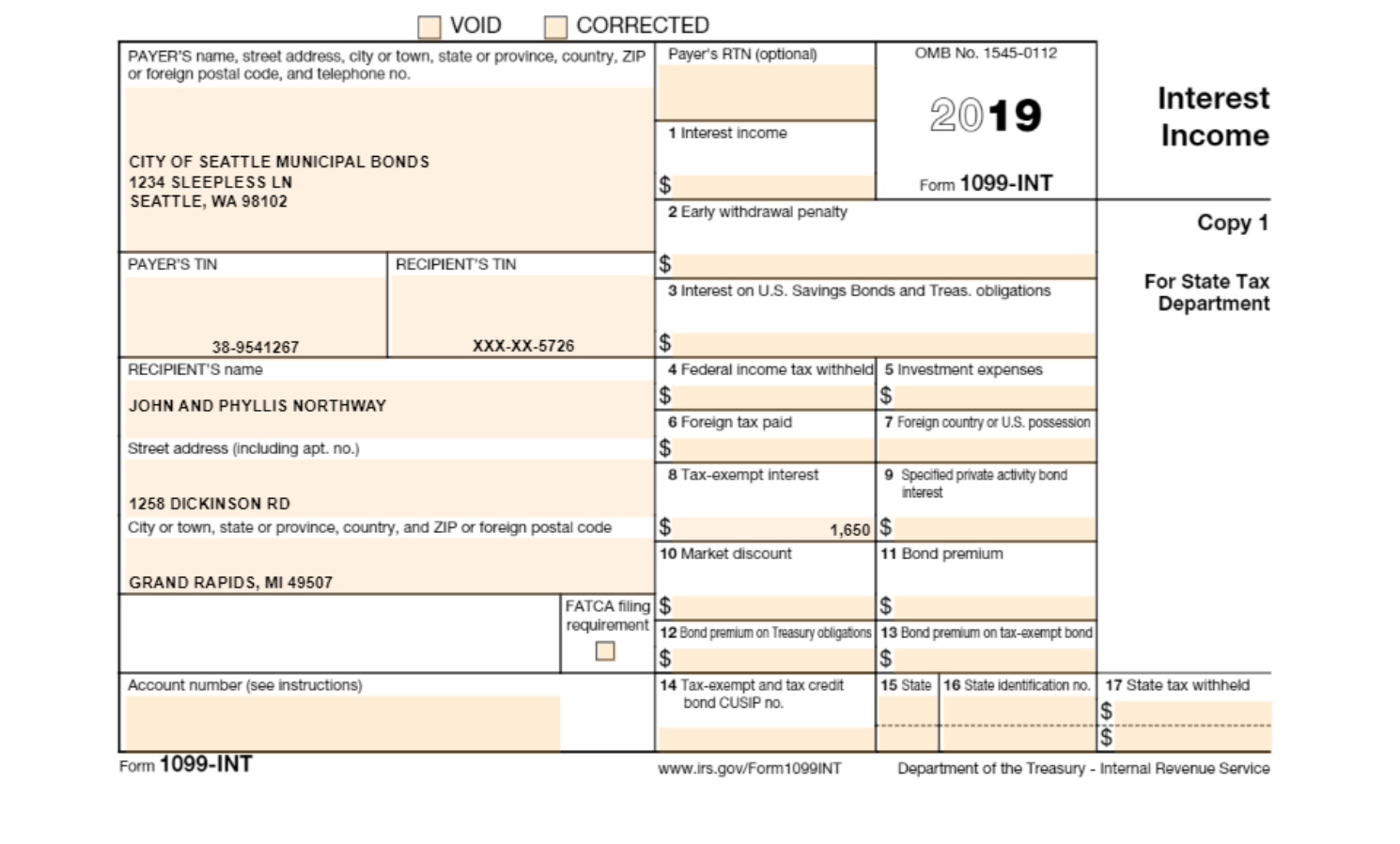

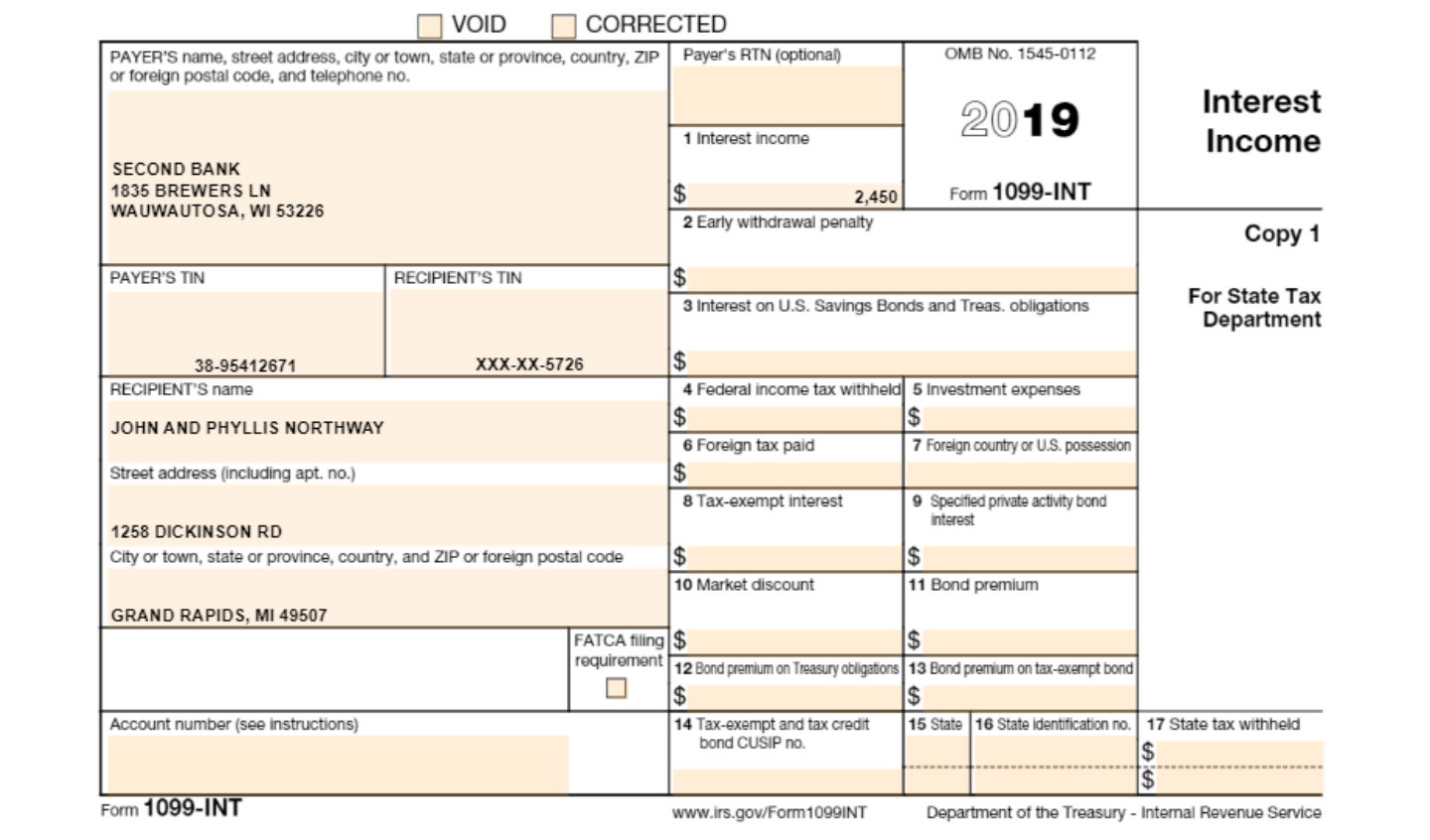

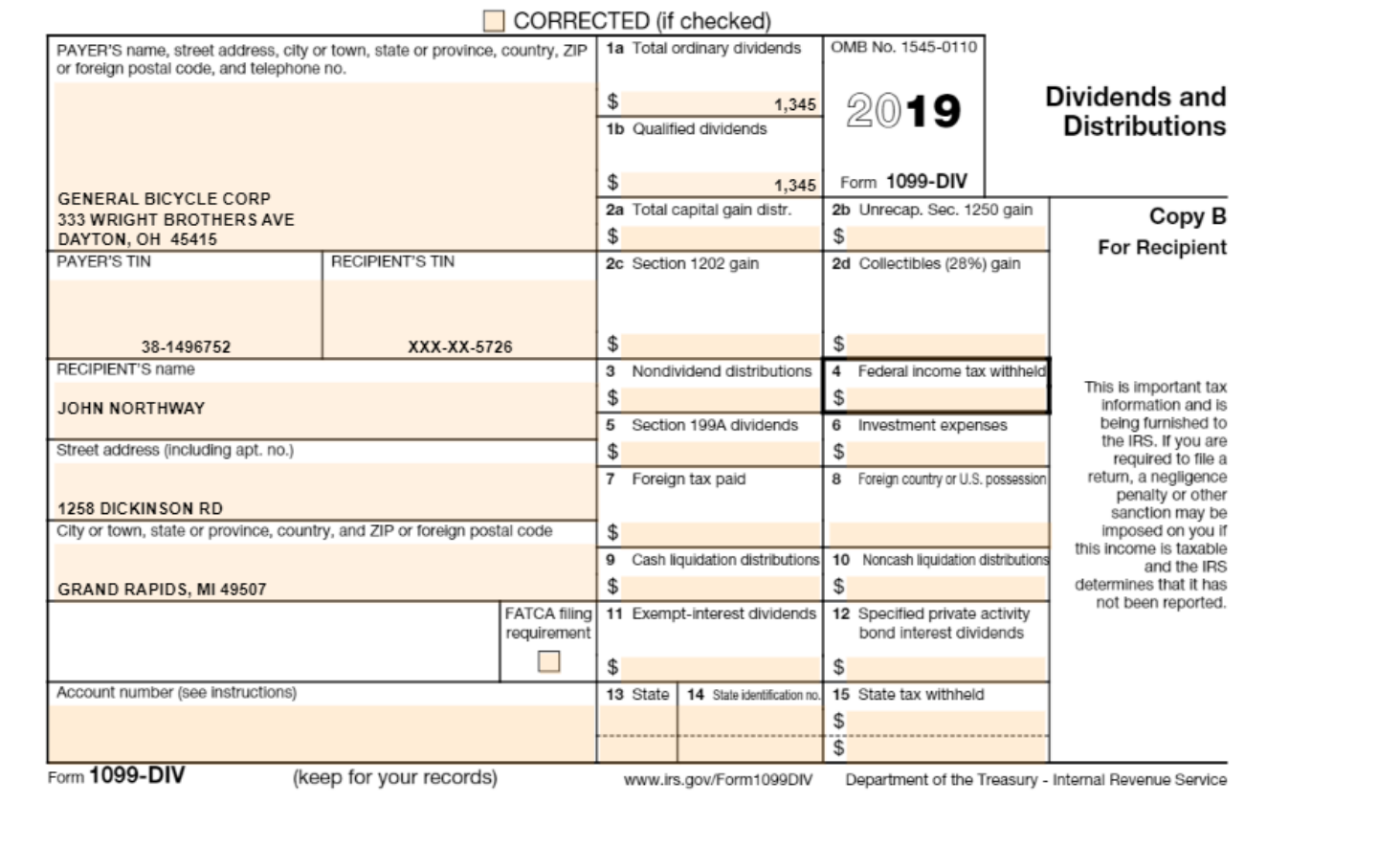

John and Phyllis Northway are married and file a joint return. John was born on 3/17/1970 and Phyllis was born on 6/19/1974. John owns a used bookstore (self-employed, Sch. C), and Phyllis is a college professor. John's Social Security number is 354-69-5726, and Phyllis's is 384-39-2985. The Northways live at 1258 Dickinson Rd, Grand Rapids, MI 49507. Their phone number is 616- 584-5621. The Northways each designate that $3 is to go to the Presidential Election Campaign Fund. John has one daughter, Katie (SS# 307-50-4861; BD 08/04/1997), from a previous marriage. Katie is age 23 and a full-time law student at Wayne State University. She worked part-time during the year earning $3,890, which she spent for her own support. In addition, she received a $5,200 scholarship from Michigan State University. Katie lived at home while not in school and John and Phyllis provided an additional $6,800 toward Katie's support. They also provided over half the support of Phyllis' son, Joshua (SS# 306-15-8012, BD 05/20/1999), from a previous marriage. Joshua is age 19 and a full-time student at Davenport University. Joshua worked part-time during the year, earning $2,900. He filed a joint return with his spouse, Kim, who earned $15,400 during the year. John and Phyllis also have twins, Faye (SS 386-54-2189; bd 02/08/2008) and Ray (SS 386-54-2190; bd 02/08/2008), age ten, who live with them. John's mother, Beverly, (SS# 101-52-1317), was born on 8/26/1932. Beverly is blind and lives with the Northways. The Northways pay $5,400 per year for dependent care expenses for Beverly as they are both employed. The dependent care provider is Senior Care, 1215 Magna Carta, Grand Rapids, MI, 49503 (EIN# 38-6451321). In addition, John and his brother Mike each ACCT 315-FALL 20 Page 1 of 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations for the Northways tax return Part 1 Filing Status and Exemptions John and Phyllis file a joint return since they are married Johns DOB 3171970 age is 52 Phyllis DOB 6191974 age is 47 Personal Exemption ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started