Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There is a proposal to procure a machine that will manufacture new kitchenware. It will cost OMR 1,550,000, with 70% to be paid initially

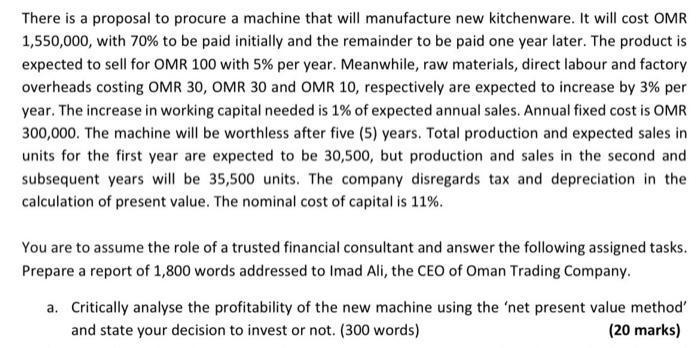

There is a proposal to procure a machine that will manufacture new kitchenware. It will cost OMR 1,550,000, with 70% to be paid initially and the remainder to be paid one year later. The product is expected to sell for OMR 100 with 5% per year. Meanwhile, raw materials, direct labour and factory overheads costing OMR 30, OMR 30 and OMR 10, respectively are expected to increase by 3% per year. The increase in working capital needed is 1% of expected annual sales. Annual fixed cost is OMR 300,000. The machine will be worthless after five (5) years. Total production and expected sales in units for the first year are expected to be 30,500, but production and sales in the second and subsequent years will be 35,500 units. The company disregards tax and depreciation in the calculation of present value. The nominal cost of capital is 11%. You are to assume the role of a trusted financial consultant and answer the following assigned tasks. Prepare a report of 1,800 words addressed to Imad Ali, the CEO of Oman Trading Company. a. Critically analyse the profitability of the new machine using the 'net present value method' and state your decision to invest or not. (300 words) (20 marks)

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Report to Imad Ali CEO of Oman Trading Company Subject Analysis of the Profitability of Procuring a New Machine Dear Mr Ali I hope this message finds ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started