Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is all the information i have on this question. what more information do you need? Q, the company's treasurer and tax matters shareholder, is

this is all the information i have on this question.

what more information do you need?

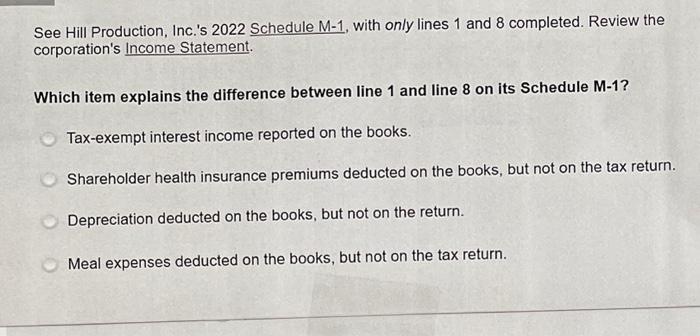

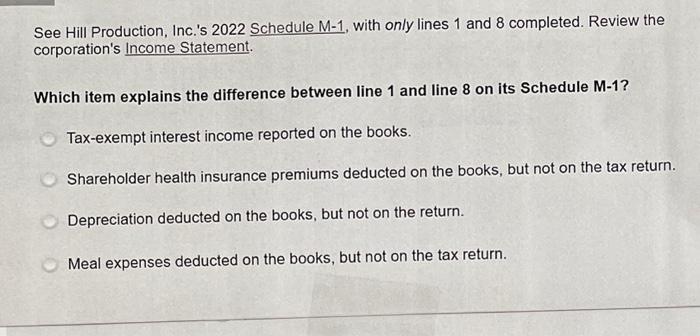

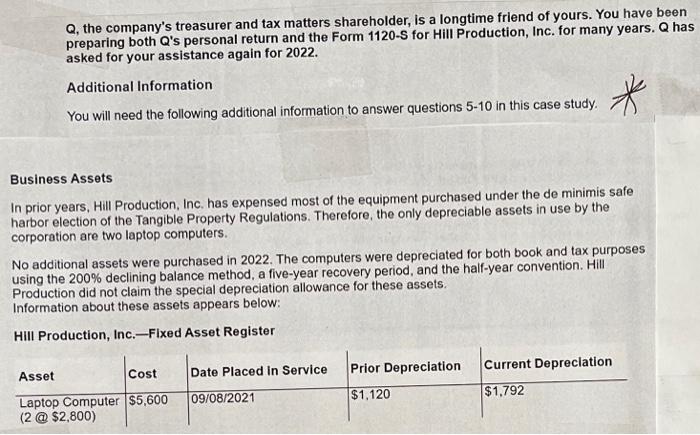

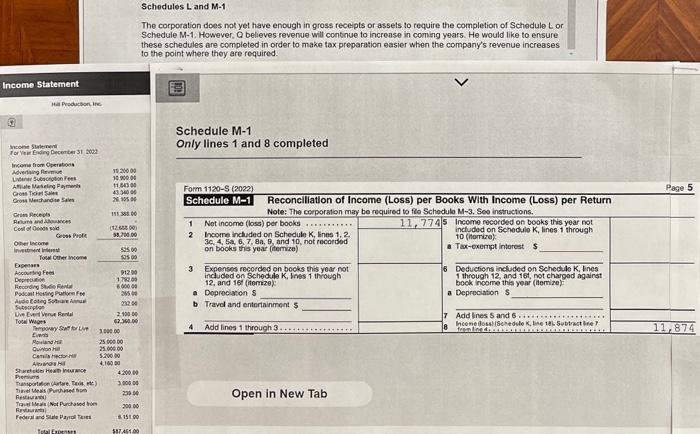

Q, the company's treasurer and tax matters shareholder, is a longtime friend of yours. You have beer preparing both Q's personal return and the Form 1120-S for Hill Production, Inc. for many years. Q h asked for your assistance again for 2022. Additional Information You will need the following additional information to answer questions 5-10 in this case study. Business Assets In prior years, Hill Production, Inc. has expensed most of the equipment purchased under the de minimis safe harbor election of the Tangible Property Regulations. Therefore, the only depreciable assets in use by the corporation are two laptop computers. No additional assets were purchased in 2022. The computers were depreciated for both book and tax purposes using the 200% declining balance method, a five-year recovery period, and the half-year convention. Hill Production did not claim the special depreciation allowance for these assets. Information about these assets appears below: HIII Production, Inc.-Fixed Asset Register See Hill Production, Inc.'s 2022 Schedule M-1, with only lines 1 and 8 completed. Review the corporation's Income Statement. Which item explains the difference between line 1 and line 8 on its Schedule M-1? Tax-exempt interest income reported on the books. Shareholder health insurance premiums deducted on the books, but not on the tax return. Depreciation deducted on the books, but not on the return. Meal expenses deducted on the books, but not on the tax return. The corporation does not yet have enough in gross receipts or assets to require the completion of Schedule L or Schedule M-1. However, Q believes revenue will continue to increase in coming years. He would like to ensure these schedules are completed in order to make tax preparation easier when the company's revenue increases to the point where they are required. Schedule M-1 Only lines 1 and 8 completed Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started