Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is all the information I was given. Use the following information on a mortgage-backed security for Problems 15. You are examining a mortgage-backed security

This is all the information I was given.

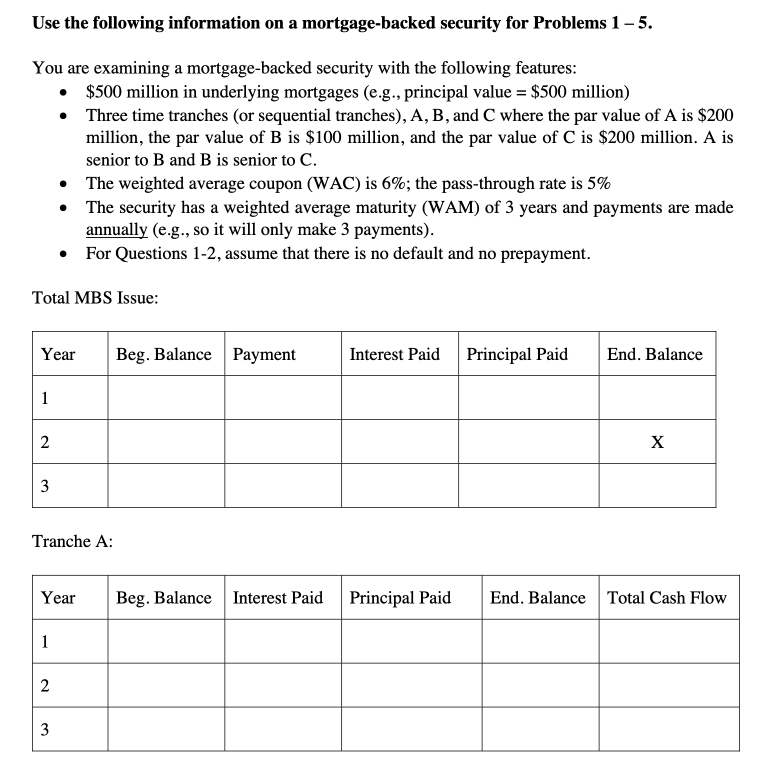

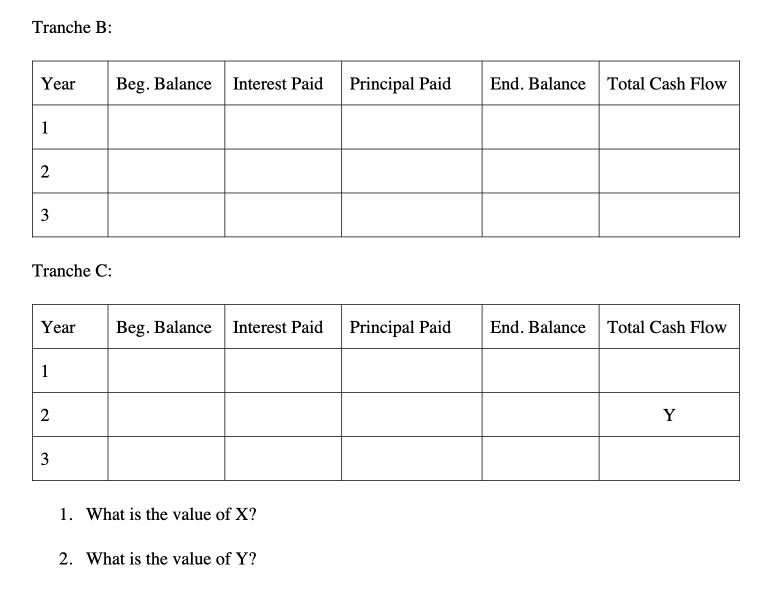

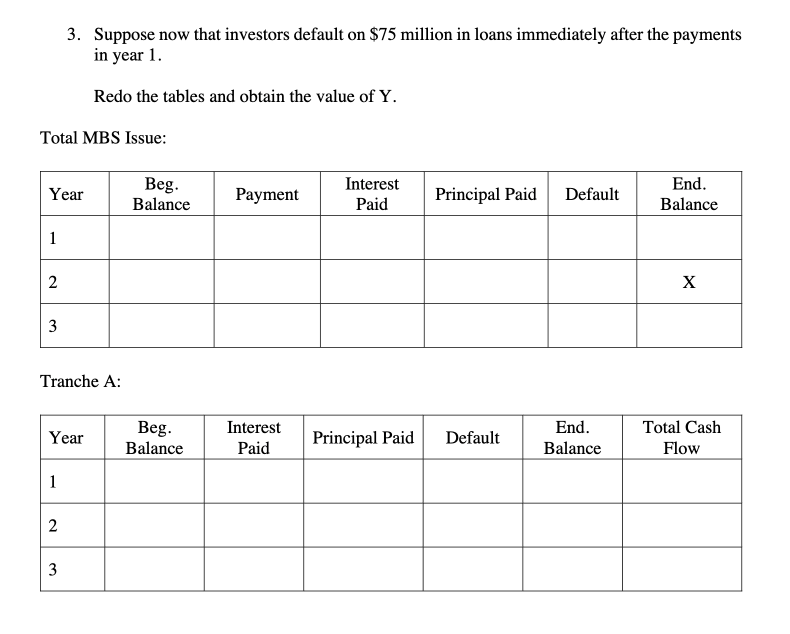

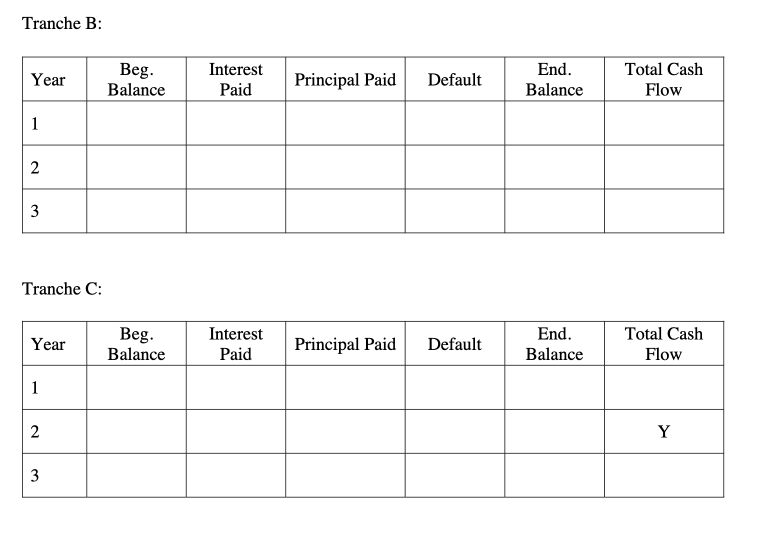

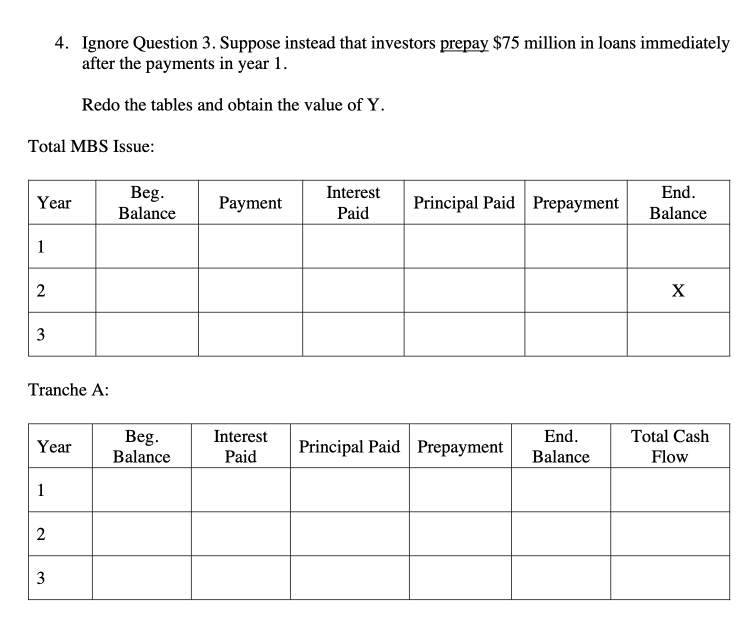

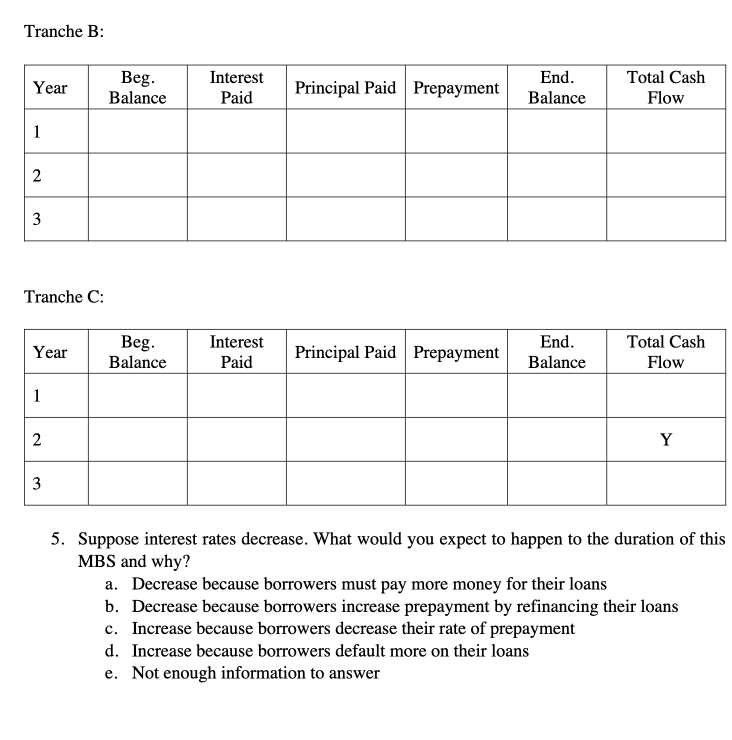

Use the following information on a mortgage-backed security for Problems 15. You are examining a mortgage-backed security with the following features: - $500 million in underlying mortgages (e.g., principal value =$500 million) - Three time tranches (or sequential tranches), A, B, and C where the par value of A is $200 million, the par value of B is $100 million, and the par value of C is $200 million. A is senior to B and B is senior to C. - The weighted average coupon (WAC) is 6%; the pass-through rate is 5% - The security has a weighted average maturity (WAM) of 3 years and payments are made annually (e.g., so it will only make 3 payments). - For Questions 1-2, assume that there is no default and no prepayment. Total MBS Issue: Tranche A: Tranche B: Tranche C: [- 1. What is the value of X ? 2. What is the value of Y ? 3. Suppose now that investors default on $75 million in loans immediately after the payments in year 1 . Redo the tables and obtain the value of Y. Total MBS Issue: Tranche A: Tranche B: Tranche C: 4. Ignore Question 3. Suppose instead that investors prepay $75 million in loans immediately after the payments in year 1 . Redo the tables and obtain the value of Y. Total MBS Issue: Tranche A: Tranche B: Tranche C: 5. Suppose interest rates decrease. What would you expect to happen to the duration of thi MBS and why? a. Decrease because borrowers must pay more money for their loans b. Decrease because borrowers increase prepayment by refinancing their loans c. Increase because borrowers decrease their rate of prepayment d. Increase because borrowers default more on their loans e. Not enough information to answer Use the following information on a mortgage-backed security for Problems 15. You are examining a mortgage-backed security with the following features: - $500 million in underlying mortgages (e.g., principal value =$500 million) - Three time tranches (or sequential tranches), A, B, and C where the par value of A is $200 million, the par value of B is $100 million, and the par value of C is $200 million. A is senior to B and B is senior to C. - The weighted average coupon (WAC) is 6%; the pass-through rate is 5% - The security has a weighted average maturity (WAM) of 3 years and payments are made annually (e.g., so it will only make 3 payments). - For Questions 1-2, assume that there is no default and no prepayment. Total MBS Issue: Tranche A: Tranche B: Tranche C: [- 1. What is the value of X ? 2. What is the value of Y ? 3. Suppose now that investors default on $75 million in loans immediately after the payments in year 1 . Redo the tables and obtain the value of Y. Total MBS Issue: Tranche A: Tranche B: Tranche C: 4. Ignore Question 3. Suppose instead that investors prepay $75 million in loans immediately after the payments in year 1 . Redo the tables and obtain the value of Y. Total MBS Issue: Tranche A: Tranche B: Tranche C: 5. Suppose interest rates decrease. What would you expect to happen to the duration of thi MBS and why? a. Decrease because borrowers must pay more money for their loans b. Decrease because borrowers increase prepayment by refinancing their loans c. Increase because borrowers decrease their rate of prepayment d. Increase because borrowers default more on their loans e. Not enough information toStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started