Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is all the information provided in the letter. I just need a 1 page explaining and referencing FASB Codifications. Formal Letter #4: Earnings Per

This is all the information provided in the letter. I just need a 1 page explaining and referencing FASB Codifications.

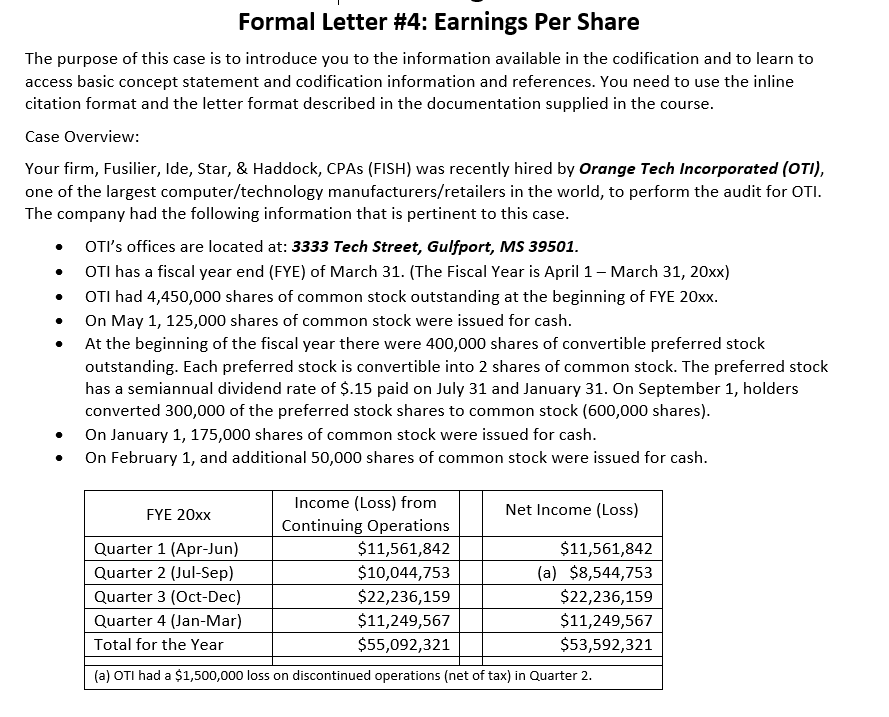

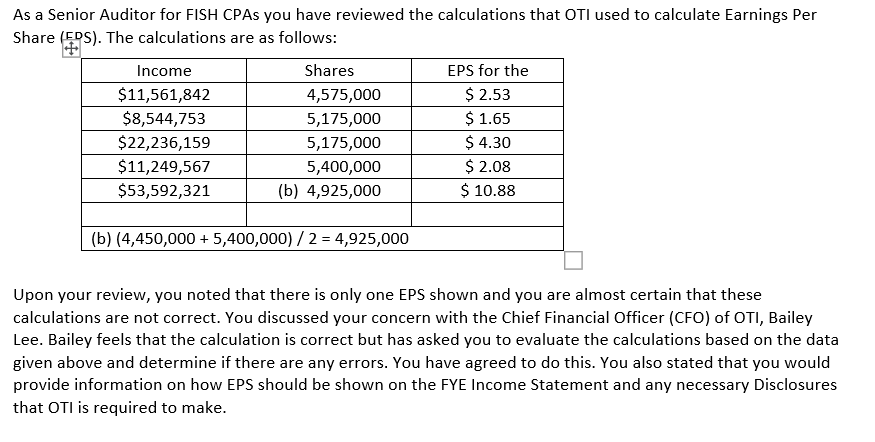

Formal Letter #4: Earnings Per Share The purpose of this case is to introduce you to the information available in the codification and to learn to access basic concept statement and codification information and references. You need to use the inline citation format and the letter format described in the documentation supplied in the course. Case Overview: Your firm, Fusilier, Ide, Star, & Haddock, CPAS (FISH) was recently hired by Orange Tech Incorporated (OTI), one of the largest computer/technology manufacturers/retailers in the world, to perform the audit for OTI. The company had the following information that is pertinent to this case. OTI's offices are located at: 3333 Tech Street, Gulfport, MS 39501. OTI has a fiscal year end (FYE) of March 31. (The Fiscal Year is April 1 - March 31, 20xx) OTI had 4,450,000 shares of common stock outstanding at the beginning of FYE 20xx. On May 1, 125,000 shares of common stock were issued for cash. At the beginning of the fiscal year there were 400,000 shares of convertible preferred stock outstanding. Each preferred stock is convertible into 2 shares of common stock. The preferred stock has a semiannual dividend rate of $.15 paid on July 31 and January 31. On September 1, holders converted 300,000 of the preferred stock shares to common stock (600,000 shares). On January 1, 175,000 shares of common stock were issued for cash. On February 1, and additional 50,000 shares of common stock were issued for cash. Income (Loss) from Net Income (Loss) FYE 20xx Continuing Operations Quarter 1 (Apr-Jun) $11,561,842 Quarter 2 (Jul-Sep) $10,044,753 Quarter 3 (Oct-Dec) $22,236,159 Quarter 4 (Jan-Mar) $11,249,567 Total for the Year $55,092,321 (a) OTI had a $1,500,000 loss on discontinued operations (net of tax) in Quarter 2. $11,561,842 (a) $8,544,753 $22,236,159 $11,249,567 $53,592,321 As a Senior Auditor for FISH CPAs you have reviewed the calculations that OTI used to calculate Earnings Per Share (EDS). The calculations are as follows: Income Shares EPS for the $11,561,842 4,575,000 $ 2.53 $8,544,753 5,175,000 $ 1.65 $22,236,159 5,175,000 $ 4.30 $11,249,567 5,400,000 $ 2.08 $53,592,321 (b) 4,925,000 $ 10.88 (b) (4,450,000 + 5,400,000)/2 = 4,925,000 Upon your review, you noted that there is only one EPS shown and you are almost certain that these calculations are not correct. You discussed your concern with the Chief Financial Officer (CFO) of OTI, Bailey Lee. Bailey feels that the calculation is correct but has asked you to evaluate the calculations based on the data given above and determine if there are any errors. You have agreed to do this. You also stated that you would provide information on how EPS should be shown on the FYE Income Statement and any necessary Disclosures that OTI is required to make. Formal Letter #4: Earnings Per Share The purpose of this case is to introduce you to the information available in the codification and to learn to access basic concept statement and codification information and references. You need to use the inline citation format and the letter format described in the documentation supplied in the course. Case Overview: Your firm, Fusilier, Ide, Star, & Haddock, CPAS (FISH) was recently hired by Orange Tech Incorporated (OTI), one of the largest computer/technology manufacturers/retailers in the world, to perform the audit for OTI. The company had the following information that is pertinent to this case. OTI's offices are located at: 3333 Tech Street, Gulfport, MS 39501. OTI has a fiscal year end (FYE) of March 31. (The Fiscal Year is April 1 - March 31, 20xx) OTI had 4,450,000 shares of common stock outstanding at the beginning of FYE 20xx. On May 1, 125,000 shares of common stock were issued for cash. At the beginning of the fiscal year there were 400,000 shares of convertible preferred stock outstanding. Each preferred stock is convertible into 2 shares of common stock. The preferred stock has a semiannual dividend rate of $.15 paid on July 31 and January 31. On September 1, holders converted 300,000 of the preferred stock shares to common stock (600,000 shares). On January 1, 175,000 shares of common stock were issued for cash. On February 1, and additional 50,000 shares of common stock were issued for cash. Income (Loss) from Net Income (Loss) FYE 20xx Continuing Operations Quarter 1 (Apr-Jun) $11,561,842 Quarter 2 (Jul-Sep) $10,044,753 Quarter 3 (Oct-Dec) $22,236,159 Quarter 4 (Jan-Mar) $11,249,567 Total for the Year $55,092,321 (a) OTI had a $1,500,000 loss on discontinued operations (net of tax) in Quarter 2. $11,561,842 (a) $8,544,753 $22,236,159 $11,249,567 $53,592,321 As a Senior Auditor for FISH CPAs you have reviewed the calculations that OTI used to calculate Earnings Per Share (EDS). The calculations are as follows: Income Shares EPS for the $11,561,842 4,575,000 $ 2.53 $8,544,753 5,175,000 $ 1.65 $22,236,159 5,175,000 $ 4.30 $11,249,567 5,400,000 $ 2.08 $53,592,321 (b) 4,925,000 $ 10.88 (b) (4,450,000 + 5,400,000)/2 = 4,925,000 Upon your review, you noted that there is only one EPS shown and you are almost certain that these calculations are not correct. You discussed your concern with the Chief Financial Officer (CFO) of OTI, Bailey Lee. Bailey feels that the calculation is correct but has asked you to evaluate the calculations based on the data given above and determine if there are any errors. You have agreed to do this. You also stated that you would provide information on how EPS should be shown on the FYE Income Statement and any necessary Disclosures that OTI is required to makeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started