This is all the information provided on the question. The green boxes mean that the answers are correct.

This is all the information provided on the question. The green boxes mean that the answers are correct.

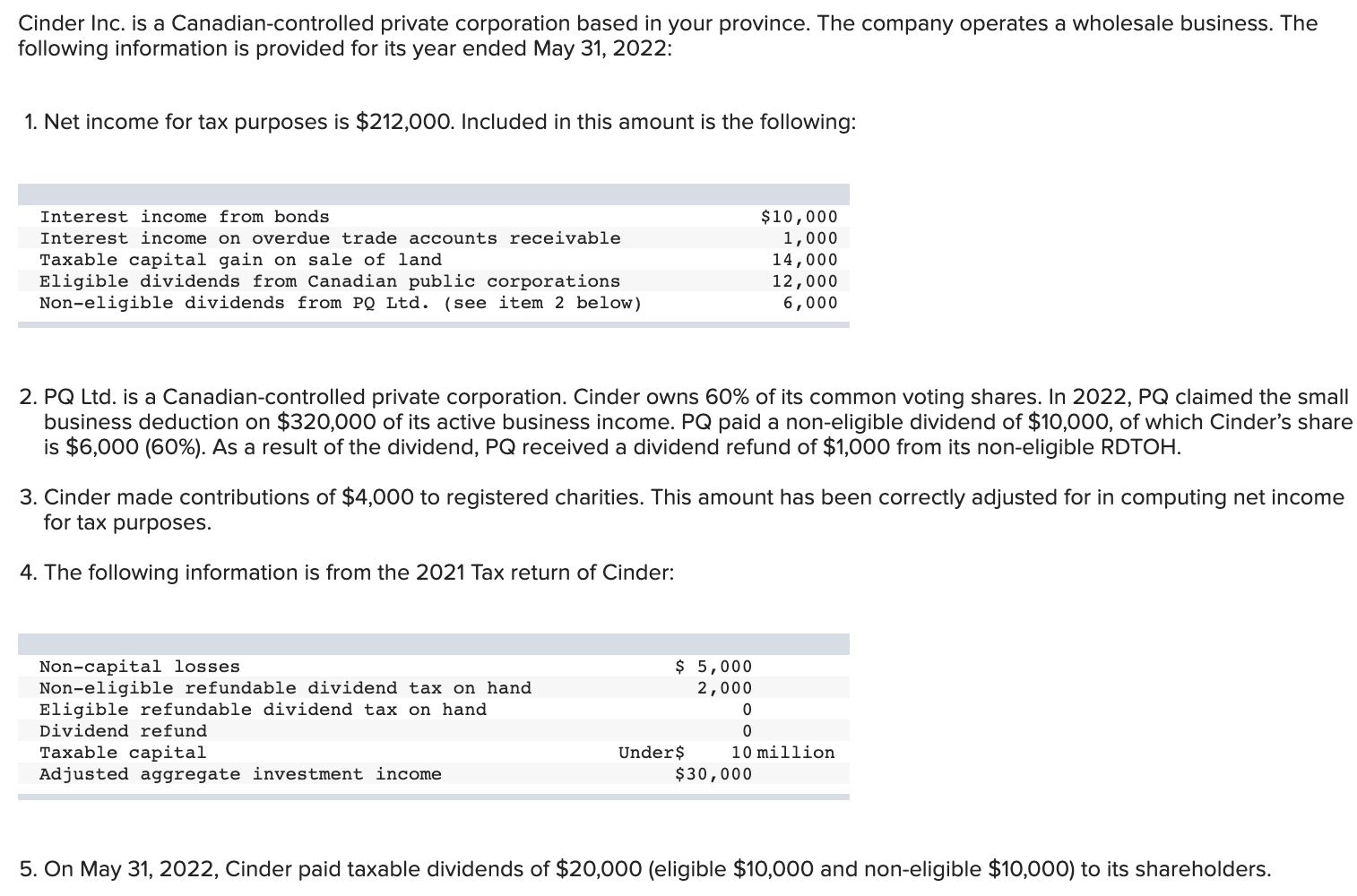

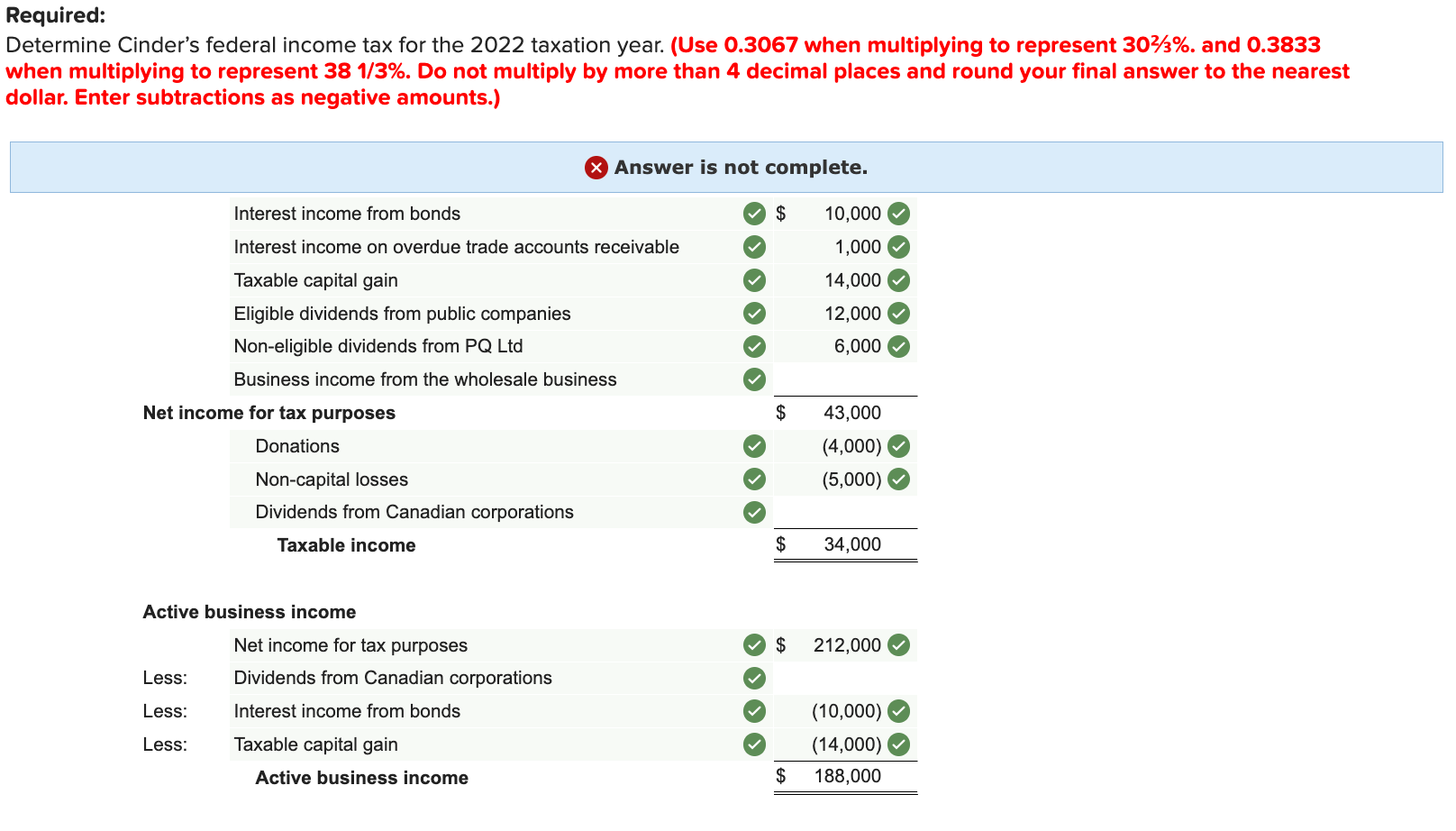

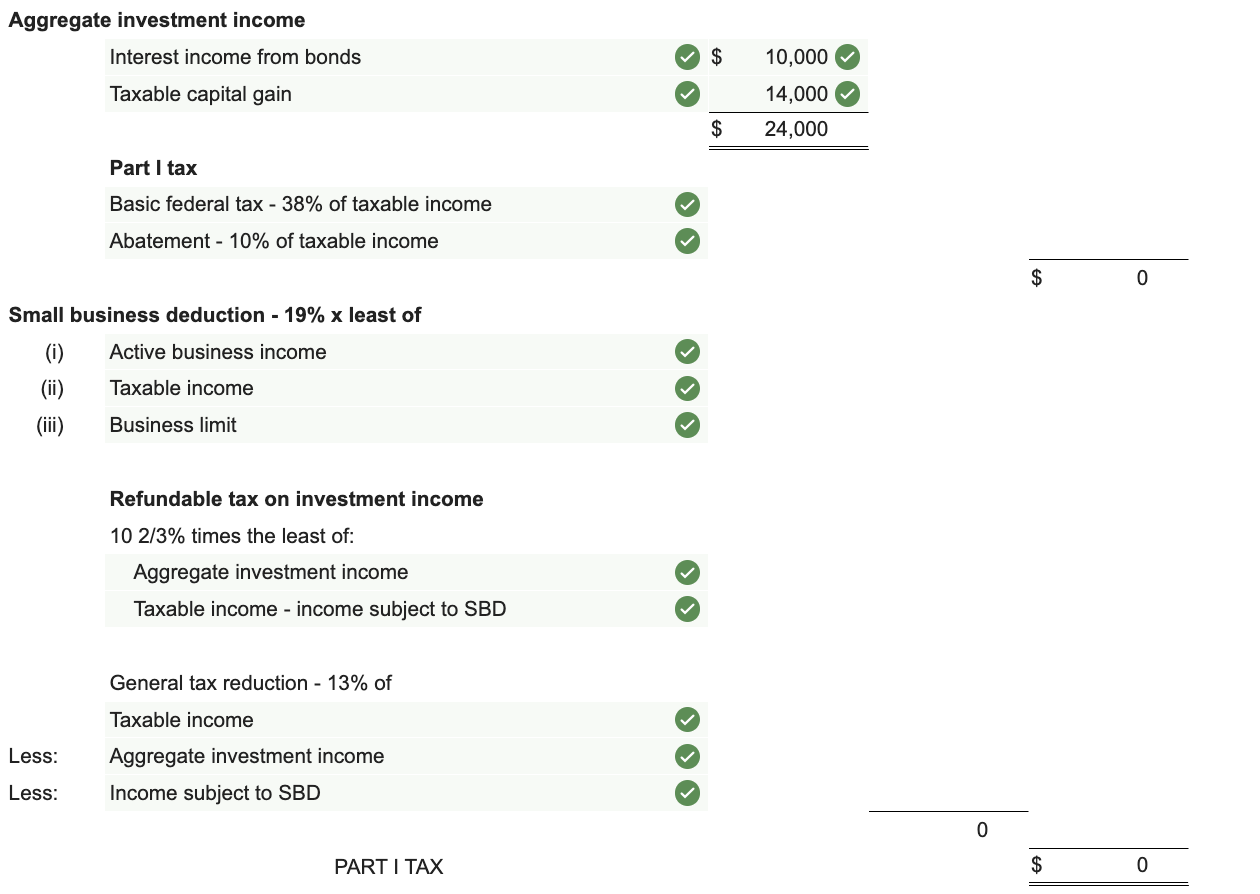

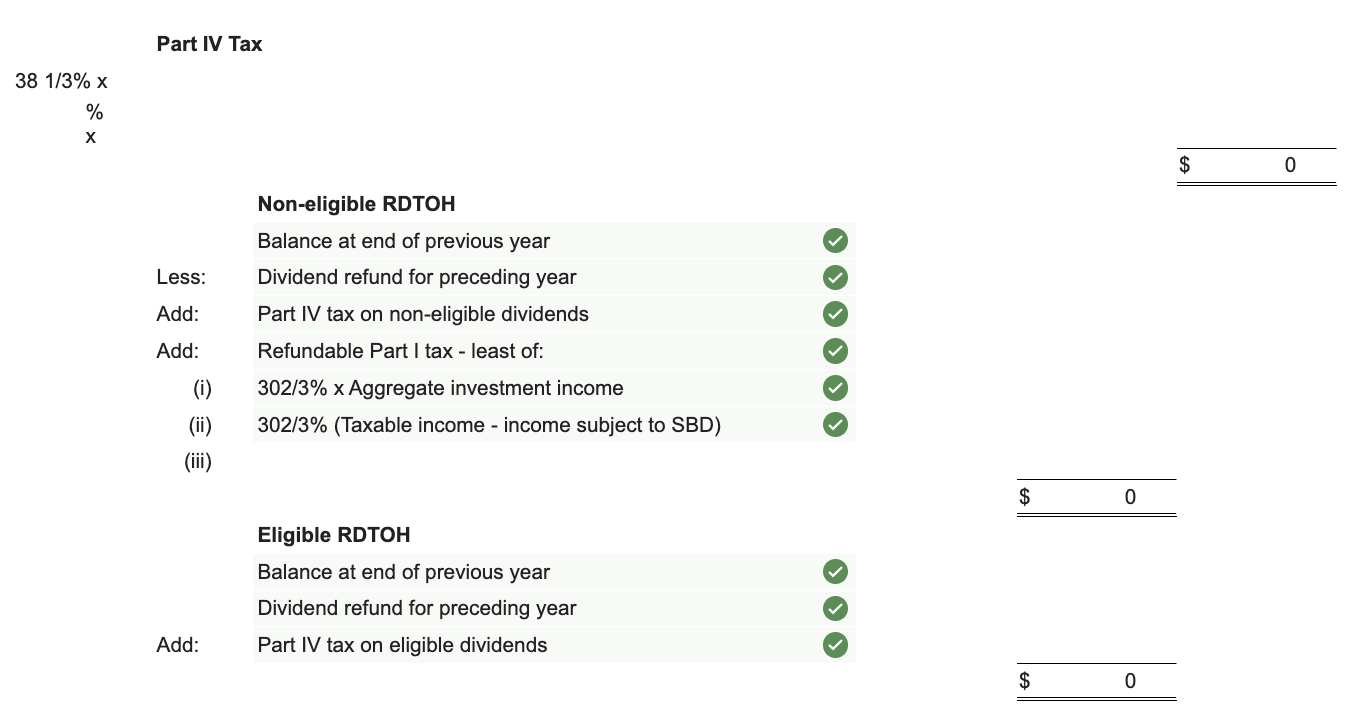

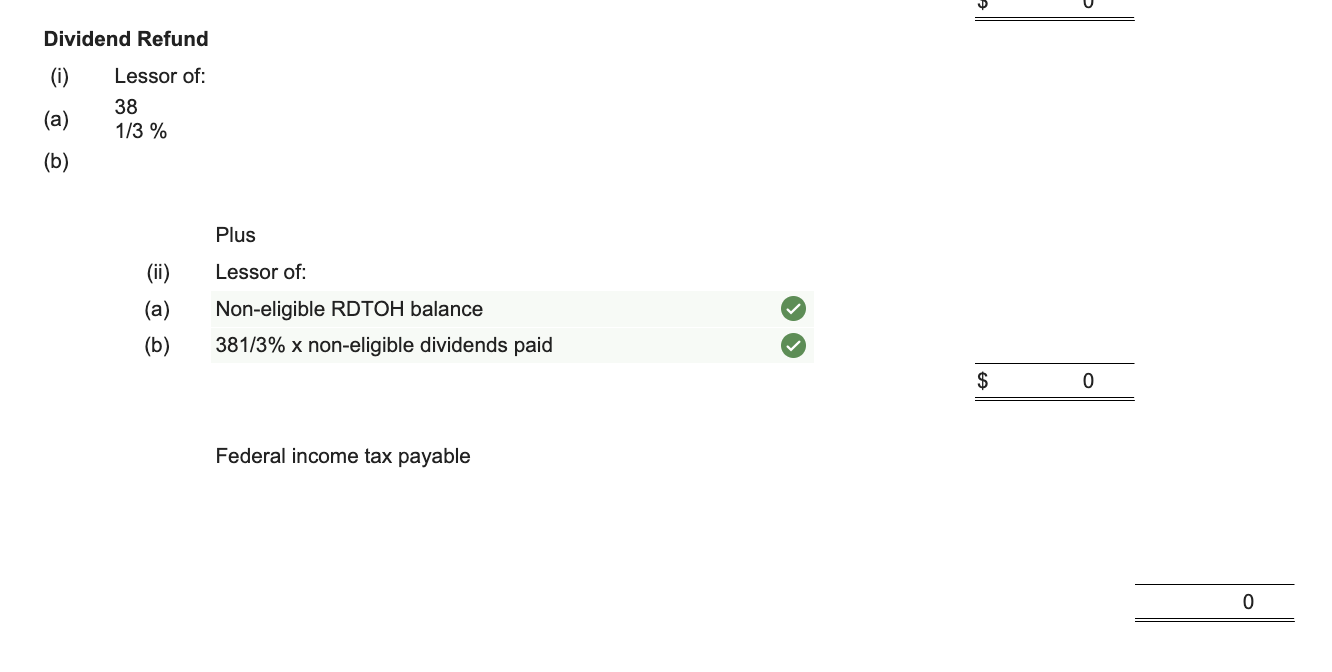

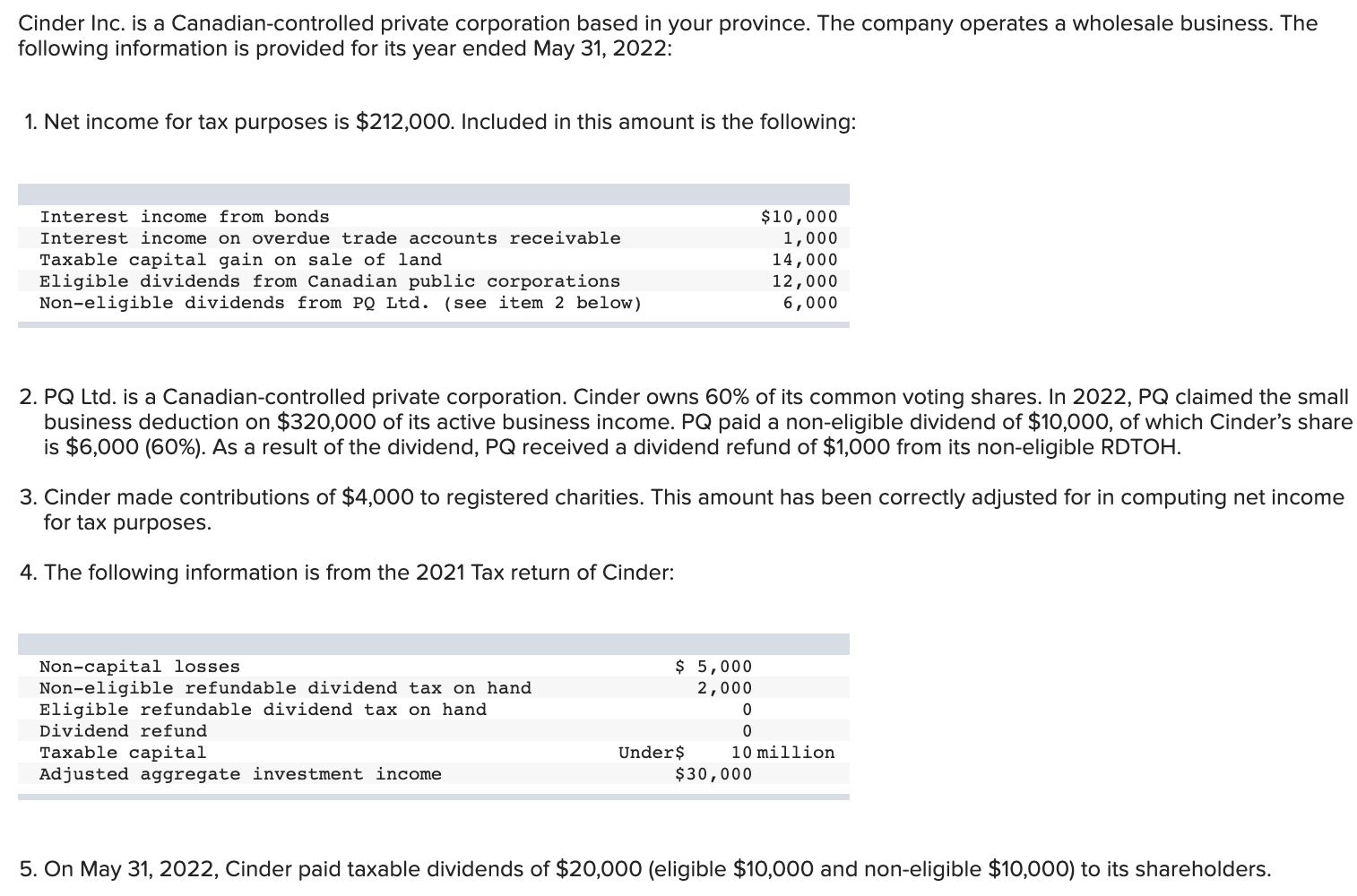

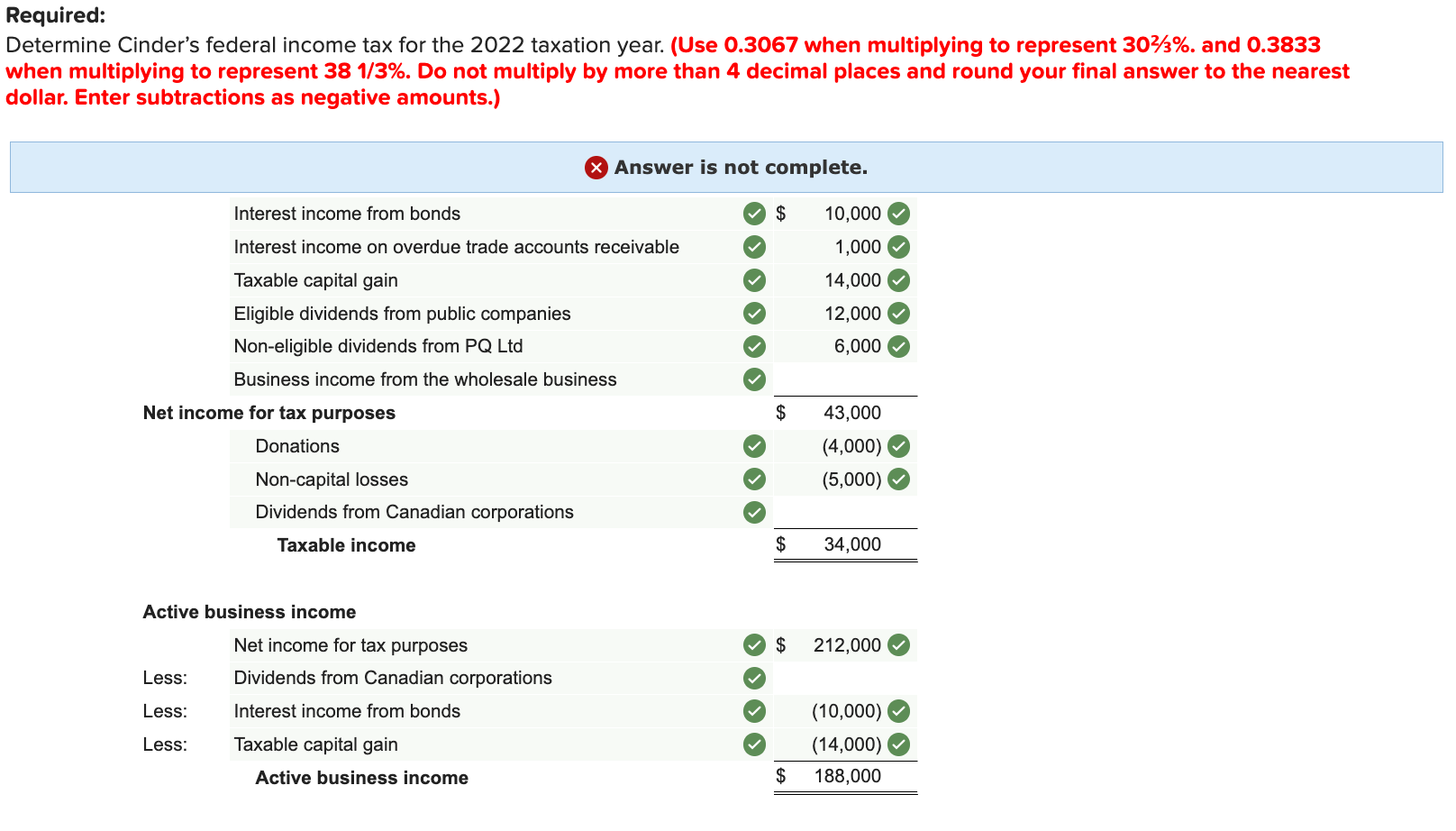

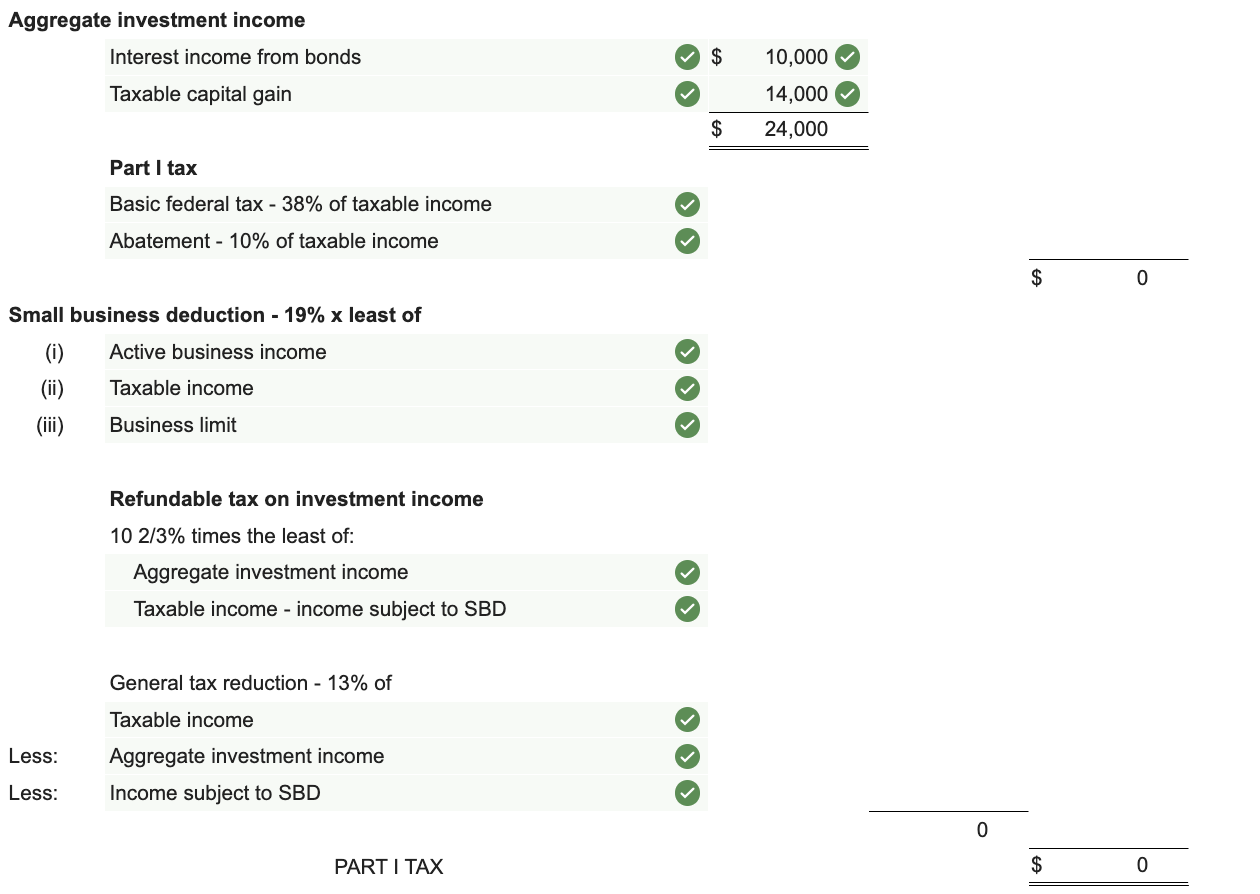

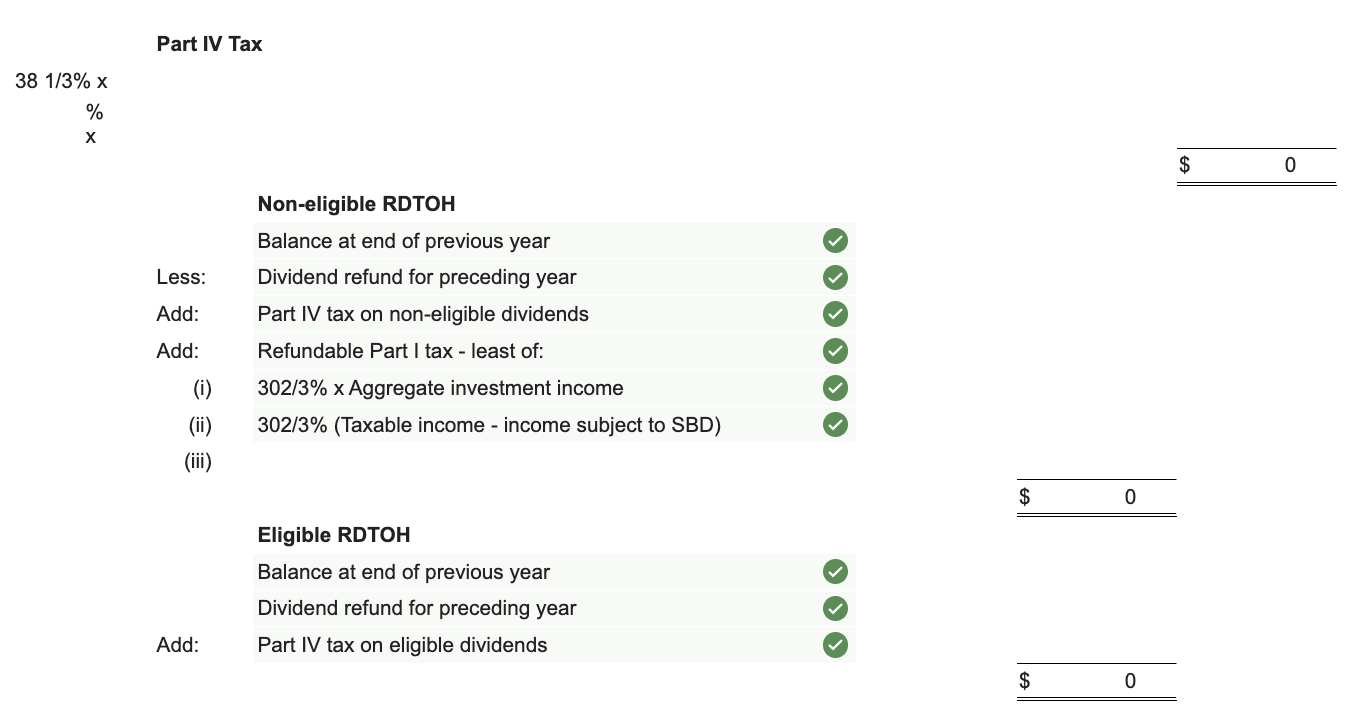

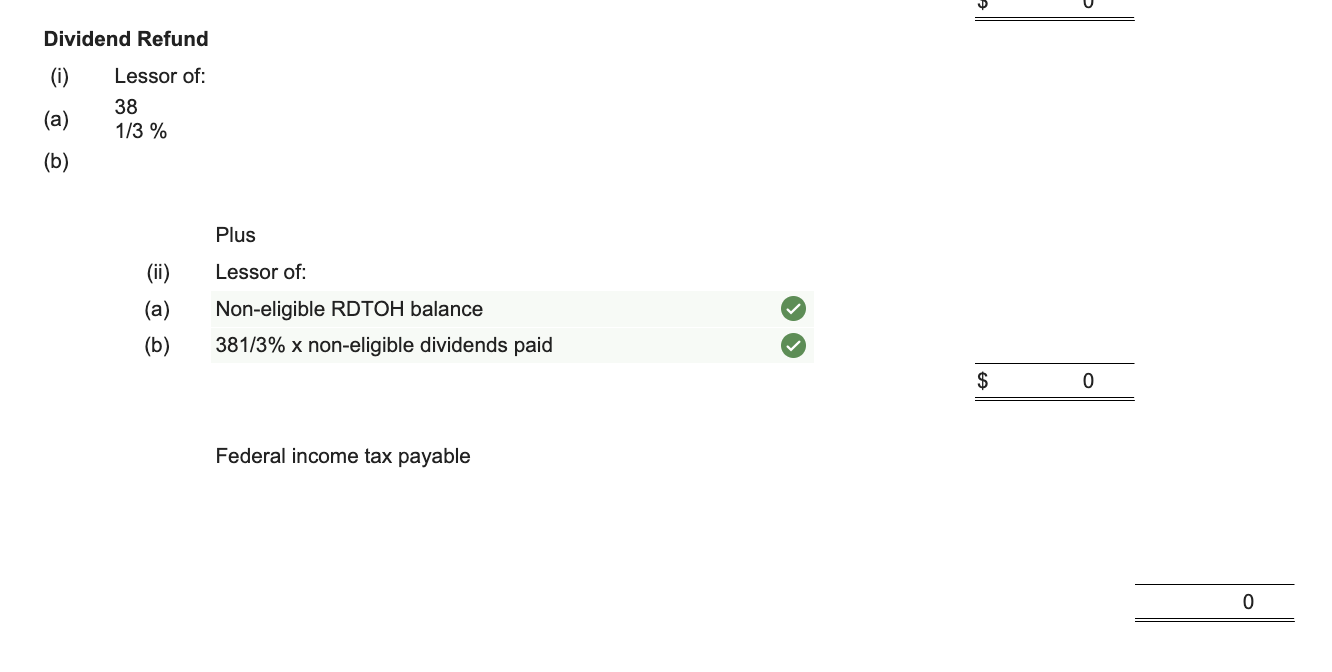

Cinder Inc. is a Canadian-controlled private corporation based in your province. The company operates a wholesale business. The following information is provided for its year ended May 31, 2022: 1. Net income for tax purposes is $212,000. Included in this amount is the following: 2. PQ Ltd. is a Canadian-controlled private corporation. Cinder owns 60% of its common voting shares. In 2022, PQ claimed the small business deduction on $320,000 of its active business income. PQ paid a non-eligible dividend of $10,000, of which Cinder's share is $6,000(60%). As a result of the dividend, PQ received a dividend refund of $1,000 from its non-eligible RDTOH. 3. Cinder made contributions of $4,000 to registered charities. This amount has been correctly adjusted for in computing net income for tax purposes. 4. The following information is from the 2021 Tax return of Cinder: 5. On May 31, 2022, Cinder paid taxable dividends of $20,000 (eligible $10,000 and non-eligible $10,000 ) to its shareholders. Determine Cinder's federal income tax for the 2022 taxation year. (Use 0.3067 when multiplying to represent 302/3%. and 0.3833 when multiplying to represent 381/3%. Do not multiply by more than 4 decimal places and round your final answer to the nearest dollar. Enter subtractions as negative amounts.) Aggregate investment income Part I tax Basic federal tax 38% of taxable income Abatement - 10% of taxable income $ Small business deduction 19% least of (i) Active business income (ii) Taxable income (iii) Business limit Refundable tax on investment income 102/3% times the least of: Aggregate investment income Taxable income - income subject to SBD General tax reduction 13% of Taxable income Less: Aggregate investment income Less: Income subject to SBD PART I TAX $ Part IV Tax 381/3%x % x \begin{tabular}{l} $0 \\ \hline \end{tabular} Non-eligible RDTOH Balance at end of previous year Less: Dividend refund for preceding year Add: Part IV tax on non-eligible dividends Add: Refundable Part I tax - least of: (i) 302/3% Aggregate investment income (ii) 302/3% (Taxable income - income subject to SBD) (iii) Eligible RDTOH $0 Balance at end of previous year Dividend refund for preceding year Add: Part IV tax on eligible dividends \begin{tabular}{ll} \hline$ & 0 \\ \hline \hline \end{tabular} Dividend Refund (i) Lessor of: (a) 38 (b) Plus (ii) Lessor of: (a) Non-eligible RDTOH balance (b) 381/3% non-eligible dividends paid \begin{tabular}{l} \hline$ \\ \hline \hline \end{tabular} Federal income tax payable \begin{tabular}{c} \hline 0 \\ \hline \hline \end{tabular} Cinder Inc. is a Canadian-controlled private corporation based in your province. The company operates a wholesale business. The following information is provided for its year ended May 31, 2022: 1. Net income for tax purposes is $212,000. Included in this amount is the following: 2. PQ Ltd. is a Canadian-controlled private corporation. Cinder owns 60% of its common voting shares. In 2022, PQ claimed the small business deduction on $320,000 of its active business income. PQ paid a non-eligible dividend of $10,000, of which Cinder's share is $6,000(60%). As a result of the dividend, PQ received a dividend refund of $1,000 from its non-eligible RDTOH. 3. Cinder made contributions of $4,000 to registered charities. This amount has been correctly adjusted for in computing net income for tax purposes. 4. The following information is from the 2021 Tax return of Cinder: 5. On May 31, 2022, Cinder paid taxable dividends of $20,000 (eligible $10,000 and non-eligible $10,000 ) to its shareholders. Determine Cinder's federal income tax for the 2022 taxation year. (Use 0.3067 when multiplying to represent 302/3%. and 0.3833 when multiplying to represent 381/3%. Do not multiply by more than 4 decimal places and round your final answer to the nearest dollar. Enter subtractions as negative amounts.) Aggregate investment income Part I tax Basic federal tax 38% of taxable income Abatement - 10% of taxable income $ Small business deduction 19% least of (i) Active business income (ii) Taxable income (iii) Business limit Refundable tax on investment income 102/3% times the least of: Aggregate investment income Taxable income - income subject to SBD General tax reduction 13% of Taxable income Less: Aggregate investment income Less: Income subject to SBD PART I TAX $ Part IV Tax 381/3%x % x \begin{tabular}{l} $0 \\ \hline \end{tabular} Non-eligible RDTOH Balance at end of previous year Less: Dividend refund for preceding year Add: Part IV tax on non-eligible dividends Add: Refundable Part I tax - least of: (i) 302/3% Aggregate investment income (ii) 302/3% (Taxable income - income subject to SBD) (iii) Eligible RDTOH $0 Balance at end of previous year Dividend refund for preceding year Add: Part IV tax on eligible dividends \begin{tabular}{ll} \hline$ & 0 \\ \hline \hline \end{tabular} Dividend Refund (i) Lessor of: (a) 38 (b) Plus (ii) Lessor of: (a) Non-eligible RDTOH balance (b) 381/3% non-eligible dividends paid \begin{tabular}{l} \hline$ \\ \hline \hline \end{tabular} Federal income tax payable \begin{tabular}{c} \hline 0 \\ \hline \hline \end{tabular}

This is all the information provided on the question. The green boxes mean that the answers are correct.

This is all the information provided on the question. The green boxes mean that the answers are correct.