this is all the information that i was given

please click on each pic to see given information.

cast study full questions and information on pics.

I have added new photos of the case study information in the related questions that I need help with in the pictures. this was all the information given to me along with the questions.

hopefully the picture of the questions 1 through 4 is more clearer....if you click on the photo youll be able to see it better i think....

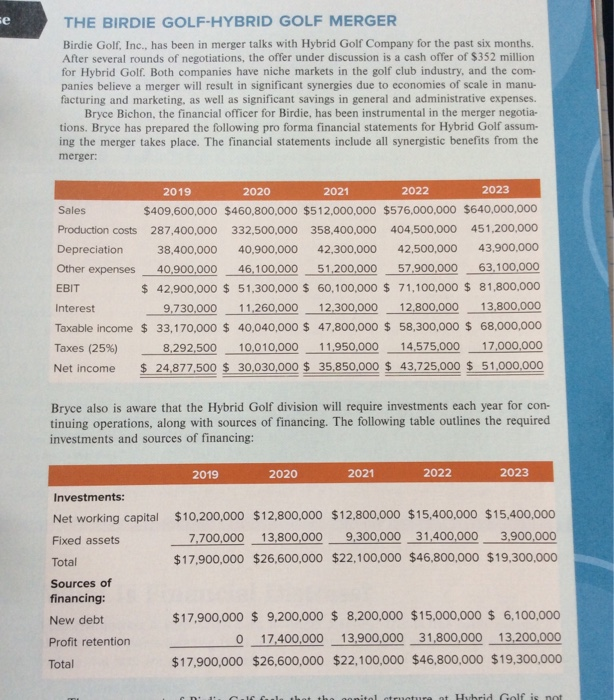

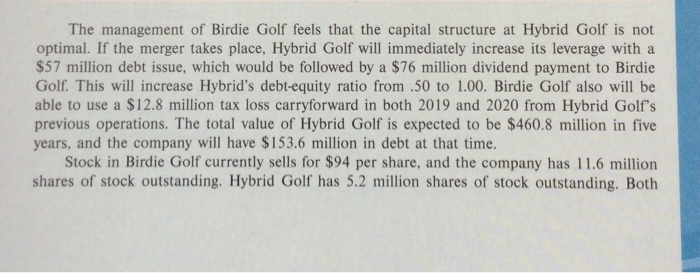

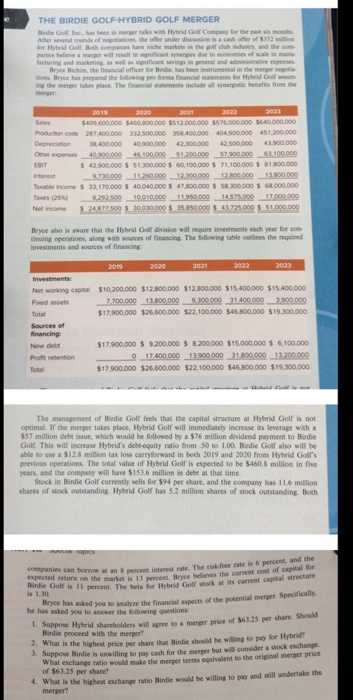

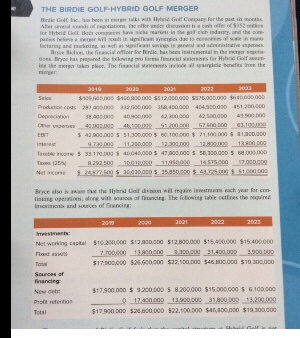

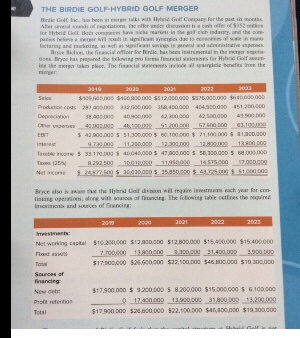

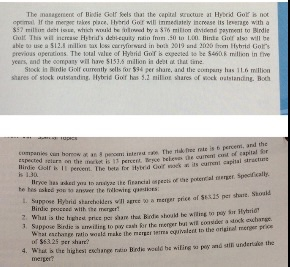

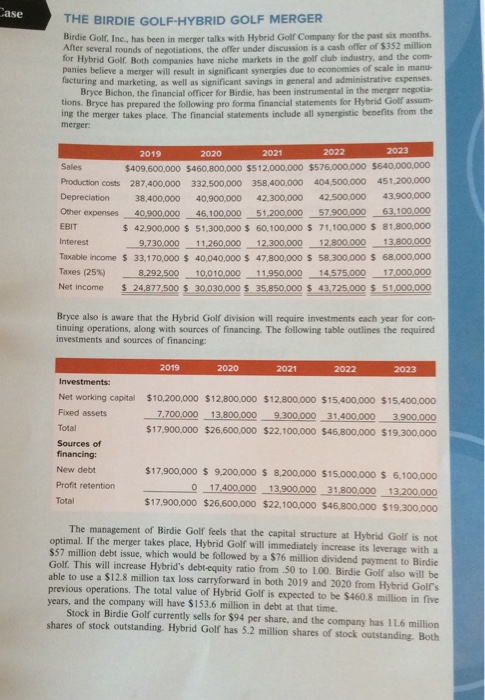

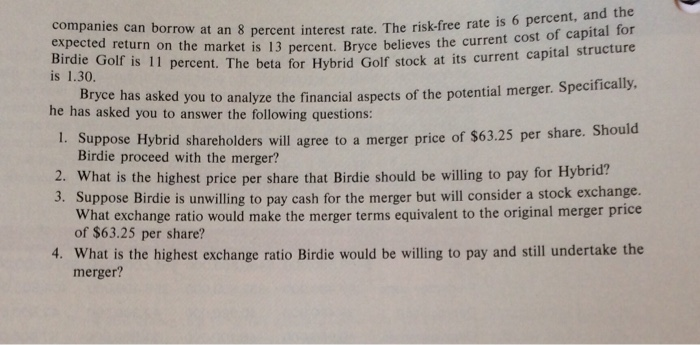

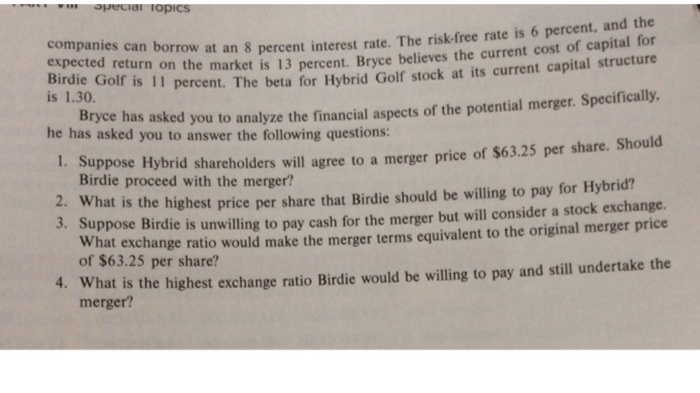

THE BIRDIE GOLF-HYBRID GOLF MERGER Birdie Golf. Inc., has been in merger talks with Hybrid Golf Company for the past six months. After several rounds of negotiations, the offer under discussion is a cash offer of $352 million for Hybrid Golf. Both companies have niche markets in the golf club industry, and the com- panies believe a merger will result in significant synergies due to economies of scale in manu- facturing and marketing, as well as significant savings in general and administrative expenses. Bryce Bichon, the financial officer for Birdie, has been instrumental in the merger negotia- tions. Bryce has prepared the following pro forma financial statements for Hybrid Golf assum- ing the merger takes place. The financial statements include all synergistic benefits from the merger: 2019 2020 2021 2022 2023 Sales $409,600,000 $460,800,000 $512,000,000 $576,000,000 $640,000,000 Production costs 287,400,000 332,500,000 358,400,000 404,500,000 451,200,000 Depreciation 38,400,000 40,900,000 42,300,000 42,500,000 43,900,000 Other expenses 40,900,000 46,100,000 51,200,000 57.900.000 63.100.000 EBIT $ 42,900,000 $ 51,300,000 $ 60,100,000 $ 71,100,000 $ 81,800,000 Interest 9.730.000 11.260,000 12.300.000 12.800.000 13,800,000 Taxable income $ 33,170,000 $ 40,040,000 $ 47,800,000 $ 58,300,000 $ 68,000,000 Taxes (25%) 8,292,500 10,010,000 11,950,000 14,575,000 17,000,000 Net income $ 24,877,500 $ 30,030,000 $ 35,850,000 $ 43,725,000 $ 51,000,000 Bryce also is aware that the Hybrid Golf division will require investments each year for con- tinuing operations, along with sources of financing. The following table outlines the required investments and sources of financing: 2019 2020 2021 2022 2023 Investments: Net working capital $10,200,000 $12,800,000 $12,800,000 $15,400,000 $15,400,000 Fixed assets 7,700,000 13,800,000 9,300,000 31,400,000 3,900,000 Total $17,900,000 $26,600,000 $22,100,000 $46,800,000 $19,300,000 Sources of financing: New debt $17,900,000 $ 9,200,000 $ 8,200,000 $15,000,000 $ 6,100,000 Profit retention 0 17,400,000 13.900,000 31,800,000 13,200,000 Total $17,900,000 $26,600,000 $22,100,000 $46,800,000 $19,300,000 1 1.41 tot de The management of Birdie Golf feels that the capital structure at Hybrid Golf is not optimal. If the merger takes place, Hybrid Golf will immediately increase its leverage with a $57 million debt issue, which would be followed by a $76 million dividend payment to Birdie Golf. This will increase Hybrid's debt-equity ratio from .50 to 1.00. Birdie Golf also will be able to use a $12.8 million tax loss carryforward in both 2019 and 2020 from Hybrid Golf's previous operations. The total value of Hybrid Golf is expected to be $460.8 million in five years, and the company will have $153.6 million in debt at that time. Stock in Birdie Golf currently sells for $94 per share, and the company has 11.6 million shares of stock outstanding. Hybrid Golf has 5.2 million shares of stock outstanding. Both Vill Special Topics companies can borrow at an 8 percent interest to ow at an 8 percent interest rate. The risk-free rate is 6 percent, and the expected return on the market is 13 percent. Birdie Golf is 11 percent. The beta for Hy the market is 13 percent. Bryce believes the current cost of capital for percent. The beta for Hybrid Golf stock at its current capital structure is 1.30. e nas asked you to analyze the financial aspects of the potential merger. Specifically, he has asked you to answer the following questions: 1. Suppose Hybrid shareholders will agree to a merger d shareholders will agree to a merger price of $63.25 per share. Should Birdie proceed with the merger? what is the highest price per share that Birdie should be willing to pay for Hybrid? 3. Suppose Birdie is unwilling to pay cash for the merger but will consider a stock exchange. nat exchange ratio would make the merger terms equivalent to the original merger price of $63.25 per share? 4. What is the highest exchange ratio Birdie would be willing to pay and still undertake the merger? THE BIRDIE GOLF-HYBRID GOLF MERGER Bindie Cole has been i s with Hybrid Golf Company for the past the Arwunds of the under di schof 152 mil for Hybrid Gol Both companies have niche markets in the polfclub industry, and the com panis believe will win d to comes of salemme cewe cancer has b een ons Bryce has prepared the in forma c ements for Hybrid Golf in the m a kes place. The financiaments include a benefit from the 2019 2020 2021 2022 2023 Sales $400.000.000 $60.000.000 $512.000.000 $575.000.000 $640.000.000 Production cos 287.400.000 332.500.000 8.400.000 404 500,000 451.200.000 Depreciation 38.400.000 40.000.000 42.300.000 42.500.000 43.900.000 Other expenses 40,000 000 45.100.000 50.200.000 57900 000 63.100.000 EGIT $42.900.000 S 51.300.000 $ 60.100.000 71.100.000 S 81.800.000 9230000 11.200.000 12.300.000 200.000 300.000 Torbe income $33.170.000 $ 40,040.000 $ 47.800.000 $ 5 00.000 $68.000.000 Taxes 25 2 92.500 1001000011050000 18.575.000 17.000.000 Not income $24.877500 510 000 000 $ 35 850 000 $ 43.725.000 $ 51 000 000 Bryce aho is ware that the Hybrid of division will require investments each year for con tinuing operations, along with sources of financing. The following table outlines the required mestments and sources of financing 2020 2021 2022 Investments Networking caps Fored assets $10.200.000 $12.800.000 $12.800.000 $15.400.000 $15.400 000 7.700.000 13.800,000_9.300.000 31.400.000_3.900.000 $17.500.000 $26.000.000 $22,100,000 $46.800.000 $19.300.000 Sources of financing New debt Proftretention $17.900.000 $ 1.200.000 $ 8.200.000 $15.000.000 $ 6.100.000 17.400.000 13.900.000 31.800.000 13.200.000 $17.900.000 $26.000.000 $22.100.000 $46.800.000 $19.300.000 The management of Bedie Golf feels that the capital structure at Hybrid Golf is not optimal. If the merger takes place, Hybrid Golf will immediately increase its leverage with a $57 million debt issue, which would be followed by a $76 million dividend payment to Birdie Golf. This will increase Hybrid's debt equity rate from 50 to 1.00. Birdie Golf also will be able to use a $12.8 million tax loss carryforward in both 2019 and 2020 from Hybrid Goirs previous operations. The total value of Hybrid Golf is expected to be $460.8 million in five years, and the company will have $153.6 million in debt at that time. Stock in Birdie Golf currently sells for $94 per share, and the company has 11.6 million shares of stock outstanding. Hybrid Golf has 5.2 million shares of stock outstanding. Both can borrow an percent interest rate. The rise free rate is 6 percent, and the on the market is 13 percent. Bryce bees the current cost of capital Il percent. The heta for Hybrid Golf stock at its current capital structure Bryce has asked you to analyze the financial aspects of the potential merger Specifically, he has asked you to answer the following questions Suppose Hybrid shareholders will agree to a merger price of $61.25 per sharehoud Birdie proceed with the merger 2. What is the highest price per share the Birdie should be willing to pay for Hybrid Suppose Birdie is unwilling to pay cash for the merger but will considers Mock exchange What exchange ratio would make the merger terms equivalent to the original merger price of $63.25 per share 4. What is the highest exchange ratio Birdie wuld he willing to pay and still undertake the merger? THE BIRDIE GOLF HYBRID GOLF MERGER Ge e n in the forth ir Hybrid Go Bad S para c hema lain in the rich industry, and the dari the offer Inhaber in the Go try hard the ring proc ess for H IT TOT T WIST ow Productions De De $1 00,000 $160.900.000 5512,000,000 5575.000.000 .000 2800.00 2.000.000 1.000.000404.500.000 451,200,000 300.000 100.000 200.000 2.500.000 4300000 40.000.000 41.200 520 57 000 000 03.100.000 54.900.000 S 31.300.000 500.100.000 111000 110010 T O 5 33.170.00 40040,000 $ 47,000,000 S 50.300.000 55.000 1292.300 100 1145000 4575000 17.000.000 10030.000 5 25.950.000 5.42.129 51 000 000 Bere els LISLITE S the Blarid all ong with us and wil regaine a ch year for con ones then Networking capital $10.200,000 $3900,000 512.800.000 $1,400,000 $15.000.000 7.700,000 11890.000 300.000 11.400.000 3.900.000 $17.500.000 1.000.000 $2,100 000 $460.000 $19.300.000 $17.900 000 $ 1.200.000 $ 8.200.000 $15.000.000 $ 6.100.000 0 17400000 11 900.000 31800 000 +3.200.000 517 900.000 $20.000.000 522.100.000 1,000.00 $19.300.000 The natus of die Gols that the capital 1 Her Goro S T desi OLE, which the red tw i n med en tondi Cul This will increase Hibrid d ui in lum.50 in 1.00 Hinten also will be los c a rd in buc 2019 and 22 til in otal vice or Hybrid C l odobe 540 milion in we YES dhe T he S152. llloni delle Stock in die Oor currently wells ar e share, and the company has 16 million Stares of stock wutstanding Hybrid of mine suures of wock as standing. Boch in the US en in the theme is een and the current of spital for is 15 percentre he de coll is 130 percent. The te for Hybrid Cuf www rested car s current capital sich det me the financial aspects of the pealer Specifically hetes kod nr the Twins que Wille m piece of 56.5 per she should the price from the Bande sole willing to pay for ili 1 Sprin ter til Nock ulteri o r in the originale price 4. What is the latest tre n ds would be wilie w pand in under the Case THE BIRDIE GOLF-HYBRID GOLF MERGER Birdie Golf, Inc. has been in merver talks with Hybrid Golf Company for the past six months After several rounds of negotiations, the offer under discussion is a cash offer of $352 million for Hybrid Goll. Both companies have niche markets in the golf club industry, and the com- panies believe a merger will result in significant synergies due to economics of scale in manu- facturing and marketing, as well as significant savings in general and administrative expenses. Bryce Bichon, the financial officer for Birdie, has been instrumental in the merger negotia- tions. Bryce has prepared the following pro forma financial statements for Hybrid Golf assum- ing the merger takes place. The financial statements include all synergistic benefits from the merger: 2019 2020 2021 2022 2023 Sales $409,600,000 $460,800,000 $512,000,000 $575,000,000 $640,000.000 Production costs 287,400,000 332,500,000 358,400,000 404,500,000 451,200,000 Depreciation 38,400,000 40,900,000 42,300,000 42,500,000 43.900,000 Other expenses 40.900,000 46.100,000 51.200.000 57.900,000 63,100,000 EBIT $ 42,900,000 $ 51,300,000 $ 60,100,000 $ 71,100,000 $ 81,800,000 Interest 9,730,000 11 260 000 12.300,000 12.800.000 13.800,000 Taxable income $ 33,170,000 $ 40,040,000 $ 47,800,000 $ 58,300,000 $ 68,000,000 Taxes (25%) 8.292,500 10,010,000 11,950,000 14.575.000 17.000.000 Net income $ 24,877,500 $ 30.030 000 $ 35,850,000 $ 43.725 000 $ 51,000,000 Bryce also is aware that the Hybrid Golf division will require investments each year for con- tinuing operations, along with sources of financing. The following table outlines the required investments and sources of financing: 2019 2020 2021 2022 2023 $10,200,000 $12,800,000 $12.800,000 $15,400,000 $15,400,000 7,700,000 13,800.000 9,300,000 31,400,000 3.900.000 $17,900,000 $26.600.000 $22,100,000 $46.800.000 $19,300,000 Investments: Net working capital Fixed assets Total Sources of financing New debt Profit retention Total $17.900,000 $ 9,200,000 S 8.200.000 $15,000,000 $ 6,100,000 17,400,000 13,900,000 31.800.000 13.200.000 $17.900,000 $26,600,000 $22,100,000 $46,800,000 $19,300,000 The management of Birdie Golf feels that the capital structure at Hybrid Golf is not optimal. If the merger takes place, Hybrid Golf will immediately increase its leverage with a $57 million debt issue, which would be followed by a $76 million dividend payment to Birdie Golf. This will increase Hybrid's debt-equity ratio from 50 to 1.00. Birdie Golf also will be able to use a $12.8 million tax loss carryforward in both 2019 and 2020 from Hybrid Golfs previous operations. The total value of Hybrid Golf is expected to be $460.8 million in five years, and the company will have $153.6 million in debt at that time. Stock in Birdie Golf currently sells for $94 per share, and the company has 1 1.6 million shares of stock outstanding. Hybrid Golf has 5.2 million shares of stock outstanding. Both rate. The risk-free rate is 6 percent, and the Bryce believes the current cost of capital for Hybrid Golf stock at its current capital structure companies can borrow at an 8 percent interest rate. The risk-free rate expected return on the market is 13 percent. Bryce believes the curren Birdie Golf is 11 percent. The beta for Hybrid Golf stock at its cur is 1.30. yce has asked you to analyze the financial aspects of the potential merger. Specifically, he has asked you to answer the following questions: 1. Suppose Hybrid shareholders will agree to a merger price of $63.20 per suam gree to a merger price of $63.25 per share. Should Birdie proceed with the merger? 2. What is the highest price per share that Birdie should be willing to pay for Hybrid! 3. Suppose Birdie is unwilling to pay cash for the merger but will consider a stock exchange. What exchange ratio would make the merger terms equivalent to the original merger price of $63.25 per share? 4. What is the highest exchange ratio Birdie would be willing to pay and still undertake the merger? Special Topics companies can borrow at an 8 percent interest rate expected return on the market is 13 percent. Br row at an 8 percent interest rate. The risk-free rate is 6 percent, and the n the market is 13 percent. Bryce believes the current cost of capital for Birdie Golf is 11 percent. The beta for Hybrid Golf stock at its cum is 1.30. or Hybrid Golf stock at its current capital structure Bryce has asked you to analyze the financial aspects of the potential mense he has asked you to answer the following questions: ne financial aspects of the potential merger. Specifically, 1. Suppose Hybrid shareholders will agree to a merger price of Birdie proceed with the merger? ers will agree to a merger price of $63.25 per share. Should the highest price per share that Birdie should be willing to pay for Hybrid? Suppose Birdie is unwilling to pay cash for the merger but will consider a stock exchange. What exchange ratio would make the merger terms equivalent to the original merger price of $63.25 per share? 4. What is the highest exchange ratio Birdie would be willing to pay and still undertake the merger? THE BIRDIE GOLF-HYBRID GOLF MERGER Birdie Golf. Inc., has been in merger talks with Hybrid Golf Company for the past six months. After several rounds of negotiations, the offer under discussion is a cash offer of $352 million for Hybrid Golf. Both companies have niche markets in the golf club industry, and the com- panies believe a merger will result in significant synergies due to economies of scale in manu- facturing and marketing, as well as significant savings in general and administrative expenses. Bryce Bichon, the financial officer for Birdie, has been instrumental in the merger negotia- tions. Bryce has prepared the following pro forma financial statements for Hybrid Golf assum- ing the merger takes place. The financial statements include all synergistic benefits from the merger: 2019 2020 2021 2022 2023 Sales $409,600,000 $460,800,000 $512,000,000 $576,000,000 $640,000,000 Production costs 287,400,000 332,500,000 358,400,000 404,500,000 451,200,000 Depreciation 38,400,000 40,900,000 42,300,000 42,500,000 43,900,000 Other expenses 40,900,000 46,100,000 51,200,000 57.900.000 63.100.000 EBIT $ 42,900,000 $ 51,300,000 $ 60,100,000 $ 71,100,000 $ 81,800,000 Interest 9.730.000 11.260,000 12.300.000 12.800.000 13,800,000 Taxable income $ 33,170,000 $ 40,040,000 $ 47,800,000 $ 58,300,000 $ 68,000,000 Taxes (25%) 8,292,500 10,010,000 11,950,000 14,575,000 17,000,000 Net income $ 24,877,500 $ 30,030,000 $ 35,850,000 $ 43,725,000 $ 51,000,000 Bryce also is aware that the Hybrid Golf division will require investments each year for con- tinuing operations, along with sources of financing. The following table outlines the required investments and sources of financing: 2019 2020 2021 2022 2023 Investments: Net working capital $10,200,000 $12,800,000 $12,800,000 $15,400,000 $15,400,000 Fixed assets 7,700,000 13,800,000 9,300,000 31,400,000 3,900,000 Total $17,900,000 $26,600,000 $22,100,000 $46,800,000 $19,300,000 Sources of financing: New debt $17,900,000 $ 9,200,000 $ 8,200,000 $15,000,000 $ 6,100,000 Profit retention 0 17,400,000 13.900,000 31,800,000 13,200,000 Total $17,900,000 $26,600,000 $22,100,000 $46,800,000 $19,300,000 1 1.41 tot de The management of Birdie Golf feels that the capital structure at Hybrid Golf is not optimal. If the merger takes place, Hybrid Golf will immediately increase its leverage with a $57 million debt issue, which would be followed by a $76 million dividend payment to Birdie Golf. This will increase Hybrid's debt-equity ratio from .50 to 1.00. Birdie Golf also will be able to use a $12.8 million tax loss carryforward in both 2019 and 2020 from Hybrid Golf's previous operations. The total value of Hybrid Golf is expected to be $460.8 million in five years, and the company will have $153.6 million in debt at that time. Stock in Birdie Golf currently sells for $94 per share, and the company has 11.6 million shares of stock outstanding. Hybrid Golf has 5.2 million shares of stock outstanding. Both Vill Special Topics companies can borrow at an 8 percent interest to ow at an 8 percent interest rate. The risk-free rate is 6 percent, and the expected return on the market is 13 percent. Birdie Golf is 11 percent. The beta for Hy the market is 13 percent. Bryce believes the current cost of capital for percent. The beta for Hybrid Golf stock at its current capital structure is 1.30. e nas asked you to analyze the financial aspects of the potential merger. Specifically, he has asked you to answer the following questions: 1. Suppose Hybrid shareholders will agree to a merger d shareholders will agree to a merger price of $63.25 per share. Should Birdie proceed with the merger? what is the highest price per share that Birdie should be willing to pay for Hybrid? 3. Suppose Birdie is unwilling to pay cash for the merger but will consider a stock exchange. nat exchange ratio would make the merger terms equivalent to the original merger price of $63.25 per share? 4. What is the highest exchange ratio Birdie would be willing to pay and still undertake the merger? THE BIRDIE GOLF-HYBRID GOLF MERGER Bindie Cole has been i s with Hybrid Golf Company for the past the Arwunds of the under di schof 152 mil for Hybrid Gol Both companies have niche markets in the polfclub industry, and the com panis believe will win d to comes of salemme cewe cancer has b een ons Bryce has prepared the in forma c ements for Hybrid Golf in the m a kes place. The financiaments include a benefit from the 2019 2020 2021 2022 2023 Sales $400.000.000 $60.000.000 $512.000.000 $575.000.000 $640.000.000 Production cos 287.400.000 332.500.000 8.400.000 404 500,000 451.200.000 Depreciation 38.400.000 40.000.000 42.300.000 42.500.000 43.900.000 Other expenses 40,000 000 45.100.000 50.200.000 57900 000 63.100.000 EGIT $42.900.000 S 51.300.000 $ 60.100.000 71.100.000 S 81.800.000 9230000 11.200.000 12.300.000 200.000 300.000 Torbe income $33.170.000 $ 40,040.000 $ 47.800.000 $ 5 00.000 $68.000.000 Taxes 25 2 92.500 1001000011050000 18.575.000 17.000.000 Not income $24.877500 510 000 000 $ 35 850 000 $ 43.725.000 $ 51 000 000 Bryce aho is ware that the Hybrid of division will require investments each year for con tinuing operations, along with sources of financing. The following table outlines the required mestments and sources of financing 2020 2021 2022 Investments Networking caps Fored assets $10.200.000 $12.800.000 $12.800.000 $15.400.000 $15.400 000 7.700.000 13.800,000_9.300.000 31.400.000_3.900.000 $17.500.000 $26.000.000 $22,100,000 $46.800.000 $19.300.000 Sources of financing New debt Proftretention $17.900.000 $ 1.200.000 $ 8.200.000 $15.000.000 $ 6.100.000 17.400.000 13.900.000 31.800.000 13.200.000 $17.900.000 $26.000.000 $22.100.000 $46.800.000 $19.300.000 The management of Bedie Golf feels that the capital structure at Hybrid Golf is not optimal. If the merger takes place, Hybrid Golf will immediately increase its leverage with a $57 million debt issue, which would be followed by a $76 million dividend payment to Birdie Golf. This will increase Hybrid's debt equity rate from 50 to 1.00. Birdie Golf also will be able to use a $12.8 million tax loss carryforward in both 2019 and 2020 from Hybrid Goirs previous operations. The total value of Hybrid Golf is expected to be $460.8 million in five years, and the company will have $153.6 million in debt at that time. Stock in Birdie Golf currently sells for $94 per share, and the company has 11.6 million shares of stock outstanding. Hybrid Golf has 5.2 million shares of stock outstanding. Both can borrow an percent interest rate. The rise free rate is 6 percent, and the on the market is 13 percent. Bryce bees the current cost of capital Il percent. The heta for Hybrid Golf stock at its current capital structure Bryce has asked you to analyze the financial aspects of the potential merger Specifically, he has asked you to answer the following questions Suppose Hybrid shareholders will agree to a merger price of $61.25 per sharehoud Birdie proceed with the merger 2. What is the highest price per share the Birdie should be willing to pay for Hybrid Suppose Birdie is unwilling to pay cash for the merger but will considers Mock exchange What exchange ratio would make the merger terms equivalent to the original merger price of $63.25 per share 4. What is the highest exchange ratio Birdie wuld he willing to pay and still undertake the merger? THE BIRDIE GOLF HYBRID GOLF MERGER Ge e n in the forth ir Hybrid Go Bad S para c hema lain in the rich industry, and the dari the offer Inhaber in the Go try hard the ring proc ess for H IT TOT T WIST ow Productions De De $1 00,000 $160.900.000 5512,000,000 5575.000.000 .000 2800.00 2.000.000 1.000.000404.500.000 451,200,000 300.000 100.000 200.000 2.500.000 4300000 40.000.000 41.200 520 57 000 000 03.100.000 54.900.000 S 31.300.000 500.100.000 111000 110010 T O 5 33.170.00 40040,000 $ 47,000,000 S 50.300.000 55.000 1292.300 100 1145000 4575000 17.000.000 10030.000 5 25.950.000 5.42.129 51 000 000 Bere els LISLITE S the Blarid all ong with us and wil regaine a ch year for con ones then Networking capital $10.200,000 $3900,000 512.800.000 $1,400,000 $15.000.000 7.700,000 11890.000 300.000 11.400.000 3.900.000 $17.500.000 1.000.000 $2,100 000 $460.000 $19.300.000 $17.900 000 $ 1.200.000 $ 8.200.000 $15.000.000 $ 6.100.000 0 17400000 11 900.000 31800 000 +3.200.000 517 900.000 $20.000.000 522.100.000 1,000.00 $19.300.000 The natus of die Gols that the capital 1 Her Goro S T desi OLE, which the red tw i n med en tondi Cul This will increase Hibrid d ui in lum.50 in 1.00 Hinten also will be los c a rd in buc 2019 and 22 til in otal vice or Hybrid C l odobe 540 milion in we YES dhe T he S152. llloni delle Stock in die Oor currently wells ar e share, and the company has 16 million Stares of stock wutstanding Hybrid of mine suures of wock as standing. Boch in the US en in the theme is een and the current of spital for is 15 percentre he de coll is 130 percent. The te for Hybrid Cuf www rested car s current capital sich det me the financial aspects of the pealer Specifically hetes kod nr the Twins que Wille m piece of 56.5 per she should the price from the Bande sole willing to pay for ili 1 Sprin ter til Nock ulteri o r in the originale price 4. What is the latest tre n ds would be wilie w pand in under the Case THE BIRDIE GOLF-HYBRID GOLF MERGER Birdie Golf, Inc. has been in merver talks with Hybrid Golf Company for the past six months After several rounds of negotiations, the offer under discussion is a cash offer of $352 million for Hybrid Goll. Both companies have niche markets in the golf club industry, and the com- panies believe a merger will result in significant synergies due to economics of scale in manu- facturing and marketing, as well as significant savings in general and administrative expenses. Bryce Bichon, the financial officer for Birdie, has been instrumental in the merger negotia- tions. Bryce has prepared the following pro forma financial statements for Hybrid Golf assum- ing the merger takes place. The financial statements include all synergistic benefits from the merger: 2019 2020 2021 2022 2023 Sales $409,600,000 $460,800,000 $512,000,000 $575,000,000 $640,000.000 Production costs 287,400,000 332,500,000 358,400,000 404,500,000 451,200,000 Depreciation 38,400,000 40,900,000 42,300,000 42,500,000 43.900,000 Other expenses 40.900,000 46.100,000 51.200.000 57.900,000 63,100,000 EBIT $ 42,900,000 $ 51,300,000 $ 60,100,000 $ 71,100,000 $ 81,800,000 Interest 9,730,000 11 260 000 12.300,000 12.800.000 13.800,000 Taxable income $ 33,170,000 $ 40,040,000 $ 47,800,000 $ 58,300,000 $ 68,000,000 Taxes (25%) 8.292,500 10,010,000 11,950,000 14.575.000 17.000.000 Net income $ 24,877,500 $ 30.030 000 $ 35,850,000 $ 43.725 000 $ 51,000,000 Bryce also is aware that the Hybrid Golf division will require investments each year for con- tinuing operations, along with sources of financing. The following table outlines the required investments and sources of financing: 2019 2020 2021 2022 2023 $10,200,000 $12,800,000 $12.800,000 $15,400,000 $15,400,000 7,700,000 13,800.000 9,300,000 31,400,000 3.900.000 $17,900,000 $26.600.000 $22,100,000 $46.800.000 $19,300,000 Investments: Net working capital Fixed assets Total Sources of financing New debt Profit retention Total $17.900,000 $ 9,200,000 S 8.200.000 $15,000,000 $ 6,100,000 17,400,000 13,900,000 31.800.000 13.200.000 $17.900,000 $26,600,000 $22,100,000 $46,800,000 $19,300,000 The management of Birdie Golf feels that the capital structure at Hybrid Golf is not optimal. If the merger takes place, Hybrid Golf will immediately increase its leverage with a $57 million debt issue, which would be followed by a $76 million dividend payment to Birdie Golf. This will increase Hybrid's debt-equity ratio from 50 to 1.00. Birdie Golf also will be able to use a $12.8 million tax loss carryforward in both 2019 and 2020 from Hybrid Golfs previous operations. The total value of Hybrid Golf is expected to be $460.8 million in five years, and the company will have $153.6 million in debt at that time. Stock in Birdie Golf currently sells for $94 per share, and the company has 1 1.6 million shares of stock outstanding. Hybrid Golf has 5.2 million shares of stock outstanding. Both rate. The risk-free rate is 6 percent, and the Bryce believes the current cost of capital for Hybrid Golf stock at its current capital structure companies can borrow at an 8 percent interest rate. The risk-free rate expected return on the market is 13 percent. Bryce believes the curren Birdie Golf is 11 percent. The beta for Hybrid Golf stock at its cur is 1.30. yce has asked you to analyze the financial aspects of the potential merger. Specifically, he has asked you to answer the following questions: 1. Suppose Hybrid shareholders will agree to a merger price of $63.20 per suam gree to a merger price of $63.25 per share. Should Birdie proceed with the merger? 2. What is the highest price per share that Birdie should be willing to pay for Hybrid! 3. Suppose Birdie is unwilling to pay cash for the merger but will consider a stock exchange. What exchange ratio would make the merger terms equivalent to the original merger price of $63.25 per share? 4. What is the highest exchange ratio Birdie would be willing to pay and still undertake the merger? Special Topics companies can borrow at an 8 percent interest rate expected return on the market is 13 percent. Br row at an 8 percent interest rate. The risk-free rate is 6 percent, and the n the market is 13 percent. Bryce believes the current cost of capital for Birdie Golf is 11 percent. The beta for Hybrid Golf stock at its cum is 1.30. or Hybrid Golf stock at its current capital structure Bryce has asked you to analyze the financial aspects of the potential mense he has asked you to answer the following questions: ne financial aspects of the potential merger. Specifically, 1. Suppose Hybrid shareholders will agree to a merger price of Birdie proceed with the merger? ers will agree to a merger price of $63.25 per share. Should the highest price per share that Birdie should be willing to pay for Hybrid? Suppose Birdie is unwilling to pay cash for the merger but will consider a stock exchange. What exchange ratio would make the merger terms equivalent to the original merger price of $63.25 per share? 4. What is the highest exchange ratio Birdie would be willing to pay and still undertake the merger