Answered step by step

Verified Expert Solution

Question

1 Approved Answer

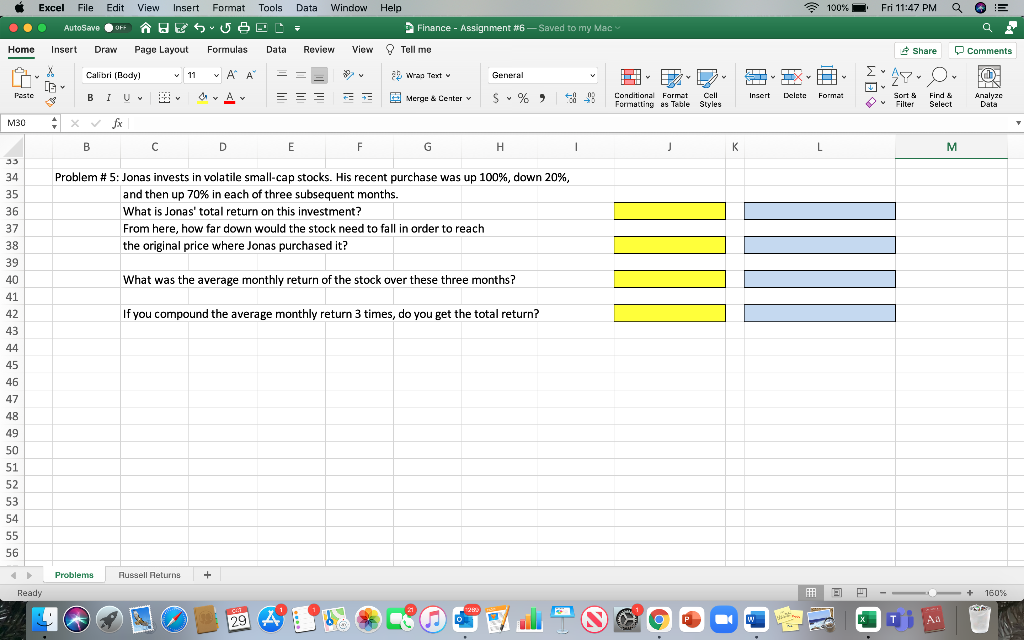

This is all the information that is given to find this answer. They do not include market prices or anything alike. Thanks! Excel File Edit

This is all the information that is given to find this answer. They do not include market prices or anything alike. Thanks!

Excel File Edit Data Window Help 100% Fri 11:47 PM Q IE View Insert Format Tools 558 AutoSave OFF Finance - Assignment #6 - Saved to my Mac Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Calibri (body) 11 X LE ~ A A Wran Text General PL F) ( LL WS Pasto B 1 BIU A y Insert Delctc E93 S%> Sort Merge & Center Fird & Format Conditional Format Call Formatting as Table Styles Filter Select Analyze Data M30 4 x fx B D E F G H 1 K L M Problem # 5: Jonas invests in volatile small-cap stocks. His recent purchase was up 100%, down 20%, and then up 70% in each of three subsequent months. What is Jonas' total return on this investment? From here, how far down would the stock need to fall in order to reach the original price where Jonas purchased it? 34 35 36 37 38 39 40 41 42 43 44 What was the average monthly return of the stock over these three months? If you compound the average monthly return 3 times, do you get the total return? 45 46 47 48 49 50 51 52 53 54 55 56 Problems Russell Returns + Ready EP + 160% 29 A T A Excel File Edit Data Window Help 100% Fri 11:47 PM Q IE View Insert Format Tools 558 AutoSave OFF Finance - Assignment #6 - Saved to my Mac Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Calibri (body) 11 X LE ~ A A Wran Text General PL F) ( LL WS Pasto B 1 BIU A y Insert Delctc E93 S%> Sort Merge & Center Fird & Format Conditional Format Call Formatting as Table Styles Filter Select Analyze Data M30 4 x fx B D E F G H 1 K L M Problem # 5: Jonas invests in volatile small-cap stocks. His recent purchase was up 100%, down 20%, and then up 70% in each of three subsequent months. What is Jonas' total return on this investment? From here, how far down would the stock need to fall in order to reach the original price where Jonas purchased it? 34 35 36 37 38 39 40 41 42 43 44 What was the average monthly return of the stock over these three months? If you compound the average monthly return 3 times, do you get the total return? 45 46 47 48 49 50 51 52 53 54 55 56 Problems Russell Returns + Ready EP + 160% 29 A T AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started