Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is all the information that was provided to me. EZ Curb Company completed the following transactions. The annual accounting period ends December 31. January

This is all the information that was provided to me.

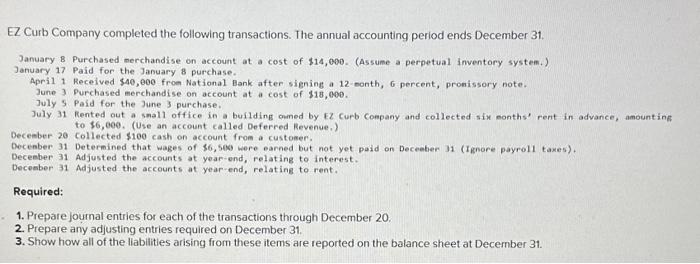

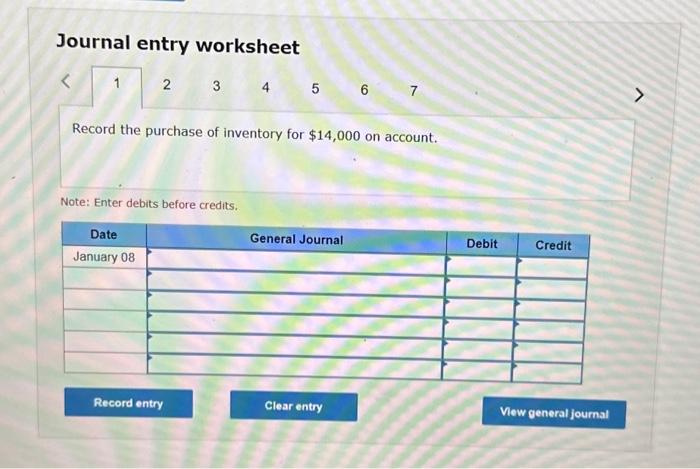

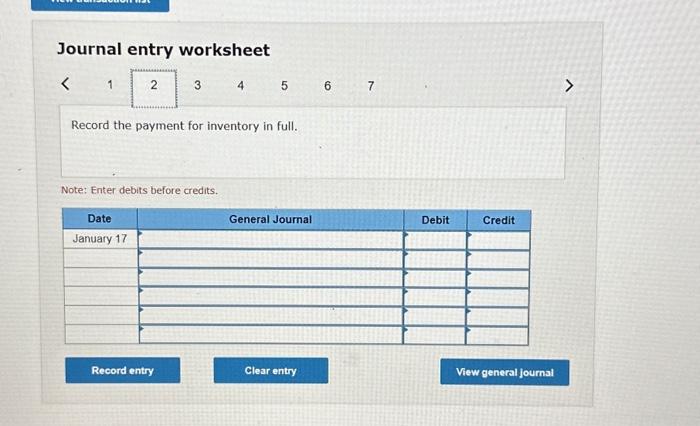

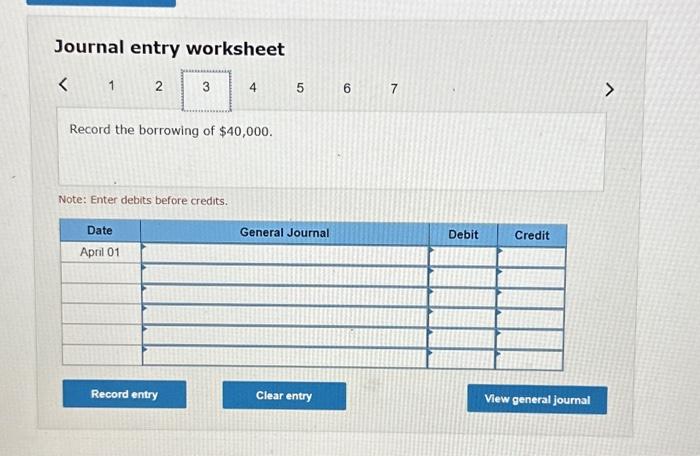

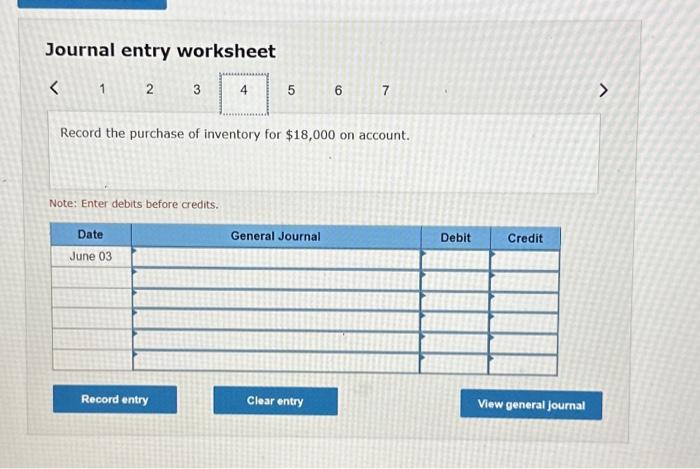

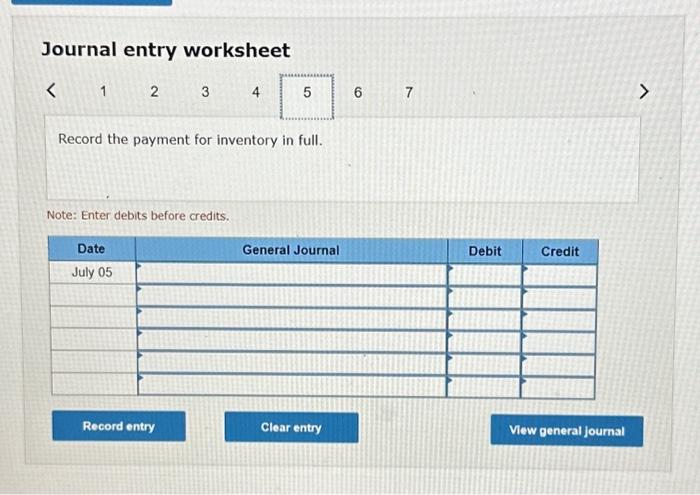

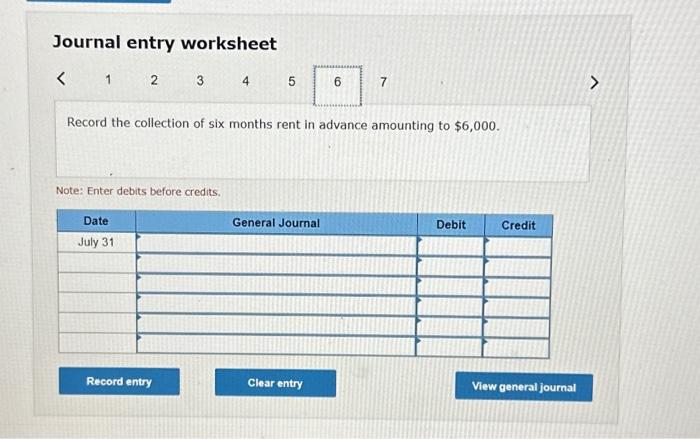

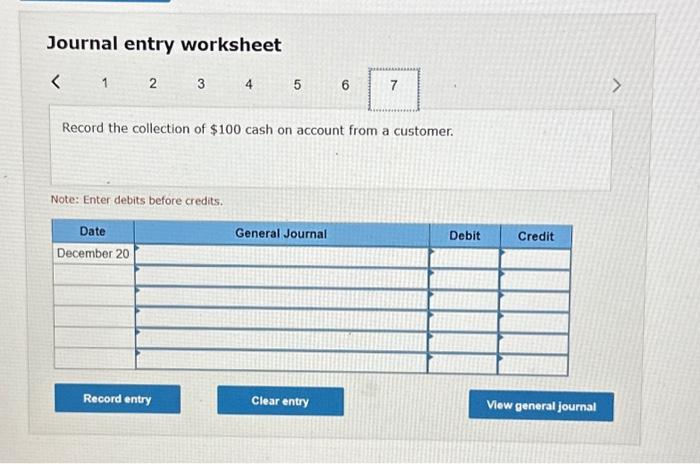

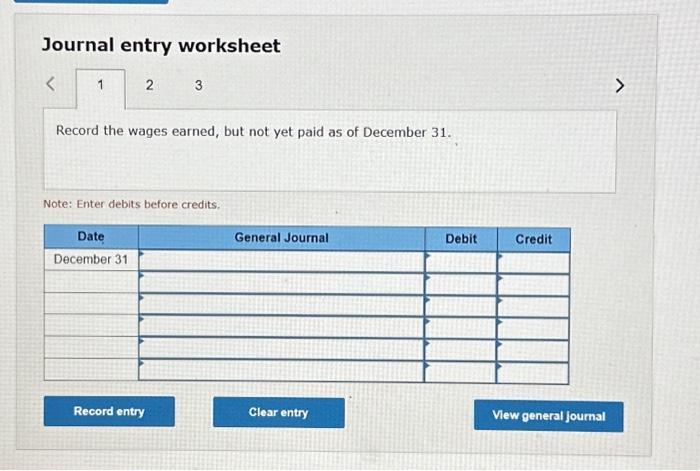

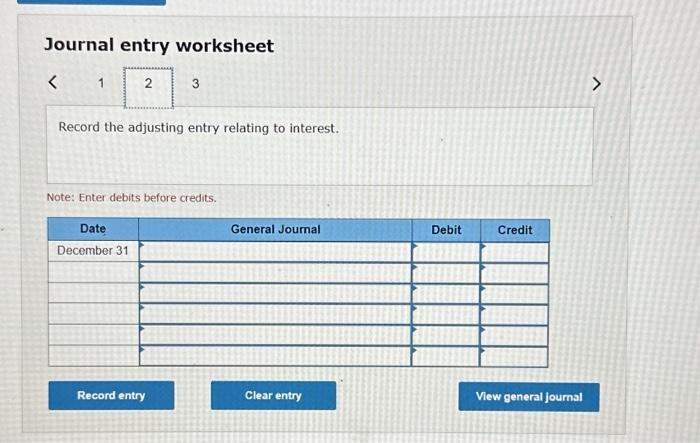

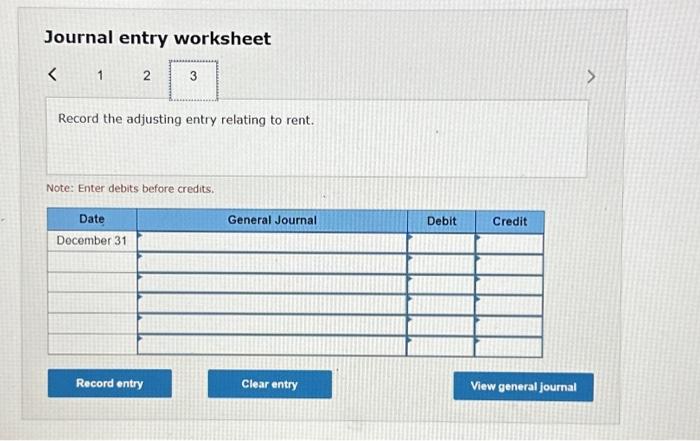

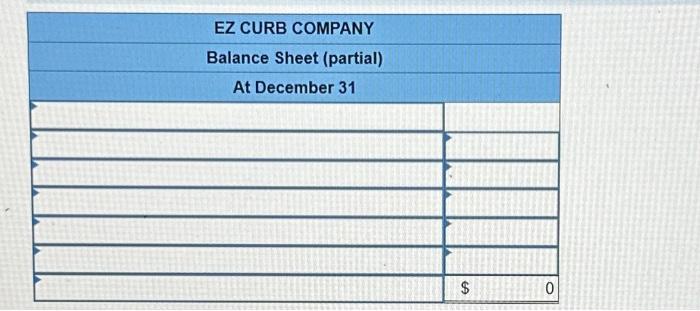

EZ Curb Company completed the following transactions. The annual accounting period ends December 31. January B Purchased merchandise on account at a cost of \$14,000. (Assume a perpetual inventory system.) January 17 Paid for the January 8 purchase. April 1 Received $40,000 froe National Bank after signing a 12-ponth, 6 percent, pronissory note. June 3 Purchased merchandise on account at a cost of $18,000. July 5 Paid for the June 3 purchase. July 31 Rented out a small office in a building ommed by EZ curb company and collected six months' rent in advance, amounting to 16,000 . (Use an account called Deferred Revenue.) Deceaber 20 collected $100 cash on account from a customer. Decenber 31 Determined that wages of 56,500 were earned but not yet paid on Deceater 31 (Ignore payrol11 taxes). Deceeber 31 Adjusted the accounts at year-end, relating to interest. Decesber 31 Adjusted the accounts at year-end, relating to rent. Required: 1. Prepare journal entries for each of the transactions through December 20 . 2. Prepare any adjusting entries required on December 31 . 3. Show how all of the llabilities arising from these items are reported on the balance sheet at December 31 . Journal entry worksheet 27 Record the purchase of inventory for $14,000 on account. Note: Enter debits before credits. Journal entry worksheet 4 5 Record the payment for inventory in full. Note: Enter debits before credits. Journal entry worksheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started