Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is an advanced accounting course question 4 PC issued 3,000,000 of its own shares (fair value of Si per share) and paid 5500,000 in

this is an advanced accounting course

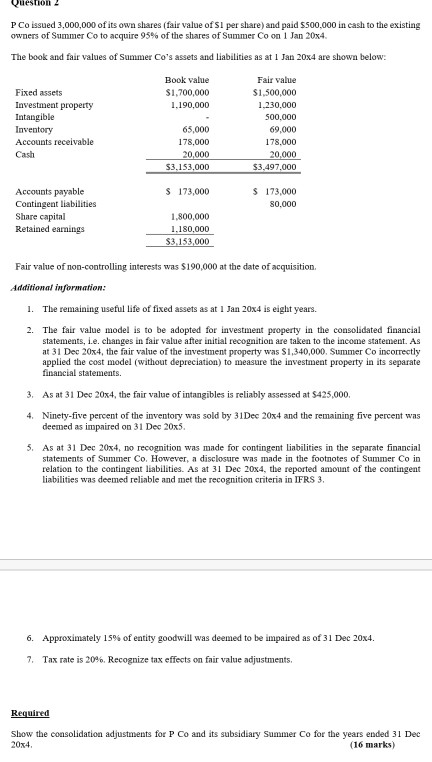

question 4 PC issued 3,000,000 of its own shares (fair value of Si per share) and paid 5500,000 in cash to the existing owners of Summer Co to acquire 95% of the shares of Summer Co on 1 Jan 20x4 The book and fair values of Summer Co's assets and liabilities as at 1 Jan 20x4 are shown below: Book value $1,700,000 1.190.000 Fixed assets Investment property Intangible Inventory Accounts receivable Cash Fair value $1,500,000 1.230.000 500.000 69,000 178,000 20.000 53.497,000 65,000 178,000 20.000 53.153.000 $ 173,000 $ 173.000 80,000 Accounts payable Contingent liabilities Share capital Retained earings 1.800,000 1.180.000 $3.153.000 Fair value of non-controlling interests was $190,000 at the date of acquisition Additional information: 1 The remaining useful life of fixed assets as at 1 Jan 20x4 is eight years. 2. The fair value model is to be adopted for investment property in the consolidated financial statements, le changes in fair value after initial recognition are taken to the income statement AS at 31 Dec 20x4, the fair value of the investment property was $1,340,000. Summer Co incorrectly applied the cost model (without depreciation) to measure the investment property in its separate financial statements. 3. As at 31 Dec 20x4, the fair value of intangibles is reliably assessed at $425,000 4. Ninety-five percent of the inventory was sold by 31 Dec 20x4 and the remaining five percent was deemed as impaired on 31 Dec 20x5. 5. As at 31 Dec 20x4, no recognition was made for contingent liabilities in the separate financial statements of Summer Co. However, a disclosure was made in the footnotes of Summer Co in relation to the contingent liabilities. As at 31 Dec 20x4, the reported amount of the contingent liabilities was deemed reliable and met the recognition criteria in IFRS 3. 6. Approximately 15% of entity goodwill was deemed to be impaired as of 31 Dec 20x4. 7. Tax rate is 20%. Recognize tax effects on fair value adjustments Required Show the consolidation adjustments for P Co and its subsidiary Summer Co for the years ended 31 Dec 20x4 (16 marks) question 4 PC issued 3,000,000 of its own shares (fair value of Si per share) and paid 5500,000 in cash to the existing owners of Summer Co to acquire 95% of the shares of Summer Co on 1 Jan 20x4 The book and fair values of Summer Co's assets and liabilities as at 1 Jan 20x4 are shown below: Book value $1,700,000 1.190.000 Fixed assets Investment property Intangible Inventory Accounts receivable Cash Fair value $1,500,000 1.230.000 500.000 69,000 178,000 20.000 53.497,000 65,000 178,000 20.000 53.153.000 $ 173,000 $ 173.000 80,000 Accounts payable Contingent liabilities Share capital Retained earings 1.800,000 1.180.000 $3.153.000 Fair value of non-controlling interests was $190,000 at the date of acquisition Additional information: 1 The remaining useful life of fixed assets as at 1 Jan 20x4 is eight years. 2. The fair value model is to be adopted for investment property in the consolidated financial statements, le changes in fair value after initial recognition are taken to the income statement AS at 31 Dec 20x4, the fair value of the investment property was $1,340,000. Summer Co incorrectly applied the cost model (without depreciation) to measure the investment property in its separate financial statements. 3. As at 31 Dec 20x4, the fair value of intangibles is reliably assessed at $425,000 4. Ninety-five percent of the inventory was sold by 31 Dec 20x4 and the remaining five percent was deemed as impaired on 31 Dec 20x5. 5. As at 31 Dec 20x4, no recognition was made for contingent liabilities in the separate financial statements of Summer Co. However, a disclosure was made in the footnotes of Summer Co in relation to the contingent liabilities. As at 31 Dec 20x4, the reported amount of the contingent liabilities was deemed reliable and met the recognition criteria in IFRS 3. 6. Approximately 15% of entity goodwill was deemed to be impaired as of 31 Dec 20x4. 7. Tax rate is 20%. Recognize tax effects on fair value adjustments Required Show the consolidation adjustments for P Co and its subsidiary Summer Co for the years ended 31 Dec 20x4 (16 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started