Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is an assignment i have for my project management class I would like help on part 1 MISM 4165 Individual Assignment 1: Project Selection

This is an assignment i have for my project management class I would like help on part 1

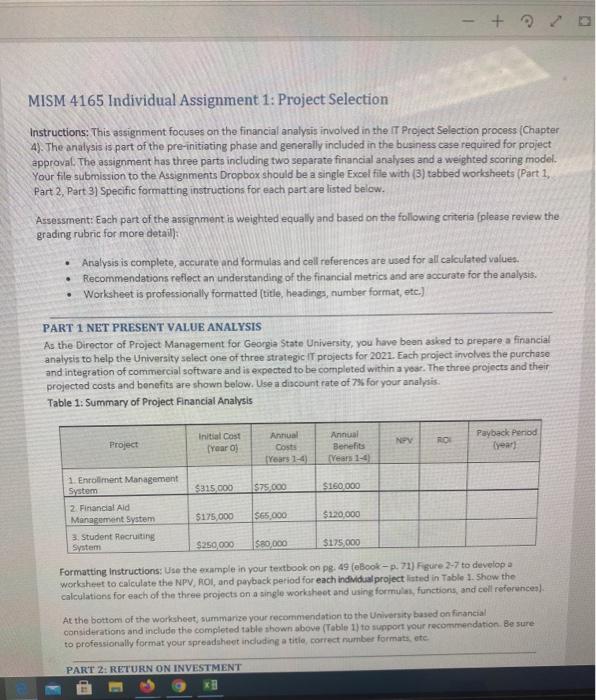

MISM 4165 Individual Assignment 1: Project Selection Instructions: This assignment focuses on the financial analysis involved in the IT Project Selection process (Chapter 4). The analysis is part of the pre-initiating phase and generally included in the business case required for project approval. The assignment has three parts including two separate financial analyses and a weighted scoring model. Your file submission to the Assignments Dropbox should be a single Excel file with (3) tabbed worksheets (Part 1, Part 2 Part 3) Specific formatting instructions for each part are listed below. Assessment: Each part of the assignment in weighted equally and based on the following criteria (please review the grading rubric for more detail); Analysis is complete, accurate and formulas and cell references are used for all calculated values. Recommendations reflect an understanding of the financial metrics and are accurate for the analysis. Worksheet is professionally formatted (title, headings, number format, etc.) PART 1 NET PRESENT VALUE ANALYSIS As the Director of Project Management for Georgia State University, you have been asked to prepare a financial analysis to help the University select one of three strategic IT projects for 2021. Each project involves the purchase and integration of commercial software and is expected to be completed within a year. The three projects and their projected costs and benefits are shown below. Use a discount rate of 7% for your analysis. Table 1. Summary of Project Financial Analysis Payback period Project Initial Cost (Year Annual Costs Years 1-4 Annual Benefits (Years 1-4 $315.000 $75.000 $160 000 1. Enrollment Management System 2. Financial Aid Management System 3. Student Recruiting System $175,000 $65.000 $120.000 $250,000 $80,000 $175.000 Formatting Instructions: Use the example in your textbook on pg. 49 (eBook-p. 71) Figure 2-7 to develop a worksheet to calculate the NPV, ROI, and payback period for each individual project sted in Table 1. Show the calculations for each of the three projects on a single worksheet and using formulas, functions, and cell references) At the bottom of the worksheet, summarize your recommendation to the University based on financial considerations and include the completed table shown above (Table 1) to support your recommendation. Be sure to professionally for your spreadsheet including a title correct number formatsete PART 2: RETURN ON INVESTMENT Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started