THIS IS AN EXAMPLE OF WHAT THE PROBLEM IS! THIS IS EXACTLY WHAT ITS GONNA LOOK LIKE BUT GOING TO BE DIFFERENT NUMBERS.

THIS IS THE ACTUAL PROBLEM!! I NEED ALL 5 PARTS! I COULD ONLY SEND THE INFORMATION AND PART 1. PLEASE AND THANK YOU

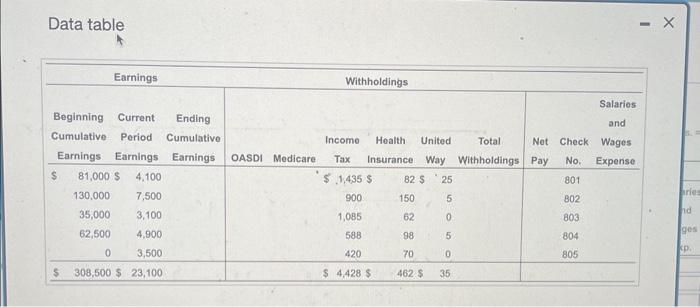

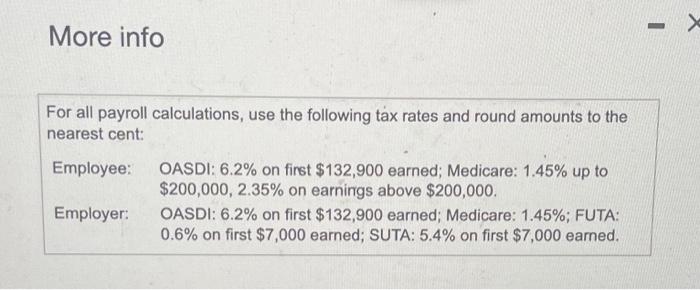

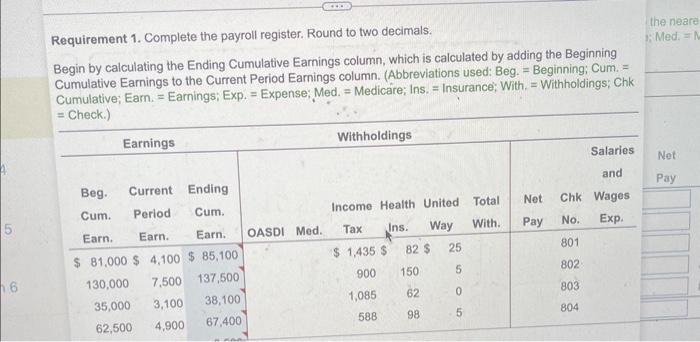

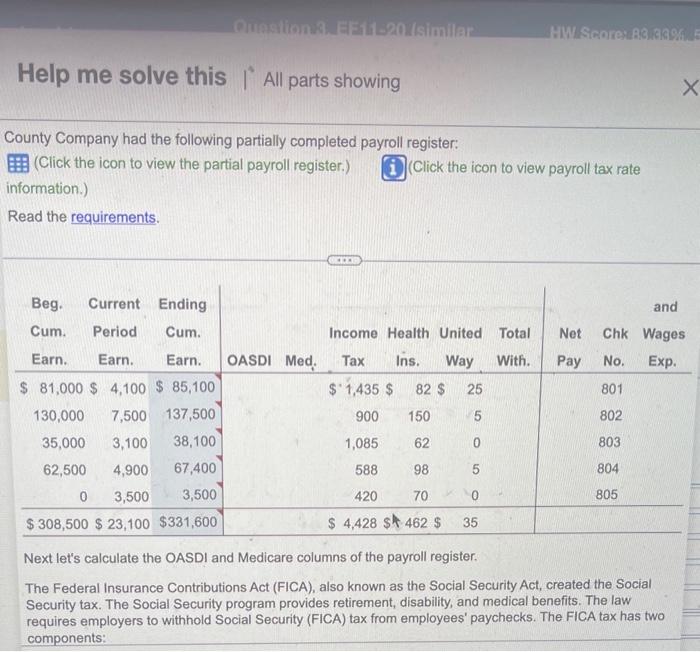

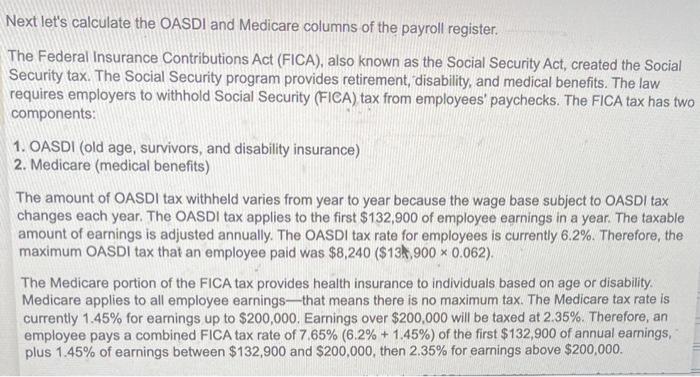

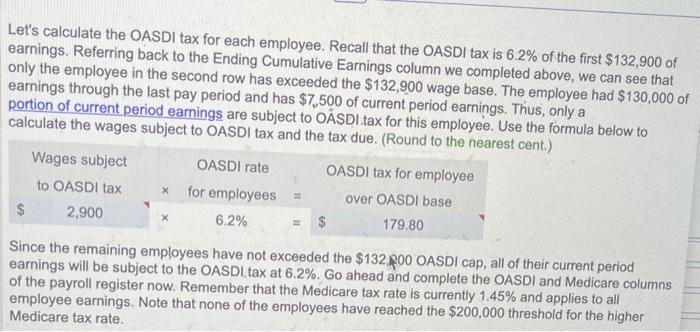

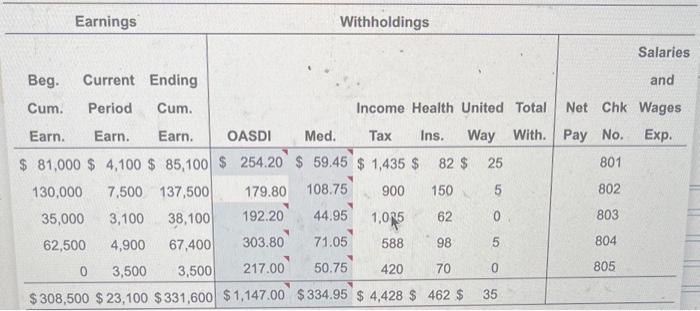

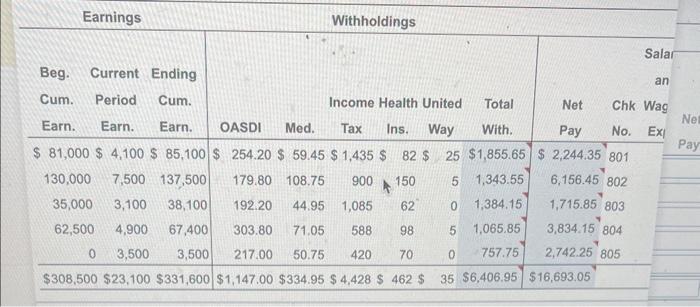

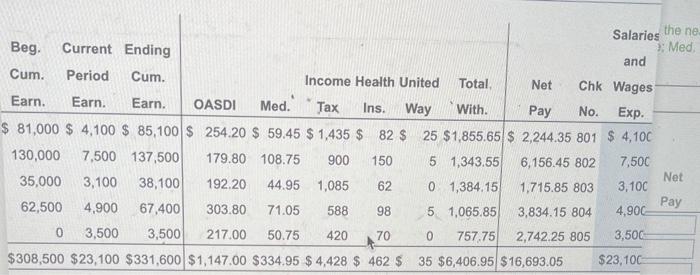

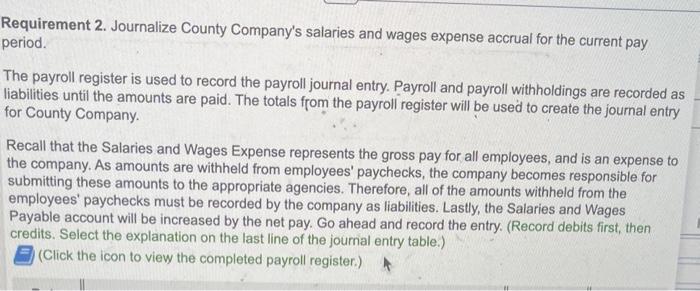

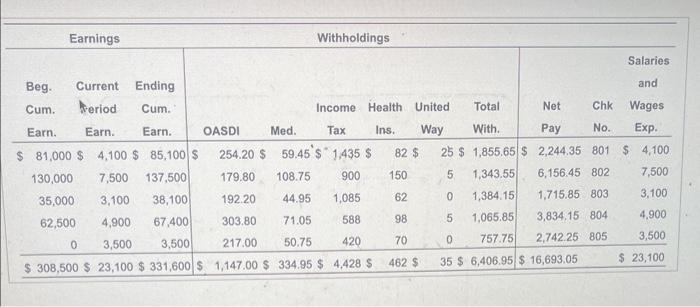

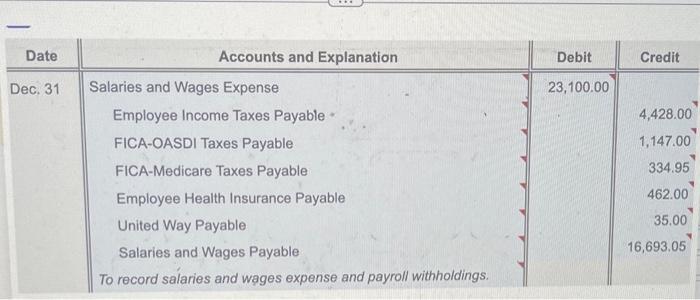

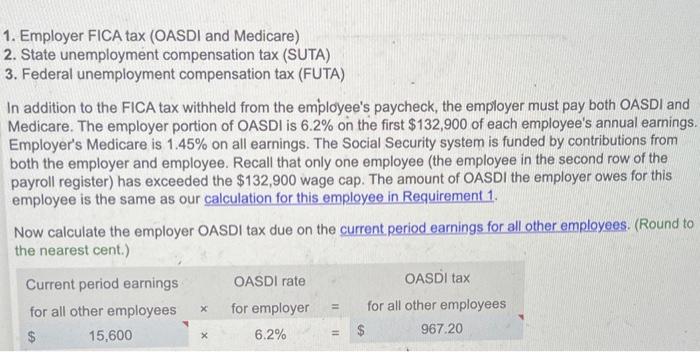

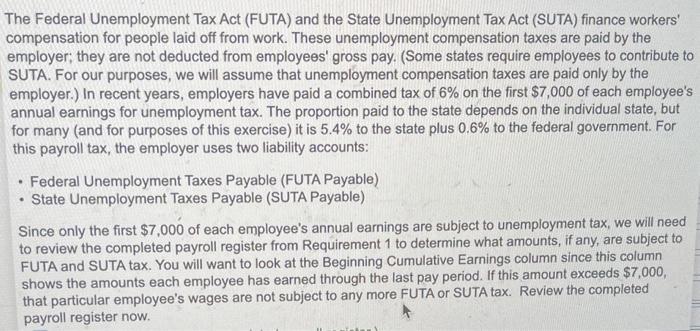

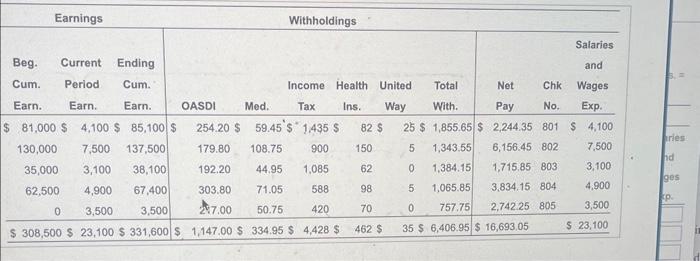

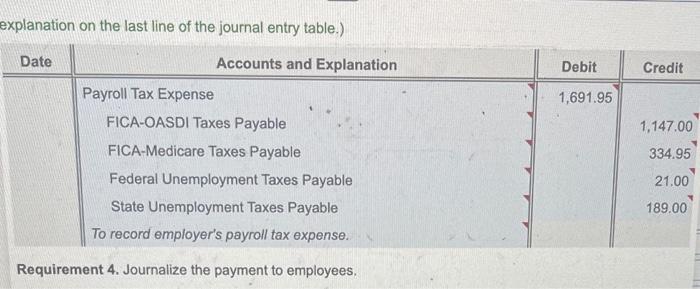

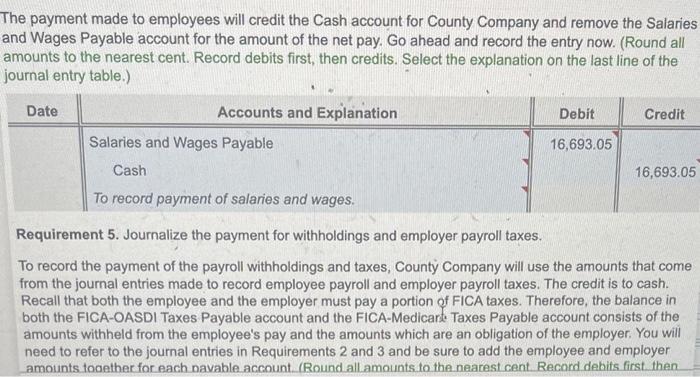

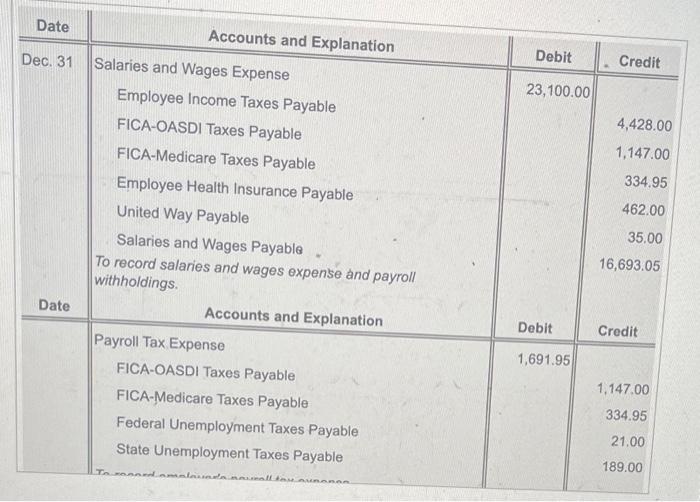

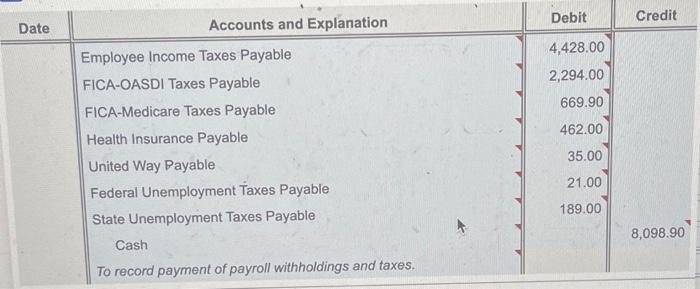

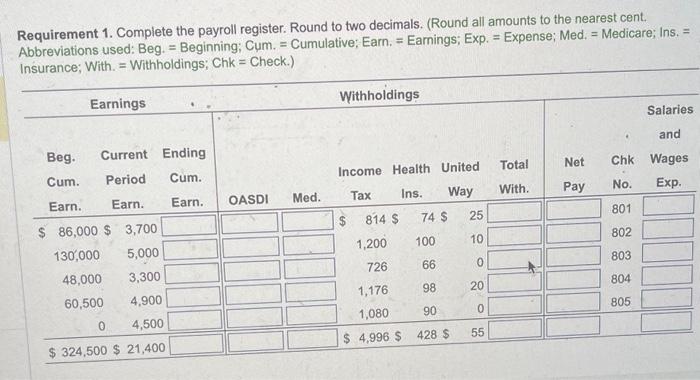

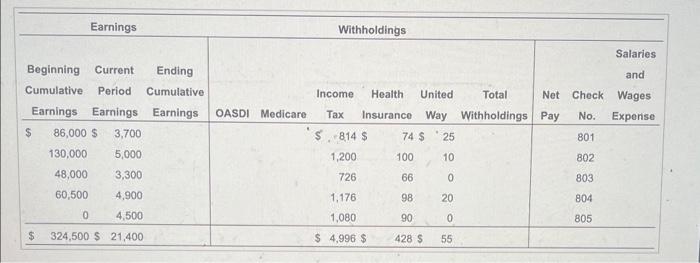

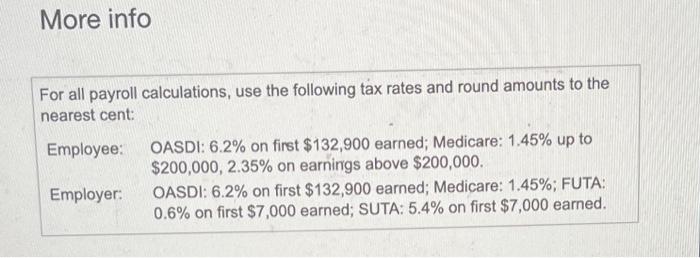

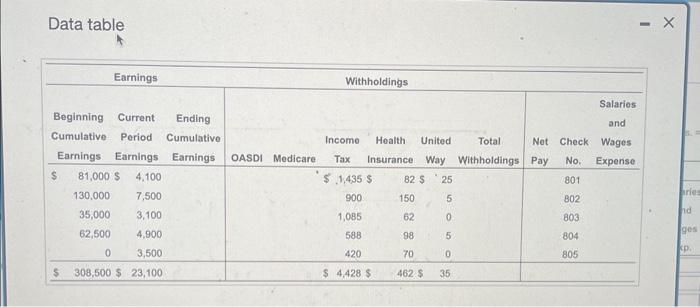

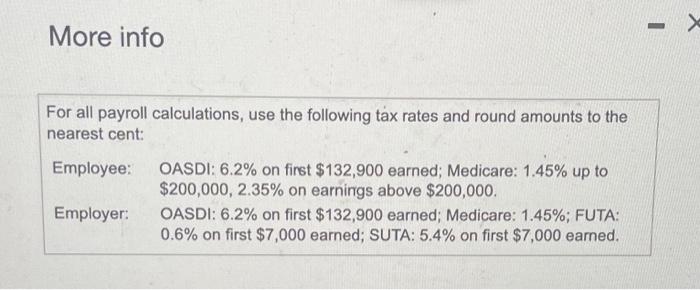

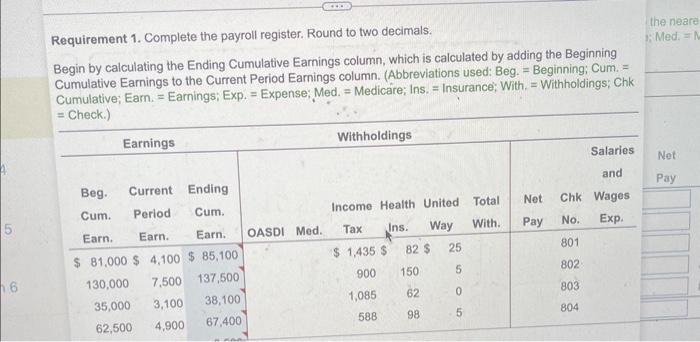

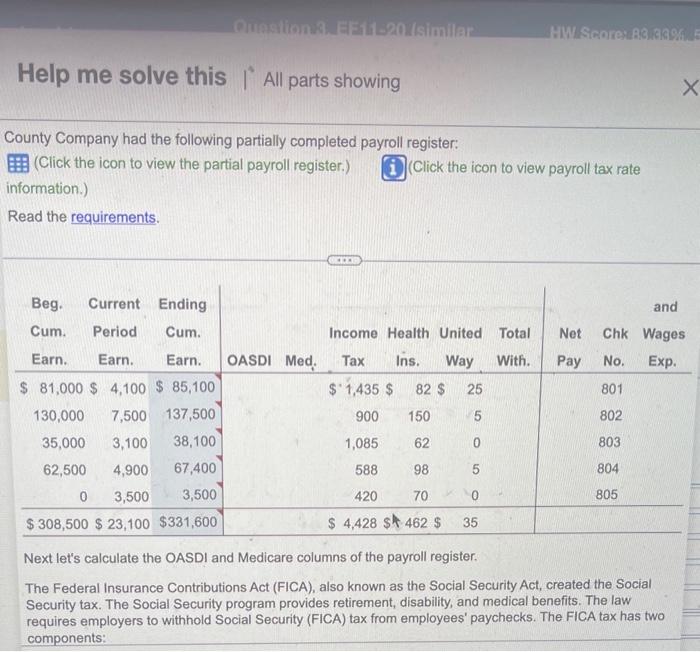

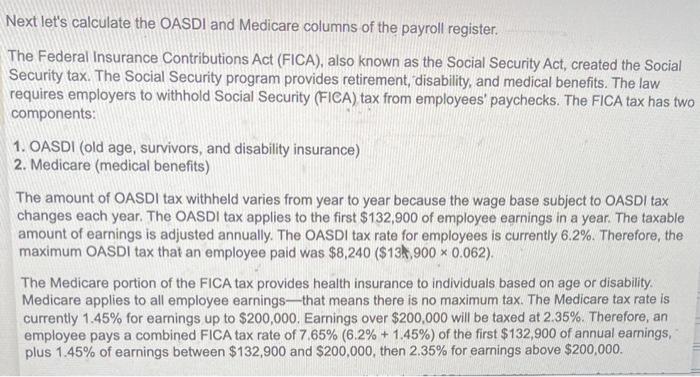

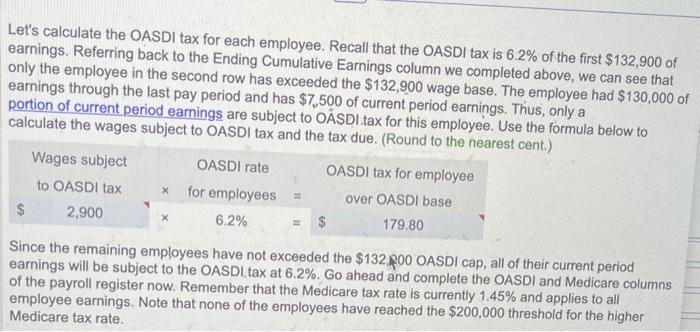

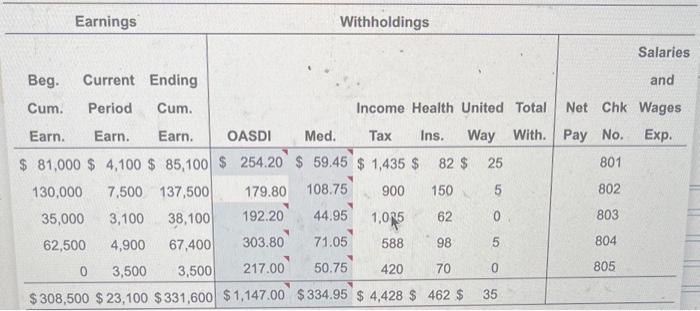

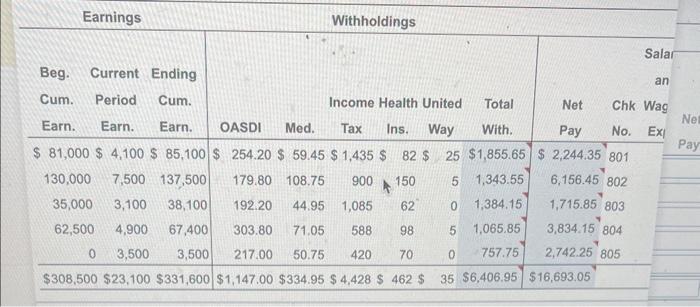

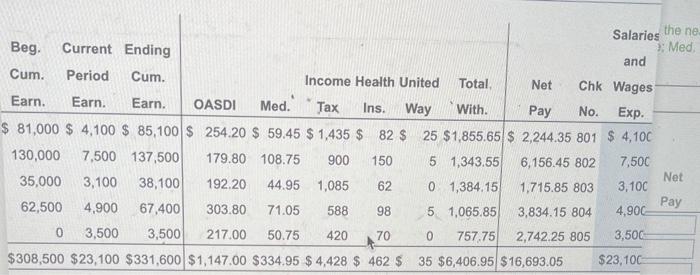

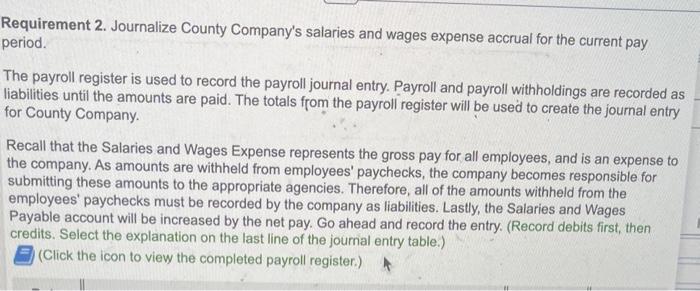

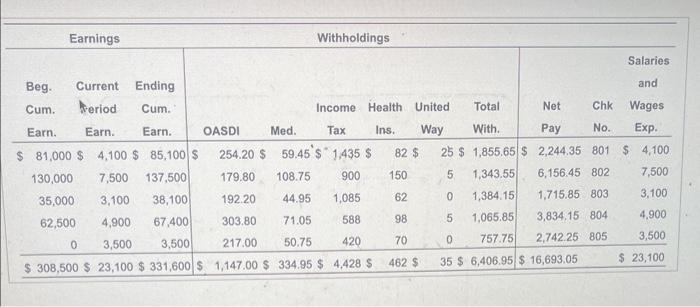

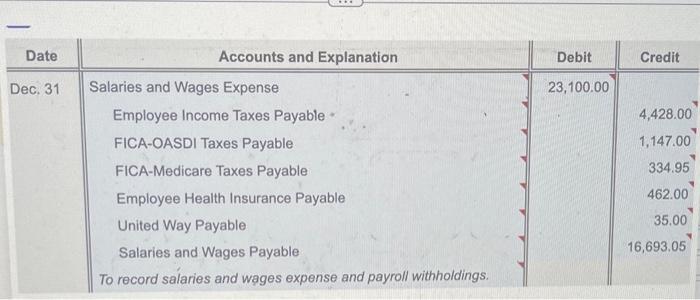

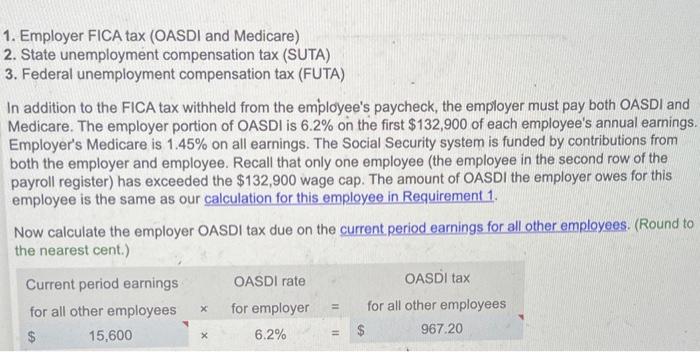

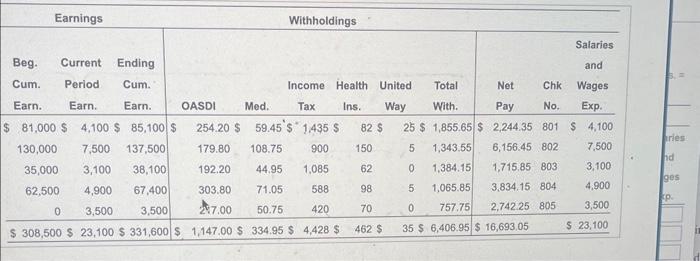

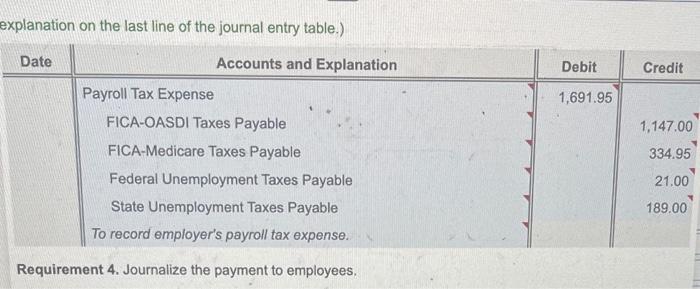

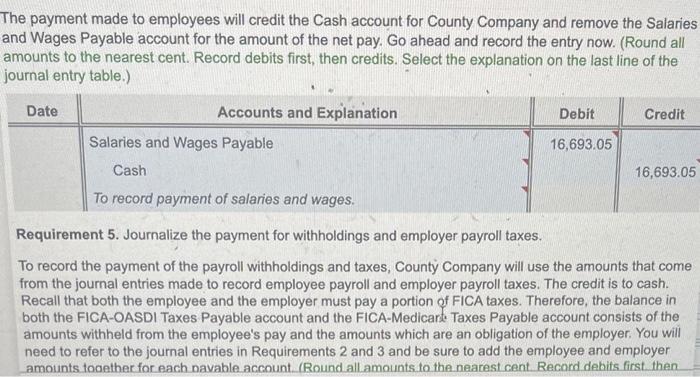

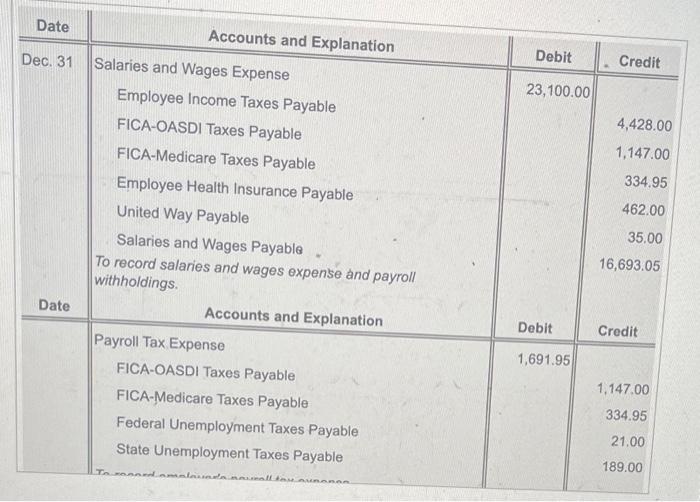

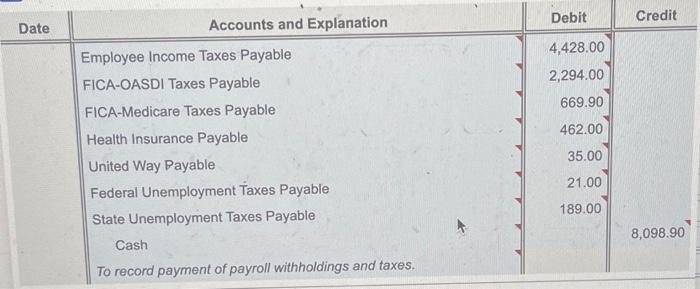

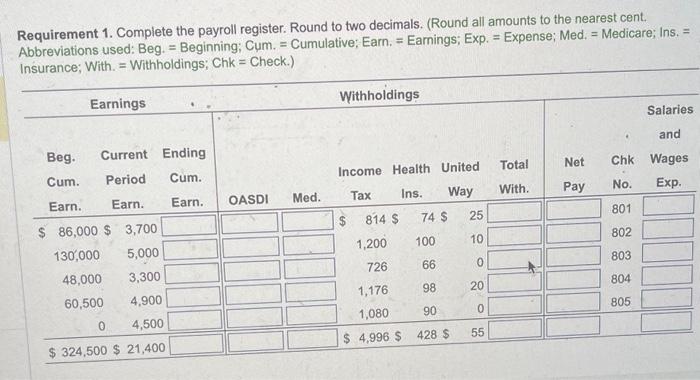

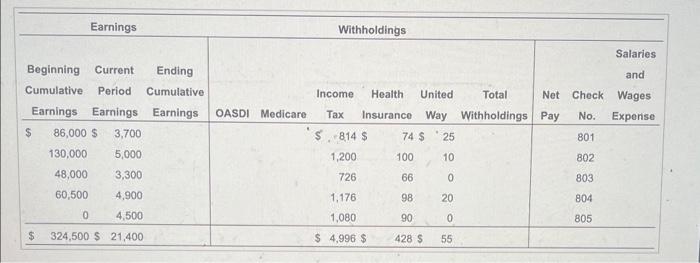

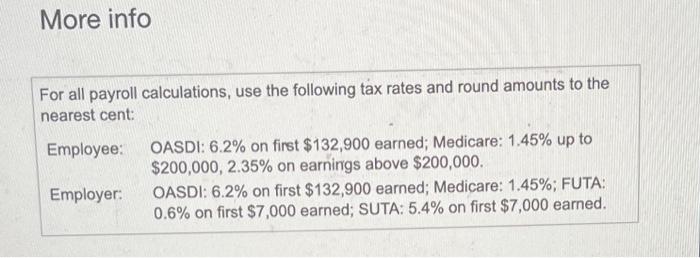

Data table More info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000,2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Requirement 1. Complete the payroll register. Round to two decimals. Begin by calculating the Ending Cumulative Earnings column, which is calculated by adding the Beginning Cumulative Earnings to the Current Period Earnings column. (Abbreviations used: Beg. = Beginning; Cum. = Cumulative; Earn. = Earnings; Exp. = Expense; Med. = Medicare; Ins. = Insurance; With. = Withholdings; Chk County Company had the following partially completed payroll register: (Click the icon to view the partial payroll register.) (Click the icon to view payroll tax rate information.) Read the requirements. Next let's calculate the OASDI and Medicare columns of the payroll register. The Federal Insurance Contributions Act (FICA), also known as the Social Security Act, created the Social Security tax. The Social Security program provides retirement, disability, and medical benefits. The law requires employers to withhold Social Security (FICA) tax from employees' paychecks. The FICA tax has two components: Next let's calculate the OASDI and Medicare columns of the payroll register. The Federal Insurance Contributions Act (FICA), also known as the Social Security Act, created the Social Security tax. The Social Security program provides retirement, disability, and medical benefits. The law requires employers to withhold Social Security (FICA) tax from employees' paychecks. The FICA tax has two components: 1. OASDI (old age, survivors, and disability insurance) 2. Medicare (medical benefits) The amount of OASDI tax withheld varies from year to year because the wage base subject to OASDI tax changes each year. The OASDI tax applies to the first $132,900 of employee earnings in a year. The taxable amount of earnings is adjusted annually. The OASDI tax rate for employees is currently 6.2%. Therefore, the maximum OASDI tax that an employee paid was $8,240($13k,9000.062). The Medicare portion of the FICA tax provides health insurance to individuals based on age or disability. Medicare applies to all employee earnings - that means there is no maximum tax. The Medicare tax rate is currently 1.45% for earnings up to $200,000. Earnings over $200,000 will be taxed at 2.35%. Therefore, an employee pays a combined FICA tax rate of 7.65%(6.2%+1.45%) of the first $132,900 of annual earnings, plus 1.45% of earnings between $132,900 and $200,000, then 2.35% for earnings above $200,000. Let's calculate the OASDI tax for each employee. Recall that the OASDI tax is 6.2% of the first $132,900 of earnings. Referring back to the Ending Cumulative Earnings column we completed above, we can see that only the employee in the second row has exceeded the $132,900 wage base. The employee had $130,000 of earnings through the last pay period and has $7,500 of current period earnings. Thus, only a portion of current period earnings are subject to OSDI tax for this employee. Use the formula below to calculate the wages subject to OASDI tax and the tax due. (Round th tha naarest cent.) Since the remaining employees have not exceeded the \$132, , 00 OASDI cap, all of their current period earnings will be subject to the OASDI.tax at 6.2%. Go ahead and complete the OASDI and Medicare columns of the payroll register now. Remember that the Medicare tax rate is currently 1.45% and applies to all employee earnings. Note that none of the employees have reached the $200,000 threshold for the higher Medicare tax rate. Requirement 2. Journalize County Company's salaries and wages expense accrual for the current pay period. The payroll register is used to record the payroll journal entry. Payroll and payroll withholdings are recorded as liabilities until the amounts are paid. The totals from the payroll register will be used to create the journal entry for County Company. Recall that the Salaries and Wages Expense represents the gross pay for all employees, and is an expense to the company. As amounts are withheld from employees' paychecks, the company becomes responsible for submitting these amounts to the appropriate agencies. Therefore, all of the amounts withheld from the employees' paychecks must be recorded by the company as liabilities. Lastly, the Salaries and Wages Payable account will be increased by the net pay. Go ahead and record the entry. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) (Click the icon to view the completed payroll register.) 1. Employer FICA tax (OASDI and Medicare) 2. State unemployment compensation tax (SUTA) 3. Federal unemployment compensation tax (FUTA) In addition to the FICA tax withheld from the employee's paycheck, the employer must pay both OASDI and Medicare. The employer portion of OASDI is 6.2% on the first $132,900 of each employee's annual earnings. Employer's Medicare is 1.45% on all earnings. The Social Security system is funded by contributions from both the employer and employee. Recall that only one employee (the employee in the second row of the payroll register) has exceeded the $132,900 wage cap. The amount of OASDI the employer owes for this employee is the same as our calculation for this employee in Requirement 1. Now calculate the employer OASDI tax due on the current period earnings for all other employees. (Round to The Federal Unemployment Tax Act (FUTA) and the State Unemployment Tax Act (SUTA) finance workers' compensation for people laid off from work. These unemployment compensation taxes are paid by the employer; they are not deducted from employees' gross pay. (Some states require employees to contribute to SUTA. For our purposes, we will assume that unemployment compensation taxes are paid only by the employer.) In recent years, employers have paid a combined tax of 6% on the first $7,000 of each employee's annual earnings for unemployment tax. The proportion paid to the state depends on the individual state, but for many (and for purposes of this exercise) it is 5.4% to the state plus 0.6% to the federal government. For this payroll tax, the employer uses two liability accounts: - Federal Unemployment Taxes Payable (FUTA Payable) - State Unemployment Taxes Payable (SUTA Payable) Since only the first $7,000 of each employee's annual earnings are subject to unemployment tax, we will need to review the completed payroll register from Requirement 1 to determine what amounts, if any, are subject to FUTA and SUTA tax. You will want to look at the Beginning Cumulative Earnings column since this column shows the amounts each employee has earned through the last pay period. If this amount exceeds $7,000, that particular employee's wages are not subject to any more FUTA or SUTA tax. Review the completed payroll register now. County Company had the following partially completed payroll register: 1:8. (Click the icon to view the partial payroll register.) (Click the icon to view payroll tax rate information.) Read the requirements. Since only the first $7,000 of each employee's annual earnings are subject to unemployment tax, we will need to review the completed payroll register from Requirement 1 to determine what amounts, if any, are subject to FUTA and SUTA tax. You will want to look at the Beginning Cumulative Earnings column since this column shows the amounts each employee has earned through the last pay period. If this amount exceeds $7,000, that particular employee's wages are not subject to any more FUTA or SUTA tax. Review the completed payroll register now. (Click the icon to view the completed payroll register.) You can see that only the last employlee has not exceeded the $7,000 limit. This employee has had no wages subject to the FUTA or SUTA tax through the last period, because they have earned $0 to date. Thus, all of this employee's current period earnings will be subject to the FUTA and SUTA tax. County Company will only pay unemployment taxes on this employee because all other employees have earned more than $7,000 to date. County Company records the employer's payroll tax expense as a debit to Payroll Tax Expense and a credit to the various payable accounts. For OASDI Taxes Payable, you will need to add the OASDI tax amounts you calculated in the previous steps. The Medicare Taxes Payable for the employer will be equal to the employee amount since this tax applies to all employee earnings at the same rate. You will need to calculate the FUTA and SUTA Taxes Payable. Record the entry now. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) explanation on the last line of the journal entry table.) Requirement 4. Journalize the payment to employees. The payment made to employees will credit the Cash account for County Company and remove the Salaries and Wages Payable account for the amount of the net pay. Go ahead and record the entry now. (Round all amounts to the nearest cent. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Requirement 5 . Journalize the payment for withholdings and employer payroll taxes. To record the payment of the payroll withholdings and taxes, County Company will use the amounts that come from the journal entries made to record employee payroll and employer payroll taxes. The credit is to cash. Recall that both the employee and the employer must pay a portion of FICA taxes. Therefore, the balance in both the FICA-OASDI Taxes Payable account and the FICA-Medicare. Taxes Payable account consists of the amounts withheld from the employee's pay and the amounts which are an obligation of the employer. You will need to refer to the journal entries in Requirements 2 and 3 and be sure to add the employee and employer amounts toanther for each navable account. (Round all amounts to the nearest cent. Record debits first then Requirement 1. Complete the payroll register. Round to two decimals. (Round all amounts to the nearest cent. Abbreviations used: Beg. = Beginning; Cum. = Cumulative; Earn. = Earnings; Exp. = Expense; Med. = Medicare; Ins. = Insurance; With. = Withholdings; Chk = Check.) More info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000,2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Data table More info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000,2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Requirement 1. Complete the payroll register. Round to two decimals. Begin by calculating the Ending Cumulative Earnings column, which is calculated by adding the Beginning Cumulative Earnings to the Current Period Earnings column. (Abbreviations used: Beg. = Beginning; Cum. = Cumulative; Earn. = Earnings; Exp. = Expense; Med. = Medicare; Ins. = Insurance; With. = Withholdings; Chk County Company had the following partially completed payroll register: (Click the icon to view the partial payroll register.) (Click the icon to view payroll tax rate information.) Read the requirements. Next let's calculate the OASDI and Medicare columns of the payroll register. The Federal Insurance Contributions Act (FICA), also known as the Social Security Act, created the Social Security tax. The Social Security program provides retirement, disability, and medical benefits. The law requires employers to withhold Social Security (FICA) tax from employees' paychecks. The FICA tax has two components: Next let's calculate the OASDI and Medicare columns of the payroll register. The Federal Insurance Contributions Act (FICA), also known as the Social Security Act, created the Social Security tax. The Social Security program provides retirement, disability, and medical benefits. The law requires employers to withhold Social Security (FICA) tax from employees' paychecks. The FICA tax has two components: 1. OASDI (old age, survivors, and disability insurance) 2. Medicare (medical benefits) The amount of OASDI tax withheld varies from year to year because the wage base subject to OASDI tax changes each year. The OASDI tax applies to the first $132,900 of employee earnings in a year. The taxable amount of earnings is adjusted annually. The OASDI tax rate for employees is currently 6.2%. Therefore, the maximum OASDI tax that an employee paid was $8,240($13k,9000.062). The Medicare portion of the FICA tax provides health insurance to individuals based on age or disability. Medicare applies to all employee earnings - that means there is no maximum tax. The Medicare tax rate is currently 1.45% for earnings up to $200,000. Earnings over $200,000 will be taxed at 2.35%. Therefore, an employee pays a combined FICA tax rate of 7.65%(6.2%+1.45%) of the first $132,900 of annual earnings, plus 1.45% of earnings between $132,900 and $200,000, then 2.35% for earnings above $200,000. Let's calculate the OASDI tax for each employee. Recall that the OASDI tax is 6.2% of the first $132,900 of earnings. Referring back to the Ending Cumulative Earnings column we completed above, we can see that only the employee in the second row has exceeded the $132,900 wage base. The employee had $130,000 of earnings through the last pay period and has $7,500 of current period earnings. Thus, only a portion of current period earnings are subject to OSDI tax for this employee. Use the formula below to calculate the wages subject to OASDI tax and the tax due. (Round th tha naarest cent.) Since the remaining employees have not exceeded the \$132, , 00 OASDI cap, all of their current period earnings will be subject to the OASDI.tax at 6.2%. Go ahead and complete the OASDI and Medicare columns of the payroll register now. Remember that the Medicare tax rate is currently 1.45% and applies to all employee earnings. Note that none of the employees have reached the $200,000 threshold for the higher Medicare tax rate. Requirement 2. Journalize County Company's salaries and wages expense accrual for the current pay period. The payroll register is used to record the payroll journal entry. Payroll and payroll withholdings are recorded as liabilities until the amounts are paid. The totals from the payroll register will be used to create the journal entry for County Company. Recall that the Salaries and Wages Expense represents the gross pay for all employees, and is an expense to the company. As amounts are withheld from employees' paychecks, the company becomes responsible for submitting these amounts to the appropriate agencies. Therefore, all of the amounts withheld from the employees' paychecks must be recorded by the company as liabilities. Lastly, the Salaries and Wages Payable account will be increased by the net pay. Go ahead and record the entry. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) (Click the icon to view the completed payroll register.) 1. Employer FICA tax (OASDI and Medicare) 2. State unemployment compensation tax (SUTA) 3. Federal unemployment compensation tax (FUTA) In addition to the FICA tax withheld from the employee's paycheck, the employer must pay both OASDI and Medicare. The employer portion of OASDI is 6.2% on the first $132,900 of each employee's annual earnings. Employer's Medicare is 1.45% on all earnings. The Social Security system is funded by contributions from both the employer and employee. Recall that only one employee (the employee in the second row of the payroll register) has exceeded the $132,900 wage cap. The amount of OASDI the employer owes for this employee is the same as our calculation for this employee in Requirement 1. Now calculate the employer OASDI tax due on the current period earnings for all other employees. (Round to The Federal Unemployment Tax Act (FUTA) and the State Unemployment Tax Act (SUTA) finance workers' compensation for people laid off from work. These unemployment compensation taxes are paid by the employer; they are not deducted from employees' gross pay. (Some states require employees to contribute to SUTA. For our purposes, we will assume that unemployment compensation taxes are paid only by the employer.) In recent years, employers have paid a combined tax of 6% on the first $7,000 of each employee's annual earnings for unemployment tax. The proportion paid to the state depends on the individual state, but for many (and for purposes of this exercise) it is 5.4% to the state plus 0.6% to the federal government. For this payroll tax, the employer uses two liability accounts: - Federal Unemployment Taxes Payable (FUTA Payable) - State Unemployment Taxes Payable (SUTA Payable) Since only the first $7,000 of each employee's annual earnings are subject to unemployment tax, we will need to review the completed payroll register from Requirement 1 to determine what amounts, if any, are subject to FUTA and SUTA tax. You will want to look at the Beginning Cumulative Earnings column since this column shows the amounts each employee has earned through the last pay period. If this amount exceeds $7,000, that particular employee's wages are not subject to any more FUTA or SUTA tax. Review the completed payroll register now. County Company had the following partially completed payroll register: 1:8. (Click the icon to view the partial payroll register.) (Click the icon to view payroll tax rate information.) Read the requirements. Since only the first $7,000 of each employee's annual earnings are subject to unemployment tax, we will need to review the completed payroll register from Requirement 1 to determine what amounts, if any, are subject to FUTA and SUTA tax. You will want to look at the Beginning Cumulative Earnings column since this column shows the amounts each employee has earned through the last pay period. If this amount exceeds $7,000, that particular employee's wages are not subject to any more FUTA or SUTA tax. Review the completed payroll register now. (Click the icon to view the completed payroll register.) You can see that only the last employlee has not exceeded the $7,000 limit. This employee has had no wages subject to the FUTA or SUTA tax through the last period, because they have earned $0 to date. Thus, all of this employee's current period earnings will be subject to the FUTA and SUTA tax. County Company will only pay unemployment taxes on this employee because all other employees have earned more than $7,000 to date. County Company records the employer's payroll tax expense as a debit to Payroll Tax Expense and a credit to the various payable accounts. For OASDI Taxes Payable, you will need to add the OASDI tax amounts you calculated in the previous steps. The Medicare Taxes Payable for the employer will be equal to the employee amount since this tax applies to all employee earnings at the same rate. You will need to calculate the FUTA and SUTA Taxes Payable. Record the entry now. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) explanation on the last line of the journal entry table.) Requirement 4. Journalize the payment to employees. The payment made to employees will credit the Cash account for County Company and remove the Salaries and Wages Payable account for the amount of the net pay. Go ahead and record the entry now. (Round all amounts to the nearest cent. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Requirement 5 . Journalize the payment for withholdings and employer payroll taxes. To record the payment of the payroll withholdings and taxes, County Company will use the amounts that come from the journal entries made to record employee payroll and employer payroll taxes. The credit is to cash. Recall that both the employee and the employer must pay a portion of FICA taxes. Therefore, the balance in both the FICA-OASDI Taxes Payable account and the FICA-Medicare. Taxes Payable account consists of the amounts withheld from the employee's pay and the amounts which are an obligation of the employer. You will need to refer to the journal entries in Requirements 2 and 3 and be sure to add the employee and employer amounts toanther for each navable account. (Round all amounts to the nearest cent. Record debits first then Requirement 1. Complete the payroll register. Round to two decimals. (Round all amounts to the nearest cent. Abbreviations used: Beg. = Beginning; Cum. = Cumulative; Earn. = Earnings; Exp. = Expense; Med. = Medicare; Ins. = Insurance; With. = Withholdings; Chk = Check.) More info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000,2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned