Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(This is an example of what to do for the above two stocks) MDC: McDonald's Corp Current Price: 194.91 Dividend: 2.52% Growth Rate: Expected Rate

(This is an example of what to do for the above two stocks)

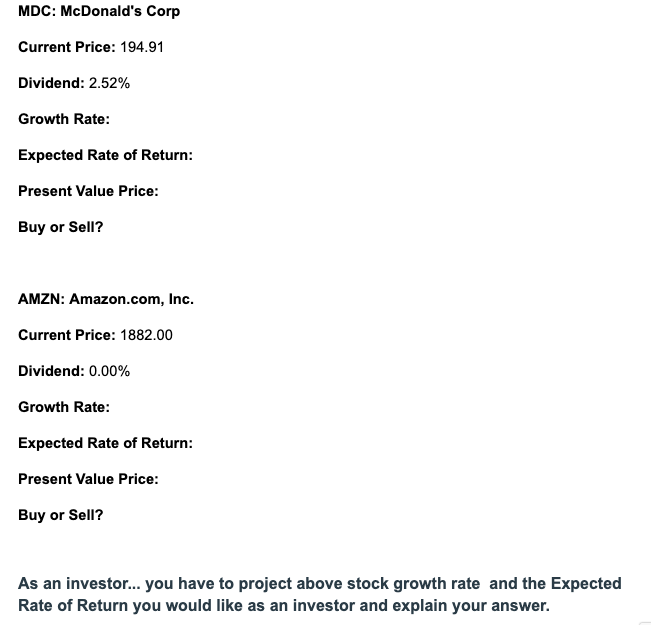

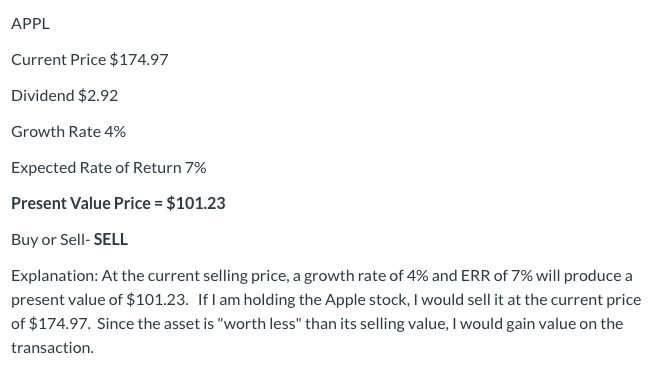

MDC: McDonald's Corp Current Price: 194.91 Dividend: 2.52% Growth Rate: Expected Rate of Return: Present Value Price: Buy or Sell? AMZN: Amazon.com, Inc. Current Price: 1882.00 Dividend: 0.00% Growth Rate: Expected Rate of Return: Present Value Price: Buy or Sell? As an investor... you have to project above stock growth rate and the Expected Rate of Return you would like as an investor and explain your answer. APPL Current Price $174.97 Dividend $2.92 Growth Rate 4% Expected Rate of Return 7% Present Value Price = $101.23 Buy or Sell- SELL Explanation: At the current selling price, a growth rate of 4% and ERR of 7% will produce a present value of $101.23. If I am holding the Apple stock, I would sell it at the current price of $174.97. Since the asset is worth less" than its selling value, I would gain value on the transactionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started