Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is an old test we took and I would just like some clarification on what the answers were and why. thanks! (Also to eliminate

This is an old test we took and I would just like some clarification on what the answers were and why. thanks! (Also to eliminate comfusion its a study abroad course so questions are asking in euros)

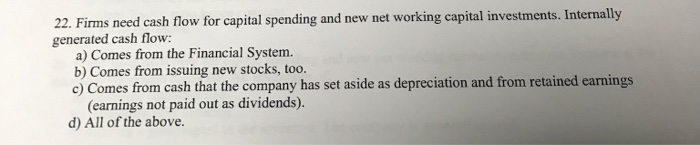

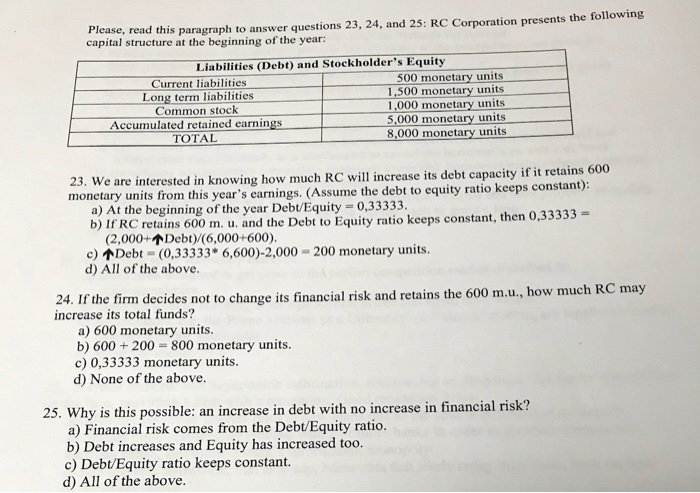

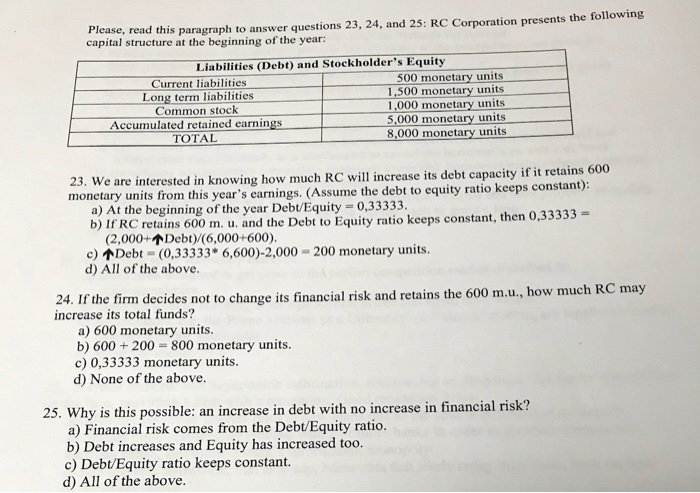

22. Firms need cash flow for capital spending and new net working capital investments. Internally generated cash flow: a) Comes from the Financial System. b) Comes from issuing new stocks, too. c) Comes from cash that the company has set aside as depreciation and from retained earnings (earnings not paid out as dividends). d) All of the above to answer questions 23, 24, and 25: RC Corporation presents the following Please, read this paragraph capital structure at the beginning of the year: Liabilities (Debt) and Stockholders Equity 500 monetary units Current liabilities 1,500 monetary units 1,000 monetary units 5,000 monetary units 8,000 monetary units Long term 1liabilities Common stock Accumulated retained earnings TOTAL 23. We are interested in knowing how much RC will increase its debt capacity if it retains 600 monetary units from this year's earnings. (Assume the debt to equity ratio keeps constant): a) At the beginning of the year Debt/Equity 0,33333. b) If RC retains 600 m. u. and the Debt to Equity ratio keeps constant, then 0,33333 (2,000+Debt)/(6,000+600). c) ADebt d) All of the above. (0,33333 6,600)-2,000 200 monetary units. 24. If the firm decides not to change its financial risk and retains the 600 m.u., how much RC may increase its total funds? a) 600 monetary units b) 600 200 800 monetary units. c) 0,33333 monetary units. d) None of the above 25. Why is this possible: an increase in debt with no increase in financial risk? a) Financial risk comes from the Debt/Equity ratio. b) Debt increases and Equity has increased too. c) Debt/Equity ratio keeps constant d) All of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started