Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is Auditing of Canada, I need the answers ASAP. Thank you very much!!! QUESTION 1 25 points Save Answer Classic and Collector Car Restoration,

This is Auditing of Canada, I need the answers ASAP. Thank you very much!!!

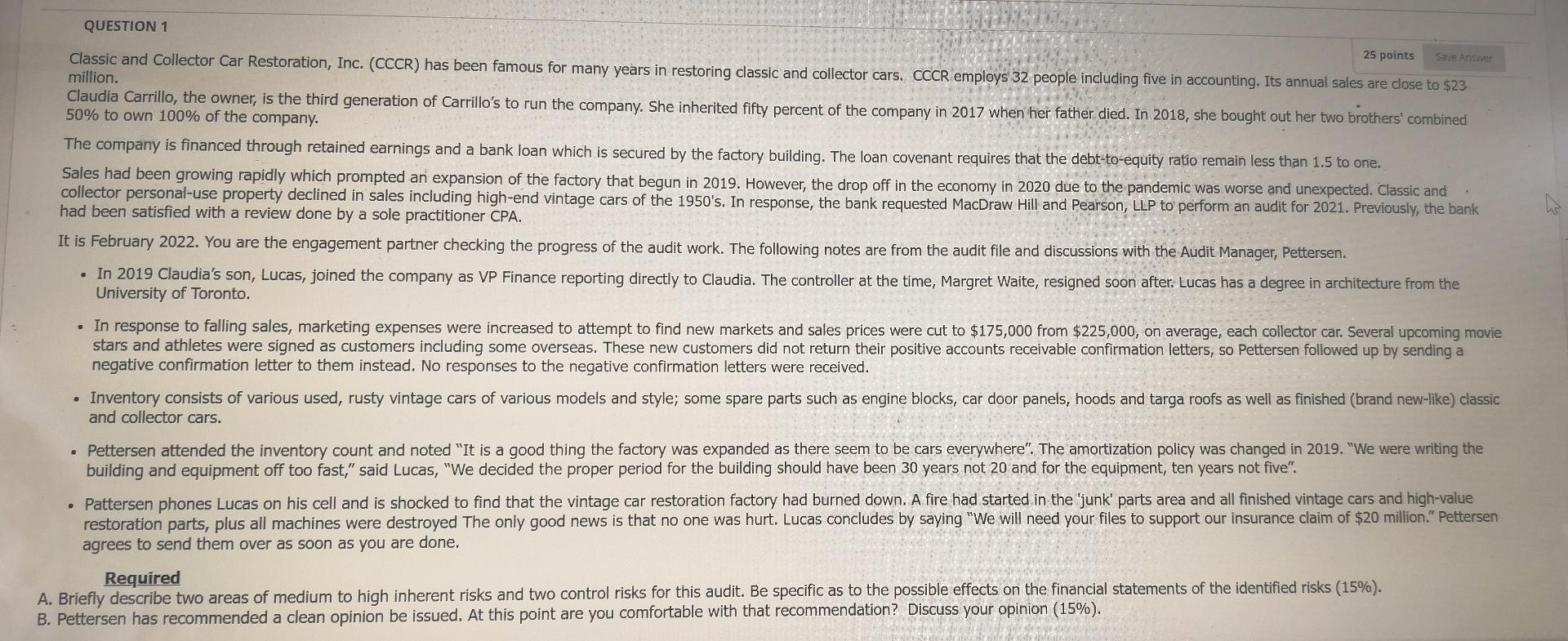

QUESTION 1 25 points Save Answer Classic and Collector Car Restoration, Inc. (CCCR) has been famous for many years in restoring classic and collector cars. CCCR employs 32 people including five in accounting. Its annual sales are close to $23 million. Claudia Carrillo, the owner, is the third generation of Carrillo's to run the company. She inherited fifty percent of the company in 2017 when her father died. In 2018, she bought out her two brothers' combined 50% to own 100% of the company. The company is financed through retained earnings and a bank loan which is secured by the factory building. The loan covenant requires that the debt-to-equity ratio remain less than 1.5 to one. Sales had been growing rapidly which prompted an expansion of the factory that begun in 2019. However, the drop off in the economy in 2020 due to the pandemic was worse and unexpected. Classic and collector personal-use property declined in sales including high-end vintage cars of the 1950's. In response, the bank requested MacDraw Hill and Pearson, LLP to perform an audit for 2021. Previously, the bank had been satisfied with a review done by a sole practitioner CPA. It is February 2022. You are the engagement partner checking the progress of the audit work. The following notes are from the audit file and discussions with the Audit Manager, Pettersen. In 2019 Claudia's son, Lucas, joined the company as VP Finance reporting directly to Claudia. The controller at the time, Margret Waite, resigned soon after. Lucas has a degree in architecture from the University of Toronto. In response to falling sales, marketing expenses were increased to attempt to find new markets and sales prices were cut to $175,000 from $225,000, on average, each collector car. Several upcoming movie stars and athletes were signed as customers including some overseas. These new customers did not return their positive accounts receivable confirmation letters, so Pettersen followed up by sending a negative confirmation letter to them instead. No responses to the negative confirmation letters were received. Inventory consists of various used, rusty vintage cars of various models and style; some spare parts such as engine blocks, car door panels, hoods and targa roofs as well as finished (brand new-like) classic and collector cars. . Pettersen attended the inventory count and noted "It is a good thing the factory was expanded as there seem to be cars everywhere. The amortization policy was changed in 2019. "We were writing the building and equipment off too fast," said Lucas, "We decided the proper period for the building should have been 30 years not 20 and for the equipment, ten years not five". Pattersen phones Lucas on his cell and is shocked to find that the vintage car restoration factory had burned down. A fire had started in the 'junk' parts area and all finished vintage cars and high-value restoration parts, plus all machines were destroyed The only good news is that no one was hurt. Lucas concludes by saying "We will need your files to support our insurance claim of $20 million." Pettersen agrees to send them over as soon as you are done. Required A. Briefly describe two areas of medium to high inherent risks and two control risks for this audit. Be specific as to the possible effects on the financial statements of the identified risks (15%). B. Pettersen has recommended a clean opinion be issued. At this point are you comfortable with that recommendation? Discuss your opinion (15%). QUESTION 1 25 points Save Answer Classic and Collector Car Restoration, Inc. (CCCR) has been famous for many years in restoring classic and collector cars. CCCR employs 32 people including five in accounting. Its annual sales are close to $23 million. Claudia Carrillo, the owner, is the third generation of Carrillo's to run the company. She inherited fifty percent of the company in 2017 when her father died. In 2018, she bought out her two brothers' combined 50% to own 100% of the company. The company is financed through retained earnings and a bank loan which is secured by the factory building. The loan covenant requires that the debt-to-equity ratio remain less than 1.5 to one. Sales had been growing rapidly which prompted an expansion of the factory that begun in 2019. However, the drop off in the economy in 2020 due to the pandemic was worse and unexpected. Classic and collector personal-use property declined in sales including high-end vintage cars of the 1950's. In response, the bank requested MacDraw Hill and Pearson, LLP to perform an audit for 2021. Previously, the bank had been satisfied with a review done by a sole practitioner CPA. It is February 2022. You are the engagement partner checking the progress of the audit work. The following notes are from the audit file and discussions with the Audit Manager, Pettersen. In 2019 Claudia's son, Lucas, joined the company as VP Finance reporting directly to Claudia. The controller at the time, Margret Waite, resigned soon after. Lucas has a degree in architecture from the University of Toronto. In response to falling sales, marketing expenses were increased to attempt to find new markets and sales prices were cut to $175,000 from $225,000, on average, each collector car. Several upcoming movie stars and athletes were signed as customers including some overseas. These new customers did not return their positive accounts receivable confirmation letters, so Pettersen followed up by sending a negative confirmation letter to them instead. No responses to the negative confirmation letters were received. Inventory consists of various used, rusty vintage cars of various models and style; some spare parts such as engine blocks, car door panels, hoods and targa roofs as well as finished (brand new-like) classic and collector cars. . Pettersen attended the inventory count and noted "It is a good thing the factory was expanded as there seem to be cars everywhere. The amortization policy was changed in 2019. "We were writing the building and equipment off too fast," said Lucas, "We decided the proper period for the building should have been 30 years not 20 and for the equipment, ten years not five". Pattersen phones Lucas on his cell and is shocked to find that the vintage car restoration factory had burned down. A fire had started in the 'junk' parts area and all finished vintage cars and high-value restoration parts, plus all machines were destroyed The only good news is that no one was hurt. Lucas concludes by saying "We will need your files to support our insurance claim of $20 million." Pettersen agrees to send them over as soon as you are done. Required A. Briefly describe two areas of medium to high inherent risks and two control risks for this audit. Be specific as to the possible effects on the financial statements of the identified risks (15%). B. Pettersen has recommended a clean opinion be issued. At this point are you comfortable with that recommendation? Discuss your opinion (15%)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started