Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is Canadian income Taxtion PROBLEM FOUR In 2018, Kiranjit Dhillon acquired 1,000 shares of Pluton Ltd. (a Canadian public cor. poration) at a cost

This is Canadian income Taxtion

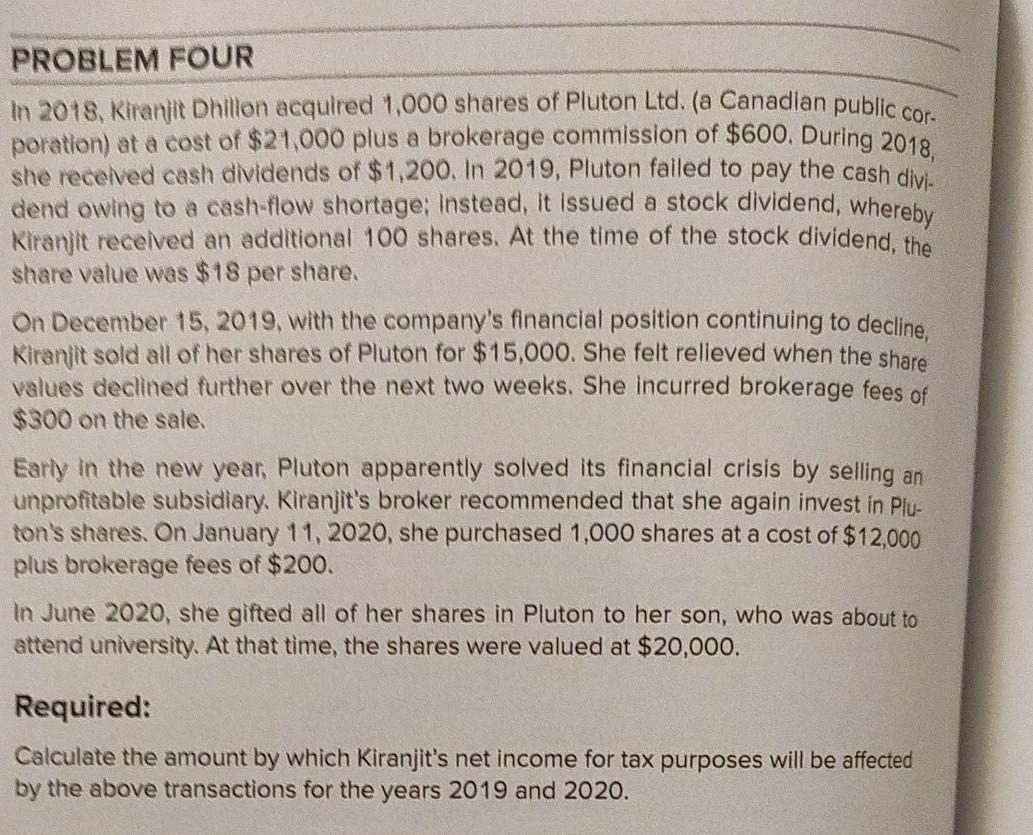

PROBLEM FOUR In 2018, Kiranjit Dhillon acquired 1,000 shares of Pluton Ltd. (a Canadian public cor. poration) at a cost of $21,000 plus a brokerage commission of $600. During 2018, she received cash dividends of $1,200. In 2019, Pluton failed to pay the cash divi dend owing to a cash-flow shortage: Instead, it issued a stock dividend, whereby Kiranjit received an additional 100 shares. At the time of the stock dividend, the share value was $18 per share. On December 15, 2019, with the company's financial position continuing to decline, Kiranjit sold all of her shares of Pluton for $15,000. She felt relieved when the share values declined further over the next two weeks. She incurred brokerage fees of $300 on the sale Early in the new year, Pluton apparently solved its financial crisis by selling an unprofitable subsidiary. Kiranjit's broker recommended that she again invest in Plu- ton's shares. On January 11, 2020, she purchased 1,000 shares at a cost of $12,000 plus brokerage fees of $200. In June 2020, she gifted all of her shares in Pluton to her son, who was about to attend university. At that time, the shares were valued at $20,000. Required: Calculate the amount by which Kiranjit's net income for tax purposes will be affected by the above transactions for the years 2019 and 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started