Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is complete question Tammy teaches elementary school history for the Metro School District. In 2018 she has incurred the following expenses associated with her

this is complete question

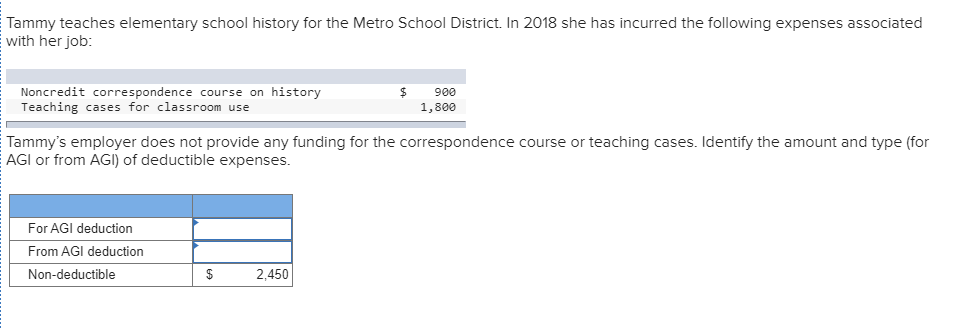

Tammy teaches elementary school history for the Metro School District. In 2018 she has incurred the following expenses associated with her job: Noncredit correspondence course on history Teaching cases for classroom use $ 900 1,800 Tammy's employer does not provide any funding for the correspondence course or teaching cases. Identify the amount and type (for EAGI or from AGI) of deductible expenses. For AGI deduction From AGI deduction Non-deductible $ 2.450Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started