Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is Due TODAy begin{tabular}{|c|c|c|} hline multicolumn{3}{|c|}{ BLUE COMPANY STORES INCORPORATED } hline multicolumn{3}{|l|}{ Balance Sheet } hline multicolumn{3}{|l|}{ Assets: } hline

This is Due TODAy

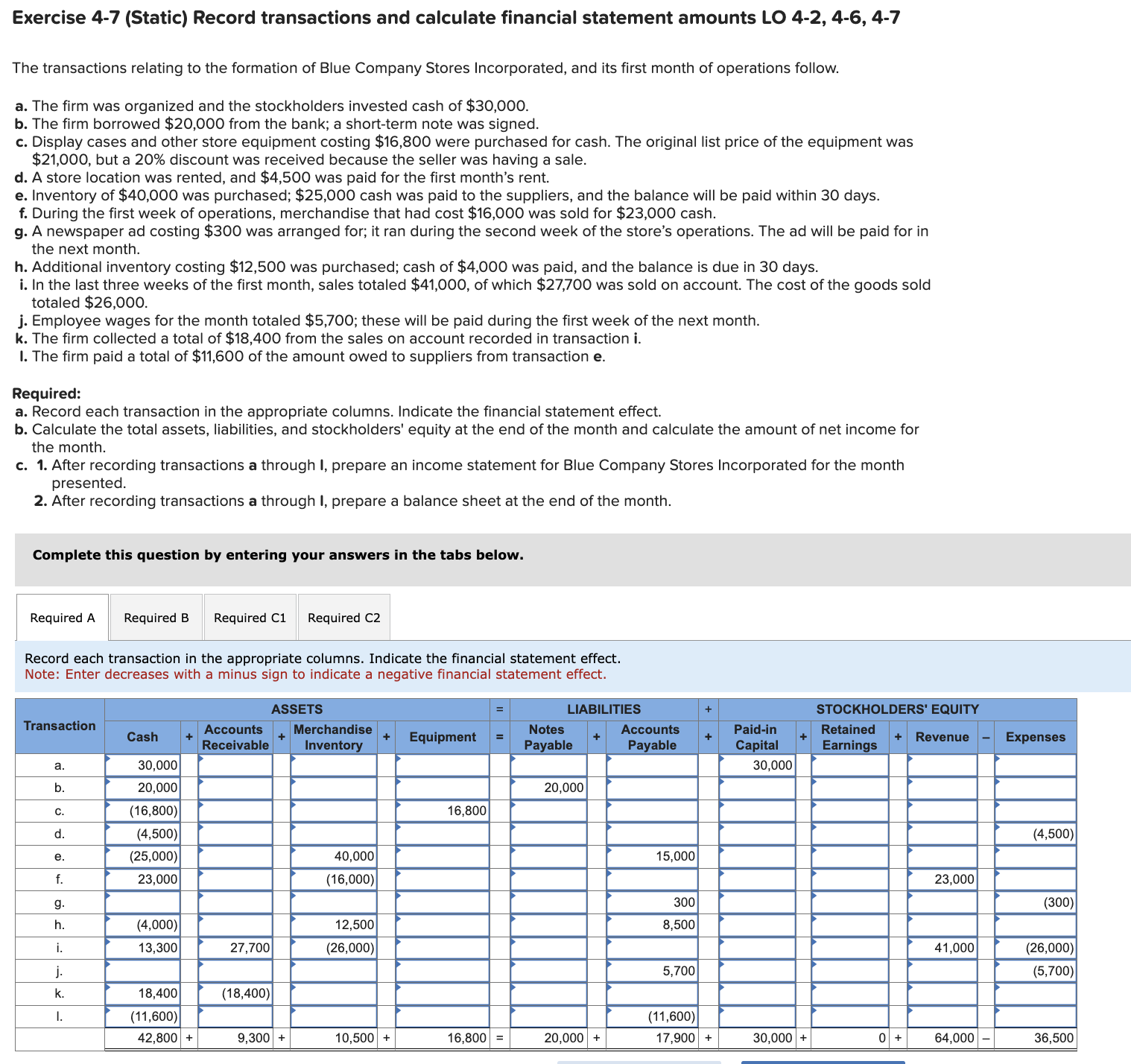

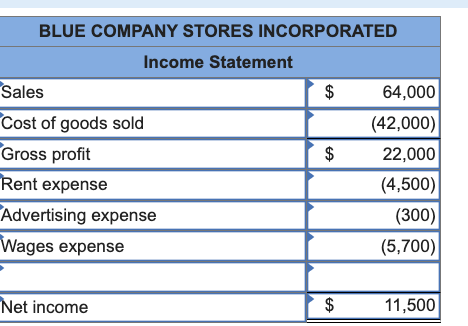

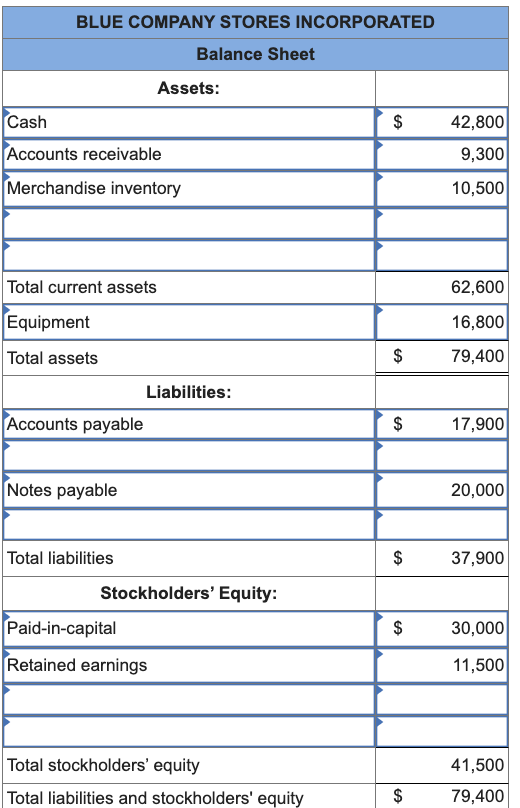

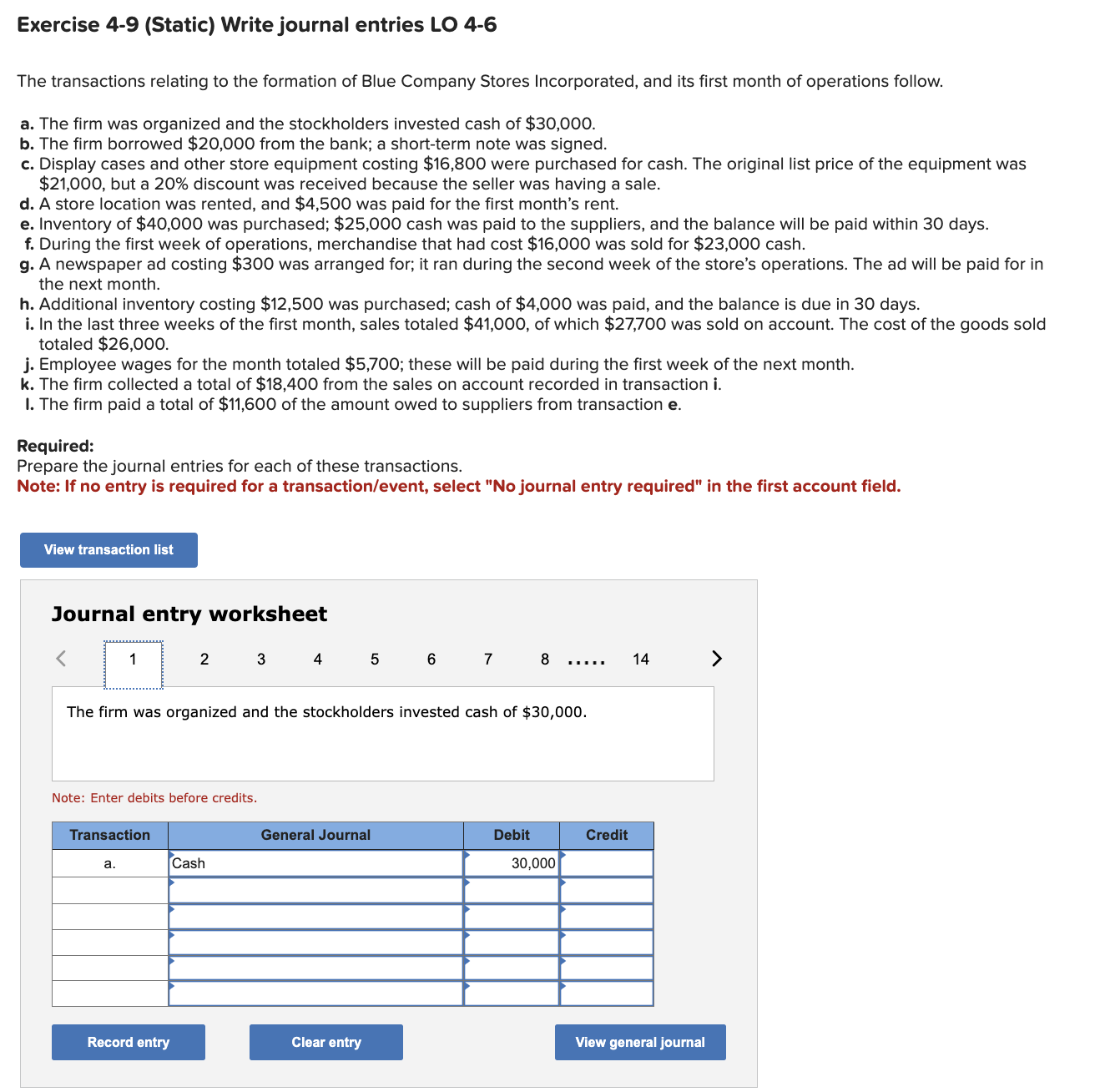

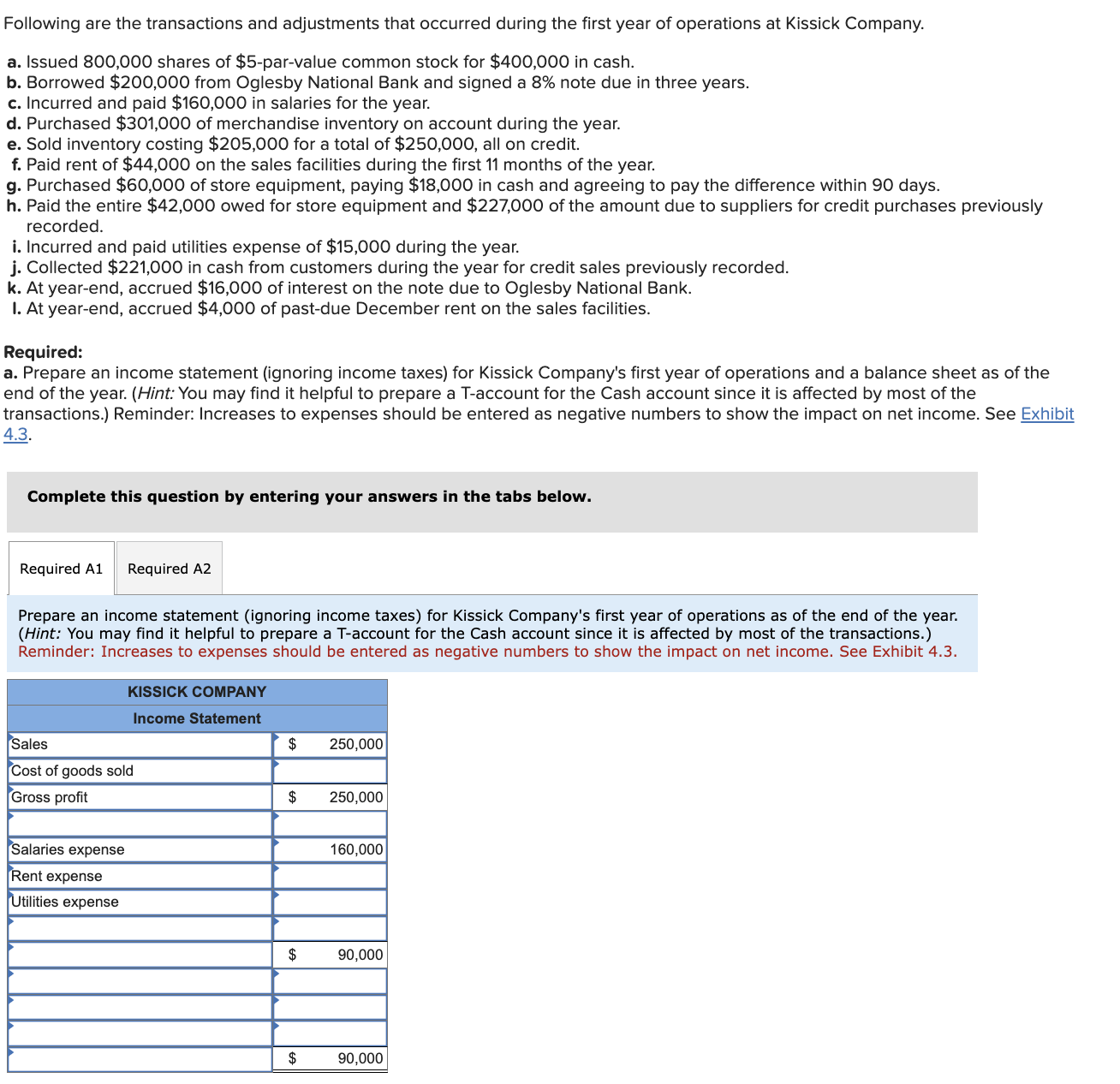

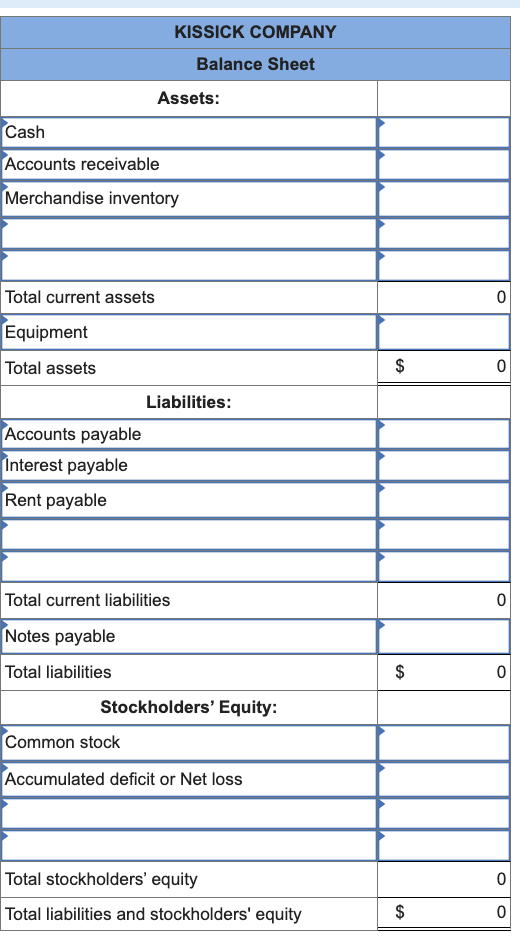

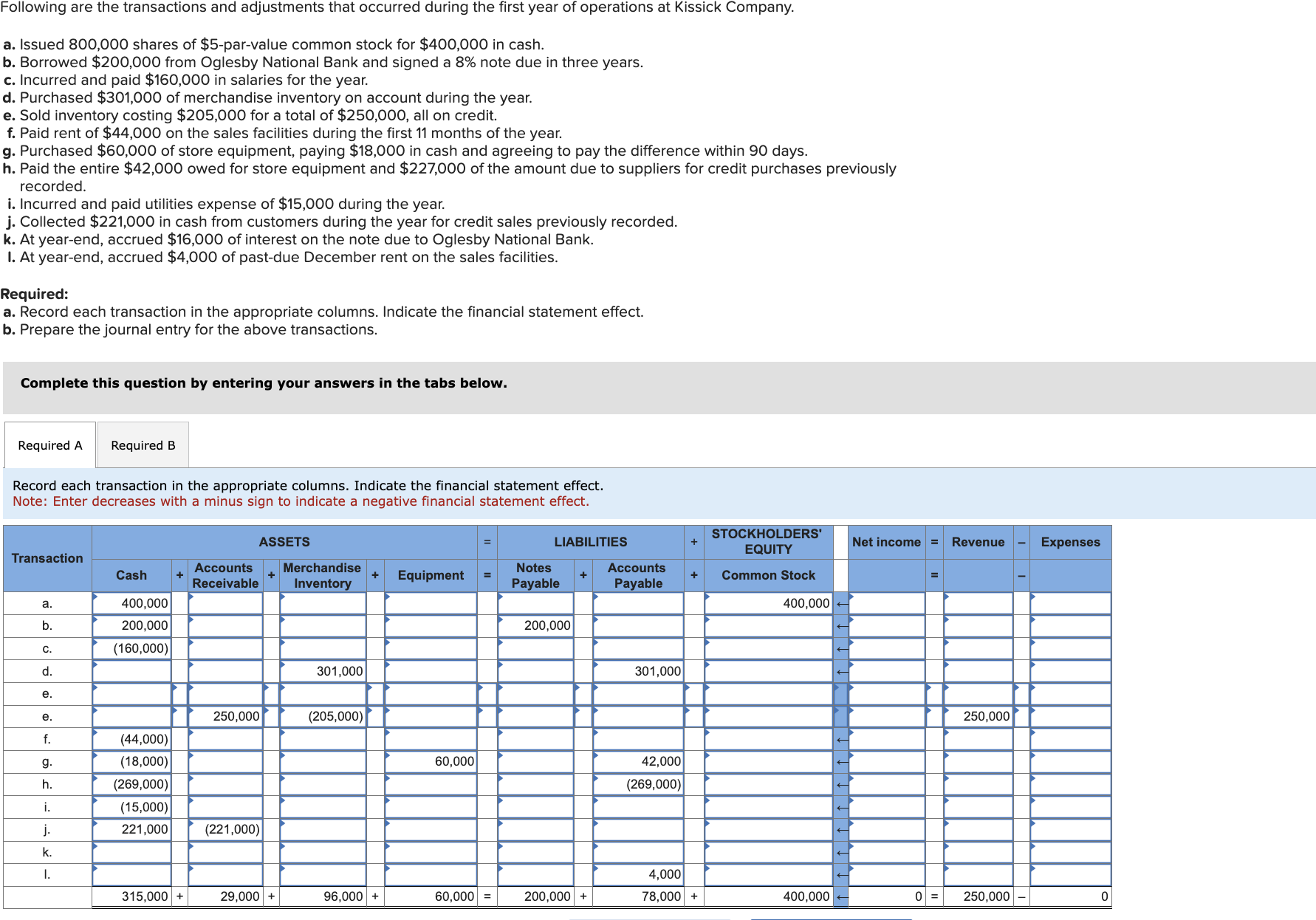

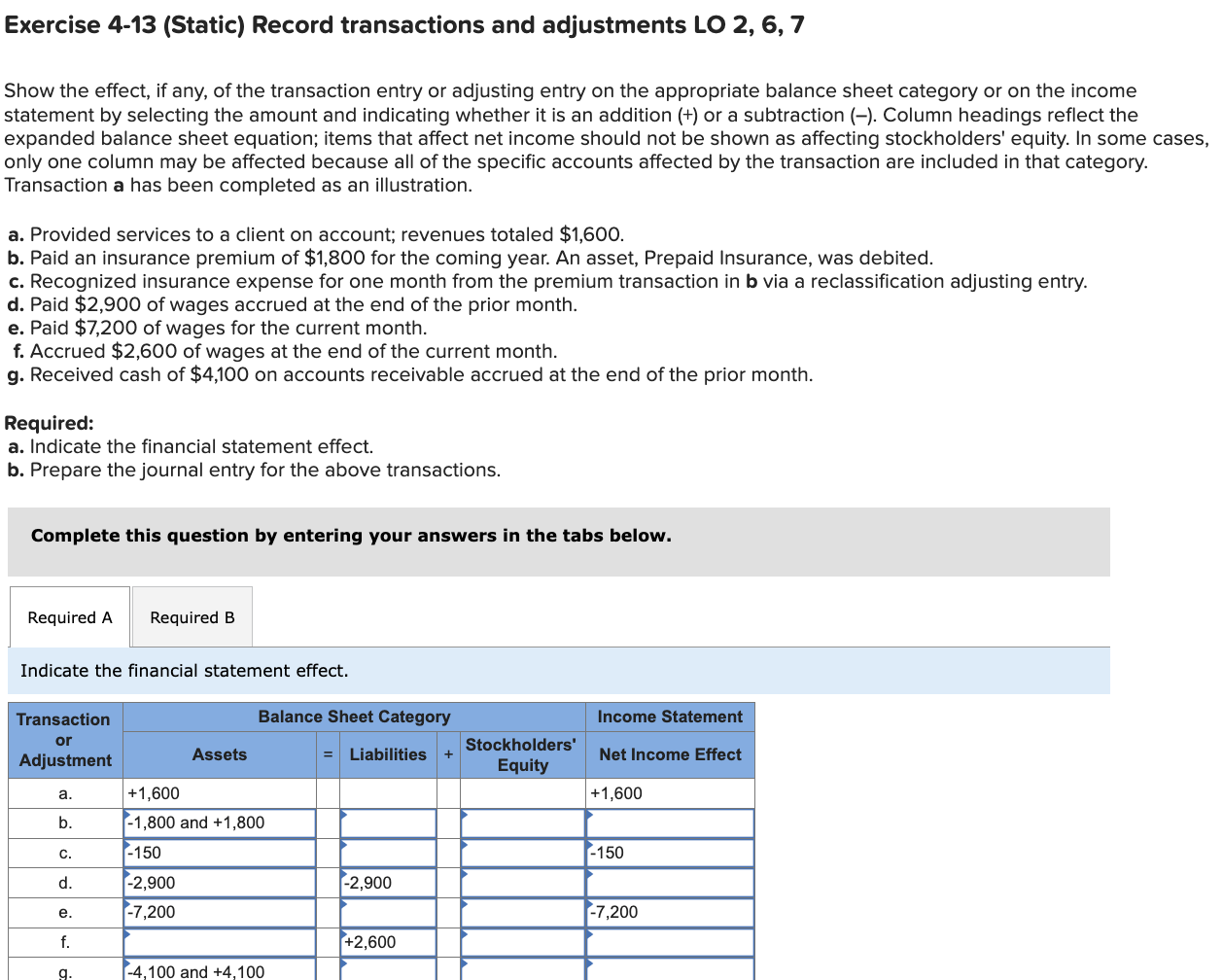

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ BLUE COMPANY STORES INCORPORATED } \\ \hline \multicolumn{3}{|l|}{ Balance Sheet } \\ \hline \multicolumn{3}{|l|}{ Assets: } \\ \hline Cash & $ & 42,800 \\ \hline Accounts receivable & & 9,300 \\ \hline Merchandise inventory & & 10,500 \\ \hline & & \\ \hline & & \\ \hline Total current assets & & 62,600 \\ \hline Equipment & & 16,800 \\ \hline Total assets & $ & 79,400 \\ \hline \multicolumn{3}{|l|}{ Liabilities: } \\ \hline Accounts payable & $ & 17,900 \\ \hline & & \\ \hline Notes payable & & 20,000 \\ \hline \\ \hline Total liabilities & $ & 37,900 \\ \hline \multicolumn{3}{|l|}{ Stockholders' Equity: } \\ \hline Paid-in-capital & $ & 30,000 \\ \hline Retained earnings & & 11,500 \\ \hline 5 & & \\ \hline & & \\ \hline Total stockholders' equity & & 41,500 \\ \hline Total liabilities and stockholders' equity & $ & 79,400 \\ \hline \end{tabular} Following are the transactions and adjustments that occurred during the first year of operations at Kissick Company. a. Issued 800,000 shares of $5-par-value common stock for $400,000 in cash. b. Borrowed $200,000 from Oglesby National Bank and signed a 8% note due in three years. c. Incurred and paid $160,000 in salaries for the year. d. Purchased $301,000 of merchandise inventory on account during the year. e. Sold inventory costing $205,000 for a total of $250,000, all on credit. f. Paid rent of $44,000 on the sales facilities during the first 11 months of the year. g. Purchased $60,000 of store equipment, paying $18,000 in cash and agreeing to pay the difference within 90 days. h. Paid the entire $42,000 owed for store equipment and $227,000 of the amount due to suppliers for credit purchases previously recorded. i. Incurred and paid utilities expense of $15,000 during the year. j. Collected $221,000 in cash from customers during the year for credit sales previously recorded. k. At year-end, accrued $16,000 of interest on the note due to Oglesby National Bank. I. At year-end, accrued $4,000 of past-due December rent on the sales facilities. Required: a. Prepare an income statement (ignoring income taxes) for Kissick Company's first year of operations and a balance sheet as of the end of the year. (Hint: You may find it helpful to prepare a T-account for the Cash account since it is affected by most of the transactions.) Reminder: Increases to expenses should be entered as negative numbers to show the impact on net income. See Exhibit 4.3. Complete this question by entering your answers in the tabs below. Prepare an income statement (ignoring income taxes) for Kissick Company's first year of operations as of the end of the year. (Hint: You may find it helpful to prepare a T-account for the Cash account since it is affected by most of the transactions.) Reminder: Increases to expenses should be entered as negative numbers to show the impact on net income. See Exhibit 4.3. Exercise 4-13 (Static) Record transactions and adjustments LO 2, 6, 7 Show the effect, if any, of the transaction entry or adjusting entry on the appropriate balance sheet category or on the income statement by selecting the amount and indicating whether it is an addition (+) or a subtraction (-). Column headings reflect the expanded balance sheet equation; items that affect net income should not be shown as affecting stockholders' equity. In some case only one column may be affected because all of the specific accounts affected by the transaction are included in that category. Transaction a has been completed as an illustration. a. Provided services to a client on account; revenues totaled $1,600. b. Paid an insurance premium of $1,800 for the coming year. An asset, Prepaid Insurance, was debited. c. Recognized insurance expense for one month from the premium transaction in b via a reclassification adjusting entry. d. Paid $2,900 of wages accrued at the end of the prior month. e. Paid $7,200 of wages for the current month. f. Accrued $2,600 of wages at the end of the current month. g. Received cash of $4,100 on accounts receivable accrued at the end of the prior month. Required: a. Indicate the financial statement effect. b. Prepare the journal entry for the above transactions. Complete this question by entering your answers in the tabs below. Indicate the financial statement effect. \begin{tabular}{|l|c|} \multicolumn{2}{|c|}{ KISSICK COMPANY } \\ \multicolumn{1}{|c|}{ Assets: } & \\ \hline Cash & \\ \hline Accounts receivable & \\ \hline Merchandise inventory & \\ \hline & 0 \\ \hline Total current assets & \\ \hline Equipment & \\ \hline Total assets & \\ \hline & \\ \hline Accounts payable & \\ \hline Interest payable & \\ \hline Rent payable & \\ \hline Totalities: & \\ \hline Total liabilities & \\ \hline \end{tabular} The transactions relating to the formation of Blue Company Stores Incorporated, and its first month of operations follow. a. The firm was organized and the stockholders invested cash of $30,000. b. The firm borrowed $20,000 from the bank; a short-term note was signed. c. Display cases and other store equipment costing $16,800 were purchased for cash. The original list price of the equipment was $21,000, but a 20% discount was received because the seller was having a sale. d. A store location was rented, and $4,500 was paid for the first month's rent. e. Inventory of $40,000 was purchased; $25,000 cash was paid to the suppliers, and the balance will be paid within 30 days. f. During the first week of operations, merchandise that had cost $16,000 was sold for $23,000 cash. g. A newspaper ad costing $300 was arranged for; it ran during the second week of the store's operations. The ad will be paid for in the next month. h. Additional inventory costing $12,500 was purchased; cash of $4,000 was paid, and the balance is due in 30 days. i. In the last three weeks of the first month, sales totaled $41,000, of which $27,700 was sold on account. The cost of the goods sold totaled $26,000. j. Employee wages for the month totaled $5,700; these will be paid during the first week of the next month. k. The firm collected a total of $18,400 from the sales on account recorded in transaction i. I. The firm paid a total of $11,600 of the amount owed to suppliers from transaction e. Required: Prepare the journal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet The firm was organized and the stockholders invested cash of $30,000. Note: Enter debits before credits. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ BLUE COMPANY STORES INCORPORATED } \\ \hline \multicolumn{3}{|c|}{ Income Statement } \\ \hline Sales & $ & 64,000 \\ \hline Cost of goods sold & & (42,000) \\ \hline Gross profit & $ & 22,000 \\ \hline Rent expense & & (4,500) \\ \hline Advertising expense & & (300) \\ \hline Wages expense & & (5,700) \\ \hline Net income & $ & 11,500 \\ \hline \end{tabular} a. Issued 800,000 shares of $5-par-value common stock for $400,000 in cash. b. Borrowed $200,000 from Oglesby National Bank and signed a 8% note due in three years. c. Incurred and paid $160,000 in salaries for the year. d. Purchased $301,000 of merchandise inventory on account during the year. e. Sold inventory costing $205,000 for a total of $250,000, all on credit. f. Paid rent of $44,000 on the sales facilities during the first 11 months of the year. g. Purchased $60,000 of store equipment, paying $18,000 in cash and agreeing to pay the difference within 90 days. h. Paid the entire $42,000 owed for store equipment and $227,000 of the amount due to suppliers for credit purchases previously recorded. i. Incurred and paid utilities expense of $15,000 during the year. j. Collected $221,000 in cash from customers during the year for credit sales previously recorded. k. At year-end, accrued $16,000 of interest on the note due to Oglesby National Bank. I. At year-end, accrued $4,000 of past-due December rent on the sales facilities. Required: a. Record each transaction in the appropriate columns. Indicate the financial statement effect. b. Prepare the journal entry for the above transactions. Complete this question by entering your answers in the tabs below. Record each transaction in the appropriate columns. Indicate the financial statement effect. Note: Enter decreases with a minus sign to indicate a negative financial statement effect. Exercise 4-7 (Static) Record transactions and calculate financial statement amounts LO 4-2, 4-6, 4-7 The transactions relating to the formation of Blue Company Stores Incorporated, and its first month of operations follow. a. The firm was organized and the stockholders invested cash of $30,000. b. The firm borrowed $20,000 from the bank; a short-term note was signed. c. Display cases and other store equipment costing $16,800 were purchased for cash. The original list price of the equipment was $21,000, but a 20% discount was received because the seller was having a sale. d. A store location was rented, and $4,500 was paid for the first month's rent. e. Inventory of $40,000 was purchased; $25,000 cash was paid to the suppliers, and the balance will be paid within 30 days. f. During the first week of operations, merchandise that had cost $16,000 was sold for $23,000 cash. g. A newspaper ad costing $300 was arranged for; it ran during the second week of the store's operations. The ad will be paid for in the next month. h. Additional inventory costing $12,500 was purchased; cash of $4,000 was paid, and the balance is due in 30 days. i. In the last three weeks of the first month, sales totaled $41,000, of which $27,700 was sold on account. The cost of the goods sold totaled $26,000. j. Employee wages for the month totaled $5,700; these will be paid during the first week of the next month. k. The firm collected a total of $18,400 from the sales on account recorded in transaction i. I. The firm paid a total of $11,600 of the amount owed to suppliers from transaction e. Required: a. Record each transaction in the appropriate columns. Indicate the financial statement effect. b. Calculate the total assets, liabilities, and stockholders' equity at the end of the month and calculate the amount of net income for the month. c. 1. After recording transactions a through I, prepare an income statement for Blue Company Stores Incorporated for the month presented. 2. After recording transactions a through I, prepare a balance sheet at the end of the month. Complete this question by entering your answers in the tabs below. Record each transaction in the appropriate columns. Indicate the financial statement effect. Note: Enter decreases with a minus sign to indicate a negative financial statement effect. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ BLUE COMPANY STORES INCORPORATED } \\ \hline \multicolumn{3}{|l|}{ Balance Sheet } \\ \hline \multicolumn{3}{|l|}{ Assets: } \\ \hline Cash & $ & 42,800 \\ \hline Accounts receivable & & 9,300 \\ \hline Merchandise inventory & & 10,500 \\ \hline & & \\ \hline & & \\ \hline Total current assets & & 62,600 \\ \hline Equipment & & 16,800 \\ \hline Total assets & $ & 79,400 \\ \hline \multicolumn{3}{|l|}{ Liabilities: } \\ \hline Accounts payable & $ & 17,900 \\ \hline & & \\ \hline Notes payable & & 20,000 \\ \hline \\ \hline Total liabilities & $ & 37,900 \\ \hline \multicolumn{3}{|l|}{ Stockholders' Equity: } \\ \hline Paid-in-capital & $ & 30,000 \\ \hline Retained earnings & & 11,500 \\ \hline 5 & & \\ \hline & & \\ \hline Total stockholders' equity & & 41,500 \\ \hline Total liabilities and stockholders' equity & $ & 79,400 \\ \hline \end{tabular} Following are the transactions and adjustments that occurred during the first year of operations at Kissick Company. a. Issued 800,000 shares of $5-par-value common stock for $400,000 in cash. b. Borrowed $200,000 from Oglesby National Bank and signed a 8% note due in three years. c. Incurred and paid $160,000 in salaries for the year. d. Purchased $301,000 of merchandise inventory on account during the year. e. Sold inventory costing $205,000 for a total of $250,000, all on credit. f. Paid rent of $44,000 on the sales facilities during the first 11 months of the year. g. Purchased $60,000 of store equipment, paying $18,000 in cash and agreeing to pay the difference within 90 days. h. Paid the entire $42,000 owed for store equipment and $227,000 of the amount due to suppliers for credit purchases previously recorded. i. Incurred and paid utilities expense of $15,000 during the year. j. Collected $221,000 in cash from customers during the year for credit sales previously recorded. k. At year-end, accrued $16,000 of interest on the note due to Oglesby National Bank. I. At year-end, accrued $4,000 of past-due December rent on the sales facilities. Required: a. Prepare an income statement (ignoring income taxes) for Kissick Company's first year of operations and a balance sheet as of the end of the year. (Hint: You may find it helpful to prepare a T-account for the Cash account since it is affected by most of the transactions.) Reminder: Increases to expenses should be entered as negative numbers to show the impact on net income. See Exhibit 4.3. Complete this question by entering your answers in the tabs below. Prepare an income statement (ignoring income taxes) for Kissick Company's first year of operations as of the end of the year. (Hint: You may find it helpful to prepare a T-account for the Cash account since it is affected by most of the transactions.) Reminder: Increases to expenses should be entered as negative numbers to show the impact on net income. See Exhibit 4.3. Exercise 4-13 (Static) Record transactions and adjustments LO 2, 6, 7 Show the effect, if any, of the transaction entry or adjusting entry on the appropriate balance sheet category or on the income statement by selecting the amount and indicating whether it is an addition (+) or a subtraction (-). Column headings reflect the expanded balance sheet equation; items that affect net income should not be shown as affecting stockholders' equity. In some case only one column may be affected because all of the specific accounts affected by the transaction are included in that category. Transaction a has been completed as an illustration. a. Provided services to a client on account; revenues totaled $1,600. b. Paid an insurance premium of $1,800 for the coming year. An asset, Prepaid Insurance, was debited. c. Recognized insurance expense for one month from the premium transaction in b via a reclassification adjusting entry. d. Paid $2,900 of wages accrued at the end of the prior month. e. Paid $7,200 of wages for the current month. f. Accrued $2,600 of wages at the end of the current month. g. Received cash of $4,100 on accounts receivable accrued at the end of the prior month. Required: a. Indicate the financial statement effect. b. Prepare the journal entry for the above transactions. Complete this question by entering your answers in the tabs below. Indicate the financial statement effect. \begin{tabular}{|l|c|} \multicolumn{2}{|c|}{ KISSICK COMPANY } \\ \multicolumn{1}{|c|}{ Assets: } & \\ \hline Cash & \\ \hline Accounts receivable & \\ \hline Merchandise inventory & \\ \hline & 0 \\ \hline Total current assets & \\ \hline Equipment & \\ \hline Total assets & \\ \hline & \\ \hline Accounts payable & \\ \hline Interest payable & \\ \hline Rent payable & \\ \hline Totalities: & \\ \hline Total liabilities & \\ \hline \end{tabular} The transactions relating to the formation of Blue Company Stores Incorporated, and its first month of operations follow. a. The firm was organized and the stockholders invested cash of $30,000. b. The firm borrowed $20,000 from the bank; a short-term note was signed. c. Display cases and other store equipment costing $16,800 were purchased for cash. The original list price of the equipment was $21,000, but a 20% discount was received because the seller was having a sale. d. A store location was rented, and $4,500 was paid for the first month's rent. e. Inventory of $40,000 was purchased; $25,000 cash was paid to the suppliers, and the balance will be paid within 30 days. f. During the first week of operations, merchandise that had cost $16,000 was sold for $23,000 cash. g. A newspaper ad costing $300 was arranged for; it ran during the second week of the store's operations. The ad will be paid for in the next month. h. Additional inventory costing $12,500 was purchased; cash of $4,000 was paid, and the balance is due in 30 days. i. In the last three weeks of the first month, sales totaled $41,000, of which $27,700 was sold on account. The cost of the goods sold totaled $26,000. j. Employee wages for the month totaled $5,700; these will be paid during the first week of the next month. k. The firm collected a total of $18,400 from the sales on account recorded in transaction i. I. The firm paid a total of $11,600 of the amount owed to suppliers from transaction e. Required: Prepare the journal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet The firm was organized and the stockholders invested cash of $30,000. Note: Enter debits before credits. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ BLUE COMPANY STORES INCORPORATED } \\ \hline \multicolumn{3}{|c|}{ Income Statement } \\ \hline Sales & $ & 64,000 \\ \hline Cost of goods sold & & (42,000) \\ \hline Gross profit & $ & 22,000 \\ \hline Rent expense & & (4,500) \\ \hline Advertising expense & & (300) \\ \hline Wages expense & & (5,700) \\ \hline Net income & $ & 11,500 \\ \hline \end{tabular} a. Issued 800,000 shares of $5-par-value common stock for $400,000 in cash. b. Borrowed $200,000 from Oglesby National Bank and signed a 8% note due in three years. c. Incurred and paid $160,000 in salaries for the year. d. Purchased $301,000 of merchandise inventory on account during the year. e. Sold inventory costing $205,000 for a total of $250,000, all on credit. f. Paid rent of $44,000 on the sales facilities during the first 11 months of the year. g. Purchased $60,000 of store equipment, paying $18,000 in cash and agreeing to pay the difference within 90 days. h. Paid the entire $42,000 owed for store equipment and $227,000 of the amount due to suppliers for credit purchases previously recorded. i. Incurred and paid utilities expense of $15,000 during the year. j. Collected $221,000 in cash from customers during the year for credit sales previously recorded. k. At year-end, accrued $16,000 of interest on the note due to Oglesby National Bank. I. At year-end, accrued $4,000 of past-due December rent on the sales facilities. Required: a. Record each transaction in the appropriate columns. Indicate the financial statement effect. b. Prepare the journal entry for the above transactions. Complete this question by entering your answers in the tabs below. Record each transaction in the appropriate columns. Indicate the financial statement effect. Note: Enter decreases with a minus sign to indicate a negative financial statement effect. Exercise 4-7 (Static) Record transactions and calculate financial statement amounts LO 4-2, 4-6, 4-7 The transactions relating to the formation of Blue Company Stores Incorporated, and its first month of operations follow. a. The firm was organized and the stockholders invested cash of $30,000. b. The firm borrowed $20,000 from the bank; a short-term note was signed. c. Display cases and other store equipment costing $16,800 were purchased for cash. The original list price of the equipment was $21,000, but a 20% discount was received because the seller was having a sale. d. A store location was rented, and $4,500 was paid for the first month's rent. e. Inventory of $40,000 was purchased; $25,000 cash was paid to the suppliers, and the balance will be paid within 30 days. f. During the first week of operations, merchandise that had cost $16,000 was sold for $23,000 cash. g. A newspaper ad costing $300 was arranged for; it ran during the second week of the store's operations. The ad will be paid for in the next month. h. Additional inventory costing $12,500 was purchased; cash of $4,000 was paid, and the balance is due in 30 days. i. In the last three weeks of the first month, sales totaled $41,000, of which $27,700 was sold on account. The cost of the goods sold totaled $26,000. j. Employee wages for the month totaled $5,700; these will be paid during the first week of the next month. k. The firm collected a total of $18,400 from the sales on account recorded in transaction i. I. The firm paid a total of $11,600 of the amount owed to suppliers from transaction e. Required: a. Record each transaction in the appropriate columns. Indicate the financial statement effect. b. Calculate the total assets, liabilities, and stockholders' equity at the end of the month and calculate the amount of net income for the month. c. 1. After recording transactions a through I, prepare an income statement for Blue Company Stores Incorporated for the month presented. 2. After recording transactions a through I, prepare a balance sheet at the end of the month. Complete this question by entering your answers in the tabs below. Record each transaction in the appropriate columns. Indicate the financial statement effect. Note: Enter decreases with a minus sign to indicate a negative financial statement effectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started