This is entire question. Please disregard previous question. Thank you

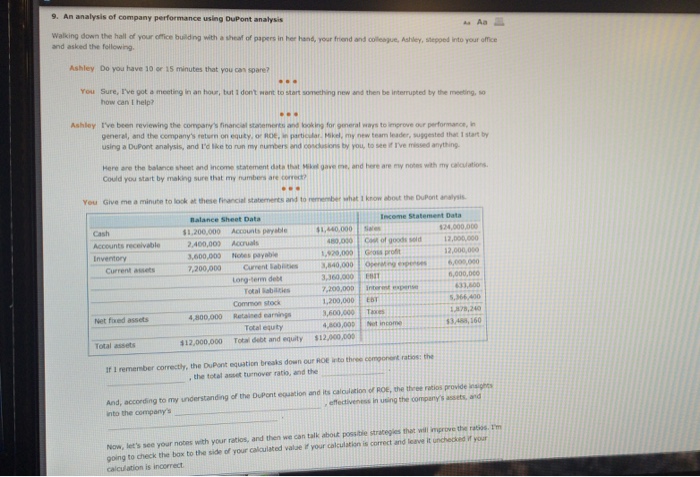

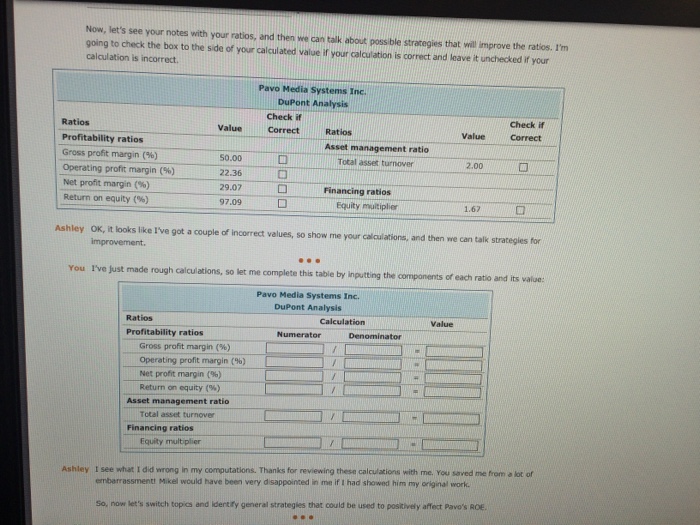

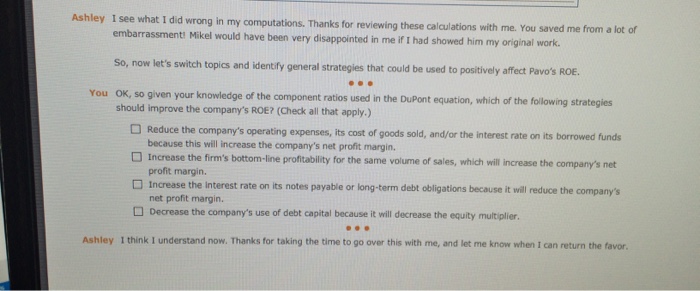

9. An analysis of company performance using DuPont analysis Walking down the hall of your office building with a sheaf of papers in her hand, your friend and collesgue, Ashley, stepped into your office and asked the fellowing Ashley Do you have 10 or 15 minutes that you can spare? You Sure, I've got a meeting in an hour, but I dont want to start something new and then be interrupted by the meeting, so how can I help? Ashley Ive been reviewing the company's financial stanements and looking for general ways to improve our performance, n generel, and the company's return on equty, or ROE, in particular. Mikel, my new team leader, suggested that 1 start by using a DuPont analysis, and I'd like to run my numbers and conclusions by you, to see if I've missed anything and looking for general ways to improve our performance, Here are the balance sheet and incomme statement data that Mkel gave ne, and here are my notes with my calculations Could you start by making sure that my numbers are con 46 You Give me a minute to look at these financial statements and to nemember what 1 krow about the DuPont analysis Balance Sheet Data Income Statement Data Cash Accounts receivable Inventory $1.200,000 Accounts peyable $1,440,000 s." 24,000,000 400,00 Accruals 600,000 Notes payable .200,000 Current Babit 80,000Cst of goods sold12,00000 920,000Gross prot 12,000,000 Current assets ,360,000 6,000,000 33,800 Lorg-term debt Total Sabaties 1,200,000 EBT ,600,000Tax 800,009Net income Common stock 878,240 $3.488, 160 Net fixed assets 4,800,000 Retaised earnings Total equty 12,000,000 Total debt and equity $12,000,00 Ir 1 remermber correcty, the DuPont equation breaks down our ROE nto three comonet ratios: the Total assets , the totel aneset turnover rats, and the And, according to my understanding of the DuPont equation and its caloulation of ROE, the three rotios provide insights into the company's , effectiveness in ueing the company's assets, and Now, let's see your notes with your ratios, and then we can talk about possibie stracegies that wil improve the ratios. m poing to check the box to the side of your caloulated value " your calculatisn is correct and leave it unchecked it yur is incorrect