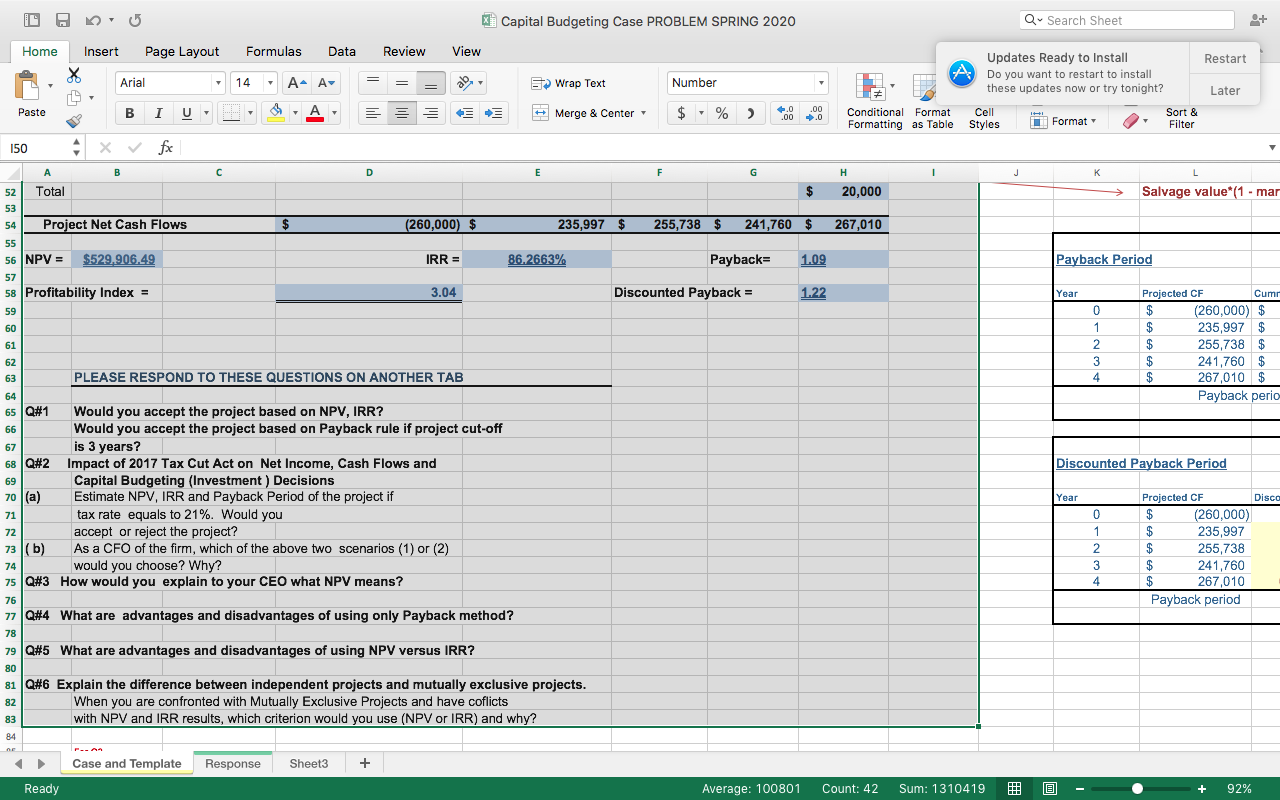

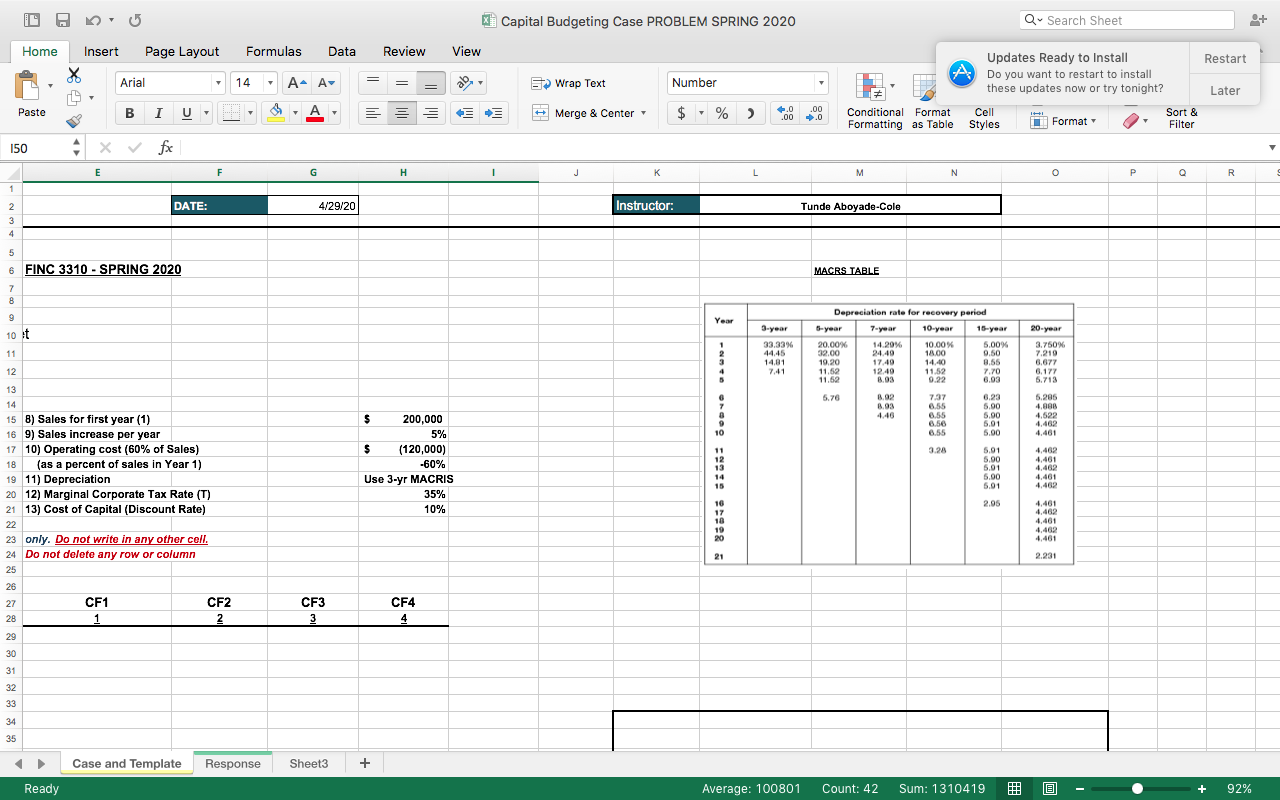

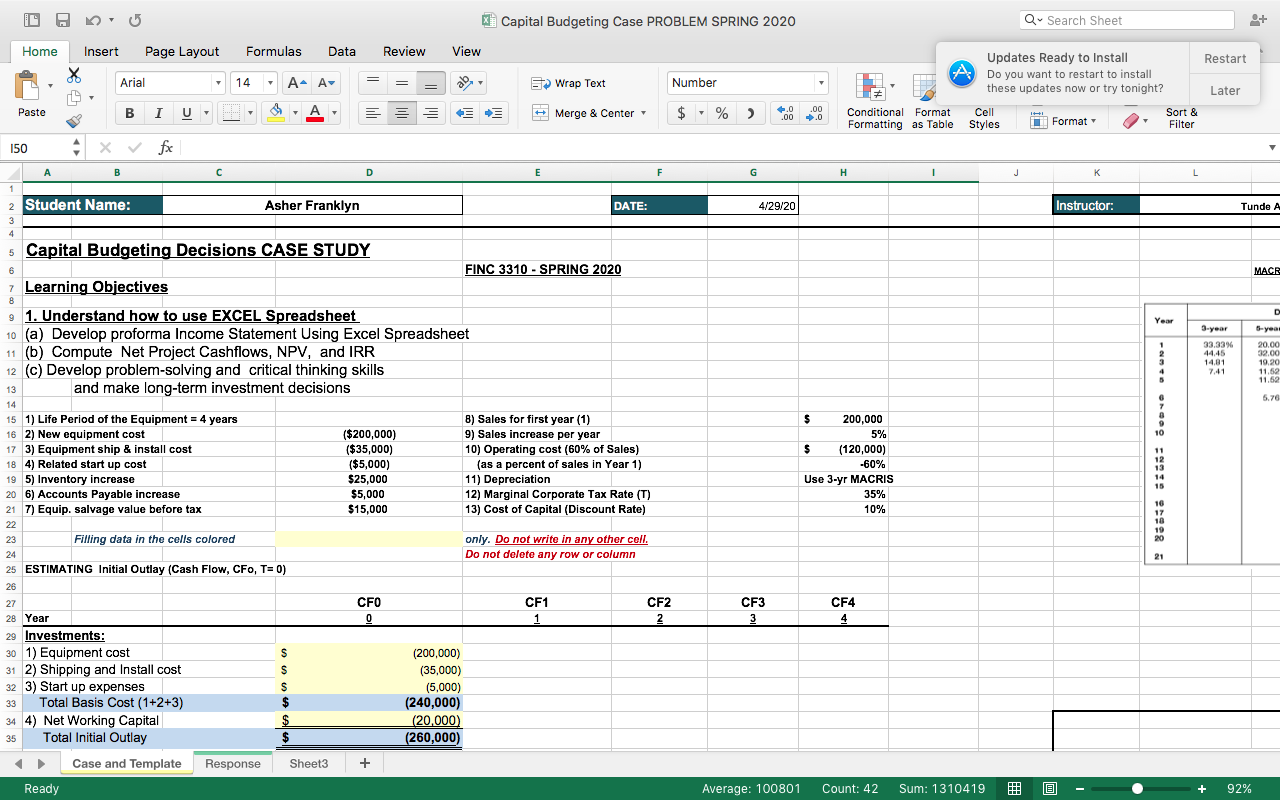

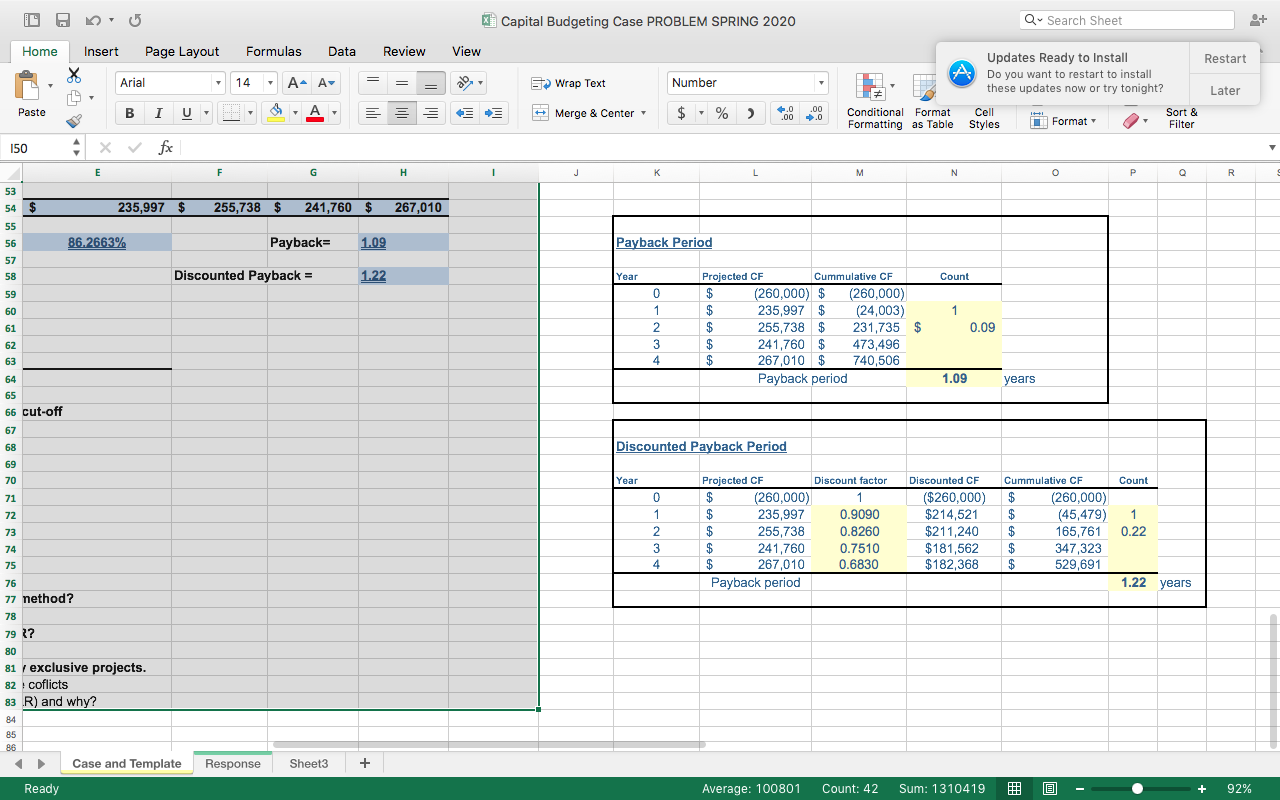

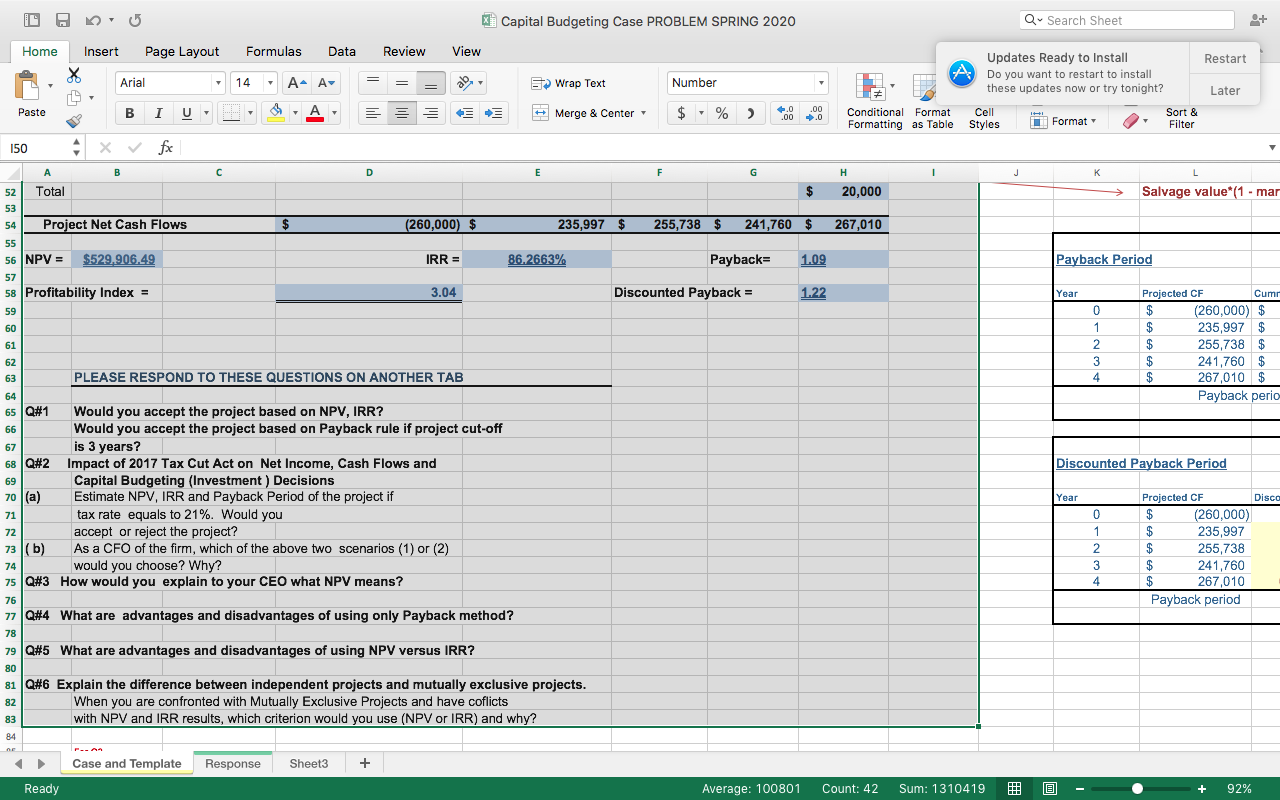

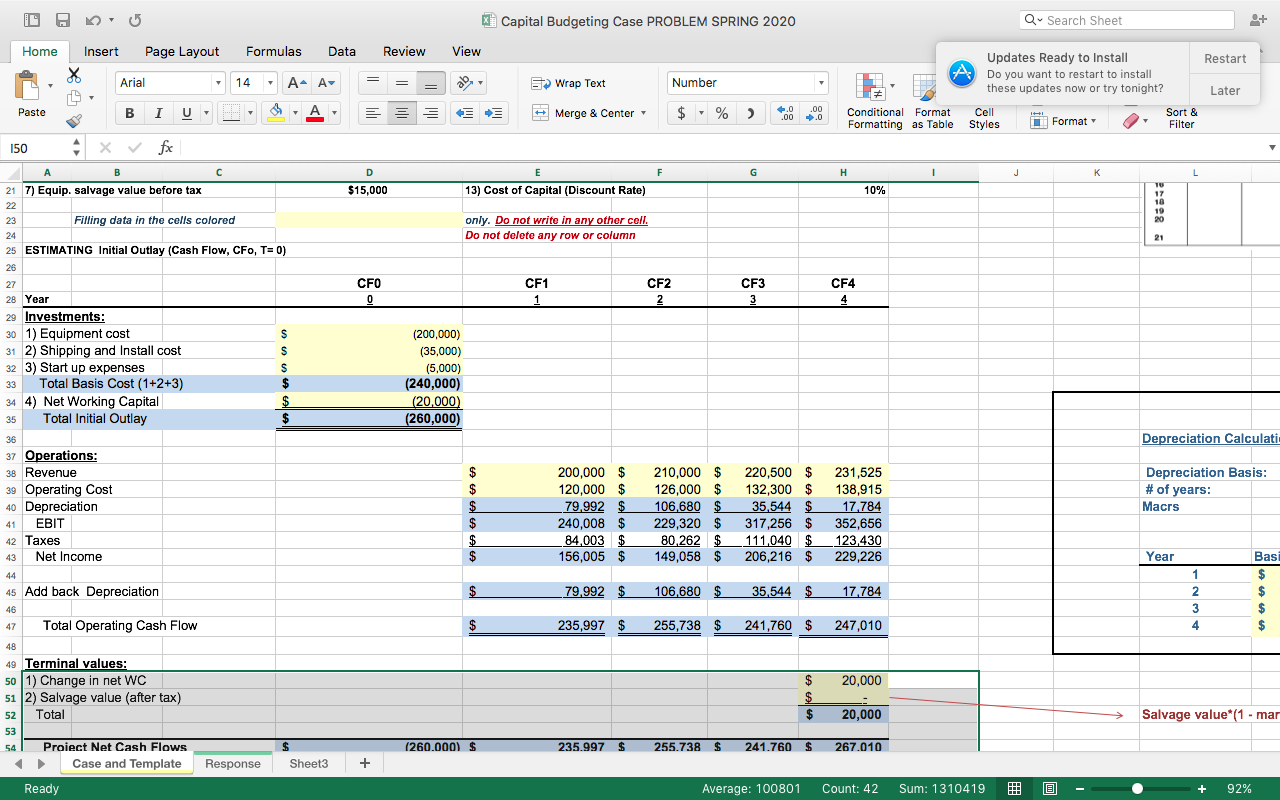

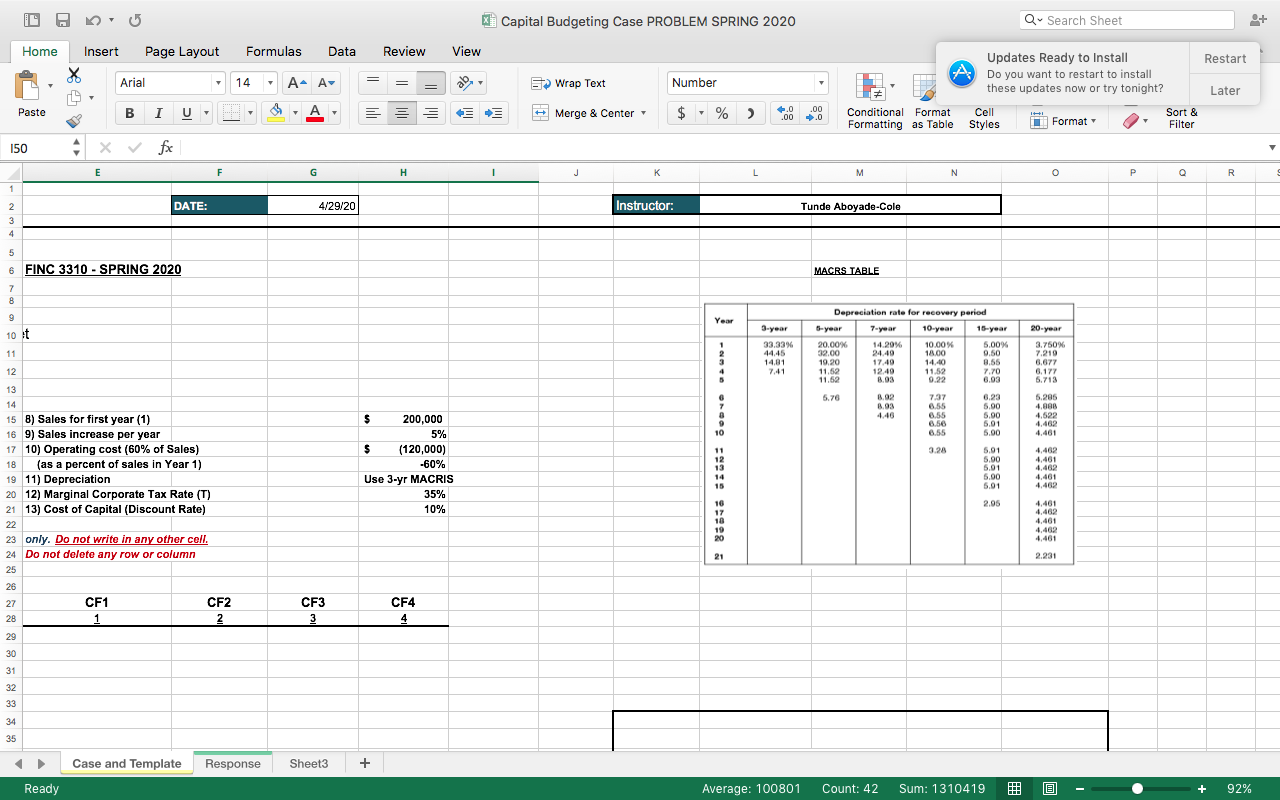

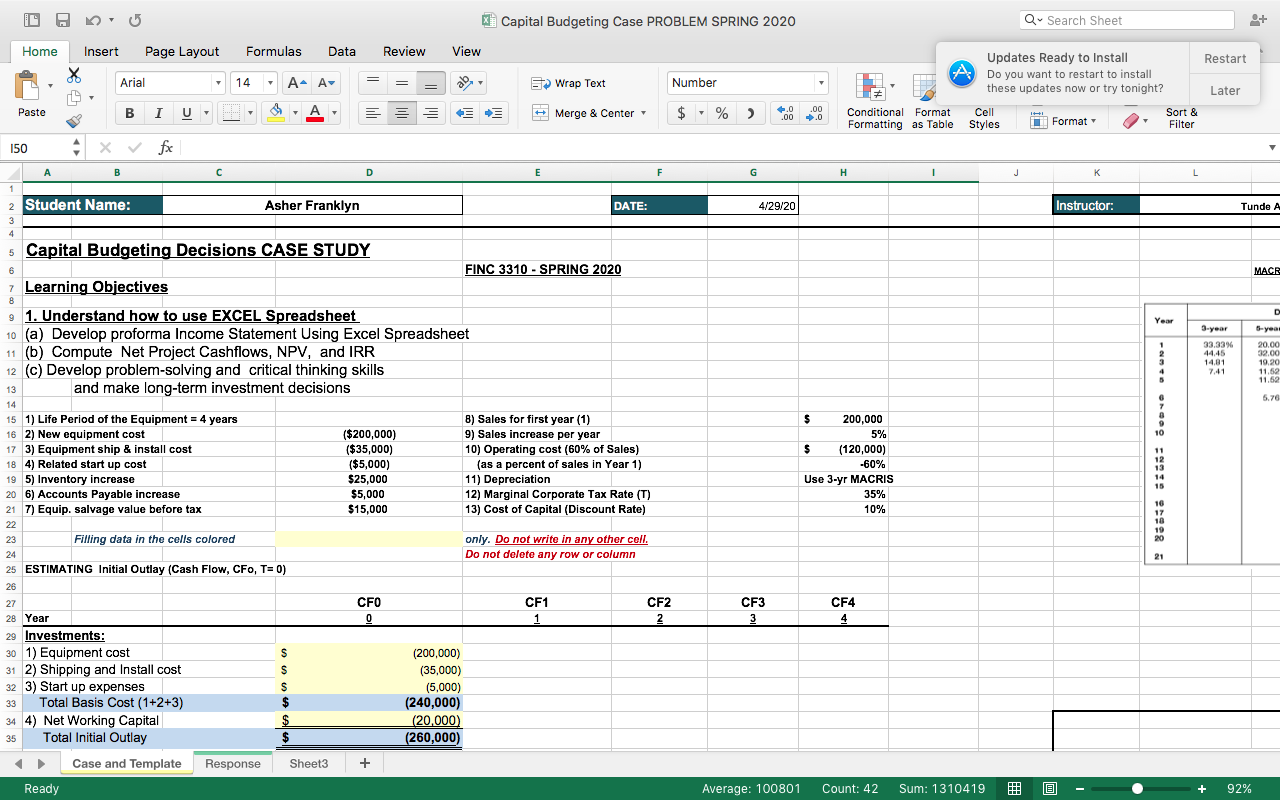

this is every piece of the project

this is every piece of the project

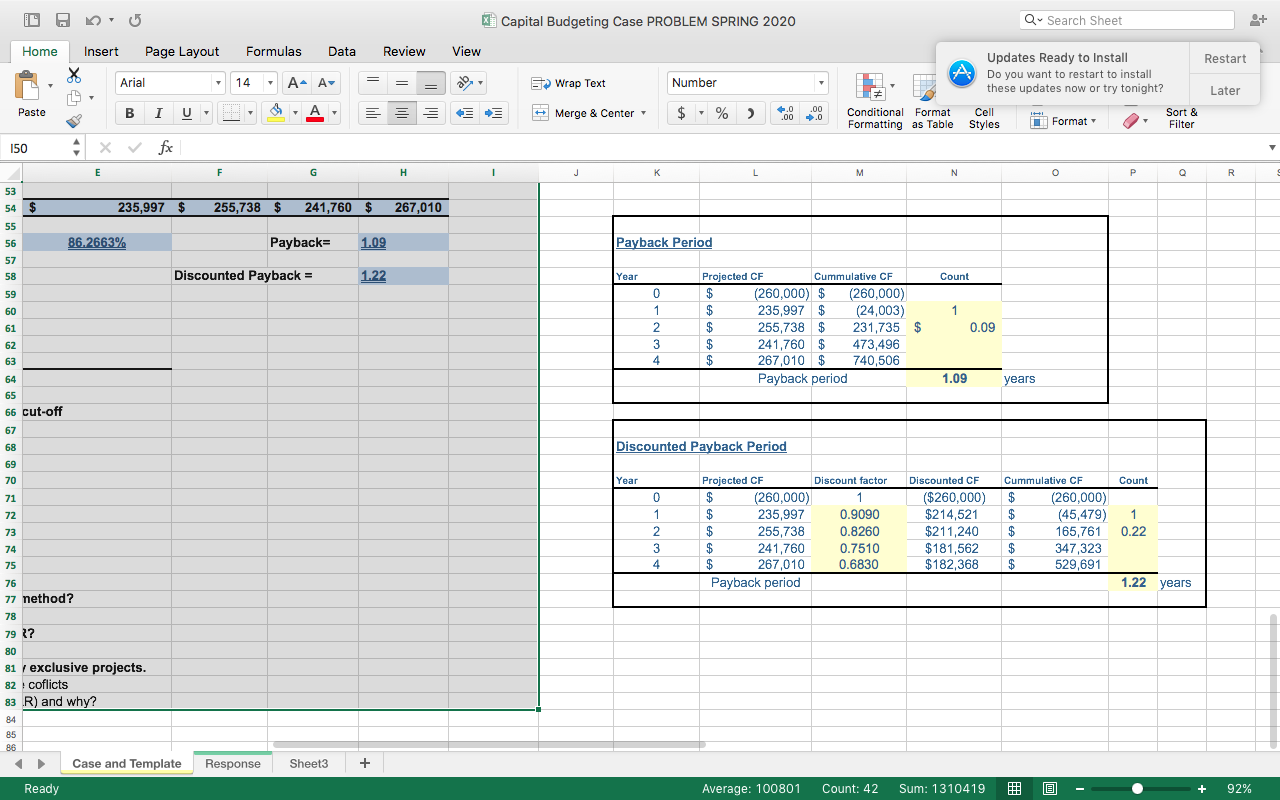

| Q#1 | Would you accept the project based on NPV, IRR? | |

| | Would you accept the project based on Payback rule if project cut-off | |

| | is 3 years? | | | |

| Q#2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and | |

| | Capital Budgeting (Investment ) Decisions | | |

| (a) | Estimate NPV, IRR and Payback Period of the project if | |

| | tax rate equals to 21%. Would you | |

| | accept or reject the project? | | |

| ( b) | As a CFO of the firm, which of the above two scenarios (1) or (2) | |

| | would you choose? Why? | | |

| Q#3 How would you explain to your CEO what NPV means? | |

| | | | | |

| Q#4 What are advantages and disadvantages of using only Payback method? |

| | | | | |

| Q#5 What are advantages and disadvantages of using NPV versus IRR? | |

| | | | | |

| Q#6 Explain the difference between independent projects and mutually exclusive projects. |

| | When you are confronted with Mutually Exclusive Projects and have coflicts |

| | with NPV and IRR results, which criterion would you use (NPV or IRR) and why? |

Capital Budgeting Case PROBLEM SPRING 2020 Q Search Sheet Restart D Do Home Insert Page Layout Formulas Data * Arial 14 A A BIULA 150 x fx Review = = = View alias Updates Ready to Install Do you want to restart to install these updates now or try tonight? Eo Wrap Text Merge & Center Number Later Paste $ % ) . Conditional Format Formatting as Table Cell Styles Sort & Format . $ 235,997 $ 255,738 $ 241,760 $ 267,010 86.2663% Payback= 1.09 Payback Period Discounted Payback = 1.22 Year Count Projected CF Cummulative CF (260,000) $ (260,000) 235,997 $ (24,003) 255,738 $ 231,735 $ 241,760 $ 473,496 267,010 $ 740,506 Payback period 0.09 1.09 years cut-off Discounted Payback Period Year Count Projected CF Discount factor (260,000) 235,997 0.9090 $ 255,738 0.8260 $ 241,760 0.7510 $ 267,010 0.6830 Payback period Discounted CF ($260,000) $214,521 $211,240 $181,562 $182,368 Cummulative CF $ (260,000) (45,479) $ 165,761 347,323 $ 529,691 1 0.22 1.22 years 77 nethod? 79 ? 81 / exclusive projects. 82 coflicts 83 R) and why? 84 86 Case and Template Response Sheet3 + Ready Average: 100801 Count: 42 Sum: 1310419 @ -- + 92% Capital Budgeting Case PROBLEM SPRING 2020 Q Search Sheet Restart Review = = = View alias Updates Ready to Install Do you want to restart to install these updates now or try tonight? Number Eo Wrap Text Merge & Center D Do Home Insert Page Layout Formulas Data * Arial 14 A A 2 BIU1A x fx A B Total Later Paste $ % ) . Conditional Format Formatting as Table Cell Styles L!! Format Format . Sort & Filter 150 H 20,000 $ - Salvage value*(1-mar Project Net Cash Flows (260,000) $ 235,997 $ 255,738 $ 241,760 $ 267,010 NPV = $529.906.49 IRR = 86.2663% Payback= 1.09 Payback Period Profitability Index = 3.04 Discounted Payback = 1.22 Year $ Projected CF Cum (260,000) $ 235,997 $ 255,738 $ 241,760 $ 267,010 $ Payback perio PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB Discounted Payback Period Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years? Q#2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment ) Decisions (a) Estimate NPV, IRR and Payback period of the project if tax rate equals to 21%. Would you accept or reject the project? As a CFO of the firm, which of the above two scenarios (1) or (2) would you choose? Why? Q#3 How would you explain to your CEO what NPV means? Year 1 2 3 4 Projected CF Disca (260,000) $ 235,997 $ 255,738 $ 241,760 $ 267,010 Payback period Q#4 What are advantages and disadvantages of using only Payback method? Q#5 What are advantages and disadvantages of using NPV versus IRR? Q#6 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have coflicts with NPV and IRR results, which criterion would you use (NPV or IRR) and why? Case and Template Response Sheet3 + Ready Average: 100801 Count: 42 Sum: 1310419 O - O - + 92% Capital Budgeting Case PROBLEM SPRING 2020 Q Search Sheet Restart D Do Home Insert Page Layout Formulas Data * Aria 14 A- A Paste BIUDA 150 4 x fx Review View = = = der Updates Ready to Install Do you want to restart to install these updates now or try tonight? Ep Wrap Text Merge & Center Number Later $ % ) . Conditional Format Formatting as Table Cell Styles Sort & Format - O . 21 7) Equip. salvage value before tax $15,000 13) Cost of Capital (Discount Rate) 10% Filling data in the cells colored only. Do not write in any other cell. Do not delete any row or column 25 ESTIMATING Initial Outlay (Cash Flow, CFO, T=0) CFO CF1 CF2CF3CF4 2 28 Year 29 Investments: 30 1) Equipment cost 31 2) Shipping and Install cost 32 3) Start up expenses 33 Total Basis Cost (1+2+3) 34 4) Net Working Capital Total Initial Outlay (200,000) (35,000) (5,000) (240,000) (20,000) (260,000) Depreciation Calculati A 37 Operations: 38 Revenue 39 Operating Cost 40 Depreciation 41 EBIT 42 Taxes 43 Net Income Depreciation Basis: # of years: Macrs A A 200,000 $ 120,000 $ 79,992 $ 240,008 $ 84,003 $ 156,005 $ 210,000 $ 126,000 $ 106,680 $ 229,320 $ 80,262 $ 149,058 $ 220,500 $ 132,300 $ 35,544 $ 317,256 $ 111,040 $ 206,216 $ 231,525 138,915 17,784 352,656 123,430 229,226 A $ Year Basi 45 Add back Depreciation $ _79,992 $ 106,680 $ 35,544 $ 17,784 Total Operating Cash Flow $ 235,997 $ 255,738 $ 241,760 $ 247,010 $ 20,000 49 Terminal values: 1) Change in net WC 512) Salvage value (after tax) Total $ 20,000 Salvage value*(1 - mar (260.000 $ 235.997 $ 255.738 $ 241.760 $ 267.010 541 Proiect Net Cash Flows Case and Template Response Sheet3 + Ready Average: 100801 Count: 42 Sum: 1310419 @ -- + 92% Capital Budgeting Case PROBLEM SPRING 2020 Q Search Sheet Restart D Do Home Insert Page Layout Formulas Data Review , Arial , 14 - A- A = = = BIVA View der A Updates Ready to Install Do you want to restart to install these updates now or try tonight? Number 1. Later Wrap Text Merge & Center Paste $ % ) . Conditional Format Formatting as Table Cell Styles Sort & Format - O . 150 DATE: 4/29/20 Instructor: Tunde Aboyade-Cole FINC 3310 - SPRING 2020 MACRS TABLE Depreciation rate for recovery period 3 year 5-year 7-year 10-year 15-year 20-year 3.750% 7,219 33,33% 44.15 14,81 7.41 0.50 20,00 12.00 19,20 11.52 11.52 10.00% 1800 14.00 14.20% 2449 17.49 19.40 8.03 11.52 0.22 6.03 6.76 3.02 737 6.55 6.23 5.2A5 B.93 4.446 6.55 6.55 5.00 3.28 5,91 5.00 1.461 15 8) Sales for first year (1) 16 9) Sales increase per year 17 10) Operating cost (60% of Sales) 18 (as a percent of sales in Year 1) 19 11) Depreciation 20 12) Marginal Corporate Tax Rate (T) 21 13) Cost of Capital (Discount Rate) 200,000 5% (120,000) -60% Use 3-yr MACRIS 35% 10% 5.01 5,00 5,01 4.461 2.95 4,461 23 only. Do not write in any other cell. 24 Do not delete any row or column 2.231 CF1CF2CF3CF4 Case and Template Response Sheet3 + Ready Average: 100801 Count: 42 Sum: 1310419 - + 92% Capital Budgeting Case PROBLEM SPRING 2020 Q Search Sheet Restart D Do Home Insert Page Layout * Arial B B IV 150 x fc A B C Formulas Data 14 A A A Review = = = = View alias Number Updates Ready to Install Do you want to restart to install these updates now or try tonight? Eo Wrap Text Merge & Center Later Paste $ % ) . Conditional Format Formatting as Table Cell Styles Sort & Format D 2 Student Name: Asher Franklyn DATE: 4/29/20 Instructor: Tunde A Capital Budgeting Decisions CASE STUDY FINC 3310 - SPRING 2020 MACE 7 Learning Objectives 3 year 5-year 20.00 1. Understand how to use EXCEL Spreadsheet 10 (a) Develop proforma Income Statement Using Excel Spreadsheet 11 (b) Compute Net Project Cashflows, NPV, and IRR 12 (c) Develop problem-solving and critical thinking skills and make long-term investment decisions 33,33% 44.15 14,81 32.00 19.20 11.52 11.62 5.76 $ 200,000 5% 15 1) Life Period of the Equipment = 4 years 16 2) New equipment cost 17 3) Equipment ship & install cost 18 4) Related start up cost 19 5) Inventory increase 20 6) Accounts Payable increase 21 7) Equip. salvage value before tax ($200,000) ($35,000) ($5,000) $25,000 $5,000 $15,000 8) Sales for first year (1) 9) Sales increase per year 10) Operating cost (60% of Sales) (as a percent of sales in Year 1) 11) Depreciation 12) Marginal Corporate Tax Rate (T) 13) Cost of Capital (Discount Rate) (120,000) -60% Use 3-yr MACRIS 35% 10% Filling data in the cells colored only. Do not write in any other cell. Do not delete any row or column ESTIMATING Initial Outlay (Cash Flow, CFO, T=0) CFO CF1 CF2CF3CF4 28 Year 29 Investments: 30 1) Equipment cost 31 2) Shipping and Install cost 32 3) Start up expenses 33 Total Basis Cost (1+2+3) 34 4) Net Working Capital 35 Total Initial Outlay Case and Template uu (200,000) (35,000) (5,000) (240,000) (20,000) (260,000) Response Sheet3 + Ready Average: 100801 Count: 42 Sum: 1310419 0 - + 92% Capital Budgeting Case PROBLEM SPRING 2020 Q Search Sheet Restart D Do Home Insert Page Layout Formulas Data * Arial 14 A A BIULA 150 x fx Review = = = View alias Updates Ready to Install Do you want to restart to install these updates now or try tonight? Eo Wrap Text Merge & Center Number Later Paste $ % ) . Conditional Format Formatting as Table Cell Styles Sort & Format . $ 235,997 $ 255,738 $ 241,760 $ 267,010 86.2663% Payback= 1.09 Payback Period Discounted Payback = 1.22 Year Count Projected CF Cummulative CF (260,000) $ (260,000) 235,997 $ (24,003) 255,738 $ 231,735 $ 241,760 $ 473,496 267,010 $ 740,506 Payback period 0.09 1.09 years cut-off Discounted Payback Period Year Count Projected CF Discount factor (260,000) 235,997 0.9090 $ 255,738 0.8260 $ 241,760 0.7510 $ 267,010 0.6830 Payback period Discounted CF ($260,000) $214,521 $211,240 $181,562 $182,368 Cummulative CF $ (260,000) (45,479) $ 165,761 347,323 $ 529,691 1 0.22 1.22 years 77 nethod? 79 ? 81 / exclusive projects. 82 coflicts 83 R) and why? 84 86 Case and Template Response Sheet3 + Ready Average: 100801 Count: 42 Sum: 1310419 @ -- + 92% Capital Budgeting Case PROBLEM SPRING 2020 Q Search Sheet Restart Review = = = View alias Updates Ready to Install Do you want to restart to install these updates now or try tonight? Number Eo Wrap Text Merge & Center D Do Home Insert Page Layout Formulas Data * Arial 14 A A 2 BIU1A x fx A B Total Later Paste $ % ) . Conditional Format Formatting as Table Cell Styles L!! Format Format . Sort & Filter 150 H 20,000 $ - Salvage value*(1-mar Project Net Cash Flows (260,000) $ 235,997 $ 255,738 $ 241,760 $ 267,010 NPV = $529.906.49 IRR = 86.2663% Payback= 1.09 Payback Period Profitability Index = 3.04 Discounted Payback = 1.22 Year $ Projected CF Cum (260,000) $ 235,997 $ 255,738 $ 241,760 $ 267,010 $ Payback perio PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB Discounted Payback Period Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years? Q#2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment ) Decisions (a) Estimate NPV, IRR and Payback period of the project if tax rate equals to 21%. Would you accept or reject the project? As a CFO of the firm, which of the above two scenarios (1) or (2) would you choose? Why? Q#3 How would you explain to your CEO what NPV means? Year 1 2 3 4 Projected CF Disca (260,000) $ 235,997 $ 255,738 $ 241,760 $ 267,010 Payback period Q#4 What are advantages and disadvantages of using only Payback method? Q#5 What are advantages and disadvantages of using NPV versus IRR? Q#6 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have coflicts with NPV and IRR results, which criterion would you use (NPV or IRR) and why? Case and Template Response Sheet3 + Ready Average: 100801 Count: 42 Sum: 1310419 O - O - + 92% Capital Budgeting Case PROBLEM SPRING 2020 Q Search Sheet Restart D Do Home Insert Page Layout Formulas Data * Aria 14 A- A Paste BIUDA 150 4 x fx Review View = = = der Updates Ready to Install Do you want to restart to install these updates now or try tonight? Ep Wrap Text Merge & Center Number Later $ % ) . Conditional Format Formatting as Table Cell Styles Sort & Format - O . 21 7) Equip. salvage value before tax $15,000 13) Cost of Capital (Discount Rate) 10% Filling data in the cells colored only. Do not write in any other cell. Do not delete any row or column 25 ESTIMATING Initial Outlay (Cash Flow, CFO, T=0) CFO CF1 CF2CF3CF4 2 28 Year 29 Investments: 30 1) Equipment cost 31 2) Shipping and Install cost 32 3) Start up expenses 33 Total Basis Cost (1+2+3) 34 4) Net Working Capital Total Initial Outlay (200,000) (35,000) (5,000) (240,000) (20,000) (260,000) Depreciation Calculati A 37 Operations: 38 Revenue 39 Operating Cost 40 Depreciation 41 EBIT 42 Taxes 43 Net Income Depreciation Basis: # of years: Macrs A A 200,000 $ 120,000 $ 79,992 $ 240,008 $ 84,003 $ 156,005 $ 210,000 $ 126,000 $ 106,680 $ 229,320 $ 80,262 $ 149,058 $ 220,500 $ 132,300 $ 35,544 $ 317,256 $ 111,040 $ 206,216 $ 231,525 138,915 17,784 352,656 123,430 229,226 A $ Year Basi 45 Add back Depreciation $ _79,992 $ 106,680 $ 35,544 $ 17,784 Total Operating Cash Flow $ 235,997 $ 255,738 $ 241,760 $ 247,010 $ 20,000 49 Terminal values: 1) Change in net WC 512) Salvage value (after tax) Total $ 20,000 Salvage value*(1 - mar (260.000 $ 235.997 $ 255.738 $ 241.760 $ 267.010 541 Proiect Net Cash Flows Case and Template Response Sheet3 + Ready Average: 100801 Count: 42 Sum: 1310419 @ -- + 92% Capital Budgeting Case PROBLEM SPRING 2020 Q Search Sheet Restart D Do Home Insert Page Layout Formulas Data Review , Arial , 14 - A- A = = = BIVA View der A Updates Ready to Install Do you want to restart to install these updates now or try tonight? Number 1. Later Wrap Text Merge & Center Paste $ % ) . Conditional Format Formatting as Table Cell Styles Sort & Format - O . 150 DATE: 4/29/20 Instructor: Tunde Aboyade-Cole FINC 3310 - SPRING 2020 MACRS TABLE Depreciation rate for recovery period 3 year 5-year 7-year 10-year 15-year 20-year 3.750% 7,219 33,33% 44.15 14,81 7.41 0.50 20,00 12.00 19,20 11.52 11.52 10.00% 1800 14.00 14.20% 2449 17.49 19.40 8.03 11.52 0.22 6.03 6.76 3.02 737 6.55 6.23 5.2A5 B.93 4.446 6.55 6.55 5.00 3.28 5,91 5.00 1.461 15 8) Sales for first year (1) 16 9) Sales increase per year 17 10) Operating cost (60% of Sales) 18 (as a percent of sales in Year 1) 19 11) Depreciation 20 12) Marginal Corporate Tax Rate (T) 21 13) Cost of Capital (Discount Rate) 200,000 5% (120,000) -60% Use 3-yr MACRIS 35% 10% 5.01 5,00 5,01 4.461 2.95 4,461 23 only. Do not write in any other cell. 24 Do not delete any row or column 2.231 CF1CF2CF3CF4 Case and Template Response Sheet3 + Ready Average: 100801 Count: 42 Sum: 1310419 - + 92% Capital Budgeting Case PROBLEM SPRING 2020 Q Search Sheet Restart D Do Home Insert Page Layout * Arial B B IV 150 x fc A B C Formulas Data 14 A A A Review = = = = View alias Number Updates Ready to Install Do you want to restart to install these updates now or try tonight? Eo Wrap Text Merge & Center Later Paste $ % ) . Conditional Format Formatting as Table Cell Styles Sort & Format D 2 Student Name: Asher Franklyn DATE: 4/29/20 Instructor: Tunde A Capital Budgeting Decisions CASE STUDY FINC 3310 - SPRING 2020 MACE 7 Learning Objectives 3 year 5-year 20.00 1. Understand how to use EXCEL Spreadsheet 10 (a) Develop proforma Income Statement Using Excel Spreadsheet 11 (b) Compute Net Project Cashflows, NPV, and IRR 12 (c) Develop problem-solving and critical thinking skills and make long-term investment decisions 33,33% 44.15 14,81 32.00 19.20 11.52 11.62 5.76 $ 200,000 5% 15 1) Life Period of the Equipment = 4 years 16 2) New equipment cost 17 3) Equipment ship & install cost 18 4) Related start up cost 19 5) Inventory increase 20 6) Accounts Payable increase 21 7) Equip. salvage value before tax ($200,000) ($35,000) ($5,000) $25,000 $5,000 $15,000 8) Sales for first year (1) 9) Sales increase per year 10) Operating cost (60% of Sales) (as a percent of sales in Year 1) 11) Depreciation 12) Marginal Corporate Tax Rate (T) 13) Cost of Capital (Discount Rate) (120,000) -60% Use 3-yr MACRIS 35% 10% Filling data in the cells colored only. Do not write in any other cell. Do not delete any row or column ESTIMATING Initial Outlay (Cash Flow, CFO, T=0) CFO CF1 CF2CF3CF4 28 Year 29 Investments: 30 1) Equipment cost 31 2) Shipping and Install cost 32 3) Start up expenses 33 Total Basis Cost (1+2+3) 34 4) Net Working Capital 35 Total Initial Outlay Case and Template uu (200,000) (35,000) (5,000) (240,000) (20,000) (260,000) Response Sheet3 + Ready Average: 100801 Count: 42 Sum: 1310419 0 - + 92%

this is every piece of the project

this is every piece of the project