Question

This is exactly the same question that the professor asked us in the exam. Do your best to answer the question with the data given

This is exactly the same question that the professor asked us in the exam. Do your best to answer the question with the data given to you!!!

A. Proponents of the use of Fair Value Accounting (FVA) argue that the use of fair value reflects current market conditions. On the contrary, opponents of the FVA argue that under specific circumstances, such as a financial crisis, mark to market accounting may lead to considerable volatility in the financial statements and especially the Income Statement (Laux and Leuz, 2009). Critically discuss the merits and flaws of FVA in relation to cost accounting. (5%)

Recommended Reference Laux, C., & Leuz, C. (2009). The crisis of fair-value accounting: Making sense of the recent debate. Accounting, organizations and society, 34(6-7), 826-834.

B. A recent path in the financial disclosure literature has aimed at uncovering information in the Notes (disclosures) of the financial statements through textual analysis (i.e. Loughran and McDonald, 2014, 2015, 2016). What you think are the advantages and disadvantages of textual analysis methods for uncovering information helpful in financial analysis from the Notes (disclosures) of the financial statements? (5%)

Recommended Reference Loughran, T., McDonald, B., 2014. Measuring Readability in Financial Disclosures. The Journal of Finance 69, 1643-1671. Loughran, T., McDonald, B., 2015. The Use of Word Lists in Textual Analysis. Journal of Behavioral Finance 16, 1-11. Loughran, T., McDonald, B., 2016. Textual Analysis in Accounting and Finance: A Survey. Journal of Accounting Research 54, 1187-1230.

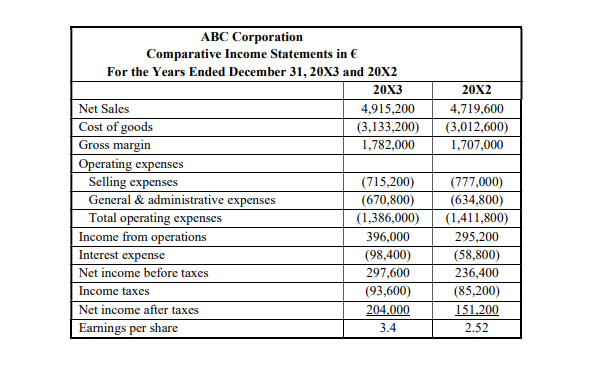

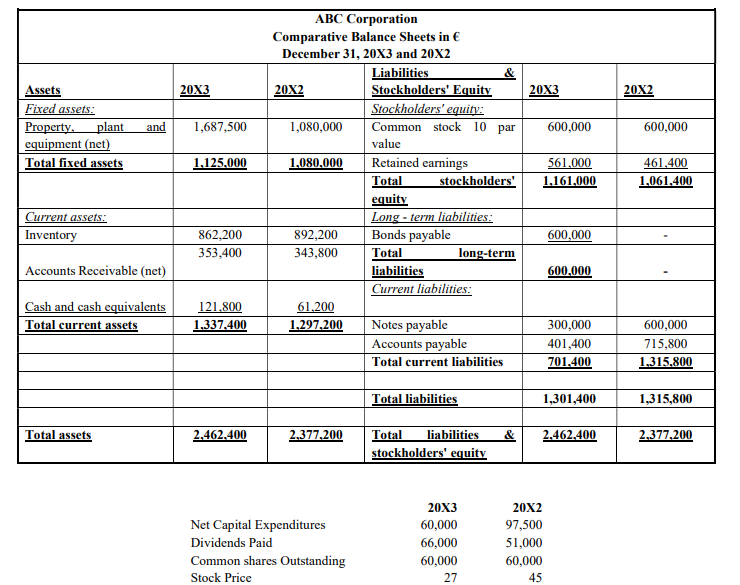

C. The following information are available for firm ABC:

Required:

1. Prepare a long-term solvency analysis by calculating for each year the total liabilites-to-equity ratio and the interest coverage ratio. (10%)

2. Prepare a market strength analysis by calculating for each year the P/E ratio and the dividends yield. (10%)

\begin{tabular}{|l|c|c|} \hline \multicolumn{3}{|c|}{ ABC Corporation } \\ \multicolumn{4}{|c|}{ Comparative Income Statements in } \\ \hline \multicolumn{2}{|c|}{ For the Years Ended December 31, 20X3 and 20X2 } \\ \hline & 20X3 & 20X2 \\ \hline Net Sales & 4,915,200 & 4,719,600 \\ \hline Cost of goods & (3,133,200) & (3,012,600) \\ \hline Gross margin & 1,782,000 & 1,707,000 \\ \hline Operating expenses & & \\ \hline Selling expenses & (715,200) & (777,000) \\ \hline General \& administrative expenses & (670,800) & (634,800) \\ \hline Total operating expenses & (1,386,000) & (1,411,800) \\ \hline Income from operations & 396,000 & 295,200 \\ \hline Interest expense & (98,400) & (58,800) \\ \hline Net income before taxes & 297,600 & 236,400 \\ \hline Income taxes & (93,600) & (85,200) \\ \hline Net income after taxes & 204,000 & 151,200 \\ \hline Earnings per share & 3.4 & 2.52 \\ \hline \end{tabular} NetCapitalExpendituresDividendsPaidCommonsharesOutstandingStockPrice20X360,00066,00060,0002720297,50051,00060,00045Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started