Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is for a case study two part question You are arranging a mortgage for a borrower and you are using a private investor to

This is for a case study two part question

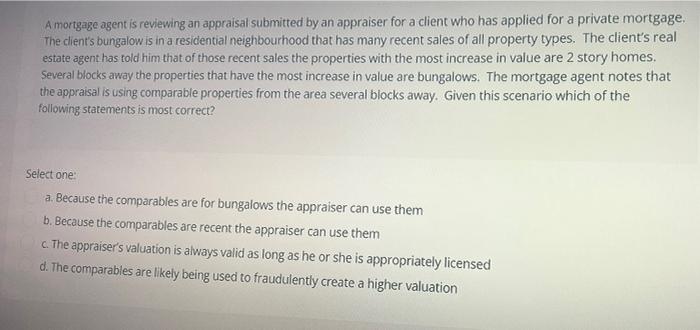

You are arranging a mortgage for a borrower and you are using a private investor to fund that mortgage. Based on the disclosure document requirements for both which of the following statements with regards to waiting periods is correct? Select one: a. The borrower has a 48 hour waiting period while the investor's is 24 hours b. The investor's waiting period can be reduced to 24 hours while the borrower's can be waived c. The investor and borrower both have waiting periods of 24 hours d. The investor has a 48 hour waiting period while the borrower's is 24 hours A mortgage agent is reviewing an appraisal submitted by an appraiser for a client who has applied for a private mortgage. The client's bungalow is in a residential neighbourhood that has many recent sales of all property types. The client's real estate agent has told him that of those recent sales the properties with the most increase in value are 2 story homes. Several blocks away the properties that have the most increase in value are bungalows. The mortgage agent notes that the appraisal is using comparable properties from the area several blocks away. Given this scenario which of the following statements is most correct? Select one a. Because the comparables are for bungalows the appraiser can use them b. Because the comparables are recent the appraiser can use them C. The appraiser's valuation is always valid as long as he or she is appropriately licensed d. The comparables are likely being used to fraudulently create a higher valuation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started