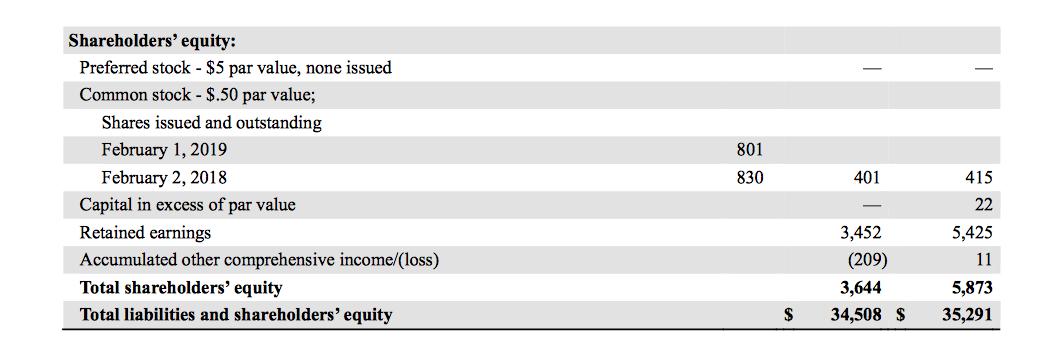

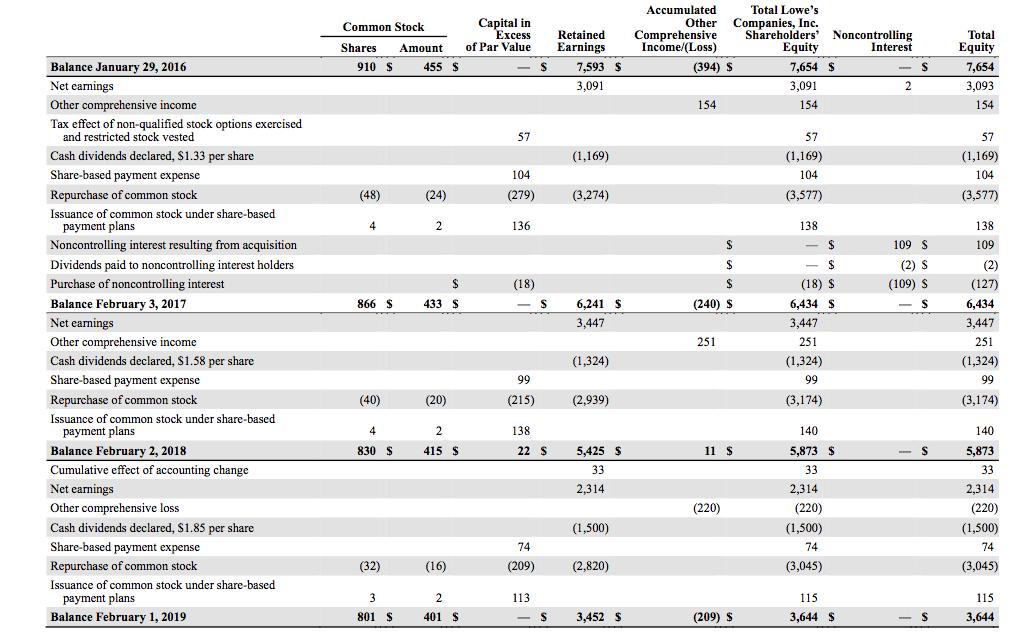

1. Identify and discuss the current types of stock, such as common or preferred stock, currently issued, and outstanding. Include a narrative description along with

1. Identify and discuss the current types of stock, such as common or preferred stock, currently issued, and outstanding. Include a narrative description along with the values and number of shares found on the balance sheet.

2. Identify the presence of treasury stock and its impact on overall stockholders' equity. If the company does not have treasury stock, indicate the absence of treasury stock and provide some discussion as to why the company may not have purchased back any of its originally issued stock.

3. Review the notes to the financial statements to determine if the company has any convertible bonds and summarize the characteristics of those bonds. If there are no convertible bonds in the notes, discuss why a company may want to consider convertible bonds in the future.

Shareholders' equity: Preferred stock - $5 par value, none issued Common stock - $.50 par value; Shares issued and outstanding February 1, 2019 801 February 2, 2018 830 401 415 Capital in excess of par value 22 Retained earnings 3,452 5,425 Accumulated other comprehensive income/(loss) (209) 11 Total shareholders' equity 3,644 5,873 Total liabilities and shareholders' equity $ 34,508 $ 35,291

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Investing in the stock market has historically been one of the most important pathways to financial success As you dive into researching stocks youll often hear them discussed with reference to differ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started