Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is for my Colorado tax help class and I need help from 2-5, Thanks! 1. Jim paid $1,100 for 100 shares of XYZ stock

This is for my Colorado tax help class and I need help from 2-5, Thanks!

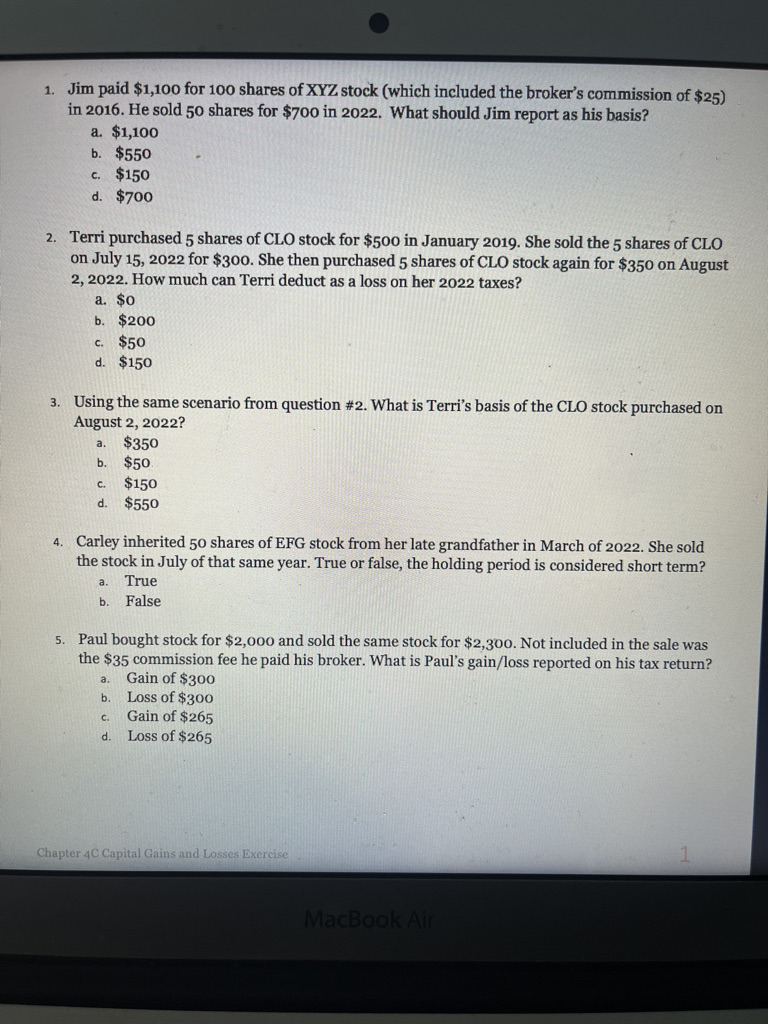

1. Jim paid $1,100 for 100 shares of XYZ stock (which included the broker's commission of $25 ) in 2016. He sold 50 shares for $700 in 2022 . What should Jim report as his basis? a. $1,100 b. $550 c. $150 d. $700 2. Terri purchased 5 shares of CLO stock for $500 in January 2019. She sold the 5 shares of CLO on July 15,2022 for $300. She then purchased 5 shares of CLO stock again for $350 on August 2, 2022. How much can Terri deduct as a loss on her 2022 taxes? a. \$0 b. $200 c. $50 d. $150 3. Using the same scenario from question \#2. What is Terri's basis of the CLO stock purchased on August 2, 2022? a. $350 b. $50 c. $150 d. $550 4. Carley inherited 50 shares of EFG stock from her late grandfather in March of 2022. She sold the stock in July of that same year. True or false, the holding period is considered short term? a. True b. False 5. Paul bought stock for $2,000 and sold the same stock for $2,300. Not included in the sale was the $35 commission fee he paid his broker. What is Paul's gain/loss reported on his tax return? a. Gain of $300 b. Loss of $300 c. Gain of $265 d. Loss of $265Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started