This is for my Corporate Finance class. The Companies That I chose are Apple (AAPL) vs. Microsoft (MSFT). PLEASE ANSWER ALL QUESTIONS

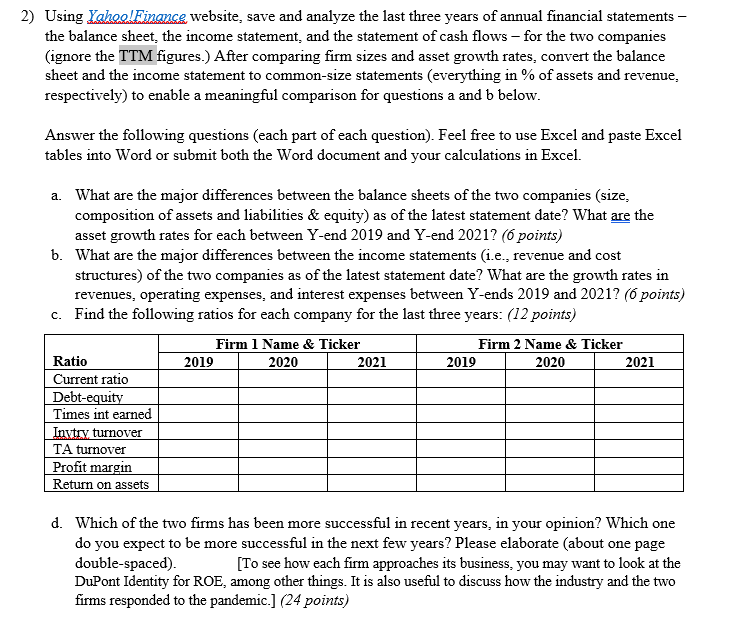

1) In this individual assignment, you will compare and contrast two firms from the same industry (or at least competing with each other in some markets), publicly traded on US exchanges, using financial statements data. Do not pick financial institutions, utilities, or the companies the instructor uses for in-class examples. Send your request to the instructor for approval as an empty email with the subject line MBA440 Assgnl LastName Ticker 1 Ticker 2 by the end of Wednesday, May 18. E.g., if I wanted to pick American Airlines and Delta Airlines, my subject line would be MBA 440 Assign1 Kotomin AAL DAL). Stock ticker symbols are found by entering company names on the Yahoo!Finance website. Feel free to identify an additional pair of tickers in case the first choice is not approved. - 2) Using Yahoo!Finance website, save and analyze the last three years of annual financial statements - the balance sheet, the income statement, and the statement of cash flows - for the two companies (ignore the TTM figures.) After comparing firm sizes and asset growth rates, convert the balance sheet and the income statement to common-size statements (everything in % of assets and revenue. respectively) to enable a meaningful comparison for questions a and b below. Answer the following questions (each part of each question). Feel free to use Excel and paste Excel tables into Word or submit both the Word document and your calculations in Excel. a. What are the major differences between the balance sheets of the two companies (size, composition of assets and liabilities & equity) as of the latest statement date? What are the asset growth rates for each between Y-end 2019 and Y-end 2021? (6 points) b. What are the major differences between the income statements (i.e., revenue and cost structures) of the two companies as of the latest statement date? What are the growth rates in revenues, operating expenses, and interest expenses between Y-ends 2019 and 2021? (6 points) c. Find the following ratios for each company for the last three years: (12 points) Firm 1 Name & Ticker 2020 Firm 2 Name & Ticker 2020 Ratio 2019 2021 2019 2021 Current ratio Debt-equity Times int earned Invtry, turnover TA turnover Profit margin Return on assets d. Which of the two firms has been more successful in recent years, in your opinion? Which one do you expect to be more successful in the next few years? Please elaborate (about one page double-spaced). [To see how each firm approaches its business, you may want to look at the DuPont Identity for ROE, among other things. It is also useful to discuss how the industry and the two firms responded to the pandemic.] (24 points) 1) In this individual assignment, you will compare and contrast two firms from the same industry (or at least competing with each other in some markets), publicly traded on US exchanges, using financial statements data. Do not pick financial institutions, utilities, or the companies the instructor uses for in-class examples. Send your request to the instructor for approval as an empty email with the subject line MBA440 Assgnl LastName Ticker 1 Ticker 2 by the end of Wednesday, May 18. E.g., if I wanted to pick American Airlines and Delta Airlines, my subject line would be MBA 440 Assign1 Kotomin AAL DAL). Stock ticker symbols are found by entering company names on the Yahoo!Finance website. Feel free to identify an additional pair of tickers in case the first choice is not approved. - 2) Using Yahoo!Finance website, save and analyze the last three years of annual financial statements - the balance sheet, the income statement, and the statement of cash flows - for the two companies (ignore the TTM figures.) After comparing firm sizes and asset growth rates, convert the balance sheet and the income statement to common-size statements (everything in % of assets and revenue. respectively) to enable a meaningful comparison for questions a and b below. Answer the following questions (each part of each question). Feel free to use Excel and paste Excel tables into Word or submit both the Word document and your calculations in Excel. a. What are the major differences between the balance sheets of the two companies (size, composition of assets and liabilities & equity) as of the latest statement date? What are the asset growth rates for each between Y-end 2019 and Y-end 2021? (6 points) b. What are the major differences between the income statements (i.e., revenue and cost structures) of the two companies as of the latest statement date? What are the growth rates in revenues, operating expenses, and interest expenses between Y-ends 2019 and 2021? (6 points) c. Find the following ratios for each company for the last three years: (12 points) Firm 1 Name & Ticker 2020 Firm 2 Name & Ticker 2020 Ratio 2019 2021 2019 2021 Current ratio Debt-equity Times int earned Invtry, turnover TA turnover Profit margin Return on assets d. Which of the two firms has been more successful in recent years, in your opinion? Which one do you expect to be more successful in the next few years? Please elaborate (about one page double-spaced). [To see how each firm approaches its business, you may want to look at the DuPont Identity for ROE, among other things. It is also useful to discuss how the industry and the two firms responded to the pandemic.] (24 points)