Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is for the course capital budgeting and financial modeling. Please have 1 answer for each of the multiple choice questions. 1) Which of the

This is for the course capital budgeting and financial modeling. Please have 1 answer for each of the multiple choice questions.

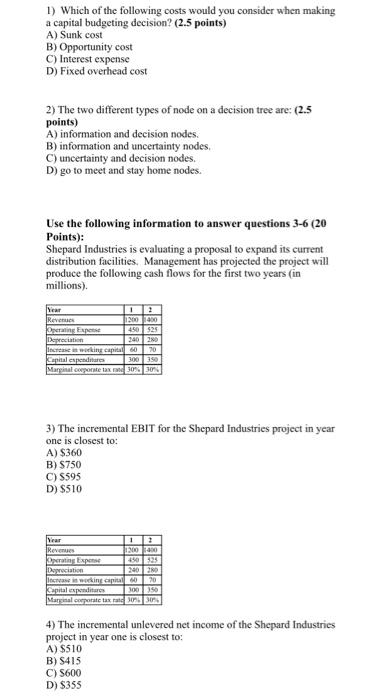

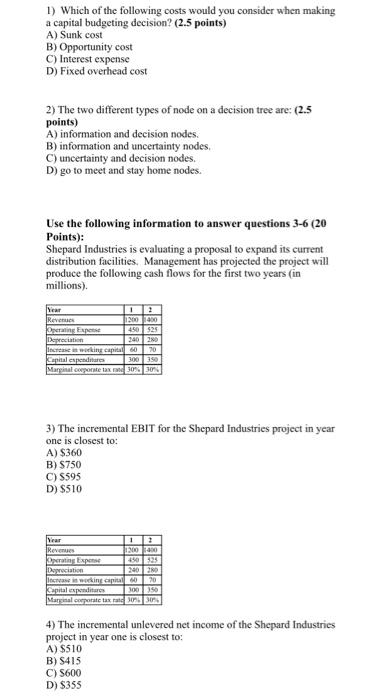

1) Which of the following costs would you consider when making a capital budgeting decision? (2.5 points) A) Sunk cost B) Opportunity cost C) Interest expense D) Fixed overhead cost 2) The two different types of node on a decision tree are: (2.5 points) A) information and decision nodes. B) information and uncertainty nodes.. C) uncertainty and decision nodes. D) go to meet and stay home nodes. Use the following information to answer questions 3-6 (20 Points): Shepard Industries is evaluating a proposal to expand its current distribution facilities. Management has projected the project will produce the following cash flows for the first two years (in millions). Year Revenues Operating Expense Depreciation 240 280 Increase in working capital 60 70 Capital expenditures 300 350 Marginal corporate tax rate 30% 30% 3) The incremental EBIT for the Shepard Industries project in year one is closest to: A) $360 B) $750 C) $595 D) $510 1 | 2 1200 1400 450 525 Year Revenues Operating Expense Depreciation 1 2 1200 400 450 525 240 280 Increase in working capital 60 70 300 350 Capital expenditures Marginal corporate tax rate 30% 30% 4) The incremental unlevered net income of the Shepard Industries project in year one is closest to: A) $510 B) $415 C) $600 D) $355

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started