Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is for the course capital budgeting and financial modeling. 2. - Projects A, B, and C each have an expected life of five years.

This is for the course capital budgeting and financial modeling.

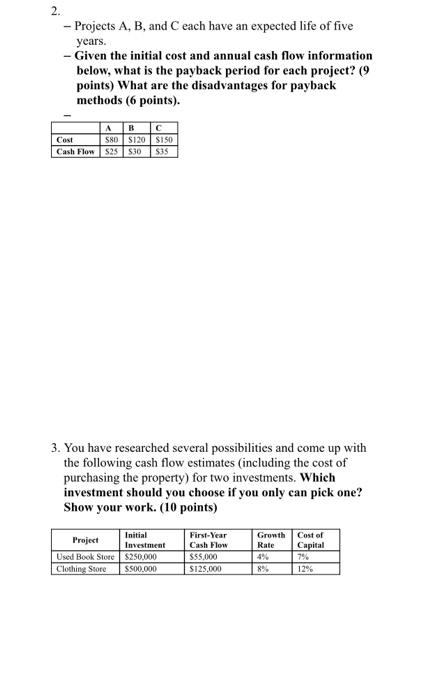

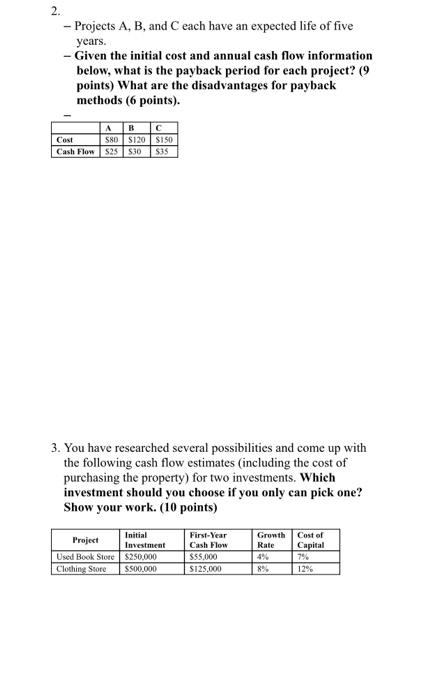

2. - Projects A, B, and C each have an expected life of five years. - Given the initial cost and annual cash flow information below, what is the payback period for each project? (9 points) What are the disadvantages for payback methods (6 points). A B Cost S80 $120 $150 Cash Flow $25 $30 $35 3. You have researched several possibilities and come up with the following cash flow estimates (including the cost of purchasing the property) for two investments. Which investment should you choose if you only can pick one? Show your work. (10 points) Project Used Book Store Clothing Store Initial Investment $250,000 $500,000 First-Year Cash Flow $55,000 $125,000 Growth Cost of Rate Capital 4% 8% 7% 12%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started