Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is for the last few problems on this worksheet about payment annuity for my fiance unit. 5. When your child is two years old

This is for the last few problems on this worksheet about payment annuity for my fiance unit.

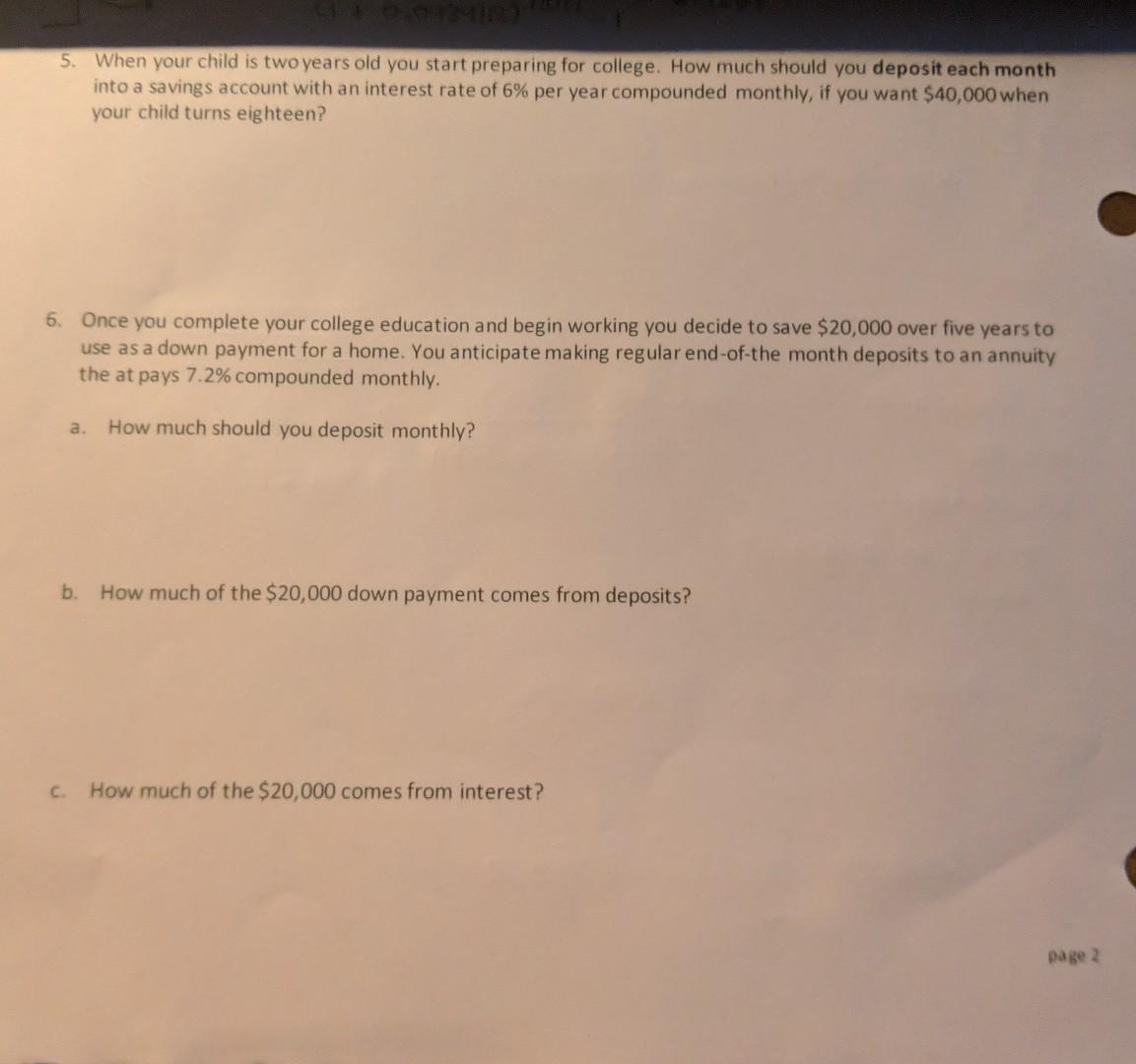

5. When your child is two years old you start preparing for college. How much should you deposit each month into a savings account with an interest rate of 6% per year compounded monthly, if you want $40,000 when your child turns eighteen? 6. Once you complete your college education and begin working you decide to save $20,000 over five years to use as a down payment for a home. You anticipate making regular end-of-the month deposits to an annuity the at pays 7.2% compounded monthly a. How much should you deposit monthly? b. How much of the $20,000 down payment comes from deposits? . How much of the $20,000 comes from interest? page 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started