Answered step by step

Verified Expert Solution

Question

1 Approved Answer

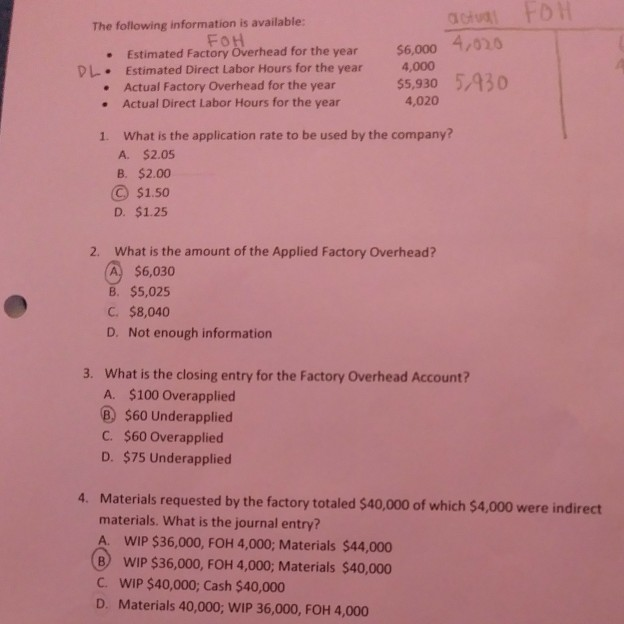

This is from chapter 16 actual FDM $6,000 4,00 The following information is available: FOH Estimated Factory Overhead for the year DL.. Estimated Direct Labor

This is from chapter 16

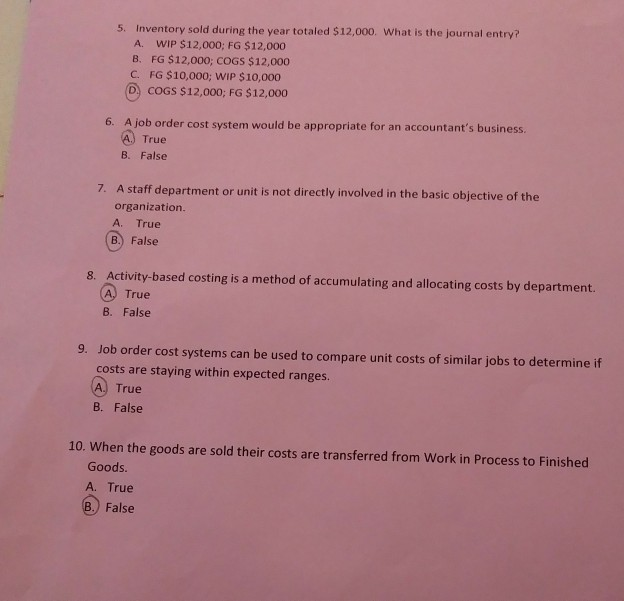

actual FDM $6,000 4,00 The following information is available: FOH Estimated Factory Overhead for the year DL.. Estimated Direct Labor Hours for the year Actual Factory Overhead for the year Actual Direct Labor Hours for the year 4,000 $5,930 5930 4,020 1. What is the application rate to be used by the company? A $2.05 B. $2.00 $1.50 D. $1.25 2. What is the amount of the Applied Factory Overhead? (A) $6,030 B. $5,025 C. $8,040 D. Not enough information 3. What is the closing entry for the Factory Overhead Account? A. $100 Overapplied B $60 Underapplied C. $60 Overapplied D. $75 Underapplied 4. Materials requested by the factory totaled $40,000 of which $4,000 were indirect! materials. What is the journal entry? A. WIP $36,000, FOH 4,000; Materials $44,000 (B) WIP $36,000, FOH 4,000; Materials $40,000 C. WIP $40,000; Cash $40,000 D. Materials 40,000; WIP 36,000, FOH 4,000 5. Inventory sold during the year totaled $12,000. What is the journal entry? A WIP $12,000; FG $12,000 B.FG $12,000; COGS $12,000 C. FG $10,000; WIP $10,000 D, COGS $12,000; FG $12,000 6. A job order cost system would be appropriate for an accountant's business. A) True B. False 7. A staff department or unit is not directly involved in the basic objective of the organization A True B. False 8. Activity-based costing is a method of accumulating and allocating costs by department. A True B. False 9. Job order cost systems can be used to compare unit costs of similar jobs to determine if costs are staying within expected ranges. A True B. False 10. When the goods are sold their costs are transferred from Work in Process to Finished Goods. A. True B. FalseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started