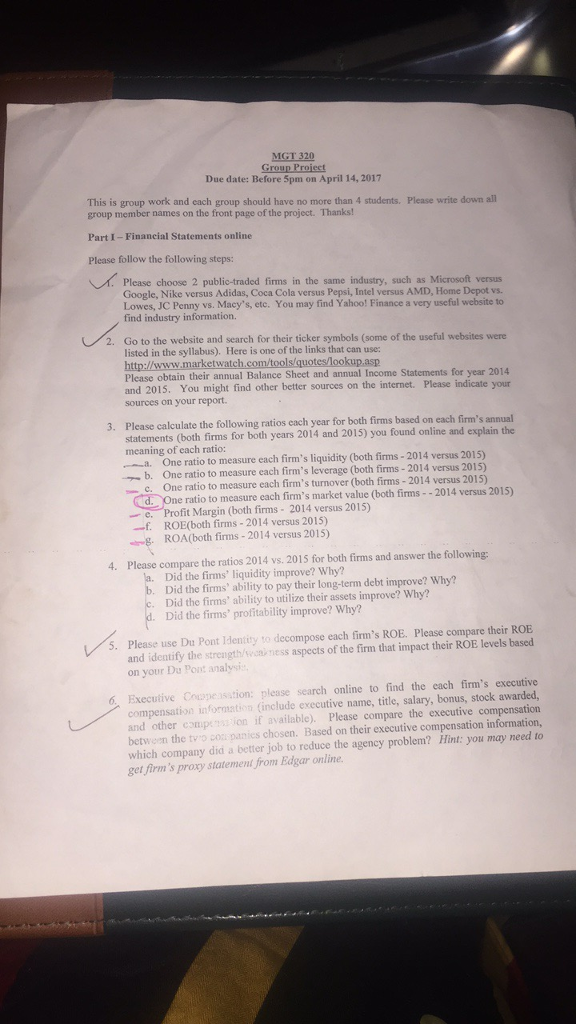

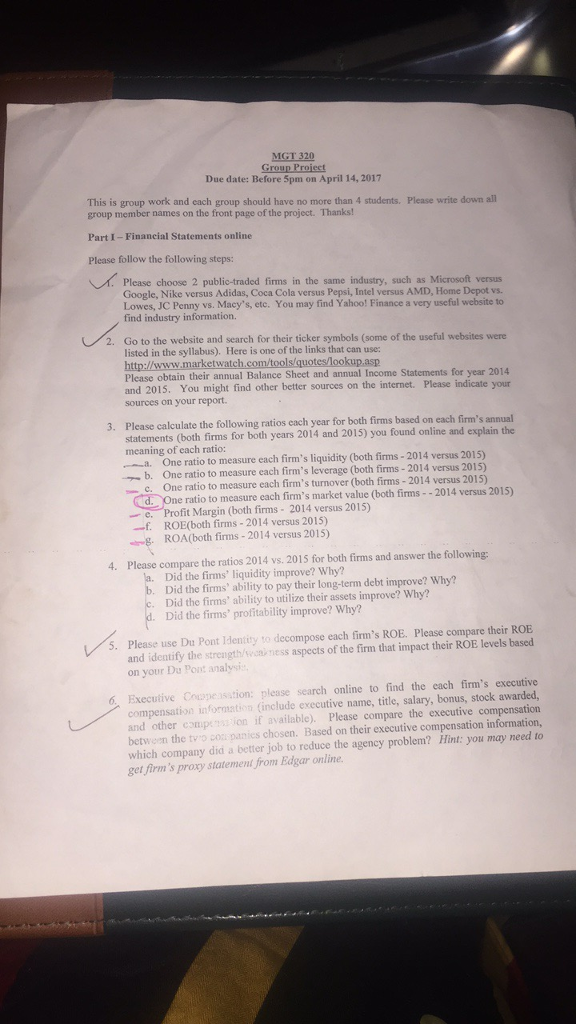

This is group work and each group should have no more than 4 students. Please write down all group member names on the front page of the project. Thanks! Please follow the following steps: Please choose 2 public-traded firms in the same industry, such as Microsoft versus Google, Nike versus Adidas, Coca Cola versus Pepsi, Intel versus AMD, Home Depot vs. Lowes, JC Penny vs. Macy's, etc. You may find Yahoo! Finance a very useful website to find industry information. Go to the website and search for their ticker symbols (some of the useful websites were listed in the syllabus). Here is one of the links that can use: Please obtain their annual Balance Sheet and annual Income Statements for year 2014 and 2015. You might find other better sources on the internet. Please indicate your sources on your report. Please calculate the following ratios each year for both firms based on each firm's annual statements (both firms for both years 2014 and 2015) you found online and explain the meaning of each ratio: a. One ratio to measure each firm's liquidity (both firms - 2014 versus 2015) b. One ratio to measure each firm's leverage (both firms - 2014 versus 2015) c. One ratio to measure each firm's turnover (both firms - 2014 versus 2015) d.. One ratio to measure each firm's market value (both firms--2014 versus 2015) e. Profit Margin (both firms - 2014 versus 2015) f. ROE(both firms - 2014 versus 2015) g. ROA(both firms - 2014 versus 2015) Please compare the ratios 2014 vs. 2015 for both firms and answer the following: a. Did the firms' liquidity improve? Why? b. Did the firms' ability to pay their long-term debt improve? Why? c. Did the firms' ability to utilize their assets improve? Why? d. Did the firms' profitability improve? Why? Please use Du Pont Identity to decompose each firm's ROE. Please compare their ROE and identify the strength/weakness aspects of the firm that impact their ROE levels based on your Du Pont analysis. Executive Compression: please search online to find the each firm's executive compensation information (include executive name, title, salary, bonus, stock awarded and other compensation if available). Please compare the executive compensation between the two companies chosen. Based on their executive compensation information, which company did a better job to reduce the agency