This is ine question the red marks with x were incorrect please help!

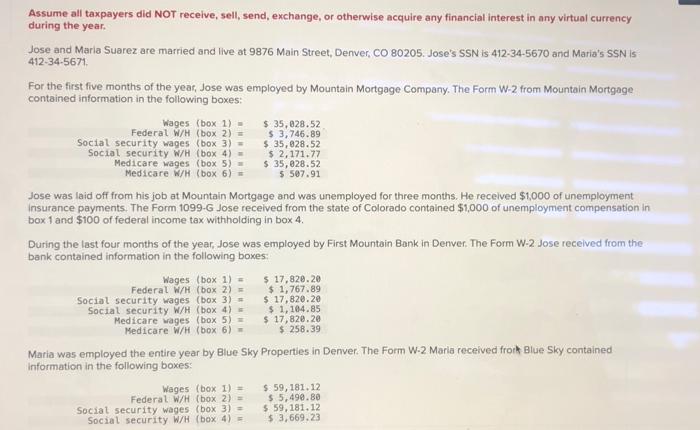

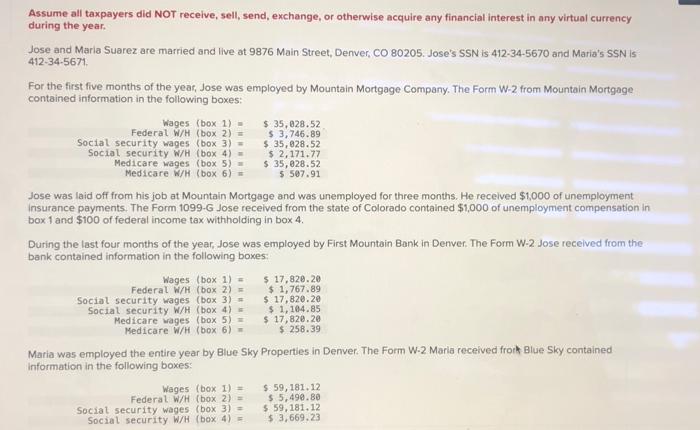

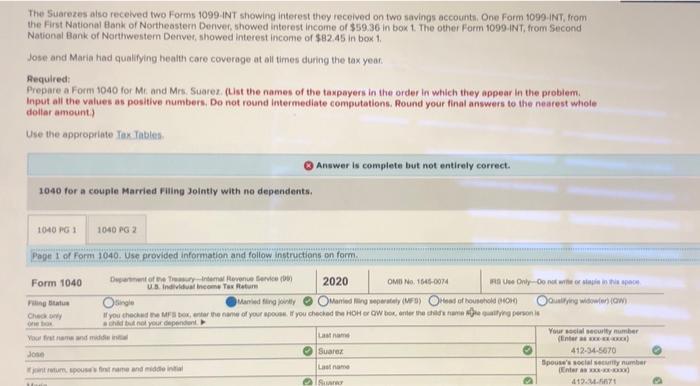

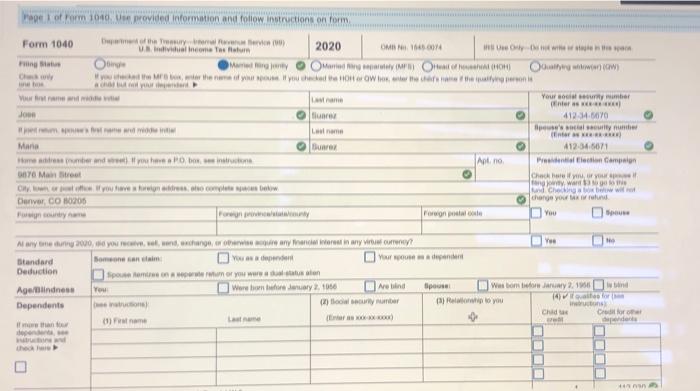

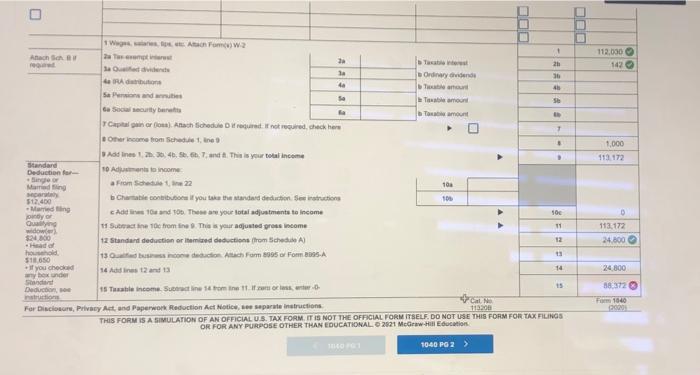

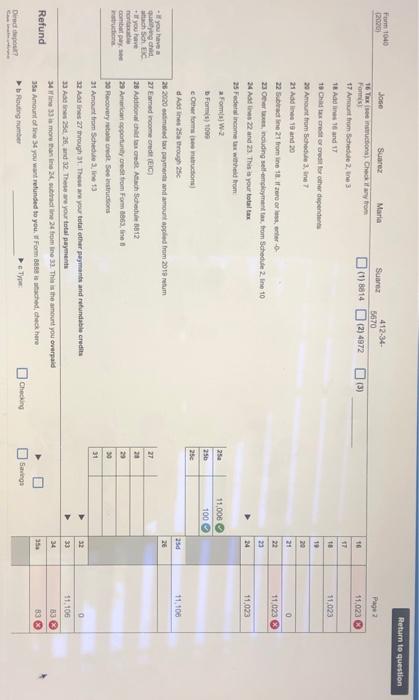

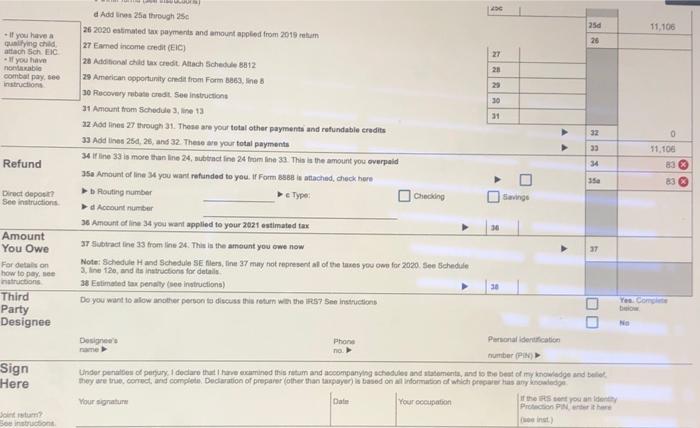

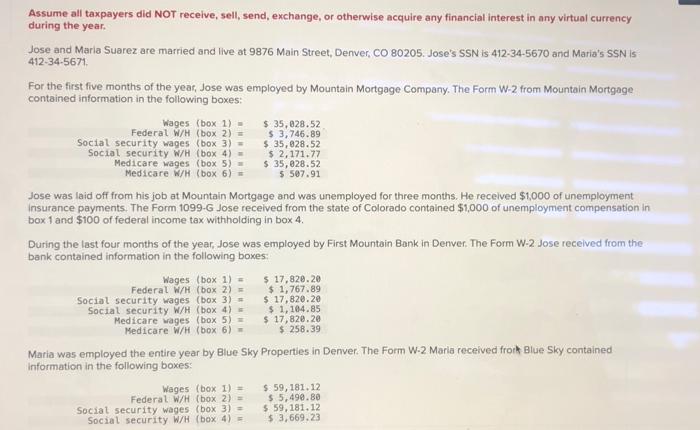

Assume all taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Jose and Marla Suarez are married and live at 9876 Main Street, Denver, CO 80205. Jose's SSN is 412-34-5670 and Maria's SSNIS 412-34-5671 For the first five months of the year, Jose was employed by Mountain Mortgage Company. The Form W-2 from Mountain Mortgage contained information in the following boxes: Wages (box 1) - $ 35,028.52 Federal W/H (box 2) = $ 3,746.89 Social security wages (box 3) = $ 35,828.52 Social security W/H (box 4) = $ 2,171.77 Medicare wages (box 5) = $ 35,028.52 Medicare W/H (box 6) = 5 507.91 Jose was laid off from his job at Mountain Mortgage and was unemployed for three months. He received $1.000 of unemployment Insurance payments. The Form 1099-G Jose received from the state of Colorado contained $1,000 of unemployment compensation in box 1 and $100 of federal income tax withholding in box 4. During the last four months of the year, Jose was employed by First Mountain Bank in Denver. The Form W-2 Jose received from the bank contained information in the following boxes Wages (box 1) = $ 17,820.20 Federal W/H (box 2) = $ 1,767.89 Social security wages (box 3) = $ 17,820.20 Social security W/H (box 4) = $ 1,104.85 Medicare wages (box 5) = $ 17,820.20 Medicare W/H (box 6) = $ 258.39 Maria was employed the entire year by Blue Sky Properties in Denver. The Form W-2 Maria received from Blue Sky contained information in the following boxes: Wages (box I) = $. 59, 181.12 Federal W/H (box 2) = $ 5,490.80 Social security wages (box 3) = $ 59, 181.12 Social security W/H (box 4) = $ 3,669.23 The Suarezes also received two Forms 1099 INT showing interest they received on two savings accounts. One Form 1099-INT, from the First National Bank of Northeastern Denver, showed interest income of $59.36 in boxt. The other Form 1099.INT. from Second National Bank of Northwester Denver, showed interest income of $82.45 in box 1 Jose and Maria had qualifying health care coverage at all times during the tax year Required: Prepare a Form 1040 for Mr and Mrs. Susrex. (List the names of the taxpayers in the order in which they appear in the problem. Input all the values as positive numbers. Do not round Intermediate computations. Round your final answers to the nearest whole dollar amount) Use the appropriate Tox Table Answer is complete but not entirely correct. 1040 for a couple Married in Jointly with no dependents, 1040 PG 1 1040 PG 2 Page 1 of Form 1040. Vse provided information and follow instructions on form Form 1040 Det er nem fevenue fico) 2020 Individual income Tax Retur Only Domowe OMB No 1545-0074 ling Oile Maled fingy Manding party (wo) Head of household MOHO Ouiting wowocow) Che If you chache Foxter the name of your post you checked the HOHOW Bontere de ating person is hidunt your dependent Your social security number Vatan di (Enter) Jose Suarez 412-34-5670 mame and Last name Spouse's social security number Enter - els 41.7 Page 1 of Form 1040. provided information and follow instructions on form Form 1040 them) Individual income fatur 2020 OMI Oy Fing O M Orion MP OH OH www.wow) youth of the Weather Witam Your som inters Joo lurer 412.34.6070 from the one wa poder Luna rity nu Maria buwal 412345671 Home mend you to be in At no Preno Campion 78 Matre Check of your nywane Combientes you towerwondo, chocolate sono Chwil change your Denver, CO 80206 Foreign Alany 2000. un change or any in any worry? Standard Someone can im You see Your Deduction postamentum or you werden Age/blindness You Weremuary 2, 1066 Non Dependents yumbar If more than name Was Bombay wind TAVI to you bons Chad Coro ch BE LIE UUL EEE 112,000 142 ---- 1,000 113. 172 1 Win Pom) -2 Anach Trem Saudi ta Ordende RA 4 4 sa Period Se Tatimo Ga Socecurity brut amount Capa panarom. Anachichte Drgret. not required, check here Other income from het. In Ads in 12. 4. 5. 6. 7 und 8. This is your total income Standard Deduction for 10 Adjustments to income Bag Marding From Schede 22 102 $12.400 Chamboll you take the Mandard deduction Structions 101 Marding CA 16 and Tob. These are your lotal adjustments to Income SO yo Quay widow 11 Strain 16 from fine. This is your adjusted gross income $2400 12 Standard deduction or iemand deductions from Schede A) 12 Head of hould 318650 13. decho Alich Form 1995 or Form 2005A If you checked 14 aybex under 14 dias 12 and 13 Standard Deduction, 15 The Income Street from it. If ther. For Disclosure, Privacy Act, and Paperwork Reduction Act Notice parte instructions 113205 THIS FORM IS A SIMULATION OF AN OFFICIAL US. TAX FORM, IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2021 McGraw-Hill Education 1040 PG 2 > D 11 113.172 24.000 24.800 8372 Form 100 2000 Return to question Form 1040 12026 Page 2 11,023 te 17 11.023 19 29 21 0 11.023 22 23 24 11,023 25 Jose Suarez Maria Suar 412-34 5670 16 Tema Checary from Fons (1)8814 (2) 4972 (3) 17 Ament from Schedule 2. 103 18 Addes 16 and 17 18 Chartered for other dependent 20 Amount from Schedule, ne? 21 Add 1 and 20 22 Subracine 21 from 18. ferrer 23 Osnouding self-employment from Schedule 2. Iine 10 24 Add to 22 and 23. This is your total tax 25 Federal income tax with from a Fomi2 Form 1000 EQUIP HNH (1) PHOI MacheHw| Add nesa og 25 28 2020 med tax payment and amount applied from 2019 tum 27 Endinome credit (LC) 28 Additional has credit. Ata schedule 1812 23 America oportunity credit tom Form 1863 in 1 0 Recovery. See on 31 Amount from Schedule, line 13 22 Addines 27 through there your total other payments and refundable credits 33 Adres 25 26 and 32. These are your total payments 33 la more than 26 tracine 24 from In 32. This is the amount you overald 35 Amount of you wantrounded to you. For the check here Routing number Checking 11,000 100 Olo 250 25 250 11.100 26 27 - you have a gchid attach sch EC If you have no Bombay 23 23 30 11 32 34 11.106 833 833 Refund 35 Savings Director 256 250 11.106 25 27 - If you have a gullying child to sch FC - If you have nontabi combat pay, see instructions 20 30 31 32 0 33 11.100 Refund Addra 25 through 250 26 2020 estimated tax payments and amount appled from 2019 rum 27 Eamed income credit (EIC) 28 Additional child tax credit Altach Schedule 8812 29 American opportunity credit from Form 1863, Ine 8 30 Recovery bale credt See Instructions 31 Amount from Schedulene 13 12 Add lines 27 through 31. These are your total other payments and refundable credits 33 Add lines 254, 25, and 32. These are your total payments 34 line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpad 35 Amount of tine you want refunded to you. If Form 3888 is attached, check here Routing number Type: Checking Account number 36 Amountain 34 you want applied to your 2021 estimated tax 37 Subtract line 33 from line 24. This is the amount you owe now Note: Schedule and Schedule Se flers, linu 27 may not represent all of the then you own for 2020. See Schedule 3 line 120, and to instructions for details 38 Estimated tax penalty free instructions) Do you want to low other person to discuss thiulotun wes the IRS? See Instructions 34 35 83 Direct depot See instructions Saving 36 Amount You Owe 37 For details on how to pay.se natructions Third Party Designee Yes com OD Ne Sign Here Designers Phone Personal defication no. number (PN) Under penales of perjury, I declare that the mind this tum and companying schedules and statements, and to the best of my knowledge and be they are the correct and complete Declaration of prepare other than tarpayer le based on information of which has any knowledge Your signatur Datum Your occupation you and Protection Phone Souco Assume all taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Jose and Marla Suarez are married and live at 9876 Main Street, Denver, CO 80205. Jose's SSN is 412-34-5670 and Maria's SSNIS 412-34-5671 For the first five months of the year, Jose was employed by Mountain Mortgage Company. The Form W-2 from Mountain Mortgage contained information in the following boxes: Wages (box 1) - $ 35,028.52 Federal W/H (box 2) = $ 3,746.89 Social security wages (box 3) = $ 35,828.52 Social security W/H (box 4) = $ 2,171.77 Medicare wages (box 5) = $ 35,028.52 Medicare W/H (box 6) = 5 507.91 Jose was laid off from his job at Mountain Mortgage and was unemployed for three months. He received $1.000 of unemployment Insurance payments. The Form 1099-G Jose received from the state of Colorado contained $1,000 of unemployment compensation in box 1 and $100 of federal income tax withholding in box 4. During the last four months of the year, Jose was employed by First Mountain Bank in Denver. The Form W-2 Jose received from the bank contained information in the following boxes Wages (box 1) = $ 17,820.20 Federal W/H (box 2) = $ 1,767.89 Social security wages (box 3) = $ 17,820.20 Social security W/H (box 4) = $ 1,104.85 Medicare wages (box 5) = $ 17,820.20 Medicare W/H (box 6) = $ 258.39 Maria was employed the entire year by Blue Sky Properties in Denver. The Form W-2 Maria received from Blue Sky contained information in the following boxes: Wages (box I) = $. 59, 181.12 Federal W/H (box 2) = $ 5,490.80 Social security wages (box 3) = $ 59, 181.12 Social security W/H (box 4) = $ 3,669.23 The Suarezes also received two Forms 1099 INT showing interest they received on two savings accounts. One Form 1099-INT, from the First National Bank of Northeastern Denver, showed interest income of $59.36 in boxt. The other Form 1099.INT. from Second National Bank of Northwester Denver, showed interest income of $82.45 in box 1 Jose and Maria had qualifying health care coverage at all times during the tax year Required: Prepare a Form 1040 for Mr and Mrs. Susrex. (List the names of the taxpayers in the order in which they appear in the problem. Input all the values as positive numbers. Do not round Intermediate computations. Round your final answers to the nearest whole dollar amount) Use the appropriate Tox Table Answer is complete but not entirely correct. 1040 for a couple Married in Jointly with no dependents, 1040 PG 1 1040 PG 2 Page 1 of Form 1040. Vse provided information and follow instructions on form Form 1040 Det er nem fevenue fico) 2020 Individual income Tax Retur Only Domowe OMB No 1545-0074 ling Oile Maled fingy Manding party (wo) Head of household MOHO Ouiting wowocow) Che If you chache Foxter the name of your post you checked the HOHOW Bontere de ating person is hidunt your dependent Your social security number Vatan di (Enter) Jose Suarez 412-34-5670 mame and Last name Spouse's social security number Enter - els 41.7 Page 1 of Form 1040. provided information and follow instructions on form Form 1040 them) Individual income fatur 2020 OMI Oy Fing O M Orion MP OH OH www.wow) youth of the Weather Witam Your som inters Joo lurer 412.34.6070 from the one wa poder Luna rity nu Maria buwal 412345671 Home mend you to be in At no Preno Campion 78 Matre Check of your nywane Combientes you towerwondo, chocolate sono Chwil change your Denver, CO 80206 Foreign Alany 2000. un change or any in any worry? Standard Someone can im You see Your Deduction postamentum or you werden Age/blindness You Weremuary 2, 1066 Non Dependents yumbar If more than name Was Bombay wind TAVI to you bons Chad Coro ch BE LIE UUL EEE 112,000 142 ---- 1,000 113. 172 1 Win Pom) -2 Anach Trem Saudi ta Ordende RA 4 4 sa Period Se Tatimo Ga Socecurity brut amount Capa panarom. Anachichte Drgret. not required, check here Other income from het. In Ads in 12. 4. 5. 6. 7 und 8. This is your total income Standard Deduction for 10 Adjustments to income Bag Marding From Schede 22 102 $12.400 Chamboll you take the Mandard deduction Structions 101 Marding CA 16 and Tob. These are your lotal adjustments to Income SO yo Quay widow 11 Strain 16 from fine. This is your adjusted gross income $2400 12 Standard deduction or iemand deductions from Schede A) 12 Head of hould 318650 13. decho Alich Form 1995 or Form 2005A If you checked 14 aybex under 14 dias 12 and 13 Standard Deduction, 15 The Income Street from it. If ther. For Disclosure, Privacy Act, and Paperwork Reduction Act Notice parte instructions 113205 THIS FORM IS A SIMULATION OF AN OFFICIAL US. TAX FORM, IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2021 McGraw-Hill Education 1040 PG 2 > D 11 113.172 24.000 24.800 8372 Form 100 2000 Return to question Form 1040 12026 Page 2 11,023 te 17 11.023 19 29 21 0 11.023 22 23 24 11,023 25 Jose Suarez Maria Suar 412-34 5670 16 Tema Checary from Fons (1)8814 (2) 4972 (3) 17 Ament from Schedule 2. 103 18 Addes 16 and 17 18 Chartered for other dependent 20 Amount from Schedule, ne? 21 Add 1 and 20 22 Subracine 21 from 18. ferrer 23 Osnouding self-employment from Schedule 2. Iine 10 24 Add to 22 and 23. This is your total tax 25 Federal income tax with from a Fomi2 Form 1000 EQUIP HNH (1) PHOI MacheHw| Add nesa og 25 28 2020 med tax payment and amount applied from 2019 tum 27 Endinome credit (LC) 28 Additional has credit. Ata schedule 1812 23 America oportunity credit tom Form 1863 in 1 0 Recovery. See on 31 Amount from Schedule, line 13 22 Addines 27 through there your total other payments and refundable credits 33 Adres 25 26 and 32. These are your total payments 33 la more than 26 tracine 24 from In 32. This is the amount you overald 35 Amount of you wantrounded to you. For the check here Routing number Checking 11,000 100 Olo 250 25 250 11.100 26 27 - you have a gchid attach sch EC If you have no Bombay 23 23 30 11 32 34 11.106 833 833 Refund 35 Savings Director 256 250 11.106 25 27 - If you have a gullying child to sch FC - If you have nontabi combat pay, see instructions 20 30 31 32 0 33 11.100 Refund Addra 25 through 250 26 2020 estimated tax payments and amount appled from 2019 rum 27 Eamed income credit (EIC) 28 Additional child tax credit Altach Schedule 8812 29 American opportunity credit from Form 1863, Ine 8 30 Recovery bale credt See Instructions 31 Amount from Schedulene 13 12 Add lines 27 through 31. These are your total other payments and refundable credits 33 Add lines 254, 25, and 32. These are your total payments 34 line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpad 35 Amount of tine you want refunded to you. If Form 3888 is attached, check here Routing number Type: Checking Account number 36 Amountain 34 you want applied to your 2021 estimated tax 37 Subtract line 33 from line 24. This is the amount you owe now Note: Schedule and Schedule Se flers, linu 27 may not represent all of the then you own for 2020. See Schedule 3 line 120, and to instructions for details 38 Estimated tax penalty free instructions) Do you want to low other person to discuss thiulotun wes the IRS? See Instructions 34 35 83 Direct depot See instructions Saving 36 Amount You Owe 37 For details on how to pay.se natructions Third Party Designee Yes com OD Ne Sign Here Designers Phone Personal defication no. number (PN) Under penales of perjury, I declare that the mind this tum and companying schedules and statements, and to the best of my knowledge and be they are the correct and complete Declaration of prepare other than tarpayer le based on information of which has any knowledge Your signatur Datum Your occupation you and Protection Phone Souco