This is integer programing problem, please slove, thanks.

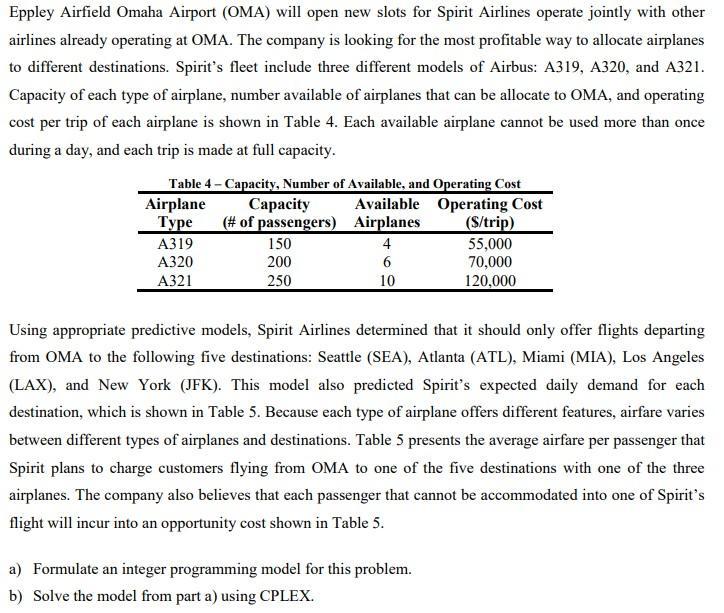

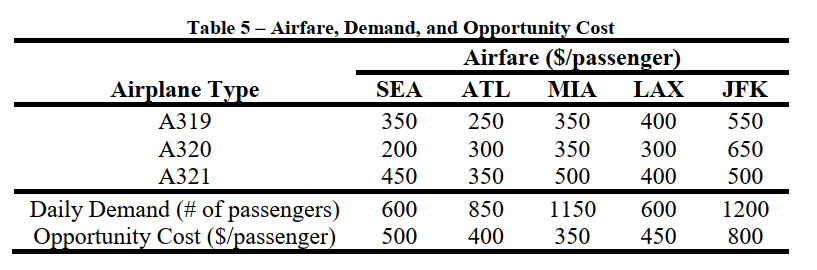

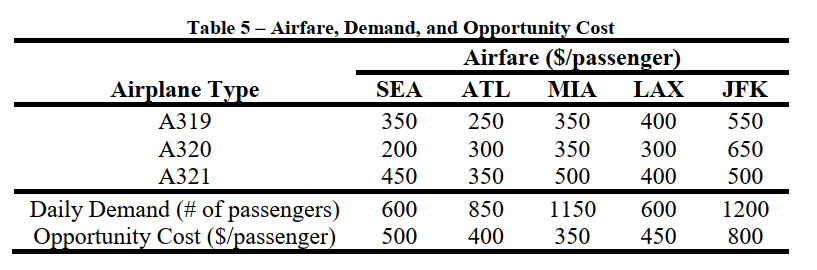

Eppley Airfield Omaha Airport (OMA) will open new slots for Spirit Airlines operate jointly with other airlines already operating at OMA. The company is looking for the most profitable way to allocate airplanes to different destinations. Spirit's fleet include three different models of Airbus: A319, A320, and A321. Capacity of each type of airplane, number available of airplanes that can be allocate to OMA, and operating cost per trip of each airplane is shown in Table 4. Each available airplane cannot be used more than once during a day, and each trip is made at full capacity. Table 4 - Capacity, Number of Available, and Operating Cost Airplane Capacity Available Operating Cost Type (# of passengers) Airplanes (S/trip) A319 150 55,000 A320 200 6 70,000 A321 250 10 120,000 4 Using appropriate predictive models, Spirit Airlines determined that it should only offer flights departing from OMA to the following five destinations: Seattle (SEA), Atlanta (ATL), Miami (MIA), Los Angeles (LAX), and New York (JFK). This model also predicted Spirit's expected daily demand for each destination, which is shown in Table 5. Because each type of airplane offers different features, airfare varies between different types of airplanes and destinations. Table 5 presents the average airfare per passenger that Spirit plans to charge customers flying from OMA to one of the five destinations with one of the three airplanes. The company also believes that each passenger that cannot be accommodated into one of Spirits flight will incur into an opportunity cost shown in Table 5. a) Formulate an integer programming model for this problem. b) Solve the model from part a) using CPLEX. Table 5 - Airfare, Demand, and Opportunity Cost Airfare ($/passenger) Airplane Type SEA ATL MIA LAX A319 350 250 350 400 A320 200 300 350 300 A321 450 350 500 400 Daily Demand (# of passengers) 600 850 1150 600 Opportunity Cost ($/passenger) 500 400 350 450 JFK 550 650 500 1200 800 Eppley Airfield Omaha Airport (OMA) will open new slots for Spirit Airlines operate jointly with other airlines already operating at OMA. The company is looking for the most profitable way to allocate airplanes to different destinations. Spirit's fleet include three different models of Airbus: A319, A320, and A321. Capacity of each type of airplane, number available of airplanes that can be allocate to OMA, and operating cost per trip of each airplane is shown in Table 4. Each available airplane cannot be used more than once during a day, and each trip is made at full capacity. Table 4 - Capacity, Number of Available, and Operating Cost Airplane Capacity Available Operating Cost Type (# of passengers) Airplanes (S/trip) A319 150 55,000 A320 200 6 70,000 A321 250 10 120,000 4 Using appropriate predictive models, Spirit Airlines determined that it should only offer flights departing from OMA to the following five destinations: Seattle (SEA), Atlanta (ATL), Miami (MIA), Los Angeles (LAX), and New York (JFK). This model also predicted Spirit's expected daily demand for each destination, which is shown in Table 5. Because each type of airplane offers different features, airfare varies between different types of airplanes and destinations. Table 5 presents the average airfare per passenger that Spirit plans to charge customers flying from OMA to one of the five destinations with one of the three airplanes. The company also believes that each passenger that cannot be accommodated into one of Spirits flight will incur into an opportunity cost shown in Table 5. a) Formulate an integer programming model for this problem. b) Solve the model from part a) using CPLEX. Table 5 - Airfare, Demand, and Opportunity Cost Airfare ($/passenger) Airplane Type SEA ATL MIA LAX A319 350 250 350 400 A320 200 300 350 300 A321 450 350 500 400 Daily Demand (# of passengers) 600 850 1150 600 Opportunity Cost ($/passenger) 500 400 350 450 JFK 550 650 500 1200 800