Answered step by step

Verified Expert Solution

Question

1 Approved Answer

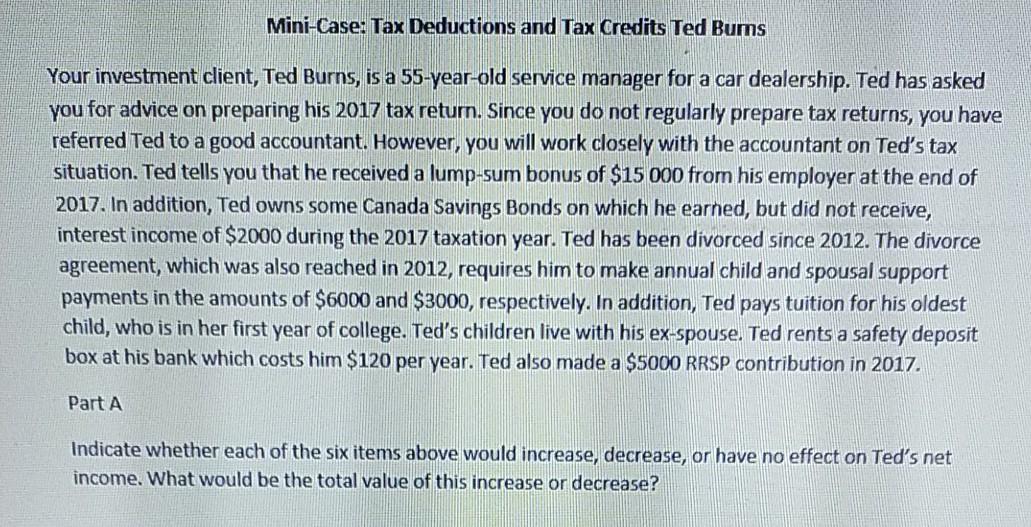

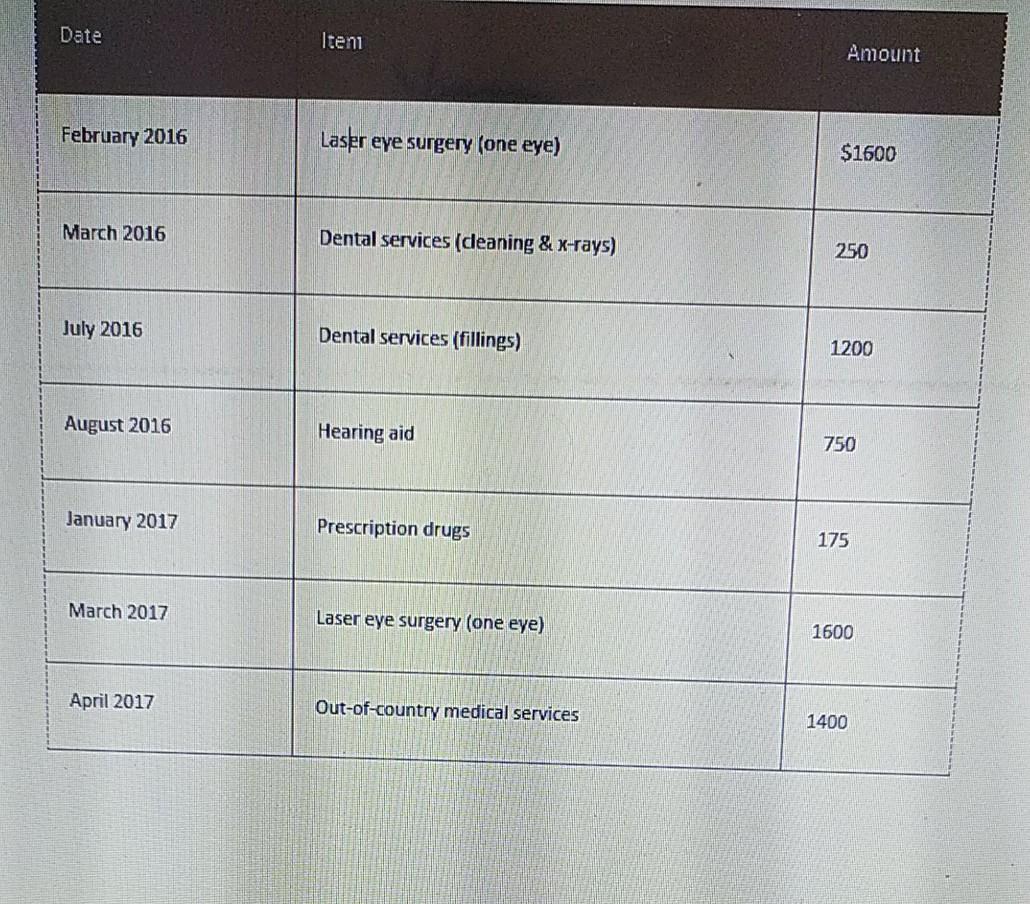

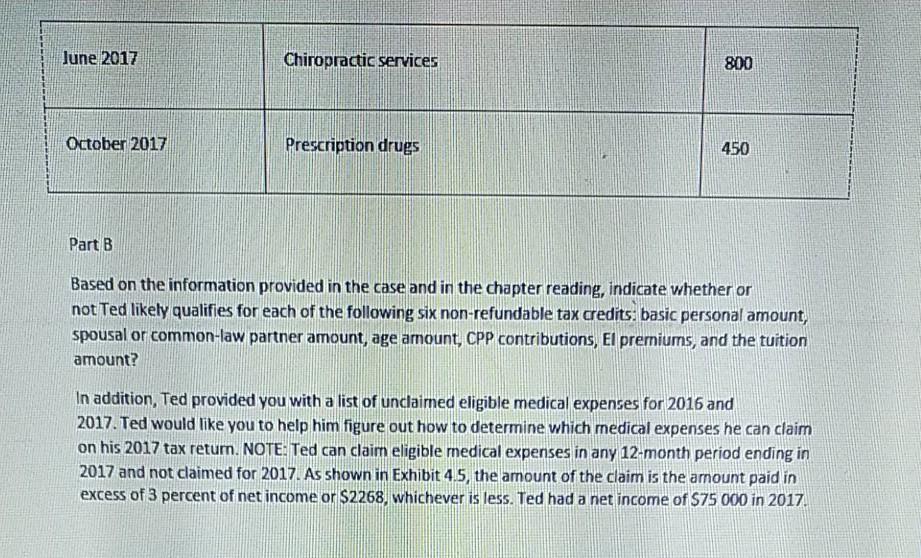

this is mini case study I need solution asap Mini-Case: Tax Deductions and Tax Credits Ted Bums Your investment client, Ted Burns, is a 55-year-old

this is mini case study I need solution asap

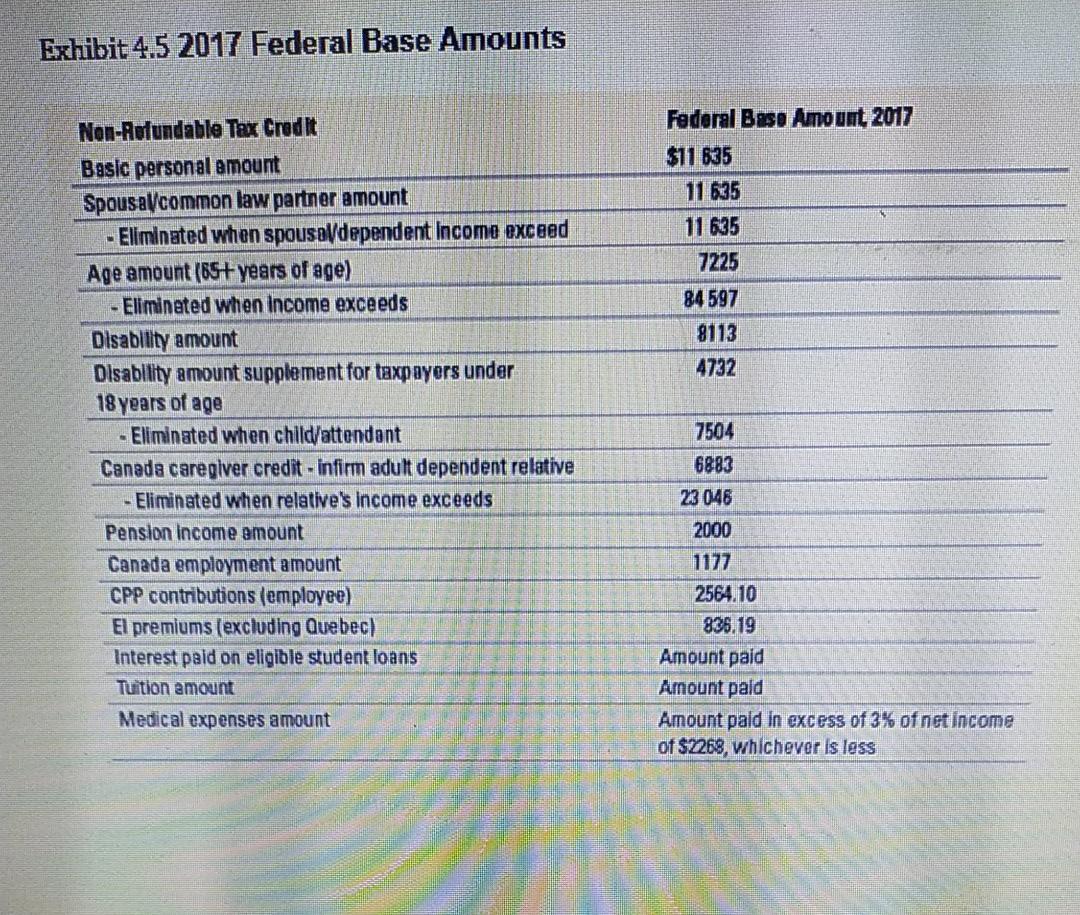

Mini-Case: Tax Deductions and Tax Credits Ted Bums Your investment client, Ted Burns, is a 55-year-old service manager for a car dealership. Ted has asked you for advice on preparing his 2017 tax return. Since you do not regularly prepare tax returns, you have referred Ted to a good accountant. However, you will work closely with the accountant on Ted's tax situation. Ted tells you that he received a lump-sum bonus of $15 000 frorn his employer at the end of 2017. In addition, Ted owns some Canada Savings Bonds on which he earned, but did not receive, interest income of $2000 during the 2017 taxation year. Ted has been divorced since 2012. The divorce agreement, which was also reached in 2012, requires him to make annual child and spousal support payments in the amounts of $6000 and $3000, respectively. In addition, Ted pays tuition for his oldest child, who is in her first year of college. Ted's children live with his ex-spouse. Ted rents a safety deposit box at his bank which costs him $120 per year. Ted also made a $5000 RRSP contribution in 2017. Part A Indicate whether each of the six items above would increase, decrease, or have no effect on Ted's net income. What would be the total value of this increase or decrease? Date Iteni Amount February 2016 Laser eye surgery (one eye) $1600 March 2016 Dental services (deaning & X-rays) 250 July 2016 Dental services (fillings) 1200 August 2016 Hearing aid 750 January 2017 Prescription drugs 175 March 2017 Laser eye surgery (one eye) 1600 April 2017 Out-of-country medical services 1400 Exhibit 4.5 2017 Federal Base Amounts Federal Baso Amount 2017 $11 635 11 635 11 635 7225 84597 9113 4732 Non-Rodundable Tax Credit Basic personal amount Spousa common law partner amount - Eliminated when spouso/dependent Income exceed Age amount (65+ years of age) - Eliminated when Income exceeds Disability amount Disability amount supplement for taxpayers under 18 years of age - Eliminated when child/attendant Canada caregiver credit - infirm adult dependent relative Eliminated when relative's income exceeds Pension Income amount Canada employment amount CPP contributions (employee) El premiums (excluding Quebec) Interest paid on eligible student loans Tuition amount 7504 6883 23 046 2000 1177 2564,10 836.19 Amount paid Amount pald Amount paid in excess of 3% of net income of $2268, whichever is less Medical expenses amount Mini-Case: Tax Deductions and Tax Credits Ted Bums Your investment client, Ted Burns, is a 55-year-old service manager for a car dealership. Ted has asked you for advice on preparing his 2017 tax return. Since you do not regularly prepare tax returns, you have referred Ted to a good accountant. However, you will work closely with the accountant on Ted's tax situation. Ted tells you that he received a lump-sum bonus of $15 000 frorn his employer at the end of 2017. In addition, Ted owns some Canada Savings Bonds on which he earned, but did not receive, interest income of $2000 during the 2017 taxation year. Ted has been divorced since 2012. The divorce agreement, which was also reached in 2012, requires him to make annual child and spousal support payments in the amounts of $6000 and $3000, respectively. In addition, Ted pays tuition for his oldest child, who is in her first year of college. Ted's children live with his ex-spouse. Ted rents a safety deposit box at his bank which costs him $120 per year. Ted also made a $5000 RRSP contribution in 2017. Part A Indicate whether each of the six items above would increase, decrease, or have no effect on Ted's net income. What would be the total value of this increase or decrease? Date Iteni Amount February 2016 Laser eye surgery (one eye) $1600 March 2016 Dental services (deaning & X-rays) 250 July 2016 Dental services (fillings) 1200 August 2016 Hearing aid 750 January 2017 Prescription drugs 175 March 2017 Laser eye surgery (one eye) 1600 April 2017 Out-of-country medical services 1400 Exhibit 4.5 2017 Federal Base Amounts Federal Baso Amount 2017 $11 635 11 635 11 635 7225 84597 9113 4732 Non-Rodundable Tax Credit Basic personal amount Spousa common law partner amount - Eliminated when spouso/dependent Income exceed Age amount (65+ years of age) - Eliminated when Income exceeds Disability amount Disability amount supplement for taxpayers under 18 years of age - Eliminated when child/attendant Canada caregiver credit - infirm adult dependent relative Eliminated when relative's income exceeds Pension Income amount Canada employment amount CPP contributions (employee) El premiums (excluding Quebec) Interest paid on eligible student loans Tuition amount 7504 6883 23 046 2000 1177 2564,10 836.19 Amount paid Amount pald Amount paid in excess of 3% of net income of $2268, whichever is less Medical expenses amountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started