This is my 3rd time asking this question and they keep using wrong figures. I provide the spead sheet at the bottom as well. I need help and i keep getting wrong answers.

Incomplete incomstatement

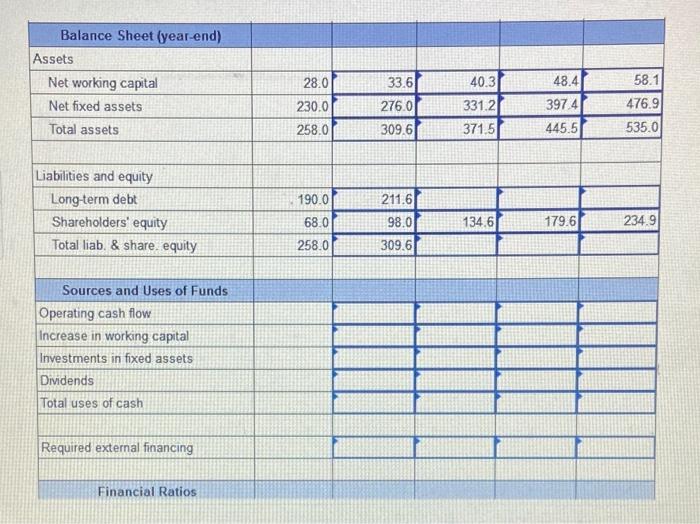

need help with sources & uses of fund

And financial ratios

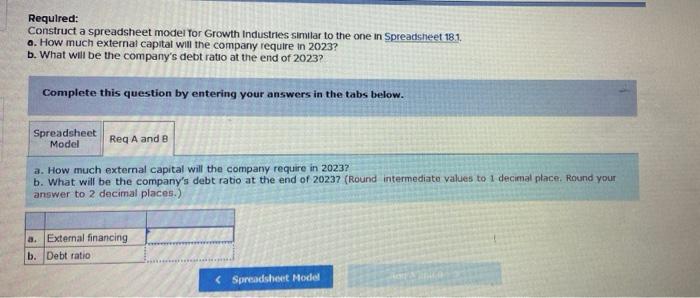

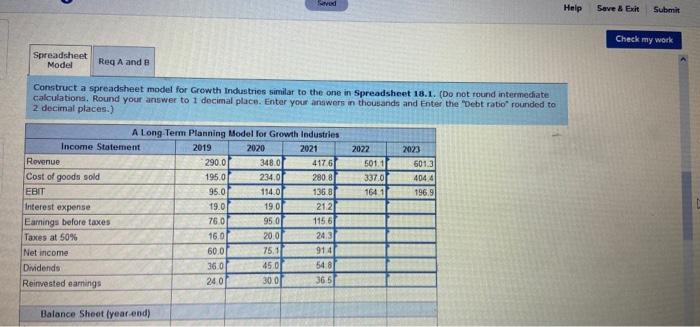

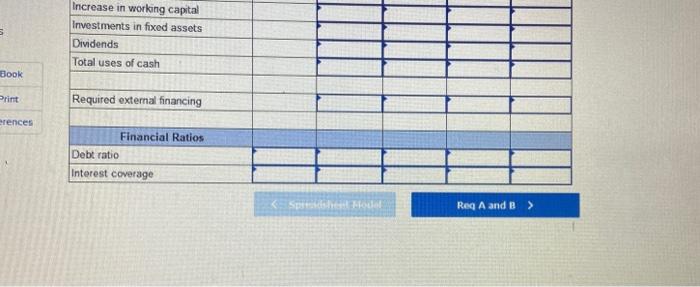

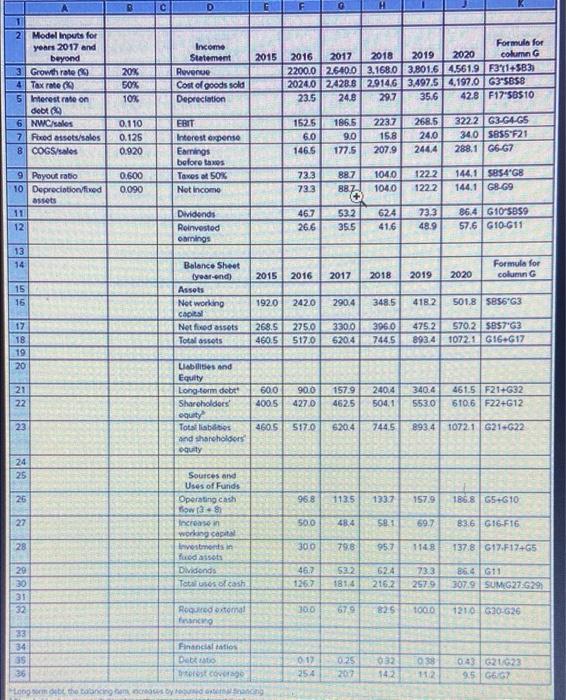

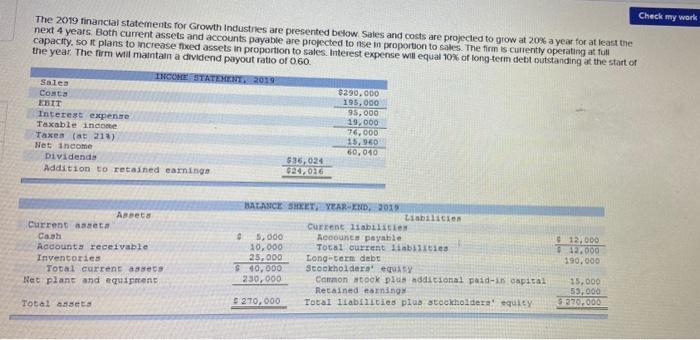

Required: Construct a spreadsheet model for Growth Industries similar to the one in Spreadsheet 181. a. How much external capital will the company require in 2023? b. What will be the company's debt ratio at the end of 2023? Complete this question by entering your answers in the tabs below. Spreadsheet Model Req A and a 3. How much external capital will the company require in 20237 b. What will be the company's debt ratio at the end of 20237 (Round intermediate values to 1 decimal place. Round your answer to 2 decimal places.) a. External financing b. Debt ratio ( Spreadsheet Model vod Help Save & Exit Submit Check my work Spreadsheet Model Reg A and Construct a spreadsheet model for Growth Industries similar to the one in Spreadsheet 18.1. (Do not round intermediate calculations. Round your answer to 1 decimal place. Enter your answers in thousands and Enter the "Debt ratio rounded to 2 decimal places.) 2022 5011 3370 164 1 2023 501.3 404 4 1969 A Long Term Planning Model for Growth Industries Income Statement 2019 2020 2021 Revenue 290.0 3480 4176 Cost of goods sold 195.0 234.0 2808 EBIT 95.0 114.0 1368 Interest expense 19.0 19.0 212 Earnings before taxes 760 950 1156 Taxes at 50% 16.0 200 24.3 Net income 60.0 75.1 914 360 45.0 Dividends 548 24.0 30.0 Reinvested earnings 36.5 Balance Sheet (year-end) Balance Sheet (year-end) Assets Net working capital Net fixed assets Total assets 28.0 33.6 276.0 309.6 230.0 258.0 40.3 331.2 371.5 48.4 397.4 445.5 58.1 476.91 535.0 Liabilities and equity Long-term debt Shareholders' equity Total liab. & share, equity 190.0 68.0 211.6 98.0 309.6 134.6 179.6 234.9 258.0 Sources and Uses of Funds Operating cash flow Increase in working capital Investments in fixed assets Dividends Total uses of cash Required external financing Financial Ratios Increase in working capital Investments in fixed assets Dividends Total uses of cash Book Print Required external financing erences Financial Ratios Debt ratio Interest coverage Sprehou Reg A and B > D ol H 2015 2 Model Inputs for years 2017 and beyond 3 Growth rate 4 Tax rate 5 Interest rate on debt ca 6 NWC/sales 7 Fixed assets/salos 8 COGS/sales 20% 50% 10% Income Statement Revenue Cost of goods sold Depreciation Formula for 2016 2017 2018 2019 2020 column G 2200.0 2.640.03.168.0 3.801.64.561.9 F3114583 2024.0 2428.8 2.914.6 3.497.54.197.0 G3-5B58 23.5 24.8 297 35.6 42.8 F17'58510 0.110 0.125 0.920 1525 6,0 146.5 186.5 9.0 177.5 2237 15.8 207.9 268.5 24.0 244.4 3222 G3-GA-GS 34.0 S855F21 288.1 66-67 EBIT Interest axpense Earnings before les Taxes at 50% Not Income 0.600 0.090 73.3 733 104.0 104.0 1222 1222 144.15854G8 144.1 GB-69 9 Payout ratio 10 Depreciation fixed assets 11 12 88.7 88.7 + 532 35.5 Dividends Roinvestod Ornings 46.7 26.6 624 41.6 73.3 48.9 86.4 G10'5859 57.6 | G10-G11 13 14 Formula for column G 2015 2016 2017 2018 2019 2020 15 15 Balance Sheet year-end) Assets Not working capital Net food assets Total assets 1920 2420 290,4 348.5 4182 501.85856'G3 $85663 268.5 460.5 275.0 517,0 330.0 6204 306.0 744.5 4752 8934 570.2 $B$7'G3 1072.1 GIG.G17 17 18 19 20 21 22 Liabilities and Equity Long-term debet Shareholders equity Totalabios and shareholders oquity 60.0 400.5 90.0 427.0 157.9 4625 240.4 504.1 340.4 553.0 4615 F21-G32 610.6F22+G12 23 4605 517.0 620.4 744.5 893.4 1072.1 G21.622 24 25 26 968 113.5 1337 157.9 1868 | 65-610 27 50.0 484 58 697 83.6G16-F16 Sources and Uses of Funds Operating cash flow Increason working capital Investments quod assots Dividends Tetails of cash 28 300 79,8 957 1148 137.8617.F17465 20 46.2 1262 522 1814 62.4 216.2 733 2579 86.4611 3079 SUMG27-29 100 679 825 1000 Roquio stomat anco 1210630-626 a las 8 Financialties 35 Detto totesto og ombe the bencing combing 0.12 254 0.25 207 032 142 098 12 0:43 G21.623 9.5G6 G7 Check my work The 2019 financial statements for Growth Industries are presented below Sales and costs are projected to grow at 20% a year for at least the next 4 years. Both current assets and accounts payable are projected to nse in proportion to sales. The firm is currently operating at tull capacity, so it plans to increase fixed assets in proportion to sales. Interest expense will equal 10% of long-term detit outstanding at the start of the year. The firm will maintain a dividend payout ratio of 060 INCOME STATE 2019 Sales $290,000 Conta 195,000 EBIT 95,000 Interest expense 19.000 Taxable income 76.000 Taxes (at 213) 15,960 Net Income 60,040 Dividendo 536.024 Addition to retained earnings 4,076 Aseta Current aeta Cash Accounts receivable Inventories Total current ages Net plant and equipment BALANCE SHEET YEAR, 2019 Liabilities Current liabilities 3,000 Accounts payable 10,000 Total current liabilities 25,000 Long-term debt $ 40,000 Scookholders' equity 230,000 Common took plus additional paid-i capital Retained earning $ 270,000 Total Labin Lies plus stockholders' equity 12,000 12.000 190.000 15.000 53,000 $ 270,000 Total Assets