Question: This is my assignment, i need help, i have posted all the details, please submit asap. Please provide detailed report on the above information. Dxhibit

This is my assignment, i need help, i have posted all the details, please submit asap. Please provide detailed report on the above information.

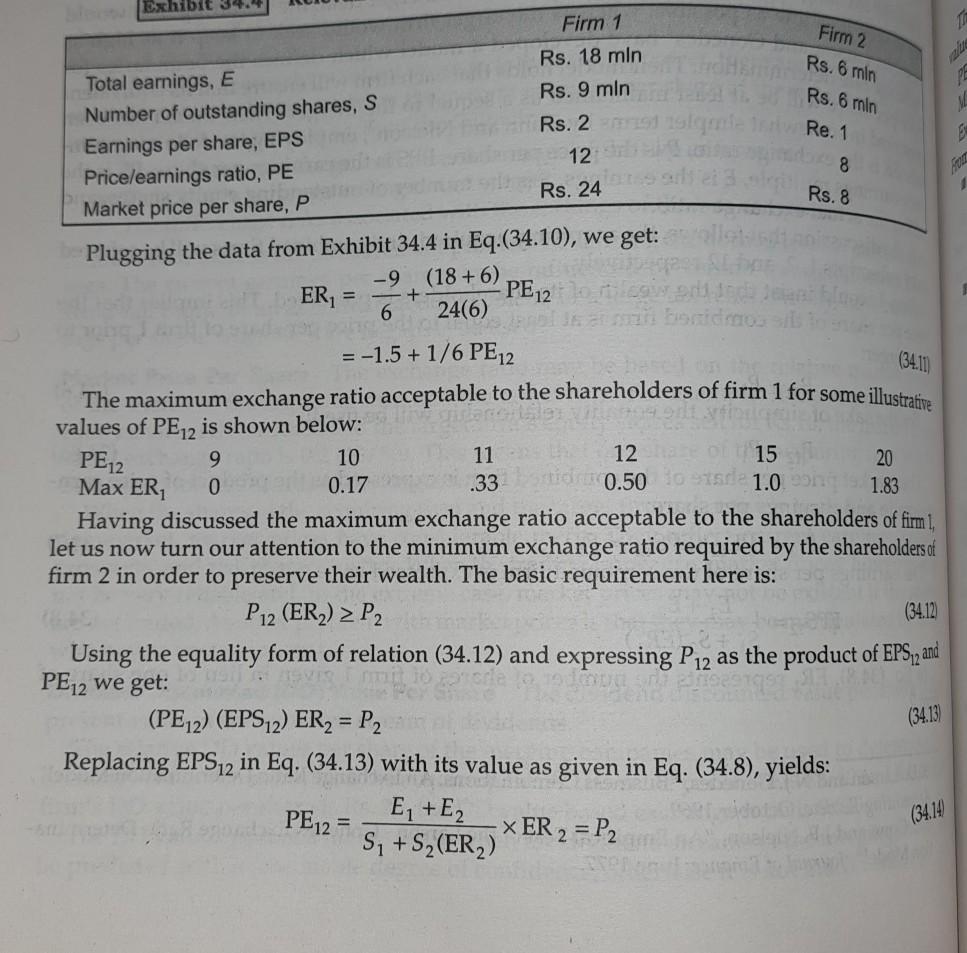

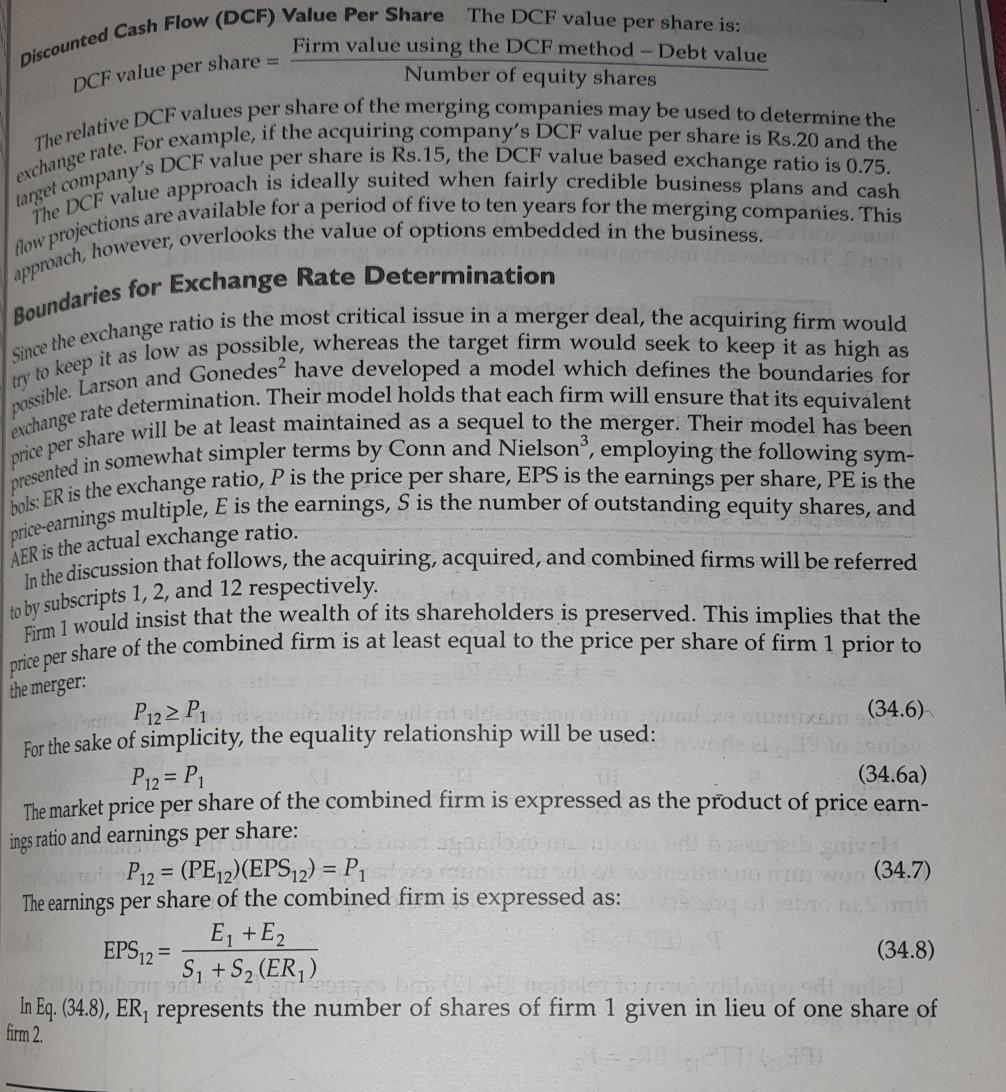

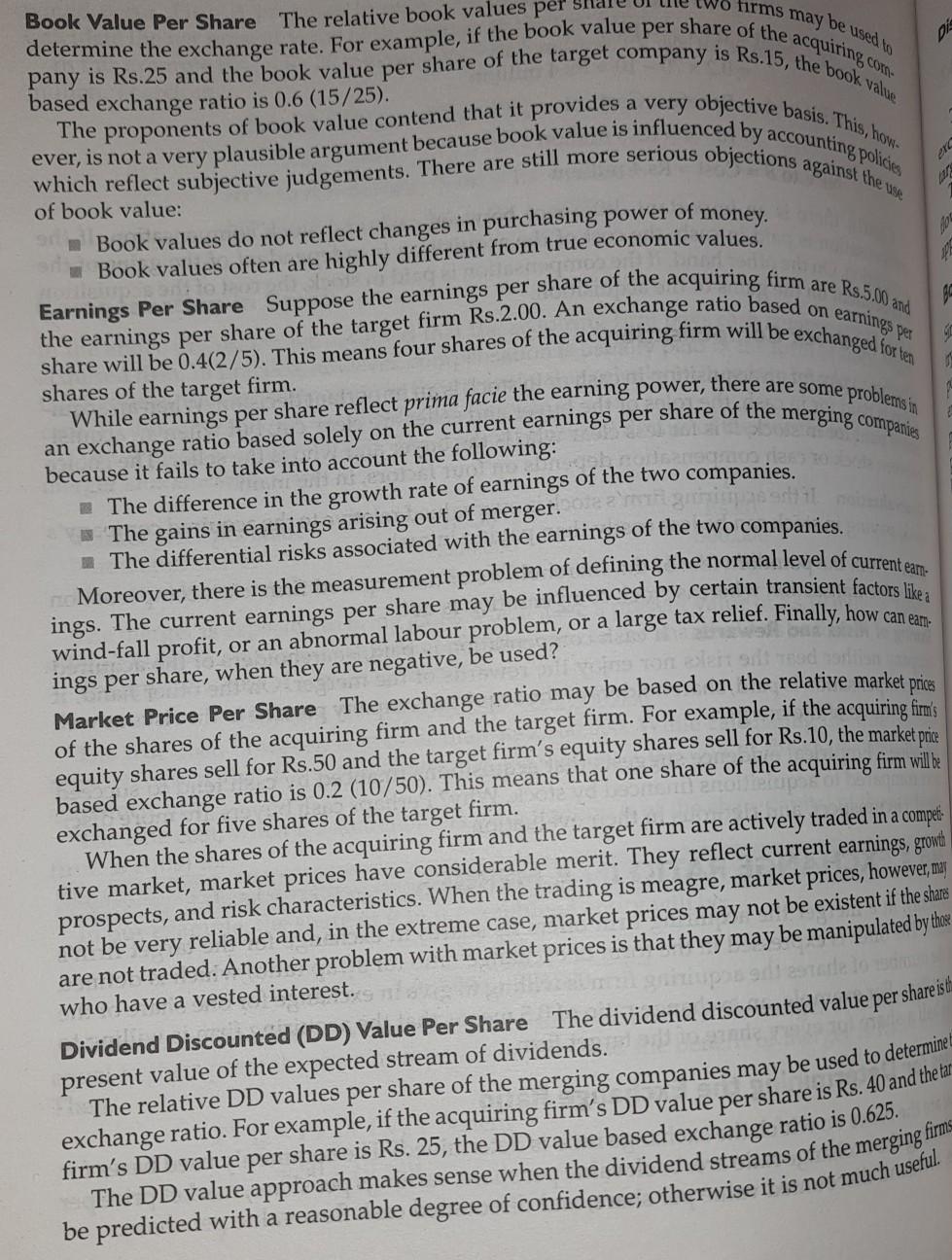

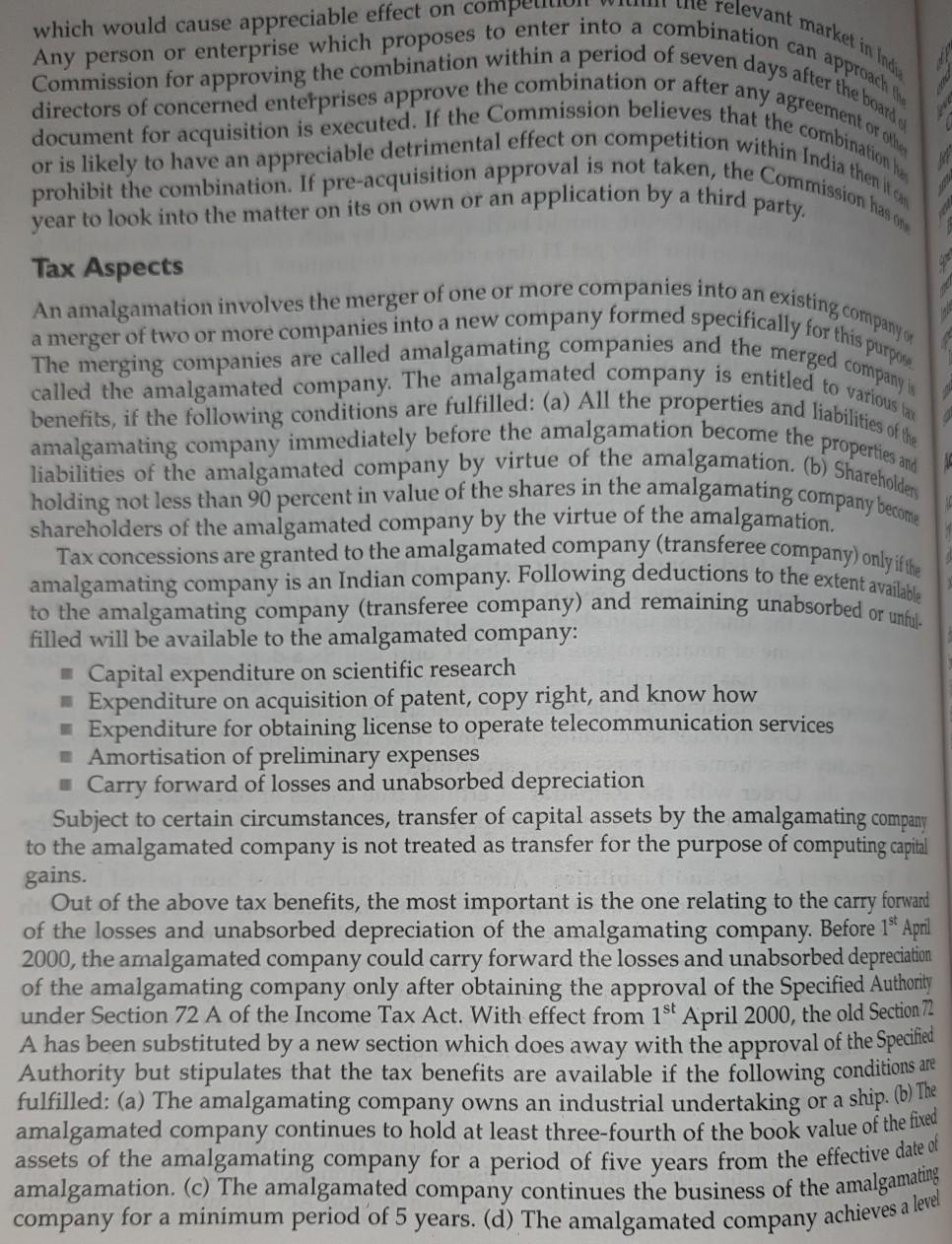

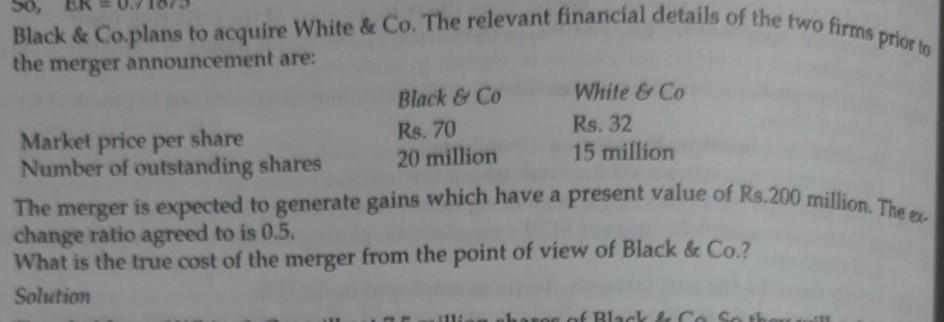

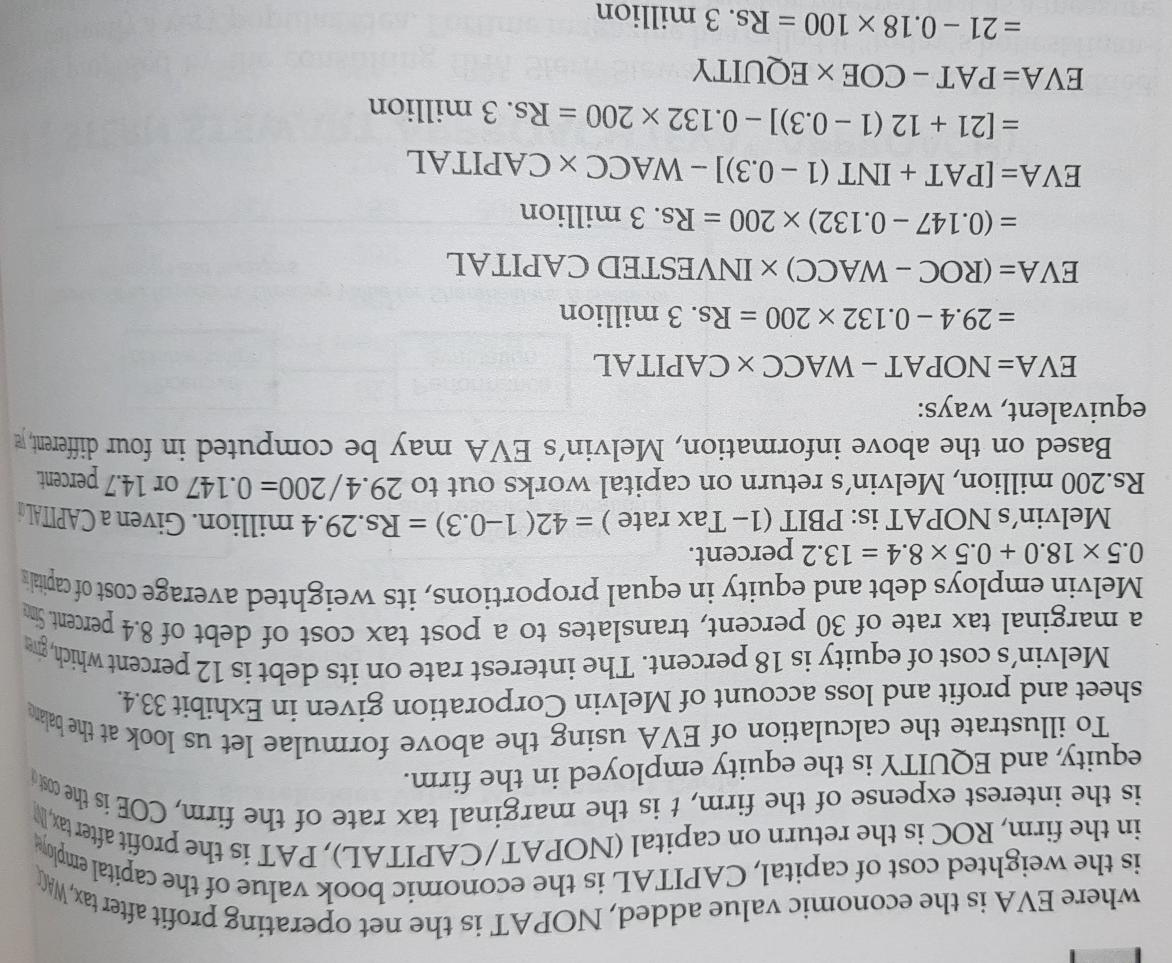

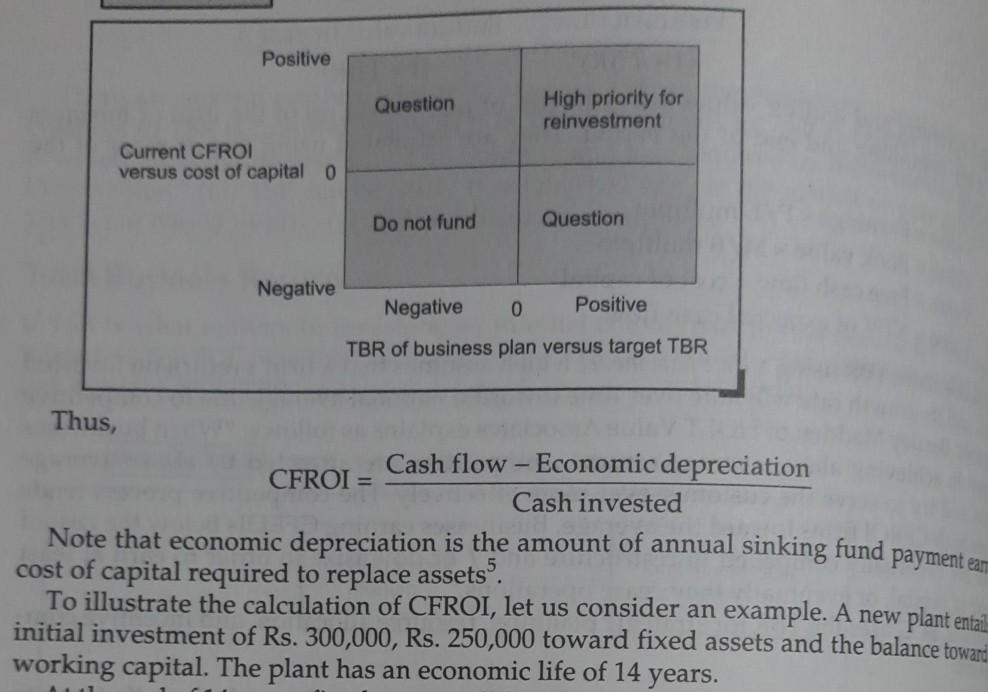

Dxhibit 34 Firm 2 Rs. 6 min Rs. 6 min M Re. 1 8 Firm 1 Total earnings, E Rs. 18 min Number of outstanding shares, S Rs. 9 min Earnings per share, EPS Rs. 2 Price/earnings ratio, PE 12 Market price per share, P Rs. 24 Plugging the data from Exhibit 34.4 in Eq.(34.10), we get: -9 (18+6) + 6 24(6) Rs. 8 ER1 = PE12 (34.11) 20 9 0 = -1.5 + 1/6 PE12 The maximum exchange ratio acceptable to the shareholders of firm 1 for some illustrative values of PE 12 is shown below: PE12 10 11 12 15 Max ER 0.17 .33 0.500 1.0 1.83 Having discussed the maximum exchange ratio acceptable to the shareholders of firm 1, let us now turn our attention to the minimum exchange ratio required by the shareholders of firm 2 in order to preserve their wealth. The basic requirement here is: P12 (ER) > P2 (34.12 Using the equality form of relation (34.12) and expressing P12 as the product of EPS,g and PE 12 we get: (PE12) (EPS12) ER2 = P2 Replacing EPS12 in Eq. (34.13) with its value as given in Eq. (34.8), yields: PE12 = E, +E2 XER 2 = P2 S; +S2(ER) (34.13 (34.14 DCF value per share = Discounted Cash Flow (DCF) Value Per Share The DCF value per share is: Firm value using the DCF method - Debt value Number of equity shares The relative DCF values per share of the merging companies may be used to determine the target company's DCF value per share is Rs.15, the DCF value based exchange ratio is 0.75. exchange rate. For example, if the acquiring company's DCF value per share is Rs.20 and the Now projections are available for a period of five to ten years for the merging companies. This The DCF value approach is ideally suited when fairly credible business plans and cash approach, however, overlooks the value of options embedded in the business. Boundaries for Exchange Rate Determination Since the exchange ratio is the most critical issue in a merger deal, the acquiring firm would possible. Larson and Gonedes have developed a model which defines the boundaries for try to keep it as low as possible, whereas the target firm would seek to keep it as high as exchange rate determination. Their model holds that each firm will ensure that its equivalent price per share will be at least maintained as a sequel to the merger. Their model has been presented in somewhat simpler terms by Conn and Nielson", employing the following sym- bols: ER is the exchange ratio, Pis the price per share, EPS is the earnings per share, PE is the price-earnings multiple, E is the earnings, S is the number of outstanding equity shares, and In the discussion that follows, the acquiring, acquired, and combined firms will be referred to by subscripts 1, 2, and 12 respectively. firm I would insist that the wealth of its shareholders is preserved. This implies that the price per share of the combined firm is at least equal to the price per share of firm 1 prior to P 122P, (34.6) For the sake of simplicity, the equality relationship will be used: P 12 = P, The market price per share of the combined firm is expressed as the product of price earn- (34.6a) ings ratio and earnings per share: let P12 = (PE12)(EPS12) = P1 The earnings per share of the combined firm is expressed as: (34.7) E + E EPS12 = S+S2 (ER) (34.8) AER is the actual exchange ratio. the merger: In Eq. (34.8), ER, represents the number of shares of firm 1 given in lieu of one share of firm 2 pis firms may be used to Book Value Per Share The relative book determine the exchange rate. For example, if the book value per share of the acquiring.com pany is Rs.25 and the book value per share of the target company is Rs.15, the book valve based exchange ratio is 0.6 (15/25). The proponents of book value contend that it provides a very objective basis. This, how ever, is not a very plausible argument because book value is influenced by accounting policies which reflect subjective judgements. There are still more serious objections against the we of money. of book value: No Book values do not reflect changes in purchasing power Book values often are highly different from true economic values. 94 Earnings Per Share Suppose the earnings per share of the acquiring firm are Rs.5.00 and the earnings per share of the target firm Rs.2.00. An exchange ratio based on earnings per share will be 0.4(2/5). This means four shares of the acquiring firm will be exchanged for en shares of the target firm. While earnings per share reflect prima facie the earning power, there are some problems in an exchange ratio based solely on the current earnings per share of the merging companies because it fails to take into account the following: The difference in the growth rate of earnings of the two companies. The gains in earnings arising out of merger.it The differential risks associated with the earnings of the two companies. Moreover, there is the measurement problem of defining the normal level of current ear. ings. The current earnings per share may be influenced by certain transient factors like wind-fall profit, or an abnormal labour problem, or a large tax relief. Finally, how can earn ings per share, when they are negative, be used? Market Price Per Share The exchange ratio may be based on the relative market prices of the shares of the acquiring firm and the target firm. For example, if the acquiring firms equity shares sell for Rs.50 and the target firm's equity shares sell for Rs.10, the market price based exchange ratio is 0.2 (10/50). This means that one share of the acquiring firm will be exchanged for five shares of the target firm. When the shares of the acquiring firm and the target firm are actively traded in a compet- tive market, market prices have considerable merit. They reflect current earnings, growth prospects, and risk characteristics. When the trading is meagre, market prices, however, may not be very reliable and, in the extreme case, market prices may not be existent if the shares are not traded. Another problem with market prices is that they may be manipulated by thos who have a vested interest. Presto Dividend Discounted (DD) Value Per Share The dividend discounted value per share istu present value of the expected stream of dividends. The relative DD values per share of the merging companies may be used to determine exchange ratio. For example, if the acquiring firm's DD value per share is Rs. 40 and the far firm's DD value per share is Rs. 25, the DD value based exchange ratio is 0.625. The DD value approach makes sense when the dividend streams of the merging firms be predicted with a reasonable degree of confidence; otherwise it is not much useful or is likely to have an appreciable detrimental effect on party existing company on an Indian relevant market in die which would cause appreciable effect on comp Any person or enterprise which proposes to enter into a combination can approach the Commission for approving the combination within a period of seven days after the board document for acquisition is executed. If the Commission believes that the combination be directors of concerned enterprises approve the combination or after any agreement or other competition within India thenito prohibit the combination. If pre-acquisition approval is not taken, the Commission has a year to look into the matter on its on own or an application by a third Tax Aspects An amalgamation involves the merger of one or more companies into an a merger of two or more companies into a new company formed specifically for this purpose The merging companies are called amalgamating companies and the merged company is benefits, if the following conditions are fulfilled: (a) All the properties and liabilities of the called the amalgamated company. The amalgamated company is entitled to various la amalgamating company immediately before the amalgamation become the properties and liabilities of the amalgamated company by virtue of the amalgamation. (b) Shareholders holding not less than 90 percent in value of the shares in the amalgamating company become shareholders of the amalgamated company by the virtue of the amalgamation. amalgamating company is company. Following deductions to the extent available to the amalgamating company (transferee company) and remaining unabsorbed or unfu. filled will be available to the amalgamated company: - Capital expenditure on scientific research - Expenditure on acquisition of patent, copy right, and know how - Expenditure for obtaining license to operate telecommunication services Amortisation of preliminary expenses Carry forward of losses and unabsorbed depreciation Subject to certain circumstances, transfer of capital assets by the amalgamating company to the amalgamated company is not treated as transfer for the purpose of computing capital gains. carry forward Out of the above tax benefits, the most important is the one relating to the of the losses and unabsorbed depreciation of the amalgamating company. Before 18 April 2000, the amalgamated company could carry forward the losses and unabsorbed depreciation of the amalgamating company only after obtaining the approval of the Specified Authority under Section 72 A of the Income Tax Act. With effect from 1st April 2000, the old Section 72 A has been substituted by a new section which does away with the approval of the Specified Authority but stipulates that the tax benefits are available if the following conditions are fulfilled: (a) The amalgamating company owns an industrial undertaking or a ship. (b) The amalgamated company continues to hold at least three-fourth of the book value of the fixed assets of the amalgamating company for a period of five years from the effective date of amalgamation. (c) The amalgamated company continues the business of the amalgamating company for a minimum period of 5 years. (d) The amalgamated company achieves a level level of production till the end of 5 years from the date of amalgamation. end of 4 years from the date of amalgamation and continues to maintain the said minimum of production of at least 50 percent of the installed capacity of the said undertaking before the On the fulfillment of the above conditions, the unabsorbed business losses and unabsorbed years for set-off or carry forward. amalgamated company for the year of amalgamation thus resulting in a fresh lease of eight depreciation of the amalgamated company are deemed to be the losses or depreciation of the Before 1st April, 2000, when a company was not sure of obtaining the approval of the Specified Authority under Section 72 A, there was a strong motivation for effecting a reverse merger - in a reverse merger, a loss making company absorbs a profit making company. operating agencies for sick companies. Interestingly, many reverse mergers were proposed by financial institutions, acting as stamp duty with suitable amendments. and Gujarat) have their own stamp duty legislation, while others have adopted the Indian In addition to income tax, you have to consider stamp duties. Some states (like Maharashtra Accounting for Amalgamations' According to the Accounting Standard 14(AS-14) on Accounting for Amalgamations issued by the Institute of Chartered Accountants of India, an amalgamation can be in the nature of acquisition wxther uniting of interests which is referred to as 'amalgamation in the nature of merger' or The conditions to be fulfilled for an amalgamation to be treated as an 'amalgamation in the nature of merger' are as follows: (i) All assets and liabilities of the transferor company before amalgamation should become the assets and liabilities of the transferee company. (1) Shareholders holding not less than 90 percent of the face value of the equity shares of the transferor company (excluding the proportion held by the transferee company) should become shareholders to the transferee company. (iii) The consideration payable to the aforesaid shareholders should be discharged by the transferee company by issue of equity shares. Cash can be paid in respect of fractional shares. (iv) The business of the transferor a company is intended to be carried on by the transferee company. (v) The transferee company fic intends to incorporate into its balance sheet the book values of assets and liabilities of the transferor company without any adjustment except to the extent needed to ensure uniformity of accounting policies. An amalgamation which is not in the nature of a merger is treated as an 'acquisition'. The accounting treatment of an amalgamation in the books of the transferee company 13 dependent on the nature of amalgamation as stated above. For a merger, the 'pooling of betesl method is to be used and for an acquisition the purchase' method is to be used. Under the 'pooling of interes method, the assets and liabilities of the merging companies de agregated. Likewise, the reserves appearing in the balance sheet of the transferor JANE company is carried forward into the balance sheet of the transferee company. The difference board of each company should pass a resolution authorising its directors/executives 4. Application to the High Court/s Once the draft of amalgamation proposal is ap- to pursue the matter further. High Court of the state where its registered office is situated so that it can convene the proved by the respective boards, each company should make an application to the meetings of shareholders and creditors for passing the amalgamation proposal. 5. Despatch of Notice to Shareholders and Creditors In order to convene the meeting of shareholders and creditors, a notice and an explanatory statement of the meeting, as approved by the High Court, should be despatched by each company to its sharehold- ers and creditors so that they get 21 days advance intimation. The notice of the meet- ings should also be published in two newspapers (one English and one vernacular). An affidavit confirming that the notice has been despatched to the shareholders/ creditors and that the same has been published in newspapers should be filed in the court. 6. Holding of Meetings of Shareholders and Creditors A meeting of shareholders should be held by each company for passing the scheme of amalgamation. At least 75 must approve the scheme of amalgamation. Likewise, in a separate meeting, the credi- percent (in value) of shareholders, in each class, who vote either in person or by proxy, tors of the company must approve of the amalgamation scheme. Here, too, at least 75 percent (in value) of the creditors who vote, either in person or by proxy, must approve 1. Petition to the High Court for Confirmation and Passing of High Court Orders Once the amalgamation scheme is passed by the shareholders and creditors, the companies involved in the amalgamation should present a petition to the High Court for confirm- ing the scheme of amalgamation. The High Court will fix a date of hearing. A notice about the same has to be published in two newspapers. After hearing the parties con- cerned and ascertaining that the amalgamation scheme is fair and reasonable, the High pass an order sanctioning the same. However, the High Court is empowered to modify the scheme and pass orders accordingly. 8. Filing the Order with the Registrar Certified true copies of the High Court order must be filed with the Registrar of Companies within the time limit specified by the Court 9. Transfer of Assets and Liabilities After the final orders have been passed by both the High Courts, all the assets and liabilities of the amalgamating company will, with effect from the appointed date, have to be transferred to the amalgamated company. 10. Issue of Shares and Debentures The amalgamated company, after fulfilling the pro- visions of the law, should issue shares and debentures of the amalgamated Cash payment may have to be arranged in some cases.) The new shares and debentures company. so issued will then be listed on the stock exchange. of the amalgamation scheme. Court will Competitie an illusion may work for a while in an inefficient market. As the market becomes efficient the Thus, if the market is 'foolish', it may be mesmerised by the magic of earnings growth. Such illusory gains are bound to disappear. In India, mergers and acquisitions are regulated mainly under the Companies Act 1956, SEB 34.3 MECHANICS OF A MERGER Act, and the Competition Act. The Companies Act primarily seeks to protect the interest of creditors, the SEBI Act principally strives to protect the interest of minority shareholders, and the Competition Act mainly tries to ensure that the interest of consumers is not hurt on merger. account of diminished competition arising out of considerations. While evaluating a merger proposal, one should bear in mind the following A merger is a complicated transaction, involving fairly complex legal, tax, and legal, tax, and accounting provisions. accounting Legal Procedure Sections 391 to 394 of the Companies Act, 1956 contain the provisions for amalgamations. The procedure for amalgamation normally involves the following steps: 1. Examination of Object Clauses The memorandum of association of both the com- panies should be examined to check if the power to amalgamate is available. Further, the object clause of the amalgamated company (transferee company) should permit it to carry on the business of the amalgamating company (transferor company). If such clauses do not exist, necessary approvals of the shareholders, boards of directors, and Company Law Board are required. 2. Intimation to Stock Exchanges. The stock exchanges where the amalgamated and amalgamating companies are listed should be informed about the amalgamation pro- posal. From time to time, copies of all notices, resolutions, and orders should be mailed to the concerned stock exchanges. 3. Approval of the Draft Amalgamation Proposal by the Respective Boards The draf amalgamation proposal should be approved by the respective boards of directors. The C So, Black & Co.plans to acquire White & Co. The relevant financial details of the two firms prior to the merger announcement are: Black & Co White & Co Rs. 70 Rs. 32 Market price per share Number of outstanding shares 20 million 15 million The merger is expected to generate gains which have a present value of Rs.200 million. The change ratio agreed to is 0.5. What is the true cost of the merger from the point of view of Black & Co.? Solution BL where EVA is the economic value added, NOPAT is the net operating profit after tax, WAKE is the weighted cost of capital, CAPITAL is the economic book value of the capital emplona in the firm, ROC is the return on capital (NOPAT/CAPITAL), PAT is the profit after tax, I is the interest expense of the firm, t is the marginal tax rate of the firm, COE is the To illustrate the calculation of EVA using the above formulae let us look at the balate COS equity, and EQUITY is the equity employed in the firm. sheet and profit and loss account of Melvin Corporation given in Exhibit 33.4. Melvin's cost of equity is 18 percent. The interest rate on its debt is 12 percent which, sa a marginal tax rate of 30 percent, translates to a post tax cost of debt of 8.4 percent Melvin employs debt and equity in equal proportions, its weighted average cost of capital: 0.5 x 18.0 +0.5 x 8.4 = 13.2 percent. Melvin's NOPAT is: PBIT (1 Tax rate ) = 42( 10.3) = Rs.29.4 million. Given a CAPITALA Rs.200 million, Melvin's return on capital works out to 29.4/200= 0.147 or 14.7 percent. Based on the above information, Melvin's EVA may be computed in four different, equivalent, ways: EVA=NOPAT - WACC X CAPITAL = 29.4 -0.132 x 200 = Rs. 3 million EVA= (ROC - WACC) X INVESTED CAPITAL = (0.147 - 0.132) 200 = Rs. 3 million EVA=[PAT + INT (1 -0.3)] - WACC X CAPITAL = [21 + 12 (1 -0.3)] - 0.132 x 200 = Rs. 3 million EVA=PAT-COEX EQUITY = 21 -0.18 x 100 = Rs. 3 million Positive Question High priority for reinvestment Current CFROI versus cost of capital 0 Do not fund Question Negative Negative 0 Positive TBR of business plan versus target TBR Thus, Cash flow - Economic depreciation CFROI = Cash invested Note that economic depreciation is the amount of annual sinking fund payment ar cost of capital required to replace assets". To illustrate the calculation of CFROI, let us consider an example. A new plant ental initial investment of Rs. 300,000, Rs. 250,000 toward fixed assets and the balance toward working capital. The plant has an economic life of 14 years. Dxhibit 34 Firm 2 Rs. 6 min Rs. 6 min M Re. 1 8 Firm 1 Total earnings, E Rs. 18 min Number of outstanding shares, S Rs. 9 min Earnings per share, EPS Rs. 2 Price/earnings ratio, PE 12 Market price per share, P Rs. 24 Plugging the data from Exhibit 34.4 in Eq.(34.10), we get: -9 (18+6) + 6 24(6) Rs. 8 ER1 = PE12 (34.11) 20 9 0 = -1.5 + 1/6 PE12 The maximum exchange ratio acceptable to the shareholders of firm 1 for some illustrative values of PE 12 is shown below: PE12 10 11 12 15 Max ER 0.17 .33 0.500 1.0 1.83 Having discussed the maximum exchange ratio acceptable to the shareholders of firm 1, let us now turn our attention to the minimum exchange ratio required by the shareholders of firm 2 in order to preserve their wealth. The basic requirement here is: P12 (ER) > P2 (34.12 Using the equality form of relation (34.12) and expressing P12 as the product of EPS,g and PE 12 we get: (PE12) (EPS12) ER2 = P2 Replacing EPS12 in Eq. (34.13) with its value as given in Eq. (34.8), yields: PE12 = E, +E2 XER 2 = P2 S; +S2(ER) (34.13 (34.14 DCF value per share = Discounted Cash Flow (DCF) Value Per Share The DCF value per share is: Firm value using the DCF method - Debt value Number of equity shares The relative DCF values per share of the merging companies may be used to determine the target company's DCF value per share is Rs.15, the DCF value based exchange ratio is 0.75. exchange rate. For example, if the acquiring company's DCF value per share is Rs.20 and the Now projections are available for a period of five to ten years for the merging companies. This The DCF value approach is ideally suited when fairly credible business plans and cash approach, however, overlooks the value of options embedded in the business. Boundaries for Exchange Rate Determination Since the exchange ratio is the most critical issue in a merger deal, the acquiring firm would possible. Larson and Gonedes have developed a model which defines the boundaries for try to keep it as low as possible, whereas the target firm would seek to keep it as high as exchange rate determination. Their model holds that each firm will ensure that its equivalent price per share will be at least maintained as a sequel to the merger. Their model has been presented in somewhat simpler terms by Conn and Nielson", employing the following sym- bols: ER is the exchange ratio, Pis the price per share, EPS is the earnings per share, PE is the price-earnings multiple, E is the earnings, S is the number of outstanding equity shares, and In the discussion that follows, the acquiring, acquired, and combined firms will be referred to by subscripts 1, 2, and 12 respectively. firm I would insist that the wealth of its shareholders is preserved. This implies that the price per share of the combined firm is at least equal to the price per share of firm 1 prior to P 122P, (34.6) For the sake of simplicity, the equality relationship will be used: P 12 = P, The market price per share of the combined firm is expressed as the product of price earn- (34.6a) ings ratio and earnings per share: let P12 = (PE12)(EPS12) = P1 The earnings per share of the combined firm is expressed as: (34.7) E + E EPS12 = S+S2 (ER) (34.8) AER is the actual exchange ratio. the merger: In Eq. (34.8), ER, represents the number of shares of firm 1 given in lieu of one share of firm 2 pis firms may be used to Book Value Per Share The relative book determine the exchange rate. For example, if the book value per share of the acquiring.com pany is Rs.25 and the book value per share of the target company is Rs.15, the book valve based exchange ratio is 0.6 (15/25). The proponents of book value contend that it provides a very objective basis. This, how ever, is not a very plausible argument because book value is influenced by accounting policies which reflect subjective judgements. There are still more serious objections against the we of money. of book value: No Book values do not reflect changes in purchasing power Book values often are highly different from true economic values. 94 Earnings Per Share Suppose the earnings per share of the acquiring firm are Rs.5.00 and the earnings per share of the target firm Rs.2.00. An exchange ratio based on earnings per share will be 0.4(2/5). This means four shares of the acquiring firm will be exchanged for en shares of the target firm. While earnings per share reflect prima facie the earning power, there are some problems in an exchange ratio based solely on the current earnings per share of the merging companies because it fails to take into account the following: The difference in the growth rate of earnings of the two companies. The gains in earnings arising out of merger.it The differential risks associated with the earnings of the two companies. Moreover, there is the measurement problem of defining the normal level of current ear. ings. The current earnings per share may be influenced by certain transient factors like wind-fall profit, or an abnormal labour problem, or a large tax relief. Finally, how can earn ings per share, when they are negative, be used? Market Price Per Share The exchange ratio may be based on the relative market prices of the shares of the acquiring firm and the target firm. For example, if the acquiring firms equity shares sell for Rs.50 and the target firm's equity shares sell for Rs.10, the market price based exchange ratio is 0.2 (10/50). This means that one share of the acquiring firm will be exchanged for five shares of the target firm. When the shares of the acquiring firm and the target firm are actively traded in a compet- tive market, market prices have considerable merit. They reflect current earnings, growth prospects, and risk characteristics. When the trading is meagre, market prices, however, may not be very reliable and, in the extreme case, market prices may not be existent if the shares are not traded. Another problem with market prices is that they may be manipulated by thos who have a vested interest. Presto Dividend Discounted (DD) Value Per Share The dividend discounted value per share istu present value of the expected stream of dividends. The relative DD values per share of the merging companies may be used to determine exchange ratio. For example, if the acquiring firm's DD value per share is Rs. 40 and the far firm's DD value per share is Rs. 25, the DD value based exchange ratio is 0.625. The DD value approach makes sense when the dividend streams of the merging firms be predicted with a reasonable degree of confidence; otherwise it is not much useful or is likely to have an appreciable detrimental effect on party existing company on an Indian relevant market in die which would cause appreciable effect on comp Any person or enterprise which proposes to enter into a combination can approach the Commission for approving the combination within a period of seven days after the board document for acquisition is executed. If the Commission believes that the combination be directors of concerned enterprises approve the combination or after any agreement or other competition within India thenito prohibit the combination. If pre-acquisition approval is not taken, the Commission has a year to look into the matter on its on own or an application by a third Tax Aspects An amalgamation involves the merger of one or more companies into an a merger of two or more companies into a new company formed specifically for this purpose The merging companies are called amalgamating companies and the merged company is benefits, if the following conditions are fulfilled: (a) All the properties and liabilities of the called the amalgamated company. The amalgamated company is entitled to various la amalgamating company immediately before the amalgamation become the properties and liabilities of the amalgamated company by virtue of the amalgamation. (b) Shareholders holding not less than 90 percent in value of the shares in the amalgamating company become shareholders of the amalgamated company by the virtue of the amalgamation. amalgamating company is company. Following deductions to the extent available to the amalgamating company (transferee company) and remaining unabsorbed or unfu. filled will be available to the amalgamated company: - Capital expenditure on scientific research - Expenditure on acquisition of patent, copy right, and know how - Expenditure for obtaining license to operate telecommunication services Amortisation of preliminary expenses Carry forward of losses and unabsorbed depreciation Subject to certain circumstances, transfer of capital assets by the amalgamating company to the amalgamated company is not treated as transfer for the purpose of computing capital gains. carry forward Out of the above tax benefits, the most important is the one relating to the of the losses and unabsorbed depreciation of the amalgamating company. Before 18 April 2000, the amalgamated company could carry forward the losses and unabsorbed depreciation of the amalgamating company only after obtaining the approval of the Specified Authority under Section 72 A of the Income Tax Act. With effect from 1st April 2000, the old Section 72 A has been substituted by a new section which does away with the approval of the Specified Authority but stipulates that the tax benefits are available if the following conditions are fulfilled: (a) The amalgamating company owns an industrial undertaking or a ship. (b) The amalgamated company continues to hold at least three-fourth of the book value of the fixed assets of the amalgamating company for a period of five years from the effective date of amalgamation. (c) The amalgamated company continues the business of the amalgamating company for a minimum period of 5 years. (d) The amalgamated company achieves a level level of production till the end of 5 years from the date of amalgamation. end of 4 years from the date of amalgamation and continues to maintain the said minimum of production of at least 50 percent of the installed capacity of the said undertaking before the On the fulfillment of the above conditions, the unabsorbed business losses and unabsorbed years for set-off or carry forward. amalgamated company for the year of amalgamation thus resulting in a fresh lease of eight depreciation of the amalgamated company are deemed to be the losses or depreciation of the Before 1st April, 2000, when a company was not sure of obtaining the approval of the Specified Authority under Section 72 A, there was a strong motivation for effecting a reverse merger - in a reverse merger, a loss making company absorbs a profit making company. operating agencies for sick companies. Interestingly, many reverse mergers were proposed by financial institutions, acting as stamp duty with suitable amendments. and Gujarat) have their own stamp duty legislation, while others have adopted the Indian In addition to income tax, you have to consider stamp duties. Some states (like Maharashtra Accounting for Amalgamations' According to the Accounting Standard 14(AS-14) on Accounting for Amalgamations issued by the Institute of Chartered Accountants of India, an amalgamation can be in the nature of acquisition wxther uniting of interests which is referred to as 'amalgamation in the nature of merger' or The conditions to be fulfilled for an amalgamation to be treated as an 'amalgamation in the nature of merger' are as follows: (i) All assets and liabilities of the transferor company before amalgamation should become the assets and liabilities of the transferee company. (1) Shareholders holding not less than 90 percent of the face value of the equity shares of the transferor company (excluding the proportion held by the transferee company) should become shareholders to the transferee company. (iii) The consideration payable to the aforesaid shareholders should be discharged by the transferee company by issue of equity shares. Cash can be paid in respect of fractional shares. (iv) The business of the transferor a company is intended to be carried on by the transferee company. (v) The transferee company fic intends to incorporate into its balance sheet the book values of assets and liabilities of the transferor company without any adjustment except to the extent needed to ensure uniformity of accounting policies. An amalgamation which is not in the nature of a merger is treated as an 'acquisition'. The accounting treatment of an amalgamation in the books of the transferee company 13 dependent on the nature of amalgamation as stated above. For a merger, the 'pooling of betesl method is to be used and for an acquisition the purchase' method is to be used. Under the 'pooling of interes method, the assets and liabilities of the merging companies de agregated. Likewise, the reserves appearing in the balance sheet of the transferor JANE company is carried forward into the balance sheet of the transferee company. The difference board of each company should pass a resolution authorising its directors/executives 4. Application to the High Court/s Once the draft of amalgamation proposal is ap- to pursue the matter further. High Court of the state where its registered office is situated so that it can convene the proved by the respective boards, each company should make an application to the meetings of shareholders and creditors for passing the amalgamation proposal. 5. Despatch of Notice to Shareholders and Creditors In order to convene the meeting of shareholders and creditors, a notice and an explanatory statement of the meeting, as approved by the High Court, should be despatched by each company to its sharehold- ers and creditors so that they get 21 days advance intimation. The notice of the meet- ings should also be published in two newspapers (one English and one vernacular). An affidavit confirming that the notice has been despatched to the shareholders/ creditors and that the same has been published in newspapers should be filed in the court. 6. Holding of Meetings of Shareholders and Creditors A meeting of shareholders should be held by each company for passing the scheme of amalgamation. At least 75 must approve the scheme of amalgamation. Likewise, in a separate meeting, the credi- percent (in value) of shareholders, in each class, who vote either in person or by proxy, tors of the company must approve of the amalgamation scheme. Here, too, at least 75 percent (in value) of the creditors who vote, either in person or by proxy, must approve 1. Petition to the High Court for Confirmation and Passing of High Court Orders Once the amalgamation scheme is passed by the shareholders and creditors, the companies involved in the amalgamation should present a petition to the High Court for confirm- ing the scheme of amalgamation. The High Court will fix a date of hearing. A notice about the same has to be published in two newspapers. After hearing the parties con- cerned and ascertaining that the amalgamation scheme is fair and reasonable, the High pass an order sanctioning the same. However, the High Court is empowered to modify the scheme and pass orders accordingly. 8. Filing the Order with the Registrar Certified true copies of the High Court order must be filed with the Registrar of Companies within the time limit specified by the Court 9. Transfer of Assets and Liabilities After the final orders have been passed by both the High Courts, all the assets and liabilities of the amalgamating company will, with effect from the appointed date, have to be transferred to the amalgamated company. 10. Issue of Shares and Debentures The amalgamated company, after fulfilling the pro- visions of the law, should issue shares and debentures of the amalgamated Cash payment may have to be arranged in some cases.) The new shares and debentures company. so issued will then be listed on the stock exchange. of the amalgamation scheme. Court will Competitie an illusion may work for a while in an inefficient market. As the market becomes efficient the Thus, if the market is 'foolish', it may be mesmerised by the magic of earnings growth. Such illusory gains are bound to disappear. In India, mergers and acquisitions are regulated mainly under the Companies Act 1956, SEB 34.3 MECHANICS OF A MERGER Act, and the Competition Act. The Companies Act primarily seeks to protect the interest of creditors, the SEBI Act principally strives to protect the interest of minority shareholders, and the Competition Act mainly tries to ensure that the interest of consumers is not hurt on merger. account of diminished competition arising out of considerations. While evaluating a merger proposal, one should bear in mind the following A merger is a complicated transaction, involving fairly complex legal, tax, and legal, tax, and accounting provisions. accounting Legal Procedure Sections 391 to 394 of the Companies Act, 1956 contain the provisions for amalgamations. The procedure for amalgamation normally involves the following steps: 1. Examination of Object Clauses The memorandum of association of both the com- panies should be examined to check if the power to amalgamate is available. Further, the object clause of the amalgamated company (transferee company) should permit it to carry on the business of the amalgamating company (transferor company). If such clauses do not exist, necessary approvals of the shareholders, boards of directors, and Company Law Board are required. 2. Intimation to Stock Exchanges. The stock exchanges where the amalgamated and amalgamating companies are listed should be informed about the amalgamation pro- posal. From time to time, copies of all notices, resolutions, and orders should be mailed to the concerned stock exchanges. 3. Approval of the Draft Amalgamation Proposal by the Respective Boards The draf amalgamation proposal should be approved by the respective boards of directors. The C So, Black & Co.plans to acquire White & Co. The relevant financial details of the two firms prior to the merger announcement are: Black & Co White & Co Rs. 70 Rs. 32 Market price per share Number of outstanding shares 20 million 15 million The merger is expected to generate gains which have a present value of Rs.200 million. The change ratio agreed to is 0.5. What is the true cost of the merger from the point of view of Black & Co.? Solution BL where EVA is the economic value added, NOPAT is the net operating profit after tax, WAKE is the weighted cost of capital, CAPITAL is the economic book value of the capital emplona in the firm, ROC is the return on capital (NOPAT/CAPITAL), PAT is the profit after tax, I is the interest expense of the firm, t is the marginal tax rate of the firm, COE is the To illustrate the calculation of EVA using the above formulae let us look at the balate COS equity, and EQUITY is the equity employed in the firm. sheet and profit and loss account of Melvin Corporation given in Exhibit 33.4. Melvin's cost of equity is 18 percent. The interest rate on its debt is 12 percent which, sa a marginal tax rate of 30 percent, translates to a post tax cost of debt of 8.4 percent Melvin employs debt and equity in equal proportions, its weighted average cost of capital: 0.5 x 18.0 +0.5 x 8.4 = 13.2 percent. Melvin's NOPAT is: PBIT (1 Tax rate ) = 42( 10.3) = Rs.29.4 million. Given a CAPITALA Rs.200 million, Melvin's return on capital works out to 29.4/200= 0.147 or 14.7 percent. Based on the above information, Melvin's EVA may be computed in four different, equivalent, ways: EVA=NOPAT - WACC X CAPITAL = 29.4 -0.132 x 200 = Rs. 3 million EVA= (ROC - WACC) X INVESTED CAPITAL = (0.147 - 0.132) 200 = Rs. 3 million EVA=[PAT + INT (1 -0.3)] - WACC X CAPITAL = [21 + 12 (1 -0.3)] - 0.132 x 200 = Rs. 3 million EVA=PAT-COEX EQUITY = 21 -0.18 x 100 = Rs. 3 million Positive Question High priority for reinvestment Current CFROI versus cost of capital 0 Do not fund Question Negative Negative 0 Positive TBR of business plan versus target TBR Thus, Cash flow - Economic depreciation CFROI = Cash invested Note that economic depreciation is the amount of annual sinking fund payment ar cost of capital required to replace assets". To illustrate the calculation of CFROI, let us consider an example. A new plant ental initial investment of Rs. 300,000, Rs. 250,000 toward fixed assets and the balance toward working capital. The plant has an economic life of 14 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts