THIS IS ON TESLA. HELP?

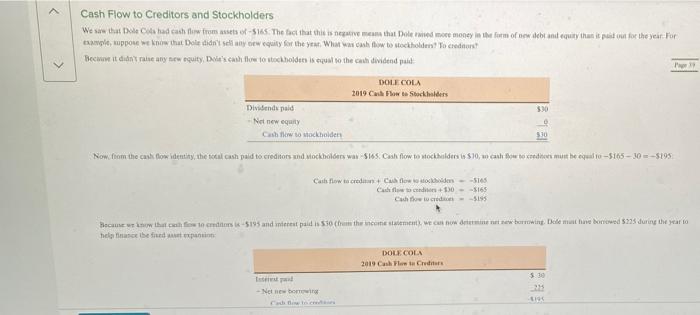

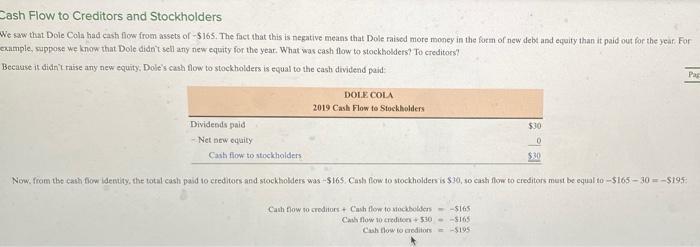

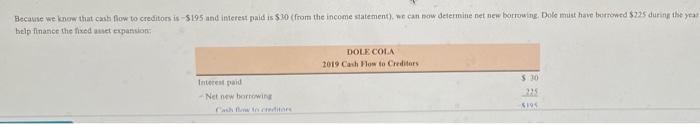

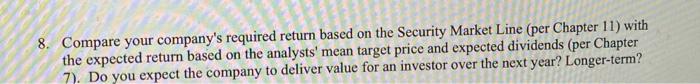

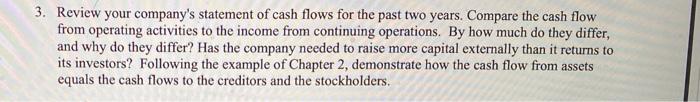

8. Compare your company's required return based on the Security Market Line (per Chapter 11) with the expected return based on the analysts' mean target price and expected dividends (per Chapter 7). Do you expect the company to deliver value for an investor over the next year? Longer-term? 3. Review your company's statement of cash flows for the past two years. Compare the cash flow from operating activities to the income from continuing operations. By how much do they differ, and why do they differ? Has the company needed to raise more capital externally than it returns to its investors? Following the example of Chapter 2, demonstrate how the cash flow from assets equals the cash flows to the creditors and the stockholders, A Cash Flow to Creditors and Stockholders We saw that had cash flow from sof-5165. The fact that this is give me that Doled more money in the form of new debat quity that put for the year. For , uppou now that Doe didn't see any w equity for the year. What was cash flow to stockholdent to creditors Because it didn't really new equity, Dit's call tow to stockholderia qual to the cash dividend pl DOLE COLA 2019 Chow to Stockholders 300 Dividend paid Net new equity Cash to Mockholder 5.30 Now from the cash flow Identity, the total cash paid to creditors and Mockholders wa sios. Cash flow to stockholders 0 530, w canh how to creditati must be equal 10 -- 5165 - 10 =-5195 Cash flow to create lood - 510 Cafe +30 - 5165 Chucre- 5195 Became with white cred-5195 and interest paldis Storm the contestament we can now been borrowing. Doe must ne bowed 5775 during the year to helance befinden DOLE COLA 2019 Cablu 5.30 - Newborn Cash Flow to Creditors and Stockholders We saw that Dole Cola had cash flow from assets of $165. The fact that this is negative means that Dole raised more money in the form of new debt and equity than it paid out for the year. For example, suppose we know that Dole didn't sell any new equity for the year. What was cash flow to stockholders to creditors! Because it didn't raise any new equity, Dole's cash flow to stockholders is equal to the cash dividend paid: Pag DOLE COLA 2019 Cash Flow to Stockholders Dividends paid -Net new equity Cash flow to stockholders $30 0 SW Now, from the cash flow Identity, the total cash paid to creditors and stockholders was $165 Cash flow to stockholders is $30, o cash flow to creditors must be equal to $165-30 = $195 Cash flow to creditors + Cash flow to stockholders - -$165 Cash flow to creditors +$30 - -S165 Chlow to creditor-5195 Because we know that cash flow to creditors is -5195 and interest paid is $20 (from the income statement) can now determine net new borrowing. Dole must have borrowed $225 during the year help finance the fixed ut pansion DOLE COLA 2019 Cach How to Creditors $ 30 Interest paid Net new borrowing 19 8. Compare your company's required return based on the Security Market Line (per Chapter 11) with the expected return based on the analysts' mean target price and expected dividends (per Chapter 7). Do you expect the company to deliver value for an investor over the next year? Longer-term? 3. Review your company's statement of cash flows for the past two years. Compare the cash flow from operating activities to the income from continuing operations. By how much do they differ, and why do they differ? Has the company needed to raise more capital externally than it returns to its investors? Following the example of Chapter 2, demonstrate how the cash flow from assets equals the cash flows to the creditors and the stockholders, A Cash Flow to Creditors and Stockholders We saw that had cash flow from sof-5165. The fact that this is give me that Doled more money in the form of new debat quity that put for the year. For , uppou now that Doe didn't see any w equity for the year. What was cash flow to stockholdent to creditors Because it didn't really new equity, Dit's call tow to stockholderia qual to the cash dividend pl DOLE COLA 2019 Chow to Stockholders 300 Dividend paid Net new equity Cash to Mockholder 5.30 Now from the cash flow Identity, the total cash paid to creditors and Mockholders wa sios. Cash flow to stockholders 0 530, w canh how to creditati must be equal 10 -- 5165 - 10 =-5195 Cash flow to create lood - 510 Cafe +30 - 5165 Chucre- 5195 Became with white cred-5195 and interest paldis Storm the contestament we can now been borrowing. Doe must ne bowed 5775 during the year to helance befinden DOLE COLA 2019 Cablu 5.30 - Newborn Cash Flow to Creditors and Stockholders We saw that Dole Cola had cash flow from assets of $165. The fact that this is negative means that Dole raised more money in the form of new debt and equity than it paid out for the year. For example, suppose we know that Dole didn't sell any new equity for the year. What was cash flow to stockholders to creditors! Because it didn't raise any new equity, Dole's cash flow to stockholders is equal to the cash dividend paid: Pag DOLE COLA 2019 Cash Flow to Stockholders Dividends paid -Net new equity Cash flow to stockholders $30 0 SW Now, from the cash flow Identity, the total cash paid to creditors and stockholders was $165 Cash flow to stockholders is $30, o cash flow to creditors must be equal to $165-30 = $195 Cash flow to creditors + Cash flow to stockholders - -$165 Cash flow to creditors +$30 - -S165 Chlow to creditor-5195 Because we know that cash flow to creditors is -5195 and interest paid is $20 (from the income statement) can now determine net new borrowing. Dole must have borrowed $225 during the year help finance the fixed ut pansion DOLE COLA 2019 Cach How to Creditors $ 30 Interest paid Net new borrowing 19