This is one problem, and can you please bold the final answer and also show work. Thank you!

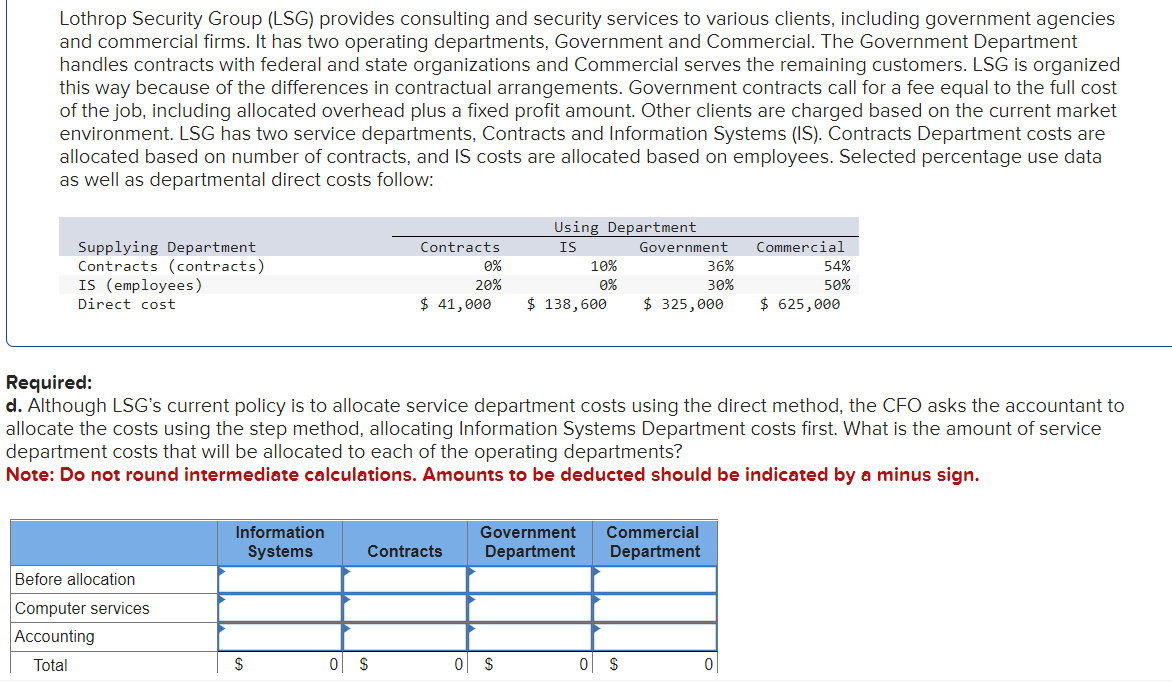

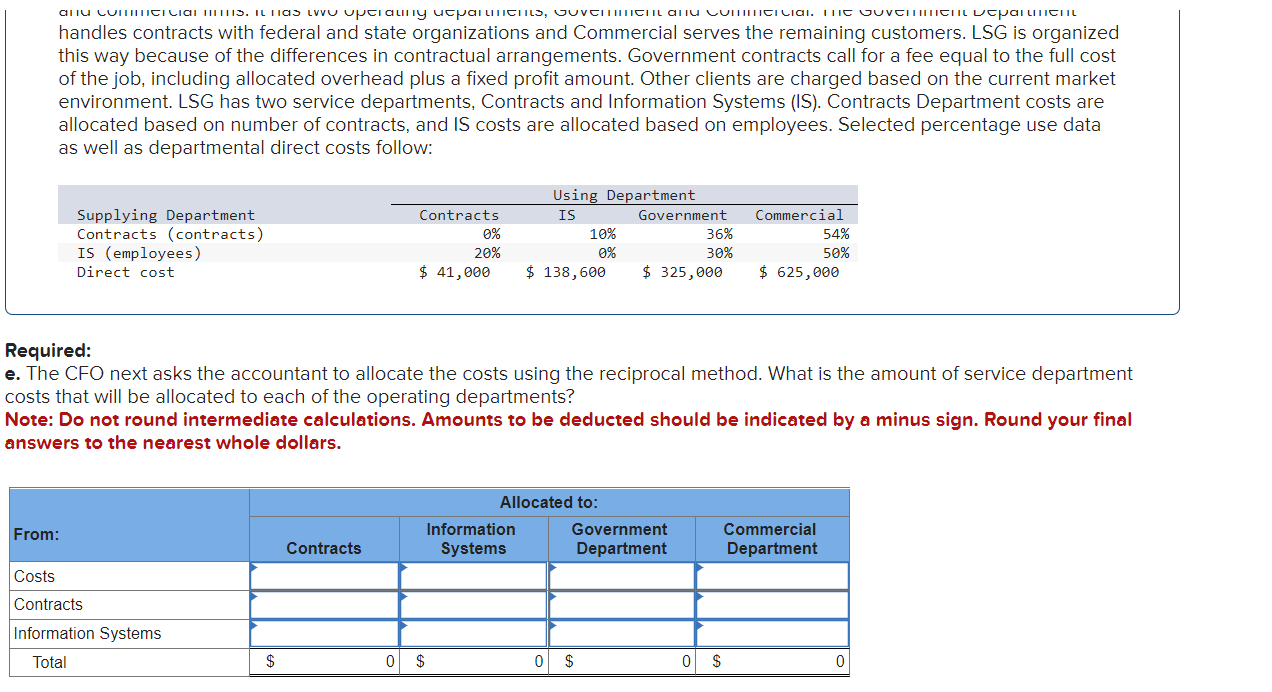

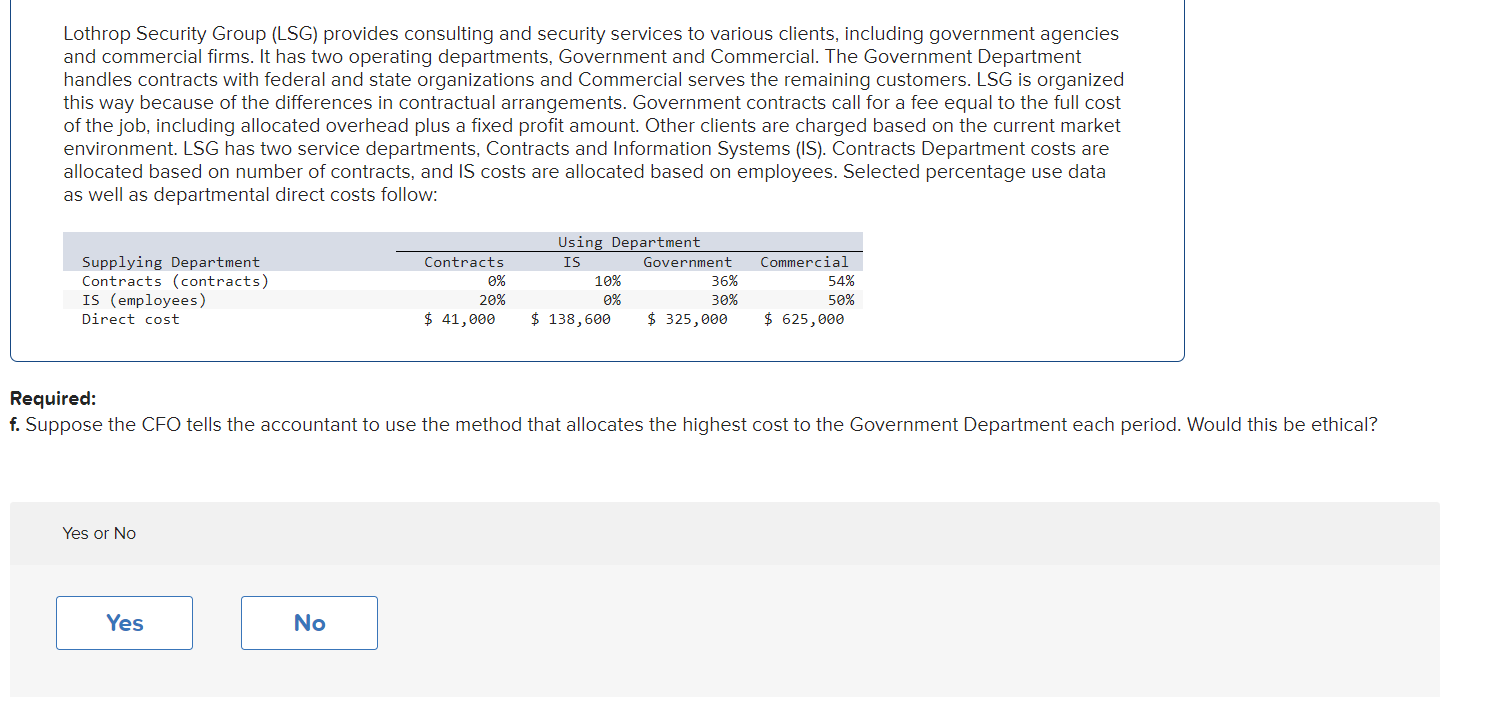

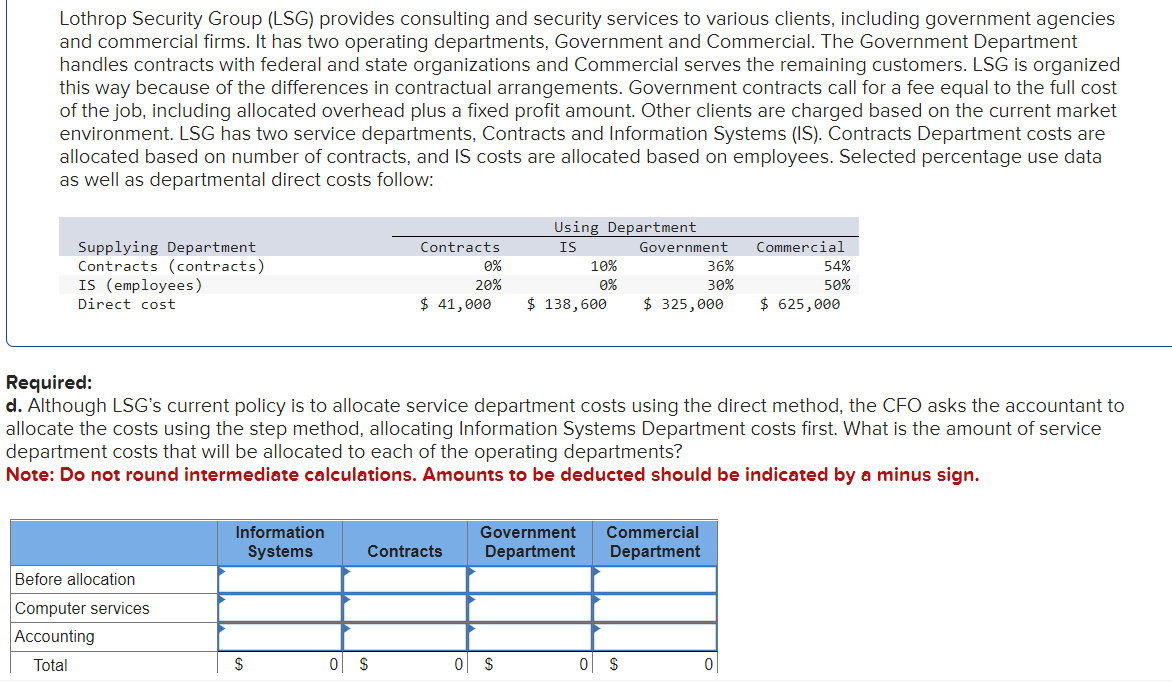

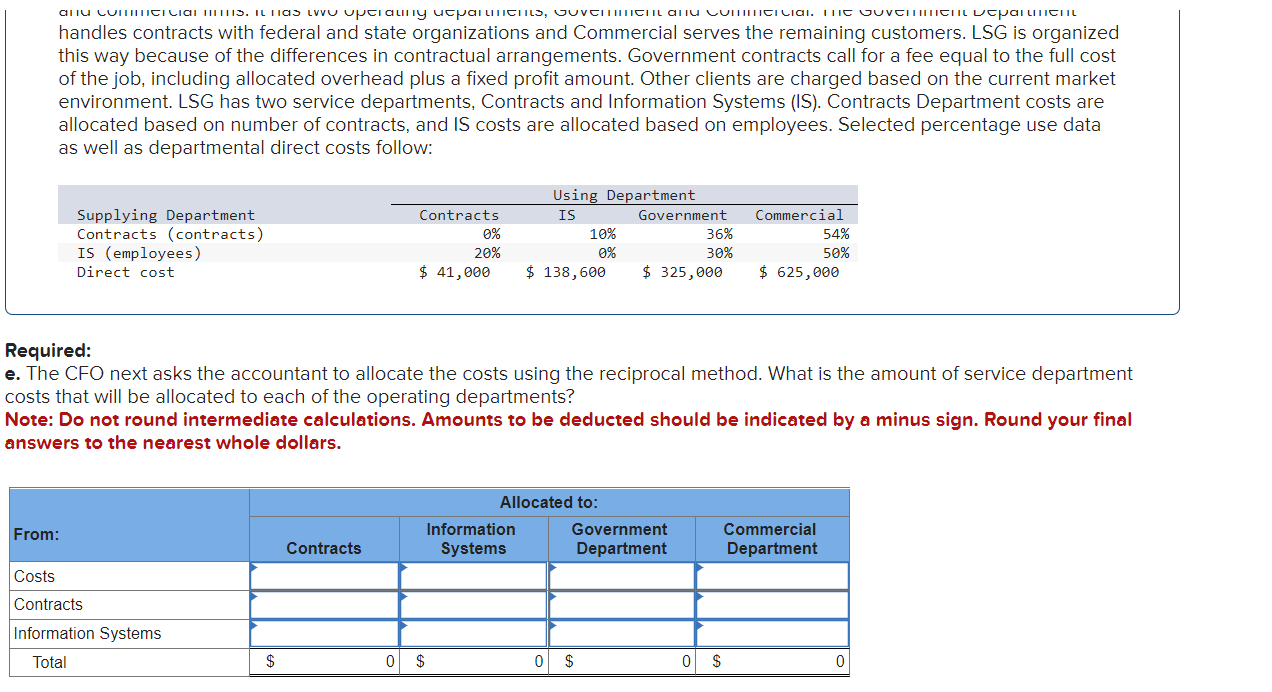

Lothrop Security Group (LSG) provides consulting and security services to various clients, including government agencies and commercial firms. It has two operating departments, Government and Commercial. The Government Department handles contracts with federal and state organizations and Commercial serves the remaining customers. LSG is organized this way because of the differences in contractual arrangements. Government contracts call for a fee equal to the full cost of the job, including allocated overhead plus a fixed profit amount. Other clients are charged based on the current market environment. LSG has two service departments, Contracts and Information Systems (IS). Contracts Department costs are allocated based on number of contracts, and IS costs are allocated based on employees. Selected percentage use data as well as departmental direct costs follow: Required: d. Although LSG's current policy is to allocate service department costs using the direct method, the CFO asks the accountant to allocate the costs using the step method, allocating Information Systems Department costs first. What is the amount of service department costs that will be allocated to each of the operating departments? Note: Do not round intermediate calculations. Amounts to be deducted should be indicated by a minus sign. a lu culmerlial handles contracts with federal and state organizations and Commercial serves the remaining customers. LSG is organized this way because of the differences in contractual arrangements. Government contracts call for a fee equal to the full cost of the job, including allocated overhead plus a fixed profit amount. Other clients are charged based on the current market environment. LSG has two service departments, Contracts and Information Systems (IS). Contracts Department costs are allocated based on number of contracts, and IS costs are allocated based on employees. Selected percentage use data as well as departmental direct costs follow: equired: . The CFO next asks the accountant to allocate the costs using the reciprocal method. What is the amount of service department osts that will be allocated to each of the operating departments? lote: Do not round intermediate calculations. Amounts to be deducted should be indicated by a minus sign. Round your final nswers to the nearest whole dollars. Lothrop Security Group (LSG) provides consulting and security services to various clients, including government agencies and commercial firms. It has two operating departments, Government and Commercial. The Government Department handles contracts with federal and state organizations and Commercial serves the remaining customers. LSG is organized this way because of the differences in contractual arrangements. Government contracts call for a fee equal to the full cost of the job, including allocated overhead plus a fixed profit amount. Other clients are charged based on the current market environment. LSG has two service departments, Contracts and Information Systems (IS). Contracts Department costs are allocated based on number of contracts, and IS costs are allocated based on employees. Selected percentage use data as well as departmental direct costs follow: equired: Suppose the CFO tells the accountant to use the method that allocates the highest cost to the Government Department each period. Would this be ethical? Yes or No Lothrop Security Group (LSG) provides consulting and security services to various clients, including government agencies and commercial firms. It has two operating departments, Government and Commercial. The Government Department handles contracts with federal and state organizations and Commercial serves the remaining customers. LSG is organized this way because of the differences in contractual arrangements. Government contracts call for a fee equal to the full cost of the job, including allocated overhead plus a fixed profit amount. Other clients are charged based on the current market environment. LSG has two service departments, Contracts and Information Systems (IS). Contracts Department costs are allocated based on number of contracts, and IS costs are allocated based on employees. Selected percentage use data as well as departmental direct costs follow: Required: d. Although LSG's current policy is to allocate service department costs using the direct method, the CFO asks the accountant to allocate the costs using the step method, allocating Information Systems Department costs first. What is the amount of service department costs that will be allocated to each of the operating departments? Note: Do not round intermediate calculations. Amounts to be deducted should be indicated by a minus sign. a lu culmerlial handles contracts with federal and state organizations and Commercial serves the remaining customers. LSG is organized this way because of the differences in contractual arrangements. Government contracts call for a fee equal to the full cost of the job, including allocated overhead plus a fixed profit amount. Other clients are charged based on the current market environment. LSG has two service departments, Contracts and Information Systems (IS). Contracts Department costs are allocated based on number of contracts, and IS costs are allocated based on employees. Selected percentage use data as well as departmental direct costs follow: equired: . The CFO next asks the accountant to allocate the costs using the reciprocal method. What is the amount of service department osts that will be allocated to each of the operating departments? lote: Do not round intermediate calculations. Amounts to be deducted should be indicated by a minus sign. Round your final nswers to the nearest whole dollars. Lothrop Security Group (LSG) provides consulting and security services to various clients, including government agencies and commercial firms. It has two operating departments, Government and Commercial. The Government Department handles contracts with federal and state organizations and Commercial serves the remaining customers. LSG is organized this way because of the differences in contractual arrangements. Government contracts call for a fee equal to the full cost of the job, including allocated overhead plus a fixed profit amount. Other clients are charged based on the current market environment. LSG has two service departments, Contracts and Information Systems (IS). Contracts Department costs are allocated based on number of contracts, and IS costs are allocated based on employees. Selected percentage use data as well as departmental direct costs follow: equired: Suppose the CFO tells the accountant to use the method that allocates the highest cost to the Government Department each period. Would this be ethical? Yes or No