This is one question pictures are out of order please read each part the data tables are provided at the bottom

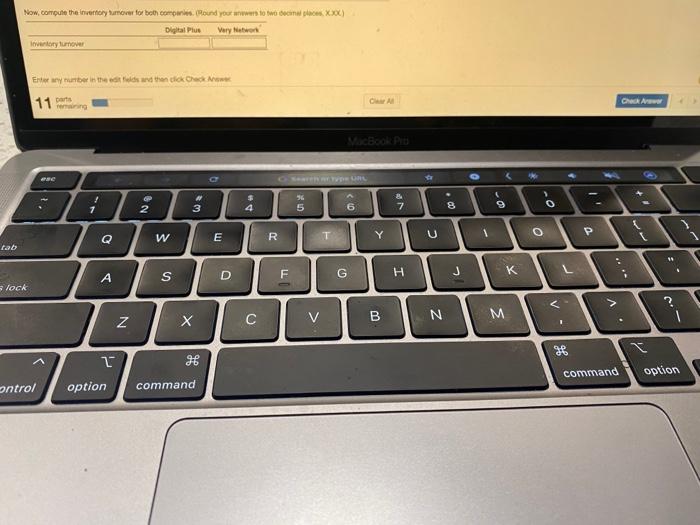

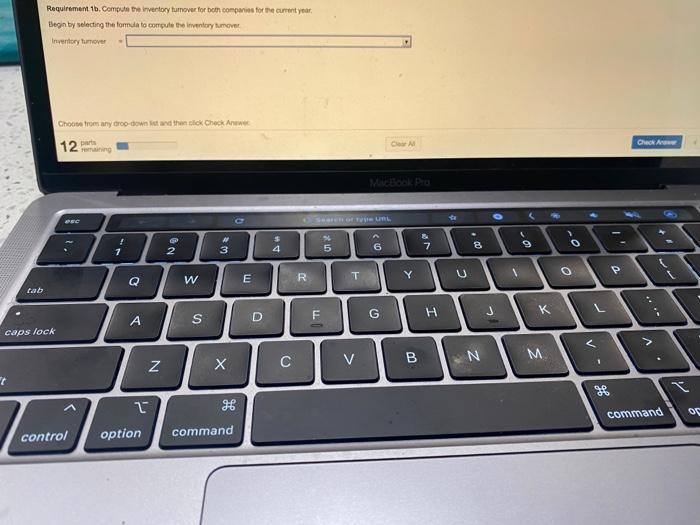

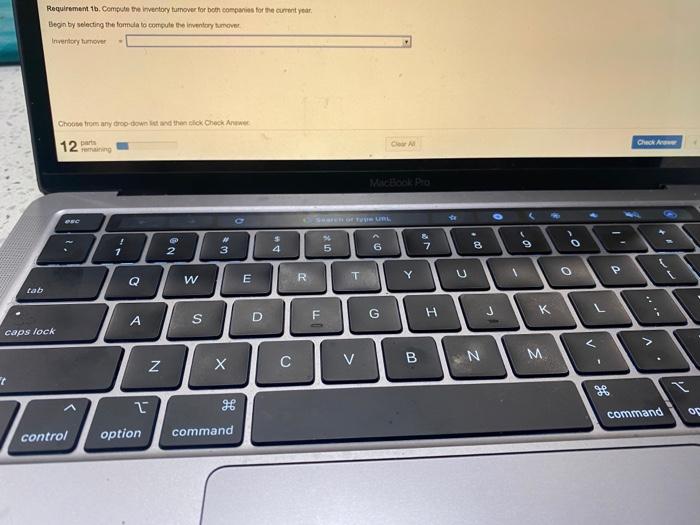

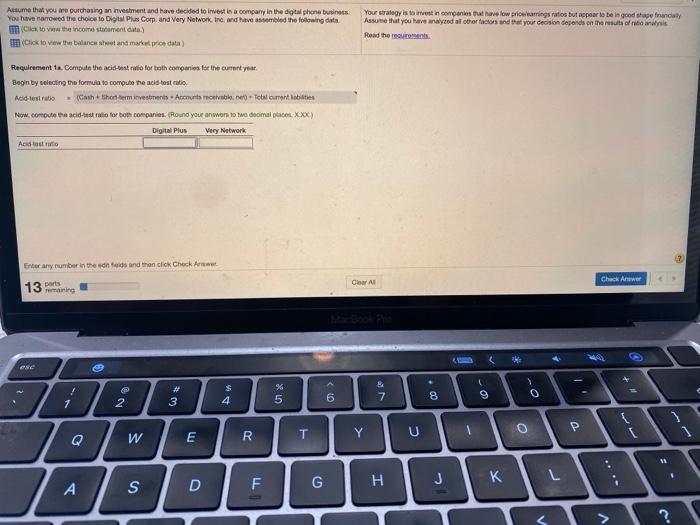

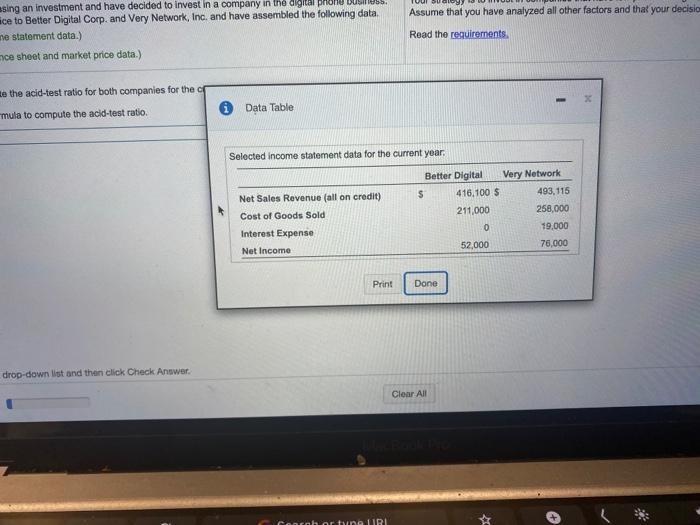

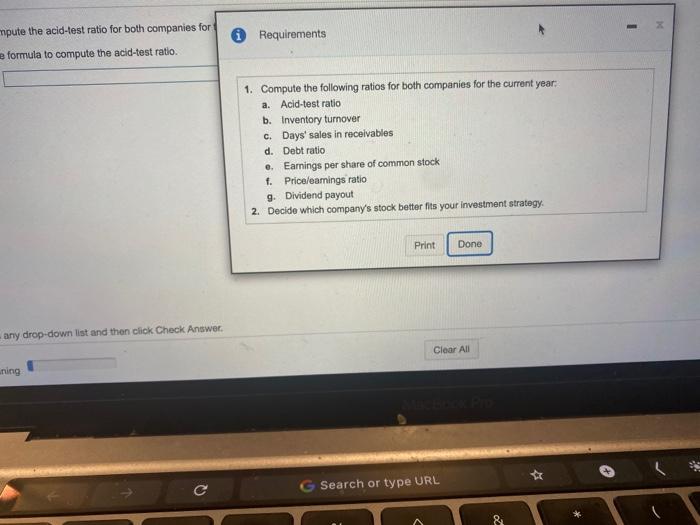

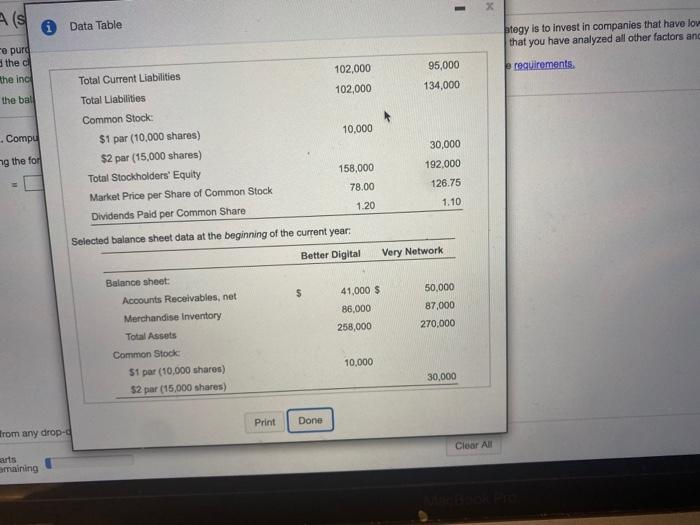

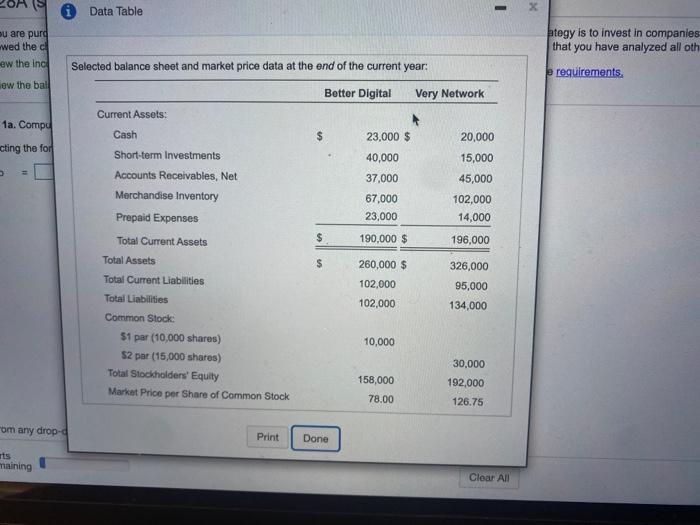

Requirement 2. Decide which company's stock by investment strategy common to the investy beter te pris Of Click to ect you and the Check Nl parts showing MACED ese UL 1 0 & 7 Q W E R T Y tab A S D F G H caps lock N X V B shift Now.compute the price learnings ratio for both companies. (Round interim and final answers to two decimal places, X.XX) Digital Plus Very Network Pricelearnings ratio Enter any number in the edit fields and then click Check Answer Clear All 3 parts remaining MacBook Pro C Search or type URL OSC A # 3 ! 1 $ 4 & 7 6 3 2 E R W T Y Q Fab H G D A S =lock B V X C N Requirement 11. Compute the pricelearnings ratio for both companies for the current year. Begin by selecting the formula to compute the price/earings ratio Price/eamings ratio Choose from any drop-down fist and then click Check Answer 4 parts remaining Clear All MacBook Pro OSC G Search or type URL ! 1 2. # 3 $ 4 % 5 & 7 6 a W E Q R T T Y b F S D G . H ock B WOW. room com and your answer the nort Digital Plus Very Network Earrings per share of common stock Enter any number in the fields and then click Check Awe 5 MacBook Pro $ 4 2 % 5 00 > 7 3 7 o 8 E w R T Q Y a tab a S A F D G H caps lock C > Z B N M shift I H fn control option command Requirement te. Compute the earnings per share of common stock for both companies for the current year Begin by selecting the formula to compute the earnings per share of common stock Earnings por share of common stock Choose from any drop-down list and then click Check Answer Clear All 6. remaining MacBook Pro ( esc tearen or type URL . ! # 3 $ 4 %. 5 B 7 8 6 2 9 C o W E R Y T Q tab G F H D J K S aps lock $ 4 5 7 6 CO 9 0 7 5 2 3 P o W Y U Q E R tab G .. J F H x D A S caps lock B V . N N 28 96 1 option command OC control command Requirement 1b. Compute the inventory turnover for both companies for the current year, Elegin by selecting the formula to compute the inventory tumore Inventory turnover Choose from any roo-down and then click Check Awe CA Check 12 Ferring > $ 4 5 7 6 CO 9 0 7 5 2 3 P o W Y U Q E R tab G .. J F H x D A S caps lock B V . N N 28 96 1 option command OC control command Autume that you are purchasing an investment and have decided to invest in a company in the digital phone business You have marrowed the choice to Digital Plus Corp. and very Network in and have assembled the following data Celow the income statement data) Click to view the balance sheet and market data) Your strategy is to invest in companies that have low price rings rats but par to be in good day Assume that you have analyzed at other factors and all your decision depends on the results from Read the Requirement 1. Compute the acidio for both companies for the current year Begin by selecting the formula to compute the acid tostati Acid-lestie (ChShort term investments Anments et Total currenties Now.comune e acids ratio for both companies. Round your answer to two decimal place XX) Digital Plus Very Network And tasto Enter any number in the end and then click Check Car Check Anwar 13 ports mining e 6 ! 1 @ 2 # 3 $ 4 % 5 & 7 6 8 9 P O T E Y R U W 10 L J S TI H D G ? Assume that you have analyzed all other factors and that your decisio asing an investment and have decided to invest in a company in the digital phone DU ice to Better Digital Corp. and Very Network, Inc., and have assembled the following data. ne statement data.) mce sheet and market price data.) Read the requirements e the acid-test ratio for both companies for the Data Table mula to compute the acid-test ratio. Selected income statement data for the current year. Net Sales Revenue (all on credit) Cost of Goods Sold Interest Expense Net Income Better Digital Very Network S 416,100 $ 493,115 211,000 258,000 0 19,000 52,000 76,000 Print Done drop-down list and then click Check Answer Clear All Carabortun TIRI mpute the acid-test ratio for both companies for Requirements e formula to compute the acid-test ratio. 1. Compute the following ratios for both companies for the current year a. Acid-test ratio b. Inventory turnover C. Days' sales in receivables d. Debt ratio e. Earnings per share of common stock f. Pricelearnings ratio g. Dividend payout 2. Decide which company's stock better fits your investment strategy Print Done any drop-down list and then click Check Answer Clear All ning G Search or type URL Z X Als Data Table e purg the the incl ategy is to invest in companies that have lov that you have analyzed all other factors and requirements the ball - Compu ng the for Total Current Liabilities 102,000 95,000 Total Liabilities 102,000 134,000 Common Stock $1 par (10,000 shares) 10,000 $2 par (15,000 shares) 30,000 Total Stockholders' Equity 158,000 192,000 Market Price per Share of Common Stock 78.00 126.75 Dividends Paid per Common Share 1.20 1.10 Selected balance sheet data at the beginning of the current year: Better Digital Very Network Balance sheet: Accounts Receivables, net $ 41,000 $ 50.000 Merchandise Inventory 86,000 Total Assets 258,000 270,000 Common Stock S1 par (10,000 shares) 10,000 $2 par (15,000 shares) 30,000 87,000 Print Done from any drop- Clear All arts amaining Data Table - * ou are puro wed the cl ew the ince btegy is to invest in companies that you have analyzed all oth e requirements. Selected balance sheet and market price data at the end of the current year: ow the bal Better Digital Very Network 1a. Compu $ 23,000 $ 20,000 cting the for 40,000 15,000 45,000 37,000 67,000 23,000 102,000 14,000 $ 190,000 $ 196,000 Current Assets: Cash Short-term Investments Accounts Receivables, Net Merchandise Inventory Prepaid Expenses Total Current Assets Total Assets Total Current Liabilities Total Liabilities Common Stock 51 par (10,000 shares) 52 par (15,000 shares) Total Stockholders' Equity Market Price per Share of Common Stock $ 260,000 $ 102,000 326,000 95,000 134,000 102,000 10,000 30,000 192,000 158,000 78.00 126.75 om any drop- Print Done ts maining Clear All