Answered step by step

Verified Expert Solution

Question

1 Approved Answer

THIS IS ONE QUESTION WITH 4 PARTS If all answers are correct, I will like the answer. Thank you in advance. ! Required information [The

THIS IS ONE QUESTION WITH 4 PARTS

If all answers are correct, I will like the answer. Thank you in advance.

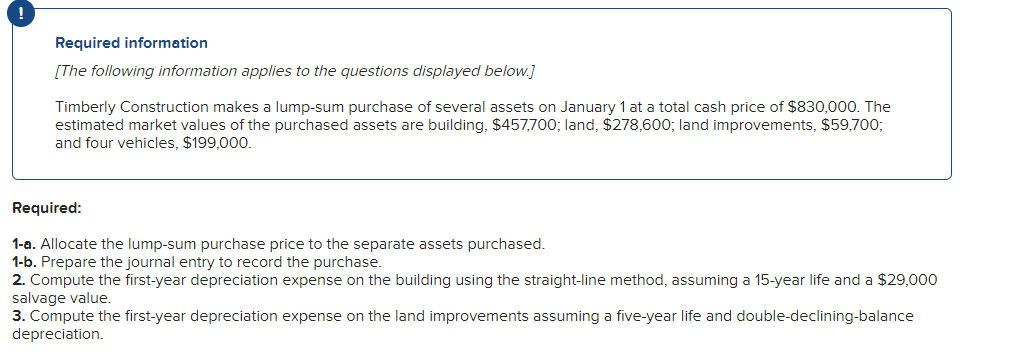

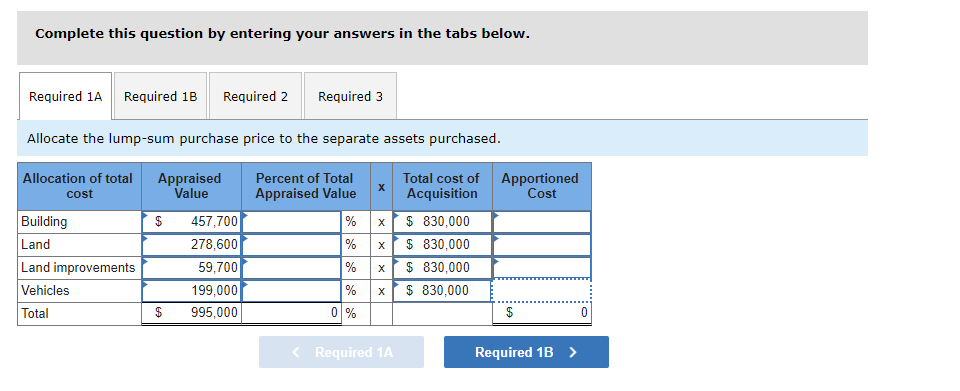

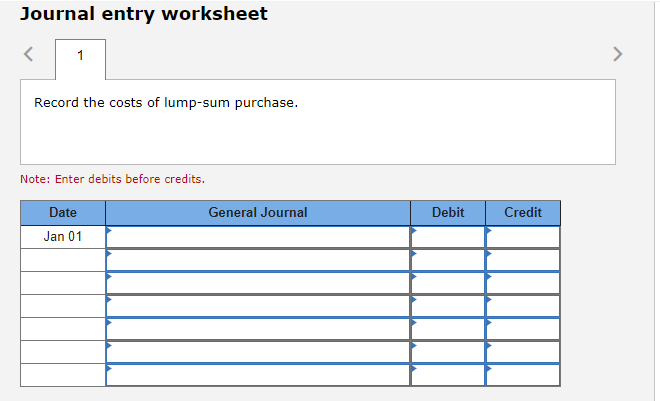

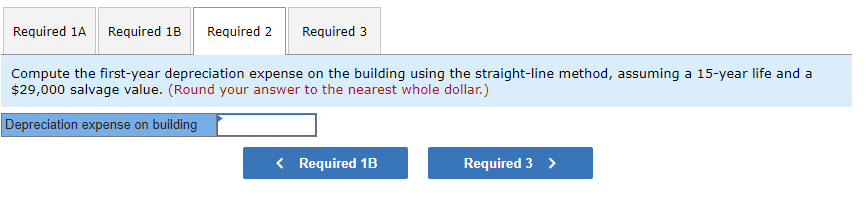

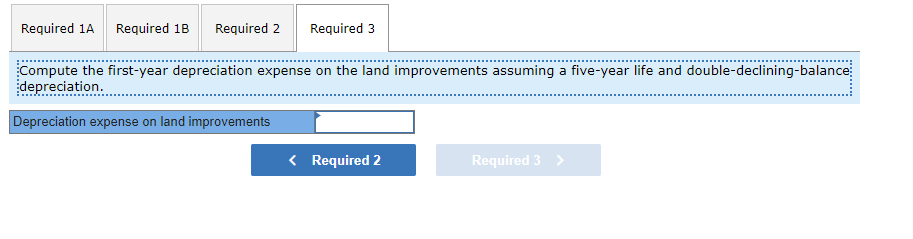

! Required information [The following information applies to the questions displayed below.) Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $830,000. The estimated market values of the purchased assets are building, $457,700; land, $278,600; land improvements, $59,700; and four vehicles, $199,000. Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $29,000 salvage value 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3 Allocate the lump-sum purchase price to the separate assets purchased. Allocation of total cost Appraised Value $ Building Land Land improvements Vehicles Total 457,700 278,600 59,700 199,000 995,000 Percent of Total Appraised Value % % % % 0 % Total cost of Apportioned Acquisition Cost x $ 830,000 X $ 830,000 $ 830,000 $ 830,000 $ 0 $ Journal entry worksheet Required 1A Required 1B Required 2 Required 3 Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Depreciation expense on land improvementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started