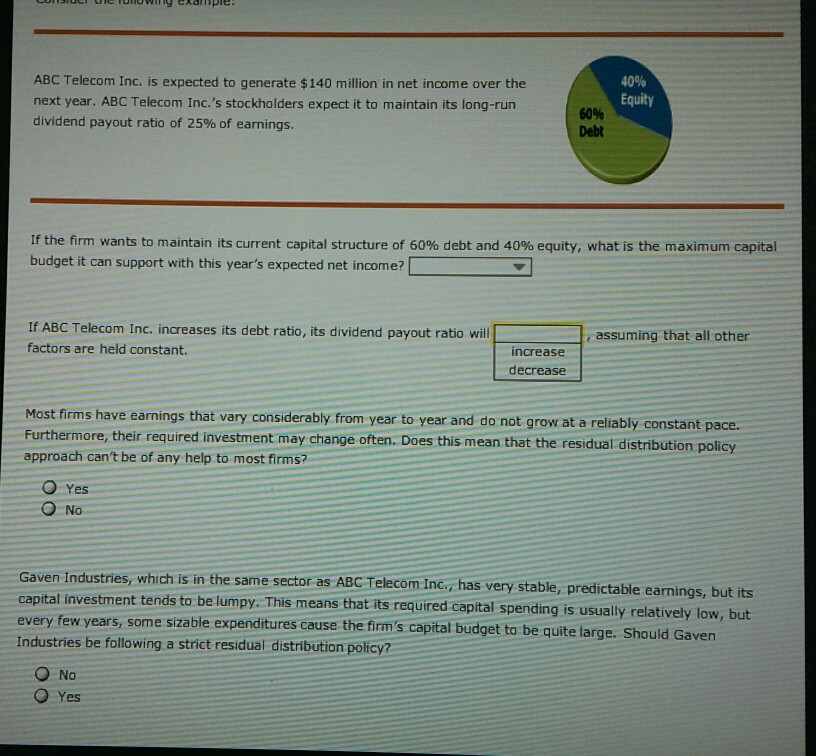

Question: this is one question.Please attempt to answer all. Thanks 40% Equity ABC Telecom Inc. is expected to generate $140 million in net income over the

this is one question.Please attempt to answer all. Thanks

40% Equity ABC Telecom Inc. is expected to generate $140 million in net income over the next year. ABC Telecom Inc.'s stockholders expect it to maintain its long-run dividend payout ratio of 25% of earnings. 60% If the firm wants to maintain its current capital structure of 60% debt and 40% equity, what is the maximum capital budget it can support with this year's expected net income? If ABC Telecom Inc. increases its debt ratio, its dividend payout ratio will factors are held constant. assuming that all other increase decrease Most firms have earnings that vary considerably from year to year and do not grow at a reliably constant pace Furthermore, their required investment may change often. Does this mean that the residual d approach can't be of any help to most firms? istribution policy O Yes O No Gaven Industries, which is in the same sector as ABC Telecom Inc., has very stable, predictable earnings, but its capital investment tends to be lumpy. This means that its required capital spending every few years, Industries be following a strict residual distribution policy? s to be lumpy. This means that its required capital spending is usually relatively low, but some sizable expenditures cause the firm's capital budget to be quite large. Should Gaven O No Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts