this is part 1

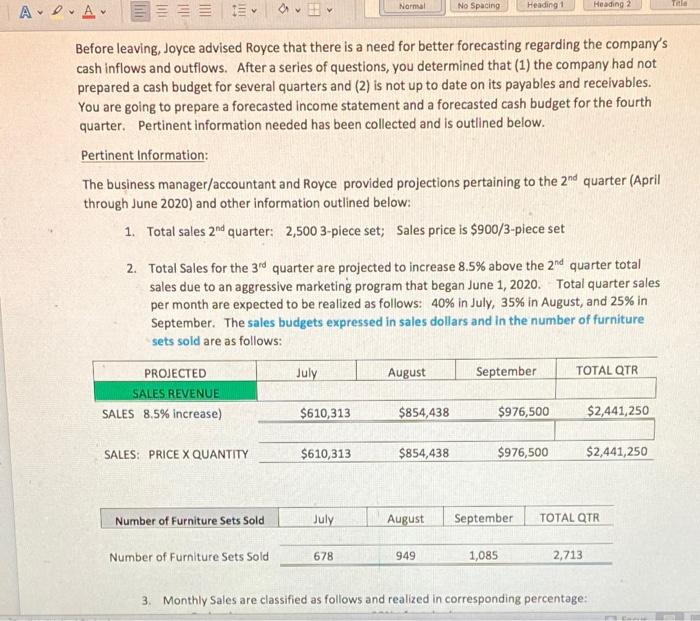

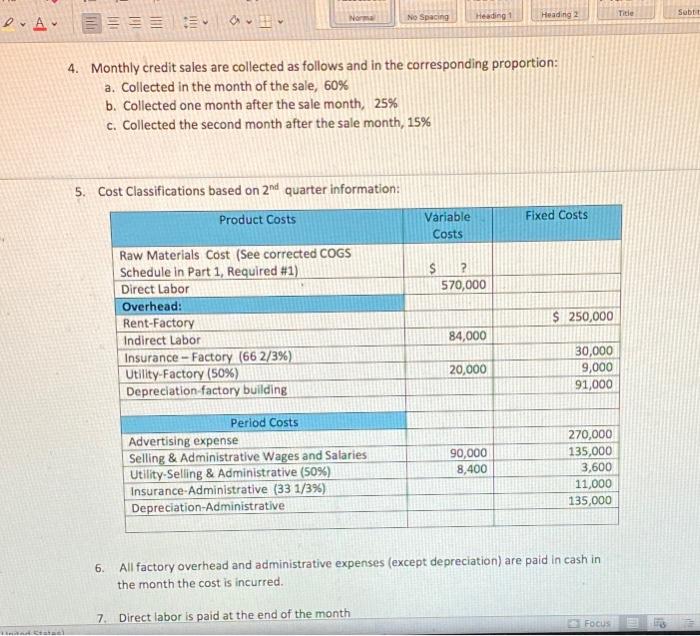

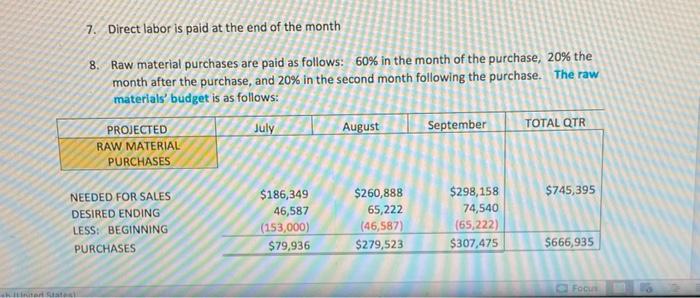

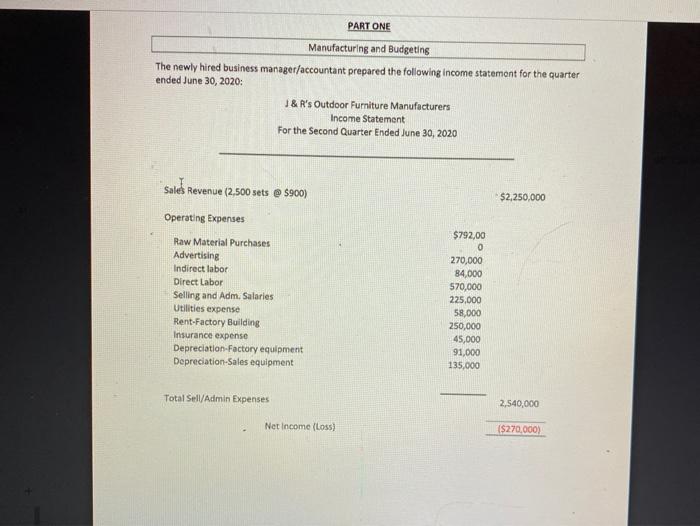

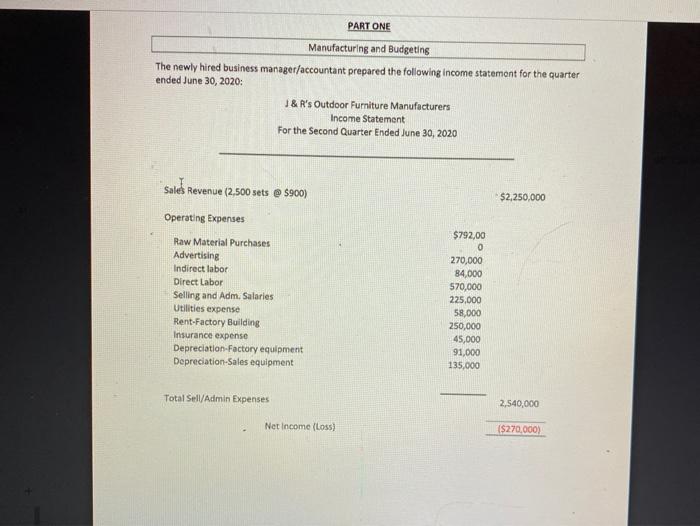

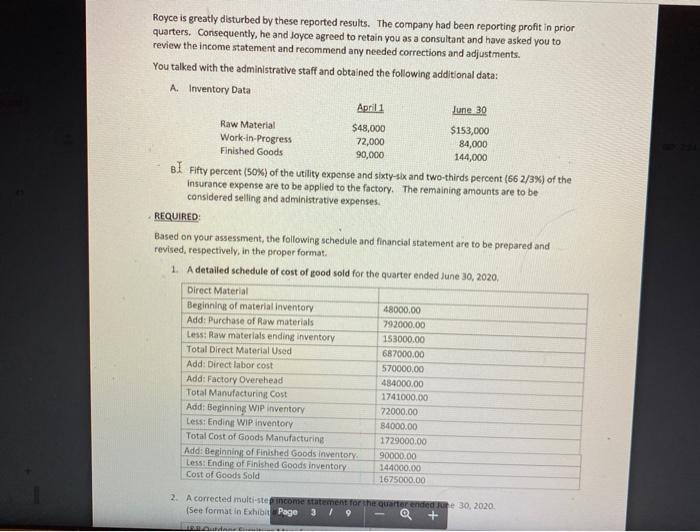

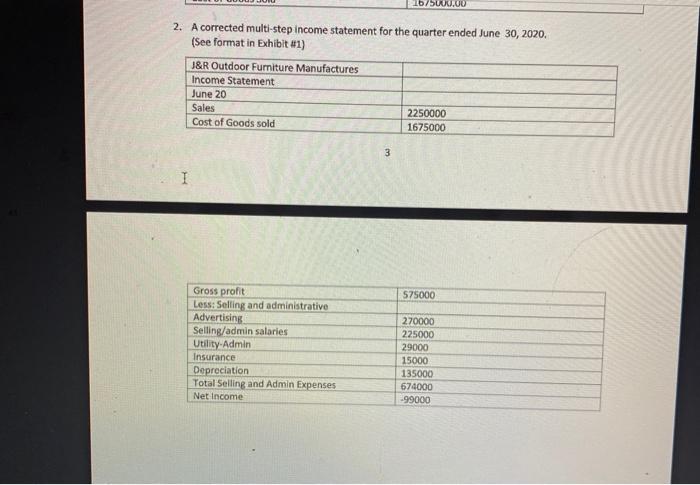

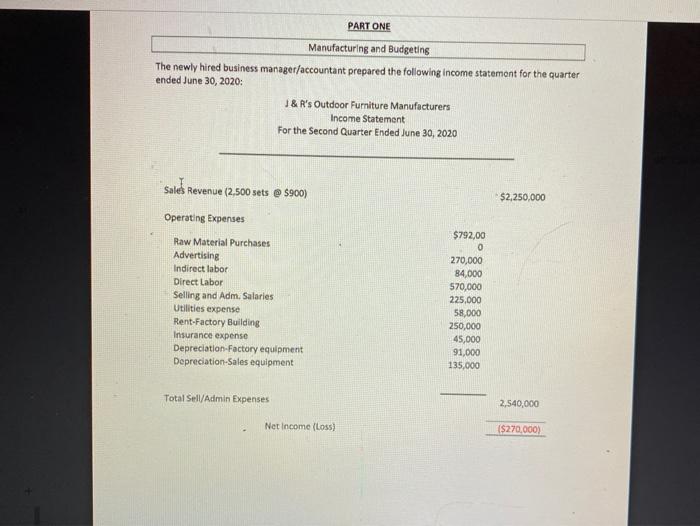

Normal No Spacing Heading 1 Heading 2 Tale Ae Before leaving, Joyce advised Royce that there is a need for better forecasting regarding the company's cash inflows and outflows. After a series of questions, you determined that (1) the company had not prepared a cash budget for several quarters and (2) is not up to date on its payables and receivables. You are going to prepare a forecasted Income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below. Pertinent Information: The business manager/accountant and Royce provided projections pertaining to the 2nd quarter (April through June 2020) and other information outlined below: 1. Total sales 2nd quarter: 2,500 3-piece set; Sales price is $900/3-piece set 2. Total Sales for the 3rd quarter are projected to increase 8.5% above the 2nd quarter total sales due to an aggressive marketing program that began June 1, 2020. Total quarter sales per month are expected to be realized as follows: 40% in July, 35% in August, and 25% in September. The sales budgets expressed in sales dollars and in the number of furniture sets sold are as follows: July August September TOTAL QTR PROJECTED SALES REVENUE SALES 8.5% increase) $610,313 $854,438 $976,500 $2,441,250 SALES: PRICE X QUANTITY $610,313 $854,438 $976,500 $2,441,250 Number of Furniture Sets Sold July August September TOTAL QTR Number of Furniture Sets Sold 678 949 1,085 2,713 3. Monthly Sales are classified as follows and realized in corresponding percentage: Title Nom Sabt No Spacing Heading 2 Heading 1 4. Monthly credit sales are collected as follows and in the corresponding proportion: a. Collected in the month of the sale, 60% b. Collected one month after the sale month, 25% C. Collected the second month after the sale month, 15% 5. Cost Classifications based on 2nd quarter information: Product Costs Fixed Costs Variable Costs $ ? 570,000 Raw Materials Cost (See corrected COGS Schedule in Part 1, Required #1) Direct Labor Overhead: Rent-Factory Indirect labor Insurance - Factory (66 2/3%) Utility-Factory (50%) Depreciation factory building $ 250,000 84,000 20,000 30,000 9,000 91,000 Period Costs Advertising expense Selling & Administrative Wages and Salaries Utility-Selling & Administrative (50%) Insurance-Administrative (33 1/3%) Depreciation Administrative 90,000 8,400 270,000 135,000 3,600 11,000 135,000 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred. 7. Direct labor is paid at the end of the month Focus 7. Direct labor is paid at the end of the month 8. Raw material purchases are paid as follows: 60% in the month of the purchase, 20% the month after the purchase, and 20% in the second month following the purchase. The raw materials' budget is as follows: July August September TOTAL QTR PROJECTED RAW MATERIAL PURCHASES $745,395 NEEDED FOR SALES DESIRED ENDING LESS: BEGINNING PURCHASES $186,349 46,587 (153,000) $79,936 $260,888 65,222 (46,587) $279,523 $298,158 74,540 (65,222) $307,475 $666,935 Foco ht PART ONE Manufacturing and Budgeting The newly hired business manager/accountant prepared the following income statement for the quarter ended June 30, 2020: 1 & R's Outdoor Furniture Manufacturers Income Statement For the Second Quarter Ended June 30, 2020 Sales Revenue (2,500 sets @ $900) $2,250,000 Operating Expenses Raw Material Purchases Advertising Indirect labor Direct Labor Selling and Adm. Salaries Utilities expense Rent-Factory Building Insurance expense Depreciation Factory equipment Depreciation Sales equipment $792,00 0 270,000 84,000 570,000 225,000 58,000 250,000 45,000 91,000 135,000 Total Sell/Admin Expenses 2,540,000 Net Income (Loss) ($270,000) Royce is greatly disturbed by these reported results. The company had been reporting profit in prior quarters. Consequently, he and Joyce agreed to retain you as a consultant and have asked you to review the income statement and recommend any needed corrections and adjustments. You talked with the administrative staff and obtained the following additional data: A. Inventory Data April 1 June 30 Raw Material $48,000 $153,000 Work in Progress 72,000 84,000 Finished Goods 90,000 144,000 BI Fifty percent (50%) of the utility expense and sixty-six and two-thirds percent (66 2/3%) of the insurance expense are to be applied to the factory. The remaining amounts are to be considered selling and administrative expenses. REQUIRED Based on your assessment, the following schedule and financial statement are to be prepared and revised, respectively, in the proper format. 1 Adetailed schedule of cost of good sold for the quarter ended June 30, 2020, Direct Material Beginning of material inventory 48000.00 Add: Purchase of Raw materials 792000.00 Less: Raw materials ending inventory 153000.00 Total Direct Material Used 687000.00 Add: Direct labor cost 570000.00 Add: Factory Overehead 484000.00 Total Manufacturing Cost 1741000.00 Add: Beinning WIP Inventory 72000.00 Less: Ending WIP inventory 84000.00 Total Cost of Goods Manufacturing 1729000.00 Add: Beginning of Finished Goods inventory 90000.00 Less: Ending of Finished Goods inventory 144000.00 Cost of Goods Sold 1675000.00 2. A corrected multi-steg income statement for the quarter endedore 30, 2020 See format in Exhibit Page 3 + UR 1b/SW.00 2. A corrected multi-step income statement for the quarter ended June 30, 2020. (See format in Exhibit 01) J&R Outdoor Furniture Manufactures Income Statement June 20 Sales 2250000 Cost of Goods sold 1675000 3 I 575000 Gross profit Less: Selling and administrative Advertising Selling/admin salaries Utility Admin Insurance Depreciation Total Selling and Admin Expenses Net Income 270000 225000 29000 15000 135000 674000 .99000 Normal No Spacing Heading 1 Heading 2 Tale Ae Before leaving, Joyce advised Royce that there is a need for better forecasting regarding the company's cash inflows and outflows. After a series of questions, you determined that (1) the company had not prepared a cash budget for several quarters and (2) is not up to date on its payables and receivables. You are going to prepare a forecasted Income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below. Pertinent Information: The business manager/accountant and Royce provided projections pertaining to the 2nd quarter (April through June 2020) and other information outlined below: 1. Total sales 2nd quarter: 2,500 3-piece set; Sales price is $900/3-piece set 2. Total Sales for the 3rd quarter are projected to increase 8.5% above the 2nd quarter total sales due to an aggressive marketing program that began June 1, 2020. Total quarter sales per month are expected to be realized as follows: 40% in July, 35% in August, and 25% in September. The sales budgets expressed in sales dollars and in the number of furniture sets sold are as follows: July August September TOTAL QTR PROJECTED SALES REVENUE SALES 8.5% increase) $610,313 $854,438 $976,500 $2,441,250 SALES: PRICE X QUANTITY $610,313 $854,438 $976,500 $2,441,250 Number of Furniture Sets Sold July August September TOTAL QTR Number of Furniture Sets Sold 678 949 1,085 2,713 3. Monthly Sales are classified as follows and realized in corresponding percentage: Title Nom Sabt No Spacing Heading 2 Heading 1 4. Monthly credit sales are collected as follows and in the corresponding proportion: a. Collected in the month of the sale, 60% b. Collected one month after the sale month, 25% C. Collected the second month after the sale month, 15% 5. Cost Classifications based on 2nd quarter information: Product Costs Fixed Costs Variable Costs $ ? 570,000 Raw Materials Cost (See corrected COGS Schedule in Part 1, Required #1) Direct Labor Overhead: Rent-Factory Indirect labor Insurance - Factory (66 2/3%) Utility-Factory (50%) Depreciation factory building $ 250,000 84,000 20,000 30,000 9,000 91,000 Period Costs Advertising expense Selling & Administrative Wages and Salaries Utility-Selling & Administrative (50%) Insurance-Administrative (33 1/3%) Depreciation Administrative 90,000 8,400 270,000 135,000 3,600 11,000 135,000 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred. 7. Direct labor is paid at the end of the month Focus 7. Direct labor is paid at the end of the month 8. Raw material purchases are paid as follows: 60% in the month of the purchase, 20% the month after the purchase, and 20% in the second month following the purchase. The raw materials' budget is as follows: July August September TOTAL QTR PROJECTED RAW MATERIAL PURCHASES $745,395 NEEDED FOR SALES DESIRED ENDING LESS: BEGINNING PURCHASES $186,349 46,587 (153,000) $79,936 $260,888 65,222 (46,587) $279,523 $298,158 74,540 (65,222) $307,475 $666,935 Foco ht PART ONE Manufacturing and Budgeting The newly hired business manager/accountant prepared the following income statement for the quarter ended June 30, 2020: 1 & R's Outdoor Furniture Manufacturers Income Statement For the Second Quarter Ended June 30, 2020 Sales Revenue (2,500 sets @ $900) $2,250,000 Operating Expenses Raw Material Purchases Advertising Indirect labor Direct Labor Selling and Adm. Salaries Utilities expense Rent-Factory Building Insurance expense Depreciation Factory equipment Depreciation Sales equipment $792,00 0 270,000 84,000 570,000 225,000 58,000 250,000 45,000 91,000 135,000 Total Sell/Admin Expenses 2,540,000 Net Income (Loss) ($270,000) Royce is greatly disturbed by these reported results. The company had been reporting profit in prior quarters. Consequently, he and Joyce agreed to retain you as a consultant and have asked you to review the income statement and recommend any needed corrections and adjustments. You talked with the administrative staff and obtained the following additional data: A. Inventory Data April 1 June 30 Raw Material $48,000 $153,000 Work in Progress 72,000 84,000 Finished Goods 90,000 144,000 BI Fifty percent (50%) of the utility expense and sixty-six and two-thirds percent (66 2/3%) of the insurance expense are to be applied to the factory. The remaining amounts are to be considered selling and administrative expenses. REQUIRED Based on your assessment, the following schedule and financial statement are to be prepared and revised, respectively, in the proper format. 1 Adetailed schedule of cost of good sold for the quarter ended June 30, 2020, Direct Material Beginning of material inventory 48000.00 Add: Purchase of Raw materials 792000.00 Less: Raw materials ending inventory 153000.00 Total Direct Material Used 687000.00 Add: Direct labor cost 570000.00 Add: Factory Overehead 484000.00 Total Manufacturing Cost 1741000.00 Add: Beinning WIP Inventory 72000.00 Less: Ending WIP inventory 84000.00 Total Cost of Goods Manufacturing 1729000.00 Add: Beginning of Finished Goods inventory 90000.00 Less: Ending of Finished Goods inventory 144000.00 Cost of Goods Sold 1675000.00 2. A corrected multi-steg income statement for the quarter endedore 30, 2020 See format in Exhibit Page 3 + UR 1b/SW.00 2. A corrected multi-step income statement for the quarter ended June 30, 2020. (See format in Exhibit 01) J&R Outdoor Furniture Manufactures Income Statement June 20 Sales 2250000 Cost of Goods sold 1675000 3 I 575000 Gross profit Less: Selling and administrative Advertising Selling/admin salaries Utility Admin Insurance Depreciation Total Selling and Admin Expenses Net Income 270000 225000 29000 15000 135000 674000 .99000