this is part 2 of a 2 part question

as can be seen in the top left. please answer 2 a following these instructions

2a:

only use these options for journal entry

here are the options for the general journal:

no journal entry required

bond discount

bond premium

bonds payable

cash

dividend revenue

dividends payable

dividends receivable

equity in investee earnings

gain on sale of investment

goodwill

interest revenue

investments

loss on sale of investments

property and equipment

unrealized gain

unrealized loss

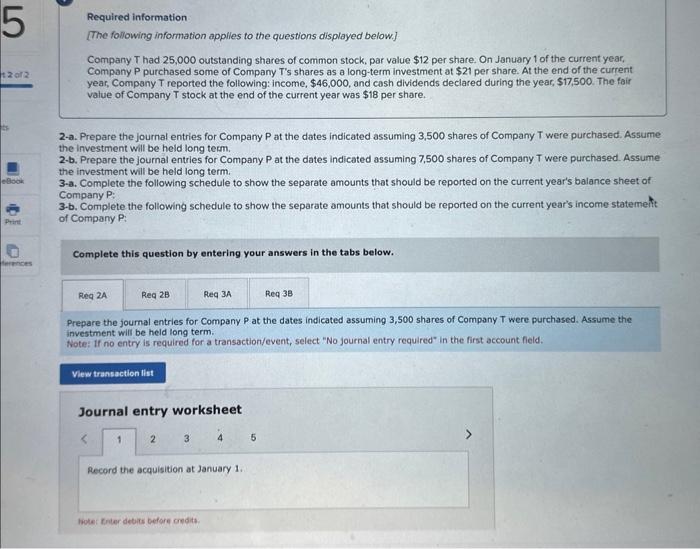

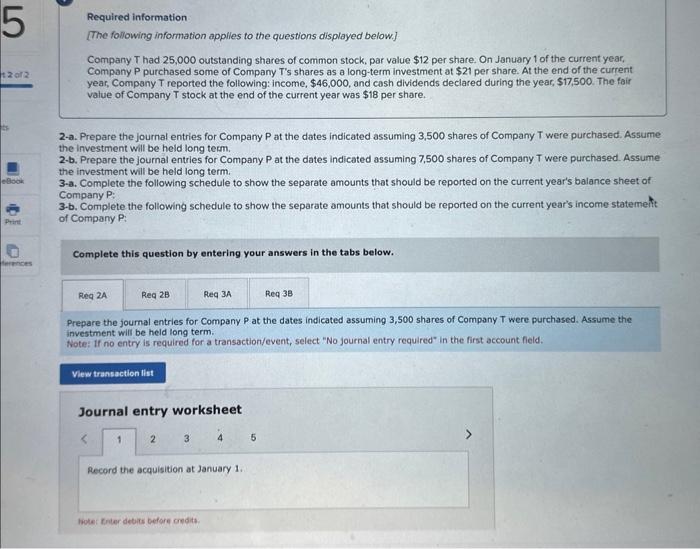

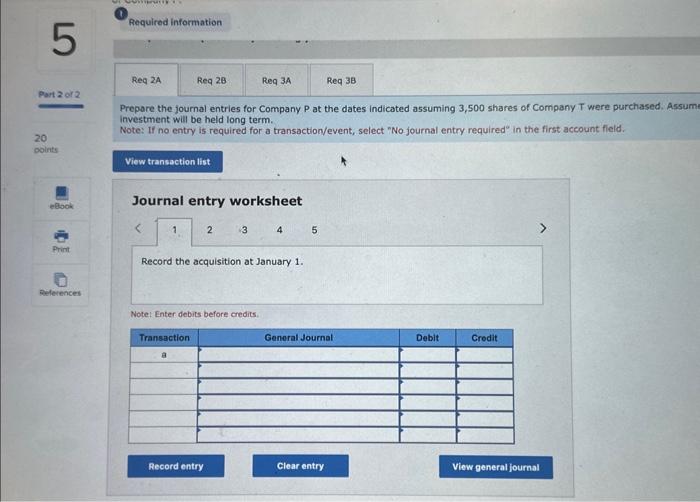

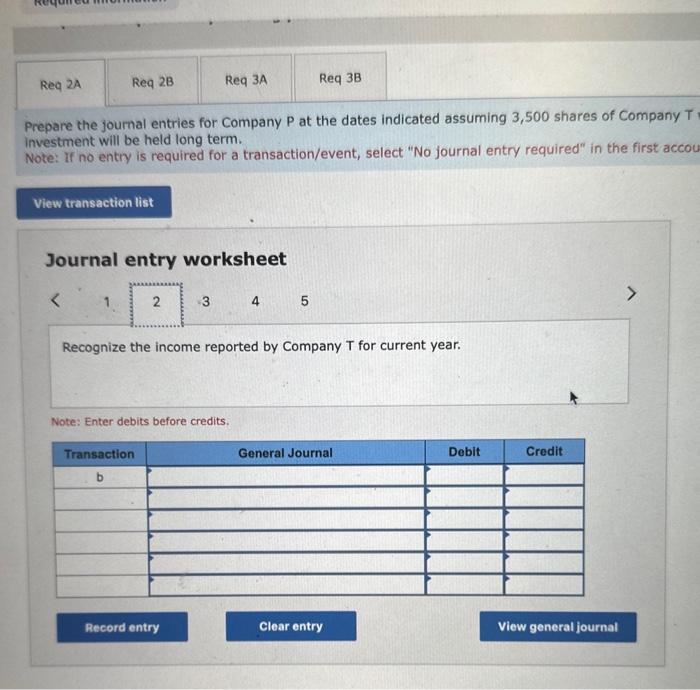

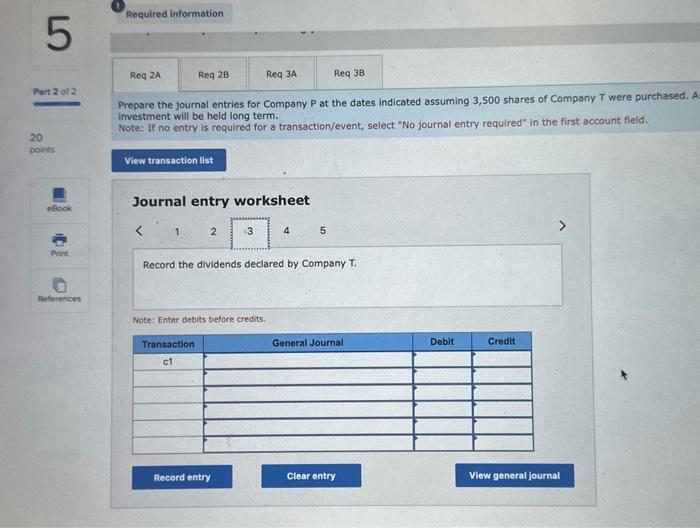

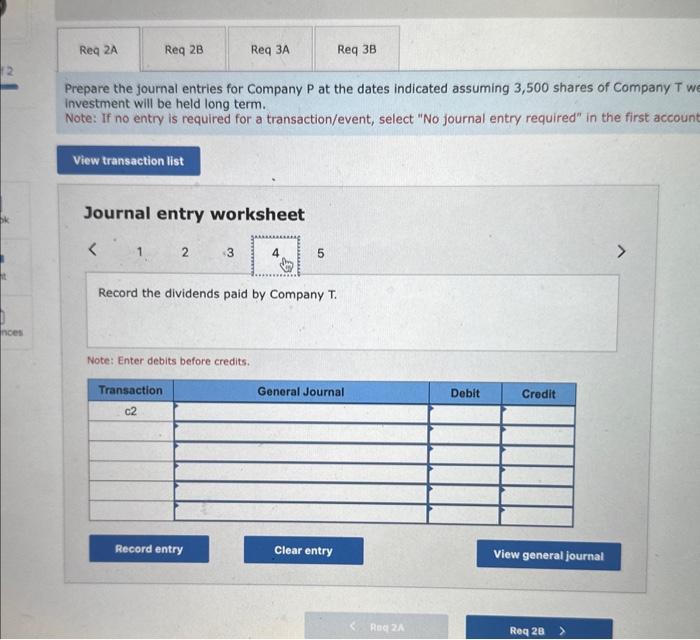

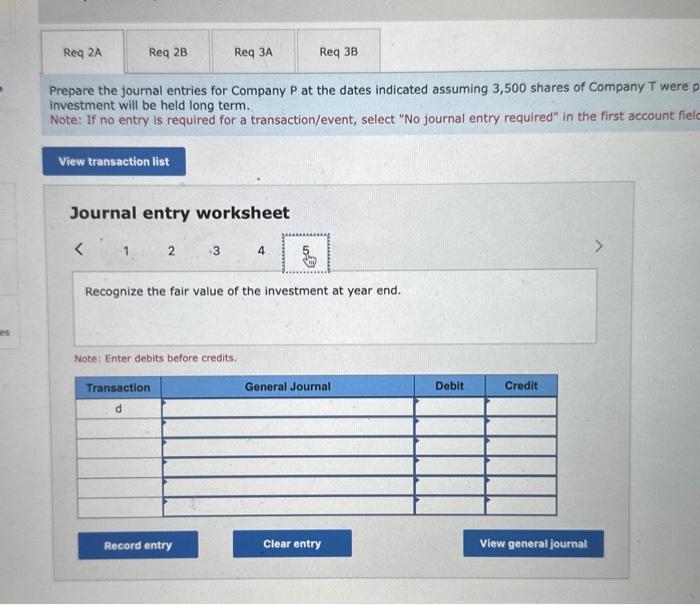

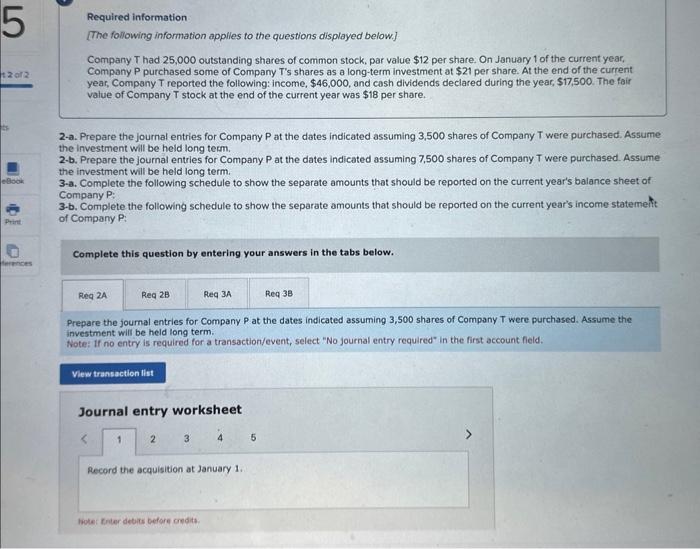

Required information [The following information applies to the questions displayed below] Company T had 25,000 outstanding shares of common stock, par value $12 per share. On January 1 of the current year, Company P purchased some of Company T's shares as a long-term investment at $21 per share. At the end of the current year, Company T reported the following: income, $46,000, and cash dividends declared during the year, $17,500. The fair value of Company T stock at the end of the current year was $18 per share. 2-a. Prepare the journal entries for Company P at the dates indicated assuming 3,500 shares of Company T were purchased. Assume he investment will be held long term. 2-b. Prepare the journal entries for Company P at the dates indicated assuming 7,500 shares of Company T were purchased. Assume he investment will be held long term. 3-a. Complete the following schedule to show the separate amounts that should be reported on the current year's balance sheet of Company P : 3.b. Complete the following schedule to show the separate amounts that should be reported on the current year's income statemeht of Company P: Complete this question by entering your answers in the tabs below. Prepare the joumal entries for Company P at the dates indicated assuming 3,500 shares of Company T were purchased. Assume the investment will be held long term. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Prepore the journal entries for Company P at the dates indicated assuming 3,500 shares of Company T were purchased. Assum investment will be held long term. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account fleld. Journal entry worksheet 2 5 Notel Enter debits before credits. Prepare the journal entries for Company P at the dates indicated assuming 3,500 shares of Company T investment will be held long term. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first acco Journal entry worksheet 5 Recognize the income reported by Company T for current year. Note: Enter debits before credits. Prepare the joumal entries for Company P at the dates indicated assuming 3,500 shares of Company T were purchased. investment will be held long term. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account fieid. Journal entry worksheet Note: Enter debits before credits. Prepare the journal entries for Company P at the dates indicated assuming 3,500 shares of Company T w investment will be held long term. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first accoun Journal entry worksheet Record the dividends paid by Company T. Note: Enter debits before credits. Prepare the journal entries for Company P at the dates indicated assuming 3,500 shares of Company T were investment will be held long term. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account fiel Journal entry worksheet Recognize the fair value of the investment at year end. Note: Enter debits before credits