Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is revision so for the purpose of exams please don't use excel 8. Consider the possible rates of return that you might obtain over

this is revision so for the purpose of exams please don't use excel

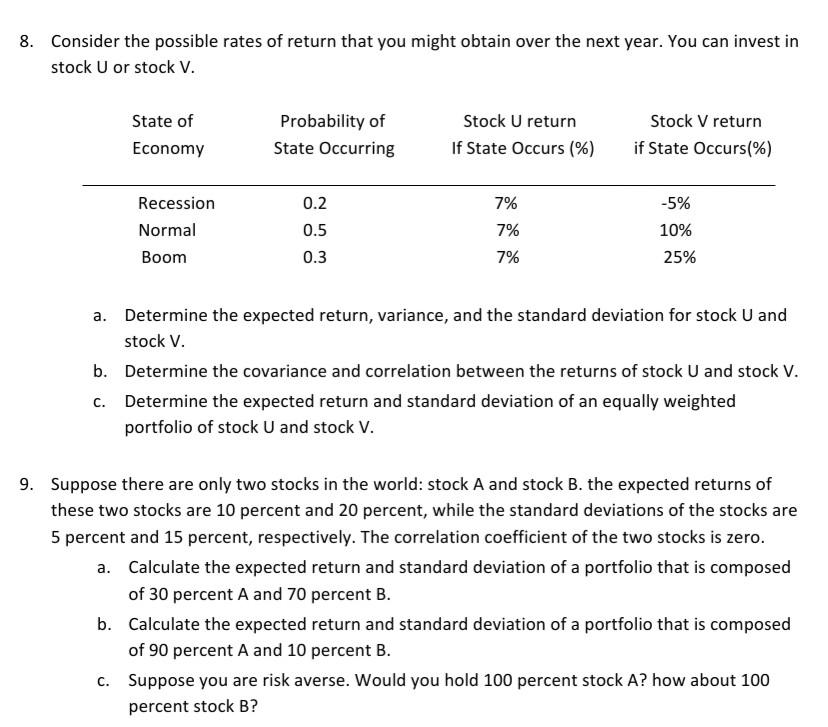

8. Consider the possible rates of return that you might obtain over the next year. You can invest in stock U or stock V. State of Economy Probability of State Occurring Stock U return If State Occurs (%) Stock V return if State Occurs(%) Recession Normal Boom 0.2 0.5 0.3 7% 7% 7% -5% 10% 25% a. Determine the expected return, variance, and the standard deviation for stock U and stock V. b. Determine the covariance and correlation between the returns of stock U and stock V. C. Determine the expected return and standard deviation of an equally weighted portfolio of stock U and stock V. 9. Suppose there are only two stocks in the world: stock A and stock B. the expected returns of these two stocks are 10 percent and 20 percent, while the standard deviations of the stocks are 5 percent and 15 percent, respectively. The correlation coefficient of the two stocks is zero. a. Calculate the expected return and standard deviation of a portfolio that is composed of 30 percent A and 70 percent B. b. Calculate the expected return and standard deviation of a portfolio that is composed of 90 percent A and 10 percent B. C. Suppose you are risk averse. Would you hold 100 percent stock A? how about 100 percent stock BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started