Answered step by step

Verified Expert Solution

Question

1 Approved Answer

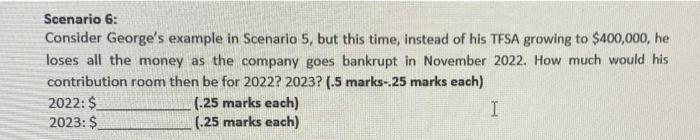

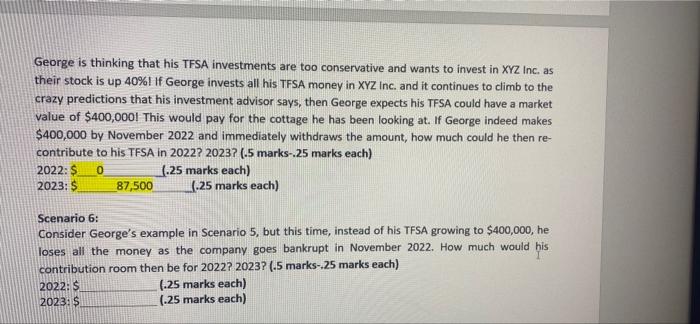

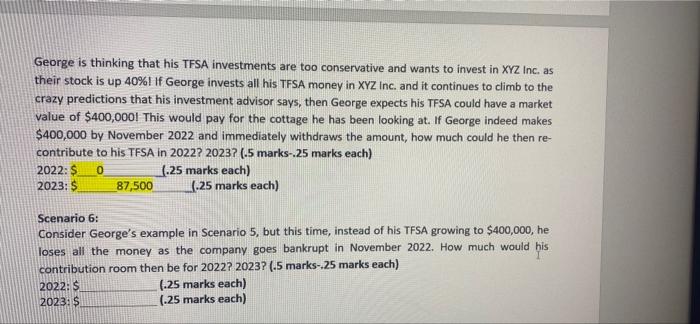

this is scenario 5. pls answwr 6. Scenario 6: Consider George's example in Scenario 5, but this time, instead of his TESA growing to $400,000,

this is scenario 5. pls answwr 6.

Scenario 6: Consider George's example in Scenario 5, but this time, instead of his TESA growing to $400,000, he loses all the money as the company goes bankrupt in November 2022. How much would his contribution room then be for 2022 2023? (.5 marks-.25 marks each) 2022:$ (.25 marks each) 2023: $ (.25 marks each) I George is thinking that his TFSA investments are too conservative and wants to invest in XYZ Inc. as their stock is up 40%! If George invests all his TFSA money in XYZ Inc. and it continues to climb to the crazy predictions that his investment advisor says, then George expects his TFSA could have a market value of $400,000! This would pay for the cottage he has been looking at. If George indeed makes $400,000 by November 2022 and immediately withdraws the amount, how much could he then re- contribute to his TFSA in 2022 2023? (.5 marks-25 marks each) 2022:$ 0 1.25 marks each) 2023: $ 87,500 (.25 marks each) Scenario 6: Consider George's example in Scenario 5, but this time, instead of his TFSA growing to $400,000, he loses all the money as the company goes bankrupt in November 2022. How much would his contribution room then be for 2022? 2023? (.5 marks-.25 marks each) 2022:$ (.25 marks each) 20231$ (.25 marks each) Scenario 6: Consider George's example in Scenario 5, but this time, instead of his TESA growing to $400,000, he loses all the money as the company goes bankrupt in November 2022. How much would his contribution room then be for 2022 2023? (.5 marks-.25 marks each) 2022:$ (.25 marks each) 2023: $ (.25 marks each) I George is thinking that his TFSA investments are too conservative and wants to invest in XYZ Inc. as their stock is up 40%! If George invests all his TFSA money in XYZ Inc. and it continues to climb to the crazy predictions that his investment advisor says, then George expects his TFSA could have a market value of $400,000! This would pay for the cottage he has been looking at. If George indeed makes $400,000 by November 2022 and immediately withdraws the amount, how much could he then re- contribute to his TFSA in 2022 2023? (.5 marks-25 marks each) 2022:$ 0 1.25 marks each) 2023: $ 87,500 (.25 marks each) Scenario 6: Consider George's example in Scenario 5, but this time, instead of his TFSA growing to $400,000, he loses all the money as the company goes bankrupt in November 2022. How much would his contribution room then be for 2022? 2023? (.5 marks-.25 marks each) 2022:$ (.25 marks each) 20231$ (.25 marks each)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started