Question: This is Strategic Management , please read the following case 9B06M092 about Lululemon Athletica: Primed for Growth and help me answer the questions related to

This isStrategic Management, please read the following case9B06M092aboutLululemon Athletica: Primed for Growthand help me answer the questions related to this case study.

Case questions:Imagine that you are a strategic advisor to Chip Wilson, founder of Lululemon. Lululemon has enjoyed quite a bit of success over the years with more opportunities for growth presenting itself. The case outlines several areas of opportunity (expansion initiatives) that Chip can pursue - the problem is that Chip cannot implement all of them. Help Chip assess Lululemon's current strategy, evaluate potential opportunities, and identify which opportunity he should focus on.

1. Executive summary - Provide an overview of the case (like a movie trailer)

2. Use the Strategy Model to:

a. Evaluate Lululemon's current strategy, and

b. Assess the urgency for action.

3. Evaluate the opportunities in the case using all aspects of the Diamond-E Framework in addition to other frameworks

4. Provide Chip with a recommendation of which opportunity he should pursue and why

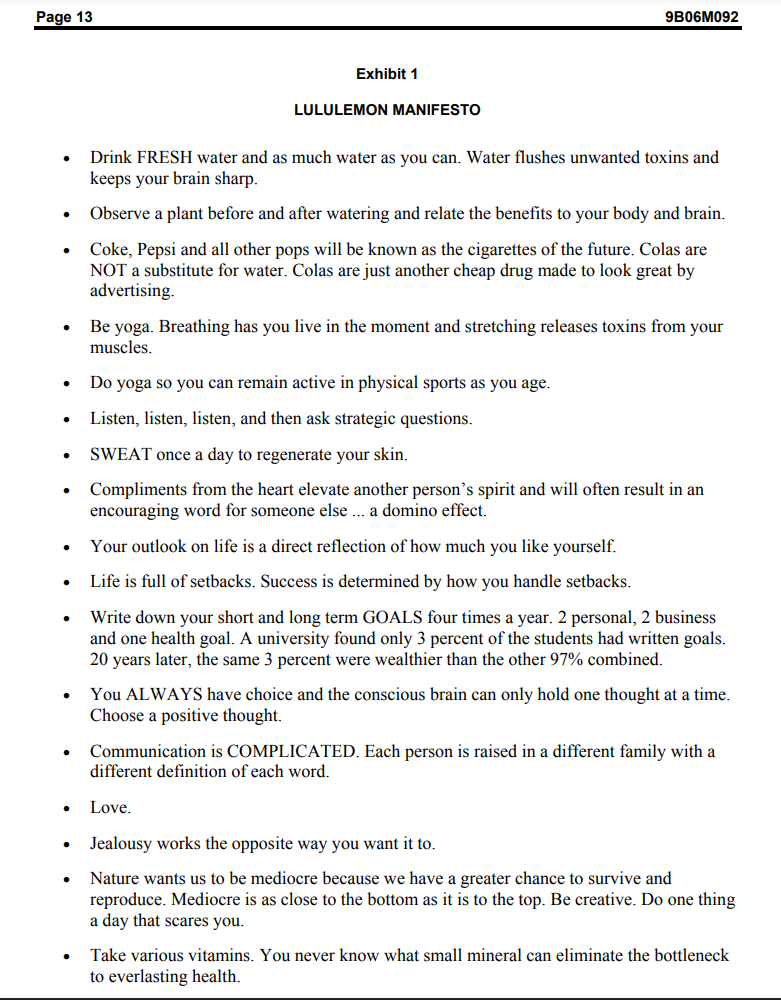

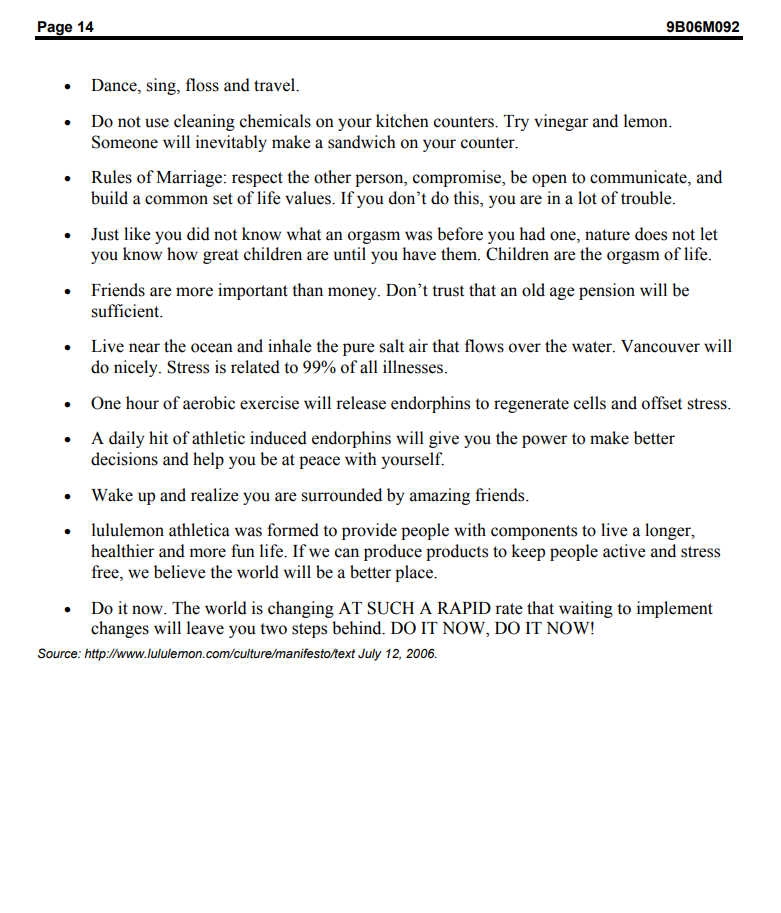

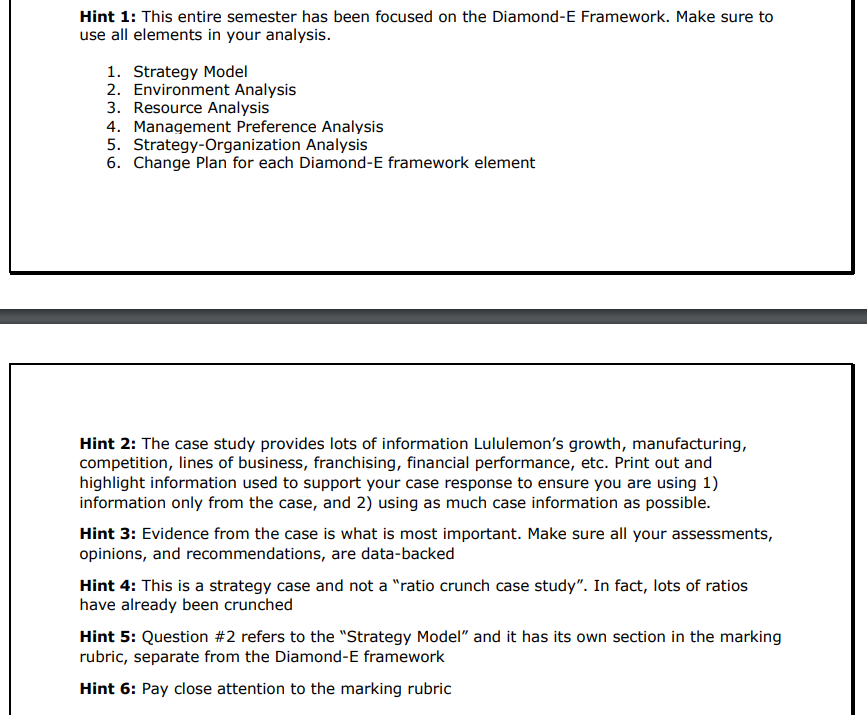

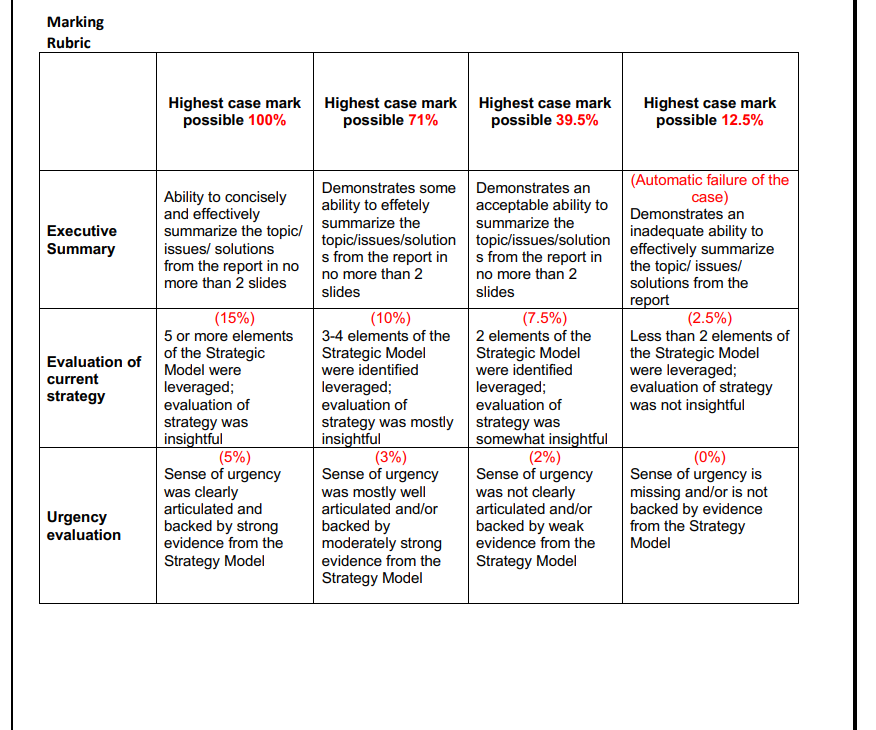

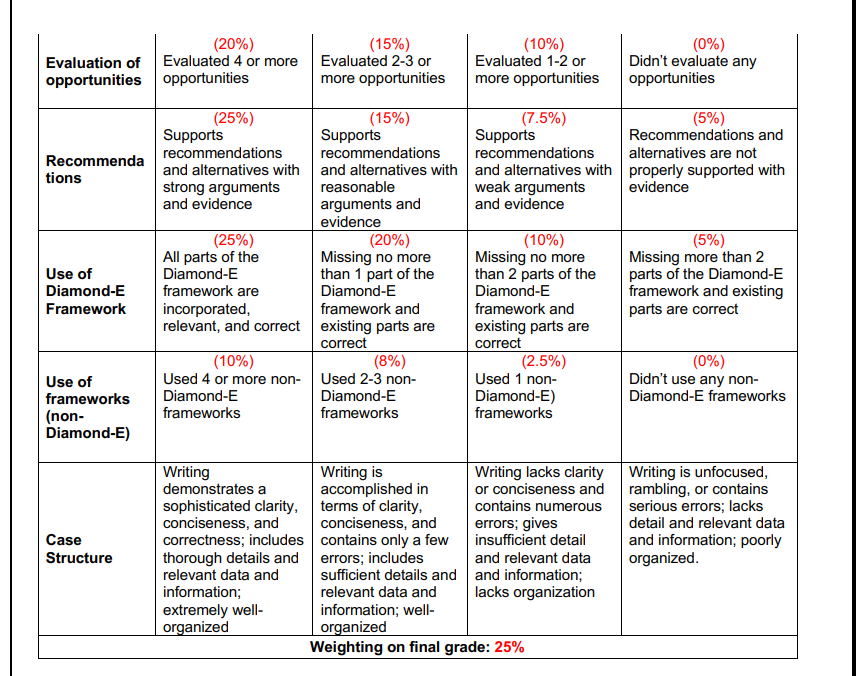

Please follow theHintas well as theMarking Rubricbelow to answer the above questions in the most complete way.

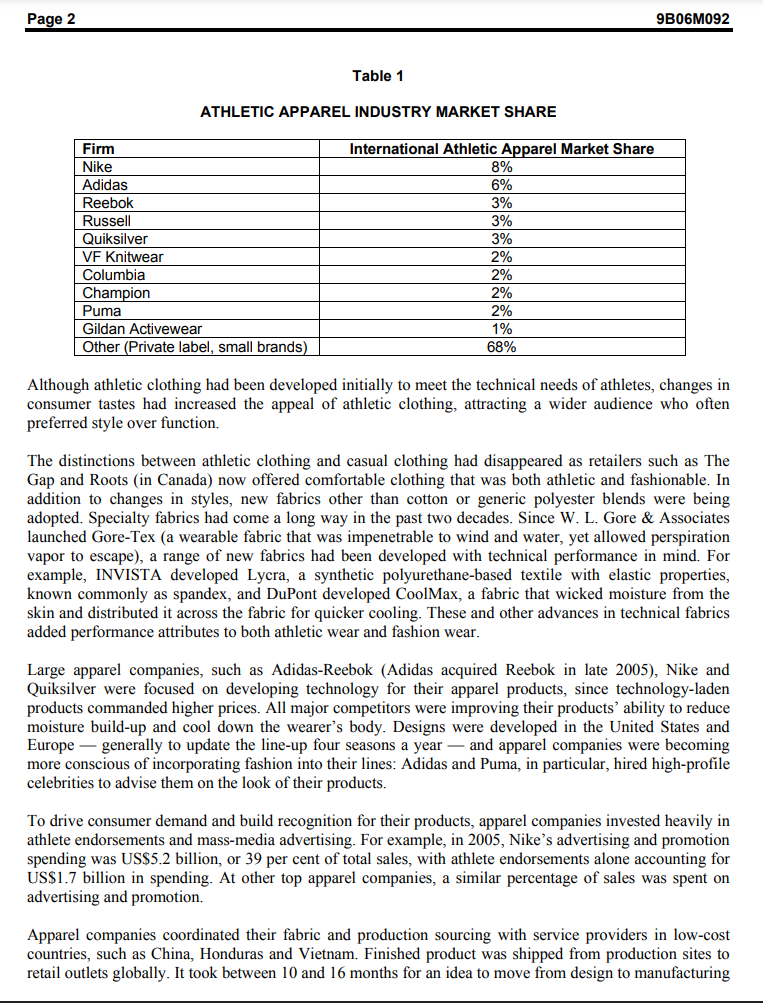

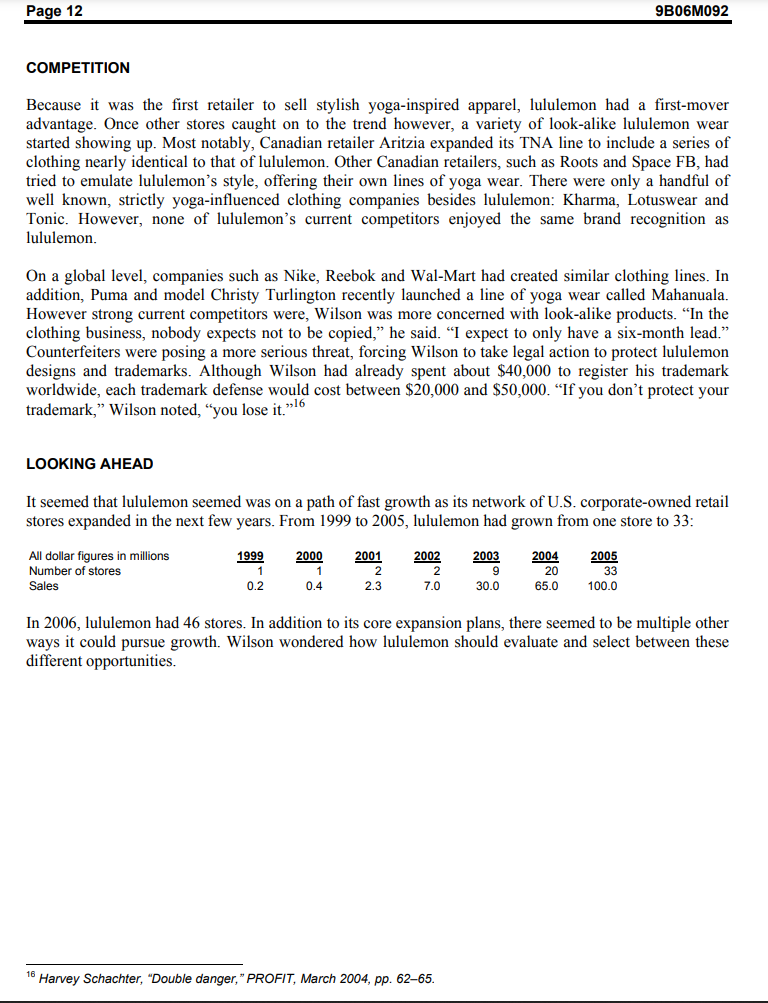

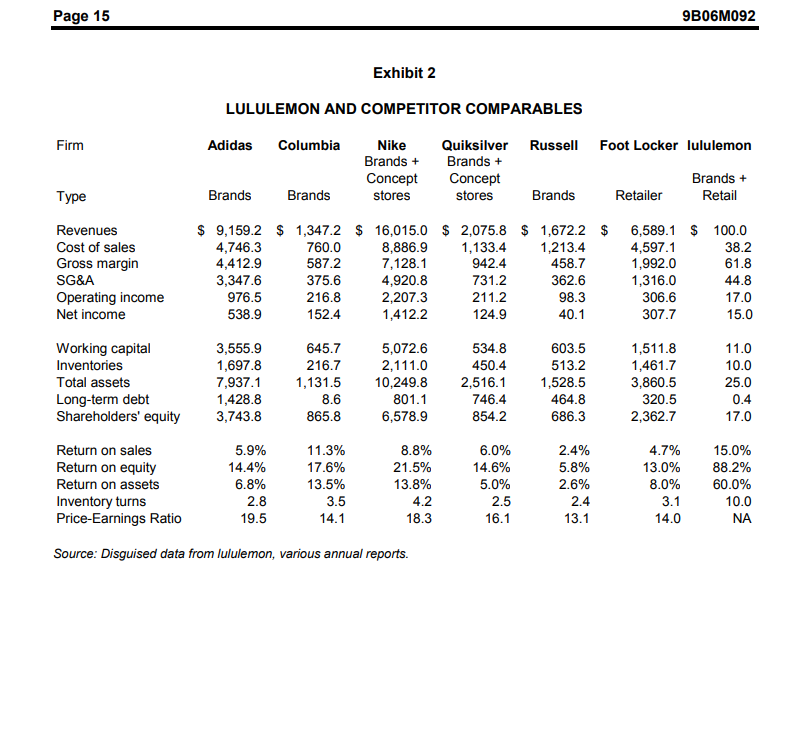

9B06M092 LULULEMON ATHLETICA: PRIMED FOR GROWTH Ken Mark and Patrick Walsh prepared this case under the supervision of Professor Eric Morse solely to provide material for class discussion. The authors do not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. Ivey Management Services prohibits any form of reproduction, storage or transmittal without its written permission. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Management Services, clo Richard Ivey School of Business, The University of Western Ontario, London, Ontario, Canada, N6A 3K7; phone (519) 661-3208; fax (519) 661-3882; e-mail cases@ivey.uwo.ca. Copyright @ 2006, Ivey Management Services Version: (A) 2009-09-23 INTRODUCTION In mid-2006, Chip Wilson, chairman and chief product designer of lululemon athletica (lululemon), was preparing to describe his company's operations to an audience at an investors' conference in Boston, Massachusetts. Founded in 1998, as a designer, manufacturer and retailer of women's yoga-inspired athletic clothing, lululemon, in just eight years, had opened stores in Canada, the United States, Japan and Australia. The firm's revenues were projected to surpass $100 million in 2006. As he prepared to address the audience, Wilson thought about lululemon's great success thus far and its growth opportunities in the next few years. He wondered how he could ensure that while pursuing growth strategies that satisfied the shareholders, lululemon did not overextend itself. THE ATHLETIC APPAREL INDUSTRY The global market for athletic apparel was worth approximately US$47 billion in 2005 and was an aggregate of sales in different sporting segments, such as basketball, football, running, swimming and hiking. No single apparel company owned more than 10 per cent of the market, as can be seen in this following table:" Kate McShane, "Nike, Inc., " Citigroup, December 22, 2005, pp. 62-63.Page 2 QBMMOBZ Table 1 ATHLETIC APPhREL INDUSTRY MARKET SHARE Firrn International Athletic Apparel market Share Nike 3% Adidas 5% Reebok 3% Russell 3% Quikailver 3% VF Knitwear 2% Columbia 2% Champion 2% Puma 2% Gildan Acvewear 1% Other {Private label, small brands) 68% Although athletic clothing had been developed initially to meet the technical needs of athletes, changes in consumer tastes had increased the appeal of athletic clothing, attracting a wider audience who often preferred style over inction. The distinctions between athletic clothing and casual clothing had disappeared as retailers such as The Gap and Roots (in Canada) now offered comfortable clothing that was both athletic and fashionable. In addition to changes in styles, new fabrics other than cotton or generic polyester blends were being adopted. Specialty fabrics had come a long way in the past two decades. Since W. L. Gore & Associates launched Gore-Tex (a wearable fabric that was impenetrable to wind and water, yet allowed perspiration vapor to escape), a range of new fabrics had been developed with technical performance in mind For example, INVISTA developed Lycra, a synthetic polyurethane-based textile with elastic properties, known commonly as spandex, and DuPont developed CoolMax, a fabric that wicked moisture from the skin and distributed it across the fabric for quicker cooling. These and other advances in technical fabrics added performance attributes to both athletic wear and fashion wear. Large apparel companies, such as Adidas-Reebok {Adidas acquired Reebok in late 2005), Nike and Quiksilver were focused on developing technology for their apparel products, since technology-laden products commanded higher prices. All major competitors were improving their products' ability to reduce moisture build-up and cool down the wearer's body. Designs were developed in the United States and Europe generally to update the line-up four seasons a year and apparel companies were becoming more conscious of incorporating fashion into their lines: Adidas and Puma, in particular, hired high-prole celebrities to advise them on the look of their products. To drive consumer demand and build recognition for their products, apparel companies invested heavily in athlete endorsements and mass-media advertising. For example, in 2005, Nike's advertising and promotion spending was US$52 billion, or 39 per cent of total sales, with athlete endorsements alone accounting for US$13 billion in spending. At other top apparel companies, a similar percentage of sales was spent on advertising and promotion. Apparel companies coordinated their fabric and production sourcing with service providers in low-cost countries, such as China, Honduras and Vietnam. Finished product was shipped from production sites to retail outlets globally. It took between 10 and 16 months for an idea to move from design to manufacturing Page 3 9806M092 to retail store:" designs had to be sketched; sample garments had to be made; cutting patterns developed; fabrics procured and cut; garments sewn, pressed and finished; and, finally, product was shipped from offshore factories to retail stores. Athletic apparel was sold mainly through specialized sporting goods retail outlets such as Foot Locker; department stores, such as Federated Department Stores; and mass merchandisers, such as Target Stores. In some cases, the name-brand firms had their own stores, such as Nike's Niketown outlets, which were focused on educating consumers about the technical aspects of the clothing. Retail outlets typically carried apparel as part of a complete athletic offering, alongside footwear and sports equipment. They often stocked brand-name apparel alongside private label and boutique brands. In most cases, because brand-name apparel provided the customer traffic, retailers had to ensure that they stocked the latest lines from the designer-manufacturers. However, private-label brands provided retailers with higher margins since retailers did not incur the heavy advertising and promotion costs required to develop national or global brands. In some cases, new or growing brands, which were often locally produced, were stocked to provide consumers with a broader range of choices. To entice retailers to allocate shelf space to their product lines, these growing brands offered incentives such as margins or discounts that were more generous than those provided by the large, established apparel brands. Athletic apparel was purchased for use in sporting activities and also as fashionable casual clothing. In 2005, women purchased 81 per cent of all athletic apparel, including 60 per cent of men's and 91 per cent of children's apparel. Some of the fastest growing categories were women's apparel for activities such as exercise walking, running, cardiovascular activities and yoga. Yet, aside from Nike's Nike Women retail stores, no large athletic footwear and apparel company had retail stores exclusively devoted to women. (In 2005, 18 per cent of Nike's total sales were products targeted to women.) Competition for the same set of consumers was beginning to increase, as high-end, fashion-oriented apparel makers, such as Ralph Lauren, Prada and Tommy Hilfiger, started to enter the athletic apparel market. For example, Ralph Lauren was a major sponsor of the U.S. Open and was also selling yoga products and activewear under its new Lauren Active line, which made its debut in the spring of 2005. CHIP WILSON In 1979, Wilson started Westbeach, an athletic clothing company focused on the surfing market and, later, on the snowboarding market. In its heyday in the mid-1990s, sales reached $15 million a year, and Westbeach employed a total of 50 people, with offices in Vancouver, Seattle, Innsbruck and Japan. Building Westbeach had not been an easy thing to do. As Wilson recalled, "hours at Westbeach were 29- hour days." The firm's fortunes took a turn for the worse when, in 1997, the combined effects of increasing competition and a collapsing Japanese yen caused sales to drop significantly. In 1997, Wilson sold Westbeach to a U.S. public company. Wilson's timing was great: It was a good time to sell. The Japanese market made up a third of our sales, and it was collapsing fast. The yen was falling, and growth in snowboarding was tapering off. We didn't have enough money to keep going and, the Friday before the sale, we couldn't make payroll: we still had the overhead expenses of a $15-million company even though http://www.kelley.iu.edu/retail/leadtimearticle72401.doc, accessed July 12, 2006. Virginia Leeming, "Surfing the Fashion Wave," The Vancouver Sun, October 2, 2001, p. C3. Paul Luke, "Fashion Guru Saw It Coming as a Kid," The Province, August 26, 2001.Pa 9 4 9306M092 sales had decreased. I moved to Salem, Ore, and worked for about half a year for the company that bought Westbeach. Then] came back to Canada and moved to Vancouver. Selling Westbeach was important. After that, I knew what a winning formula was in this business, and that was skipping the middleman. [just needed the ideas A year later Wilson started lululemon athletica. The startup of lululemon was difcult, as Wilson had to re- mortgage his house to raise sufcient funds to launch his company. Although his house was paid off and re-mortgaging it gave him roughly $300,000 to work with, he had no other funds with which to invest in the rm. LULULEMON ATHLEHCA Wilson had founded lululemon in response to the increased participation of women in athletics, especially yoga. Yoga enthusiasts believed the discipline would lead participants to a sense of peace and well-being, and also a feeling of being at one with their environment Participants were drawn to yoga as an activity for its calming, stress-relieving benets. In addition, yoga's inclusive, non-competitive nature had broad appeal. In the 1990s, global athletic wear companies were primarily focused on men's athletic needs, with manufacturers making only slight modications to the men's lines to create clothing for women. Wilson noticed that while attendance in the yoga classes was rising rapidly, athletic wear companies were not developing clothing to ll this niche market. He hired two designers, contracted out manufacturing to a local rm and opened a small retail shop in Vancouver, British Columbia. Clothing at lululemon was designed with the feedback of athletes and yogis, allowing the company to continually shape the flmctionality and fit of its apparel. The company offered a comprehensive line of athletic pants, tops and yoga accessories. Wilson's goal was to build lululemon into a global athletic brand, known for its technical perfom'iance and great t. Wilson deliberately chose to locate the first lululemon store in Kitsilano, a desirable suburb of Vancouver that attracted active, fashion-conscious residents who often shaped trends that spread across the country. As customers made their purchases, Wilson would solicit their feedback on the clothes. In the centre of the store was the product design studio, where the designers could update their designs. Clothing was manufactured in small batches, and there could be dozens of design changes before a successful product was ready for market. All lululemon clothing was stitched together using a special process called at seaming, which reduced chang during wear. Clothing was also pre-shrunk and available in regular and tall lengths. As an added service, lululemon offered customers an alteration free of charge. Prices of garments averaged $80 each, and gross margins were more than 50 per cent. Although lululemon charged a slightly higher price-point for its products, customers believed that the clothing was worth the price due to the high quality, great style and excellent service they received." 5 mp Wilson,\"Nabhnat Rust Business Magazine, December 2904. 6 Aviva Shealelzky, hijnanadianvalueimeshcswhbgLavaesms'003275.!Ibnl, accessed July 1'2, 2606. Pa 9 5 BBDGMOB2 Consumers Wilson was involved in the design of the products, and he knew what he wanted: feminine, high-quality, hi gh-tech athletic clothing d1at attered all body types His target market was the \"32-year-old professional won-ran.\"T These women were generally well-educated, active in the workforce and had signicant disposable income. In addition to appreciating the technical aspects of lululemon's clothing line, consumers enjoyed being both comfortable and stylish wearing the clothes before and after their yoga workouts . The initial lululemon pant the company's signature product that drew a great response from its target audience, was constructed using a form-tting Lycra blend with ared bottoms. Wilson had originally developed the fabric for Westbeach: it felt like cotton, wicked away moisture, could be inrsed with aloe and repelled bacteria.8 The yoga pant, became the store's best-selling item. Retailing for 593, this pant cost $35 per unit in variable costs to manufacture. Fabric Development and Sourcing Wilson had many contacts in the fabric industry from his two decades of running an athletic apparel company. As a result of this networlc Wilson was able to assess and procure technical fabrics for lululemon garments, such as Luon, a fabric made with 86 per cent nylon and 14 per cent Lycra. This fabric wicked moisture away from skin and had a four-way stretch to allow a lull range of movement. Other proprietary technical fabrics included Silverescent, Vitasea and Stretch French Terry. Fabrics were generally purchased in China and shipped to Vancouver for the manufacturing process. Design As the company grew, lululemon continued its close relationships with customers and sought to integrate their ideas into the design process. At design sessions, held twice a year, one in Eastern Canada and one in Western Canada, a group of athletic professionals or dedicated consumers contributed their views on how garments could be improved. Another research method was to review customers' written feedback or their comments generated from attendance at design sessions. In exchange, lululemon provided a 15 per cent discount on selected articles of clothing. There were typically dozens of R&D members, primarily personal trainers and others who worked in the fitness industry. In addition, customers were encouraged to jot down garment design suggestions on one of the clipboards outside of all change room doors or in a binder at the cash registers. This data was collected and used by the design team to facilitate better demand management and maintain an innovative edge. At its headquarters, lululemon maintained a sample room where hundreds of product designs were housed. From this consumer research, new products were developed and improvements were made to current products. Manufacturing Wilson was aware of the importance the entire value chain played at lululemon. To maximize economies of scale, Wilson first considered fabric prices and manufacturing costs, then forecasted retail sales to determine an optimal fabric purchase and production batch size. At every step of the operation, 7 Paul Luke, 'Fashm Guru Saw tt Coming a5 a m,\" The Province August 26, 2001. 8 Samantha Shepherd 'Man behind the Woman, \"Si-Jarrett FebmaqrMal-ch 2004. Page 6 BBDSMDQZ procedures were examined to increase output and minimize waste, For example, special sewing machines, many times the price of regular sewing machines, were purchased so that seams could be sewn at. Aer patterns were cut out, waste fabric was recovered and re-cut for smaller patterns. Any remaining swatches of fabric were donated to local schools. Products were manufactured in small batches {about 1,000 pieces per batch) and shipped to stores every 45 days. If new products sold well, they were incorporated into the regular line-up. To ensure that quality remained high, products passed through two quality assurance inspections: the rst inspection was performed by factory employees, the second by lululemon employees. Clothing that was destined for North American stores was manufactured primarily in Vancouver, at the rm's two production facilities (lululemon had an equity stake in the factories). Since manufacturing was located in the same city, close monitoring and last-minute changes to product design were possible. As the design department was located above the factory, drawings of new products could be tumed into prototypes the same day. To service its Asia-Pacic stores, Wilson shipped product from a factory owned by the same owners of lululemon's Vancouver factory. Wilson explained why he chose to manufacture clothing in two locations: This is how it works. If we made something here for $20, it would probably cost US$10 to make it in China, but by the time we've changed the US. dollar, paid for shipping duty, and everything else that went with it, it might land at $19. From that point of view, it might not make a difference, so why not make it here, which we did.9 But lululemon's expansion required it to change its sourcing mentality. A $20 Canadian-produced garment, which was as inexpensive as it could be made in Canada, would end up costing $30 after being shipped to intemational stores. He continued: If I ship it out of Asia the landed cost is $20, which is what our competitors would do. So we have two choices, which are to manufacture everything (we sell} in Asia offshore, or to not be in business. You do it or die. w R918\" Sales and Retail \"Educators" In 2006, lululemon had 46 retail stores: 3] in Canada, 13 in the United States, one in Australia and one in Japan. Several other retailers (in regions without a lululemon retail store) carried lululemon products purchased at wholesale prices, The typical lululemon store was 2,500 square feet in size. Most were corporate-owned, with a handful of franchisees owning about five stores. The stores, which attracted customer visits from a wide trade area, were located in high-prestige shopping areas next to retailers such as Banana Republic, The Gap and fine shopping stores, such as Cartier and Gucci. One lululemon store was located next to Wholefoods Market, a US. retailer of gourmet foods. 9 Scott Demo, 'Yaga Mogul Has Cnitics in a Knot, " The TM February 17, 2005, availabb at amamegeemwwmm YJLuiquicy', accessed July 12, 2005. 1 Scott Demo, 'Yoga M'DgulHas Canes in a mt'rne rm Fanmary 17, 2905, available at ntmamm.moomm moon-rim: accessed July 12, 2006. Page 7 9806M092 About 650 retail workers were employed at lululemon. Most store-level employees were selected through group interview processes. They were hired based on their athletic history and whether they possessed an attitude that reflected lululemon's values. In the competitive retail market, lululemon sought to differentiate itself from other retailers through its customer service experience. Wilson insisted that his retail floor staff were not salespeople but rather "educators," and they were trained to simply educate customers - especially on the technical aspects of the garment - and then allow customers to make their own decisions about their purchase. Educators were to greet customers amicably and provide cheerful advice if asked. For example, educators were encouraged to tell guests in the change room areas if pants didn't fit the way they were designed. This open and honest approach boosted customer esteem and created a very positive experience. The following letter from Darrell Kopke, lululemon's general manager to all staff illustrated lululemon's retail-based strategy: Our product designs are innovative, cutting edge, great quality, and technically proficient. Our vertically integrated supply chain is slick and efficient and our production, logistics and distribution center departments are world class. Our training is innovative, cutting edge, and definitely top of class. Our support departments like the CEC (Customer Education Centre), accounting, IT, sustainability, and community education are exceedingly well run. At the end of the day, however, what makes lululemon one of the finest performing companies (in terms of sales per square foot, efficiency, margins, etc.) in the world is our retail floor experience. I wanted to celebrate the retail floor because it is the foundation of our success and the most important department, by far, in this company. Our guests are our livelihood. We set a "Wow! It's You!" customer experience as the minimum standard of guest interaction. If it were not for our guests, we would not be on track today to fulfill our mission of elevating the world from mediocrity to a place of greatness. How important are our guests? Think about the lives of our employees, our families, our suppliers, employees, their families, etc. Decisions we make impact the lives of many people and everything centers on the lululemon guest experience. Our winning formula is focused on the retail floor. Almost all lululemon employees work the retail floor because as policy makers we need to be great retailers. We are retailers first.... The retail floor is our R&D Centre. We ask for feedback. We seek to understand. We educate. We react and adapt. We listen. This concept of our retail floor as an R&D centre has been so successful for us. In addition to an hourly wage that was 30 per cent higher than the standard minimum wage paid for most retail positions, lululemon offered its employees benefits and free yoga classes. Staff were governed by "egoless" management and were constantly being asked for feedback. A transparent communication structure and an environment where management openly valued employee input significantly lowered part-time employee turnover to 20 per cent, far below the 67 per cent average turnover rate in the retail industry.Page 8 BBOSMDQZ Me rchand ising A staff member who was \"head of merchandising\" at each store location carried out all merchandising efforts. Interested staff augmented the position, however the basic concept of pant display was always similar: Pant mannequins were placed just above eye level and below each mannequin were cubby holes with pants neatly folded and an'anged by size. Unlike displays at other athletic retailers, there was no need to sort through horizontally arranged garments on hangers to locate a particular size. The store's entire stock of garments was on the floor, allowing the store manager to instantly monitor inventory levels. A folding table was located in the middle of the display area, allowing employees to refold and restock clothes that customers had browsed through, while being available for customer enquiries. Ma rketing Marketing activities at lululemon were designed to generate awareness through word of mouth. Each store had a \"community educator\" who was in charge of recruiting half a dozen ambassadors for the store. These ambassadors were \"connectors\" to the community for the lululemon brand. They were typically yoga instructors, personal trainers or professionals in their athletic pursuit rarely were marquee professional athletes used to endorse products. Photos of the ambassador wearing lululemon clothing were placed in stores, and some ambassadors were recognized by customers who lived in the same community In addition, to tap into their expertise, design feedback was regularly solicited from ambassadors. In addition to the ambassador program, lululemon advertised in yoga magazines and sponsored attention-grabbing activities {for example, the first few people who showed up naked at a Vancouver store opening were given free clothes). Over the years, local and national media outlets had written extensively about the company. At lululemon, marketing costs were about one per cent of sales. Human Resources and Organizational Culture It was lululemon's policy to hire people who were passionate about work and life, and committed to the company's motto: \"providing components for people to live longer, healthier and more fun lives.\" Employees enjoyed competitive salaries and a profit-sharing plan, and could purchase company shares; in 2006, employees owned 10 per cent of lululemon's outstanding shares. Management worked to foster a culture where individuals were respected. The lululemon's website describes the company's approach to managing and supporting employees: At lululemon athletica, we respect each individual for their uniqueness and the value they bring to our world. We place an emphasis on self-empowerment and positive inner development, and taking responsibility for our own lives. We support our team members with a comprehensive educational \"success\" library, as well as world-class training tools to assist them in developing their chosen areas of expertise. We work interactively as an organization to encourage goal setting and excellence in both our personal and professional lives. We offer our employees free yoga classes in our local communities as well as at a beautiful studio adjacent to our Vancouver factory, and our factory staff enjoy yogafstretch breaks with an inhouse yoga instructor. Our employees embody the lululemon culture and believe in our company spirit, which aims toward a balanced, Page 9 BBOSMDBZ healthy life. We go hiking in the summer, snow-running in the winter and work and play together year round. At lululemon, we believe it is vital to walk the talk and talk the talk or we will never be able to maintain a culture of integrity and inspire people to live longer, healthier and more fun lives. For more information on lululemon's culture, see Exhibit 1. Financials The company had grown from just $200,000 in sales in 1999 to $100 million in sales in 2005. Amazingly, lululemon had funded its expansion entirely through free cash ow, estimated by observers to be between 10 and 20 per cent of sales. All stores were rented, and customers typically paid with cash or credit. The rm maintained very little long-term debt (less than half a million dollars} and returned excess capital to investors via dividends. In December 2005, Wilson sold 48 per cent of his rm to Advent Intemational and Highland lCapital Partners, The enterprise value of the transaction was $225 million. After the sale, Wilson owned approximately 42 per cent of lululemon, with the remaining 10 per cent owned by employees. The sale provided Wilson partial liquidity and allowed him to spend more time with his family. In connection with the investment, Wilson had appointed fonner Reebok chief executive ofcer (CEO) and Advent operating partner Robert Meers as the new CEO of lululemon. Initially, Meers had been introduced to Wilson as a great addition to lululemon's board of directors. As Wilson got to know him, Wilson realized that Meers's extensive consumer and retail experience would be valuable in leading the company through its aggressive US. expansion plans. When Wilson approached Meers with an invitation to replace him as CEO of lululemon, Meers accepted, leaving Wilson with the role of chairman and chief product designer. EXPANSION INITIATIVES Wilson was constantly evaluating ways to expand lululemon's activities. To reach his goal of making tululemon a global athletic brand, Wilson had to search out or create opportunities and evaluate them on an ongoing basis. Several of the opportunities that Wilson is currently confronted with are listed below. Wholesaling From its inception, lululemon had offered wholesale accounts to yoga studios and pilates studios. Minimum orders ranged between $1,000 and $1,500 every four to six weeks. Orders would take about a week to pick and pack, with shipping taking no longer than one week. Trade terms were net 30 with a 10 per cent discount for cash on delivery. Typically, product was sold to wholesale accounts at 30 per cent below the suggested retail price. However, tululemon reserved the right to terminate wholesale agreements at any time. For example, wholesale accounts would be terminated if they were located in the same vicinity as new corporate or franchised stores. In 2005, wholesaling revenues accounted for about ve per cent of sales. With 46 stores around the world, wholesaling product to drive revenue growth and margins seemed like a promising option. Sales from lululemon's Asian-based wholesale accounts were growing rapidly compared to Page 10 BBDGMDSZ domestic and US. store sales, and Wilson wondered whether it would be more benecial to replace these wholesale accounts with joint-venture stores in Asian countries such as Hong Kong, Japan and Australia." How important was the in-store customer experience for people purchasing lululemon gear? Should Wilson actively recruit wholesale accounts in local North American markets not currently served by stores? Web-based Sales Clothing was currently not sold from lululemon's website. However, it had developed a basic website to see if there was an opportunity to generate Web-based sales. Wilson believed that his Web consumers generally lived in areas without a lululemon presence, and might buy two to three items at the same time. In addition to paying ill price for the product Web consumers would pay appropriate shipping fees and duties (if purchasing -om the United States or abroad). Credit cards would be the only accepted form of payment. Managing the sales portion of the website would require dedicated associates, who would update new styles every 45 days, receive, pick and ship orders. Maintenance of the site itself would be the responsibility of the marketing department. Making the current website sales-ready would cost approximately $1 million and would require about $250,000 a year in variable costs. Was developing the capability to sell online the right move for lululemon\"?I Franchising A handil of lululemon's current stores were franchised. Wilson's employee-focused philosophy extended to the rm's selection of potential franchisees \"We just wait for the right person to show up and, if they have money, we set up a franchise and, if they don't we set up a corporate store and have them run it. We don't set a goal {for the number of franchises we'd like}. We're patient for the right people to make a project work.\"'2 He looked for investors with about $500,000 to invest in a store. The costs broke down as follows: a $25,000 franchise fee, with the other $475,000 for leases, improvements, inventory, training, pre-opening marketing expenses and working capital. Product was purchased for 30 per cent below the suggested retail price. Franchisees had to be passionate about athletics, health, success and retailing. They had to work at least 30 hours per week on the retail oor in order to know their store guests, their needs and the lululemon brand.'3 The company had buy-out clauses in each franchisee agreement, in case it needed to regain control of stores for any reason. Interest in lululemon products was not limited to Asian investors. In the United Kingdom alone, 30 prospective franchisees were interested. The two regions differed signicantly: the United Kingdom and Europe were similar to North America in climate and in cultural environment, whereas Asian countries (not including Australia) were not. Although lululemon could continue its current strategy of focusing on growth through corporate stores, was there a way to augment this growth by aggressively signing up qualied franchisees? u Peter \"than, 'l'uiulemon Leaks West {mariner-ram Opportunities \"Business in- Vancouver, Apt-it 2026, 2004. '2 'Chip Mtson,\"Naubnai F'batuainess Magazine, December 2004. '3 Mum website, 'Fianctmhg 0&1, \"December 15, 2005, accessed 12 July 2006. Page 11 9806Mlm2 Other Athletic Wear Markets Over the years, lululemon had built considerable brand equity among yoga fans and, with the number of yoga participants in the United States jumping more than ve-fold, from three million in 2000 to 16.5 million in 2005, growth opportunities for the business were excellent.\" Wilson wondered whether there was an opportunity to become the leader in another sport or activity. Currently, lululemon was branching out into clothing for specialized sports, with approximately 15 per cent of its clothing targeted at such activities as running, rowing, rock-climbing and \"multi-sport\" {dened as a combination of several activities such as hiking and biking, or sports such as triathlon.) Should lululemon's brand be extended beyond its original promise of good-looking, technical yoga wear for women? Menswear Since 2000, lululemon had a limited menswear line that accounted for about 10 per cent of each store's merchandise, with similar prices and margins. The market for men's athletic clothing dwarfed that of women's athletic clothing. Was there an opportunity to signicantly expand lululemon's menswear line? 00000 Over the years, lululemon customers had expressed interest in buying comfortable and fashionable clothing made from natural and organic materials. Wilson saw an opportunity to meet this customer need and help develop the sustainable fibre industry. In 2005, he launched OQOQO, a streetwear line of clothing that combined fashion and social conscience to provide environmentally friendly clothing. Part of OQOQO's mandate was \"to provide a threshold demand for sustainable textiles to make it economically feasible for each area of the textile supply chain, from farms to fabric mills to manufacturers and even other retailers, to follow suit\" Thus, OQOQO committed to having all of its garments contain at least 75 per cent natural, organic or sustainable material, with the ultimate goal of containing 100 per cent renewable resources in the next few years. As the OQOQO website stated: We aim to support the textile industry as a whole to increase its use of organic and sustainable bers. Large scale production of these types of bers and fabrics is not a significant part of the garment industry. This is largely due to a lack of demand which leads to inefficient economics within the production chain. The fashion segment in Canada was worth about $9 billion annually, or slightly more than half of total annual Canadian clothing store sales of $16 billion. In Toronto, Canada's largest city, home to about 10 per cent of the country's population, there were 4,600 fashion retail stores generating annual retail sales of $2.6 billion, and 550 apparel manufacturers producing garments worth $1.4 billion at wholesale prices.IS In mid-2006, lululemon had invested about $1.5 million into OQOQO, operating two stores in Vancouver. How should lululemon management divide their time between growing their original lululemon stores and working on the OQOQO opportunity? 1" \"Minter-nan emerge Gains Para-Jets in Gm Equity lit-resonant, \"Highland Capital Partners Press Release, December a, 2905. U \"Toronto's Key industry Omelet-5' FashicanppamLthymmmccafemanm. him Jul 12, 2006. Page 12 9806M092 COMPETITION Because it was the first retailer to sell stylish yoga-inspired apparel, lululemon had a first-mover advantage. Once other stores caught on to the trend however, a variety of look-alike lululemon wear started showing up. Most notably, Canadian retailer Aritzia expanded its TNA line to include a series of clothing nearly identical to that of lululemon. Other Canadian retailers, such as Roots and Space FB, had tried to emulate lululemon's style, offering their own lines of yoga wear. There were only a handful of well known, strictly yoga-influenced clothing companies besides lululemon: Kharma, Lotuswear and Tonic. However, none of lululemon's current competitors enjoyed the same brand recognition as lululemon. On a global level, companies such as Nike, Reebok and Wal-Mart had created similar clothing lines. In addition, Puma and model Christy Turlington recently launched a line of yoga wear called Mahanuala. However strong current competitors were, Wilson was more concerned with look-alike products. "In the clothing business, nobody expects not to be copied," he said. "I expect to only have a six-month lead." Counterfeiters were posing a more serious threat, forcing Wilson to take legal action to protect lululemon designs and trademarks. Although Wilson had already spent about $40,000 to register his trademark worldwide, each trademark defense would cost between $20,000 and $50,000. "If you don't protect your trademark," Wilson noted, "you lose it."16 LOOKING AHEAD It seemed that lululemon seemed was on a path of fast growth as its network of U.S. corporate-owned retail stores expanded in the next few years. From 1999 to 2005, lululemon had grown from one store to 33: All dollar figures in millions 1999 2000 2001 2002 2003 2004 2005 Number of stores 20 33 Sales 0.2 0.4 2.3 7.0 30.0 65.0 100.0 In 2006, lululemon had 46 stores. In addition to its core expansion plans, there seemed to be multiple other ways it could pursue growth. Wilson wondered how lululemon should evaluate and select between these different opportunities. 16 Harvey Schachter, "Double danger," PROFIT, March 2004, pp. 62-65.Page 1 3 QBOEMDBZ Exhibit 1 LULULEMON MANIFESTO . Drink FRESH water and as much water as you can, Water ushes unwanted toxins and keeps your brain sharp. - Observe a plant before and after watering and relate the benets to your body and brain. - Coke, Pepsi and all other pops will be known as the cigarettes of the future. Colas are NOT a substitute for water. Colas are just another cheap drug made to look great by advertising. - Be yoga. Breathing has yOu live in the moment and stretching releases toxins from your muscles. . Do yoga so you can remain active in physical sports as you age. . Listen, listen, listen, and then ask strategic questions. . SWEAT once a day to regenerate your skin. . Compliments from the heart elevate another person's spirit and will often result in an encouraging word for someone else a domino effect. - Your outlook on life is a direct reection of how much you like yourself. . Life is full of setbacks. Success is determined by how you handle setbacks. . Write down your short and long term GOALS four times a year. 2 personal, 2 business and one health goal. A university found only 3 percent of the students had written goals. 20 years later, the same 3 percent were wealthier than the other 97% combined. . You ALWAYS have choice and the conscious brain can only hold one thought at a time. Choose a positive thought. I Communication is COMPLICATED, Each person is raised in a different family with a different denition of each word. I Love. - Jealousy works the opposite way you want it to. - Nature wants us to be mediocre because we have a greater chance to survive and reproduce. Mediocre is as close to the bottom as it is to the top. Be creative. Do one thing a day that scares you. - Take various vitamins. You never know what small mineral can eliminate the bottleneck to everlasting health. Page 14 9 306M092 . Dance, sing, oss and travel. I Do not use cleaning chemicals on your kitchen counters. Try vinegar and lemon. Someone will inevitably make a sandwich on your counter. . Rules of Marriage: respect the other person, compromise, be open to communicate, and build a common set of life values. If you don't do this, you are in a lot of trouble. I. Just like you did not know what an orgasm was before you had one, nature does not let you know how great children are until you have them. Children are the orgasm of life. - Friends are more important than money. Don't trust that an old age pension will be sufficient. . Live near the ocean and inhale the pure salt air that ows over the water. Vancouver will do nicely. Stress is related to 99% of all illnesses. - One hour of aerobic exercise will release endorphins to regenerate cells and offset stress. - A daily hit of athletic induced endorphins will give you the power to make better decisions and help you be at peace with yourself. . Wake up and realize you are surrounded by amazing iends. - lululemon athletica was formed to provide people with components to live a longer, healthier and more Jn life. If we can produce products to keep people active and stress free, we believe the world will be a better place. - Do it now. The world is changing AT SUCH A RAPID rate that waiting to implement changes will leave you two steps behind. DO IT NOW, DO IT NOW! Source: Mam torment-meanwuttumwmnesmn July 12, 2006. Page 15 9806M092 Exhibit 2 LULULEMON AND COMPETITOR COMPARABLES Firm Adidas Columbia Nike Quiksilver Russell Foot Locker lululemon Brands + Brands + Concept Concept Brands + Type Brands Brands stores stores Brands Retailer Retail Revenues $ 9,159.2 $ 1,347.2 $ 16,015.0 $ 2,075.8 $ 1,672.2 $ 6,589.1 $ 100.0 Cost of sales 4,746.3 760.0 8,886.9 1,133.4 1,213.4 4,597.1 38.2 Gross margin 4,412.9 587.2 7,128.1 942.4 458.7 1,992.0 61.8 SG&A 3,347.6 375.6 4,920.8 731.2 362.6 1,316.0 44.8 Operating income 976.5 216.8 2,207.3 211.2 98.3 306.6 17.0 Net income 538.9 152.4 1,412.2 124.9 40.1 307.7 15.0 Working capital 3,555.9 645.7 5,072.6 534.8 603.5 1,511.8 11.0 Inventories 1,697.8 216.7 2, 111.0 450.4 513.2 1,461.7 10.0 Total assets 7,937.1 1,131.5 10,249.8 2,516.1 1,528.5 3,860.5 25.0 Long-term debt 1,428.8 8.6 801.1 746.4 464.8 320.5 0.4 Shareholders' equity 3,743.8 865.8 6,578.9 854.2 686.3 2,362.7 17.0 Return on sales 5.9% 11.3% 8.8% 6.0% 2.4% 4.7% 15.0% Return on equity 14.4% 17.6% 21.5% 14.6% 5.8% 13.0% 88.2% Return on assets 6.8% 13.5% 13.8% 5.0% 2.6% 8.0% 60.0% Inventory turns 2.8 3.5 4.2 2.5 2.4 3.1 10.0 Price-Earnings Ratio 19.5 14.1 18.3 16.1 13.1 14.0 NA Source: Disguised data from lululemon, various annual reports.Hint 1: This entire semester has been focused on the Diamond-E Framework. Make sure to use all elements in your analysis. 1. Strategy Model 2. Environment Analysis 3. Resource Analysis 4. Management Preference Analysis 5. Strategy-Organization Analysis 6. Change Plan for each Diamond-E framework element Hint 2: The case study provides lots of information Lululemon's growth, manufacturing, competition, lines of business, franchising, financial performance, etc. Print out and highlight information used to support your case response to ensure you are using 1) information only from the case, and 2) using as much case information as possible. Hint 3: Evidence from the case is what is most important. Make sure all your assessments, opinions, and recommendations, are data-backed Hint 4: This is a strategy case and not a "ratio crunch case study". In fact, lots of ratios have already been crunched Hint 5: Question #2 refers to the "Strategy Model" and it has its own section in the marking rubric, separate from the Diamond-E framework Hint 6: Pay close attention to the marking rubricMarking Rubric Highest case mark Highest case mark Highest case mark Highest case mark possible 100% possible 71% possible 39.5% possible 12.5% Automatic failure of the Demonstrates an Ability to concisely Demonstrates some case ability to effetely acceptable ability to and effectively Demonstrates an summarize the summarize the Executive summarize the topic/ topic/issues/solution topic/issues/solution nadequate ability to Summary issues/ solutions s from the report in s from the report in effectively summarize from the report in no no more than 2 no more than 2 the topic/ issues/ more than 2 slides solutions from the slides slides report (15%) (10%) 7.5%) (2.5%) 5 or more elements 3-4 elements of the 2 elements of the Less than 2 elements of Strategic Model Strategic Model the Strategic Model Evaluation of of the Strategic Model were were identified were identified were leveraged; current leveraged; leveraged; leveraged; evaluation of strategy strategy evaluation of evaluation of evaluation of was not insightful strategy was strategy was mostly strategy was insightful insightful somewhat insightful (5% (3%) (2%) (0%) Sense of urgency Sense of urgency Sense of urgency Sense of urgency is was clearly was mostly well was not clearly missing and/or is not articulated and articulated and/or articulated and/or backed by evidence Urgency backed by strong backed by backed by weak from the Strategy evaluation evidence from the moderately strong evidence from the Model Strategy Model evidence from the Strategy Model Strategy Model{20%) {1 5%) {10%} {0%) Evaluation of Evaluated 4 or more Evaluated 2-3 or Evaluated 1-2 or Didn't evaluate any opportunities opportunities more opportunities more opportunities opportunities {25%) {1 5%) {7.5%} {5%) Supports Supports Supports Recommendations and Recommends recommendations recommendations recommendations alternatives are not one and alternatives with and alternatives with and alternatives with properly supported with strong arguments reasonable weak arguments evidence and evidence arguments and and evidence evidence {2 5%) {20%) {10%) (5%) All parts of the Missing no more Missing no more Missing more than 2 Use of Diamond-E than 1 part ofthe than 2 parts of the parts of the Diamond-E Diamond-E framework are Diamond-E Diamond-E framework and existing Framework incorporated, framework and framework and parts are correct relevant, and correct existing parts are existing parts are correct correct {10%) (3%) {2.5%} (0%) Use of Used 4 or more non- Used 2-3 non- Used 1 non- Didn't use any non- frameworks Diamond-E Diamond-E Diamond-E) Diamond-E frameworks {non- frameworks frameworks frameworks Diamond-E} Writing Writing is Writing lacks clarity Writing is unfocused, demonstrates a accomplished in or conciseness and rambling, or contains sophisticated clarity, terms of clarity, contains numerous serious errors: lacks conciseness, and conciseness; and errors; gives detail and relevant data Case correctness: includes contains only a few insufficient detail and information; poorly Structure thorough details and errors; includes and relevant data organized. relevant data and sufficient details and and information; information; relevant data and lacks organization extremely well- information; well- organized organized Weighting on nal grade: 25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts