Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is tax based question , please answer as soon as possible please do not use excel, i need the detailed steps on a paper

this is tax based question , please answer as soon as possible

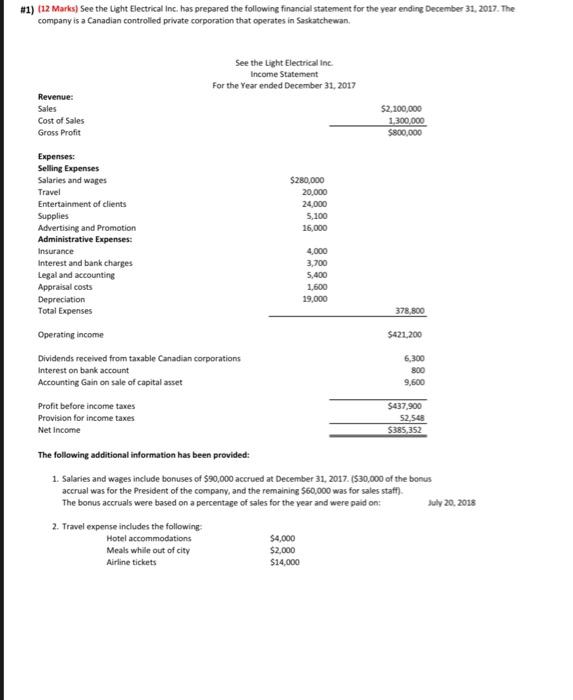

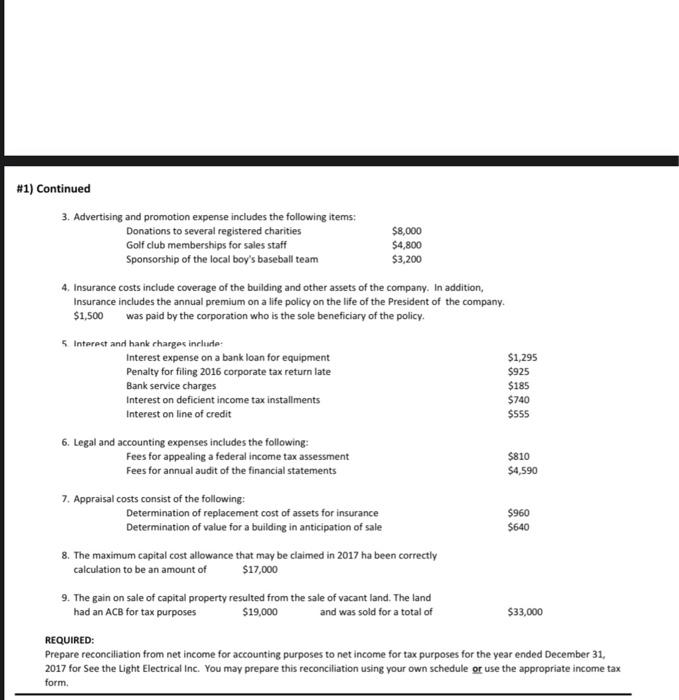

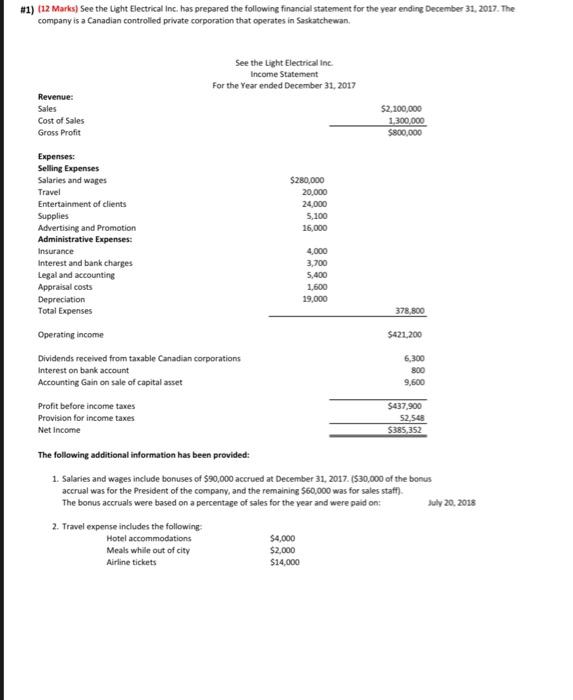

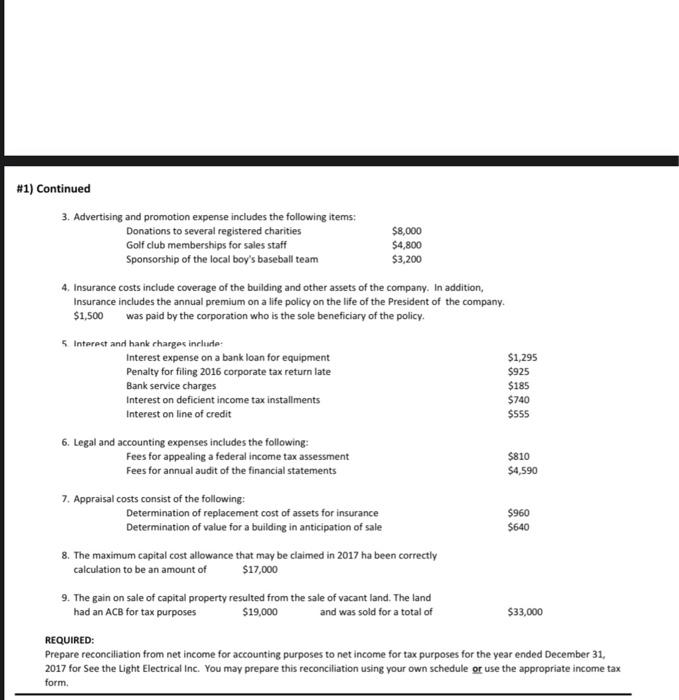

#1) (12 Marks) See the Light Electrical Inc. has prepared the following financial statement for the year ending December 31, 2017. The company is a Canadian controlled private corporation that operates in Saskatchewan. See the light Electrical in Income Statement For the Year ended December 31, 2017 Revenue: Sales Cost of Sales Gross Profit $2,100,000 1.300.000 $800,000 $280,000 20.000 24,000 5.100 16,000 Expenses: Selling Expenses Salaries and wages Travel Entertainment of clients Supplies Advertising and Promotion Administrative Expenses: Insurance Interest and bank charges Legal and accounting Appraisal costs Depreciation Total Expenses 4,000 3,700 5,400 1,600 19.000 378.800 Operating income $421,200 6.300 800 9,600 Dividends received from taxable Canadian corporations Interest on bank account Accounting Gain on sale of capital asset Profit before income taxes Provision for income taxes Net Income $437,900 52.548 $385,352 The following additional information has been provided: 1. Salaries and wages include bonuses of $90,000 accrued at December 31, 2017 (530,000 of the bonus accrual was for the President of the company, and the remaining 560,000 was for sales staff) The bonus accruals were based on a percentage of sales for the year and were paid on: July 20, 2018 2. Travel expense includes the following Hotel accommodations $4,000 Meals while out of city $2.000 Airline tickets $14,000 #1) Continued 3. Advertising and promotion expense includes the following items: Donations to several registered charities $8,000 Golf club memberships for sales staff $4,800 Sponsorship of the local boy's baseball team $3,200 4. Insurance costs include coverage of the building and other assets of the company. In addition, Insurance includes the annual premium on a life policy on the life of the President of the company. $1,500 was paid by the corporation who is the sole beneficiary of the policy. 5 Interact and hank charges include Interest expense on a bank loan for equipment $1,295 Penalty for filing 2016 corporate tax return late $925 Bank service charges $185 Interest on deficient income tax installments $740 Interest on line of credit $555 6. Legal and accounting expenses includes the following: Fees for appealing a federal income tax assessment $810 Fees for annual audit of the financial statements $4,590 7. Appraisal costs consist of the following: Determination of replacement cost of assets for insurance $960 Determination of value for a building in anticipation of sale $640 8. The maximum capital cost allowance that may be claimed in 2017 ha been correctly calculation to be an amount of $17,000 9. The gain on sale of capital property resulted from the sale of vacant land. The land had an ACB for tax purposes $19,000 and was sold for a total of $33,000 REQUIRED: Prepare reconciliation from net income for accounting purposes to net income for tax purposes for the year ended December 31, 2017 for See the Light Electrical Inc. You may prepare this reconciliation using your own schedule or use the appropriate income tax form. #1) (12 Marks) See the Light Electrical Inc. has prepared the following financial statement for the year ending December 31, 2017. The company is a Canadian controlled private corporation that operates in Saskatchewan. See the light Electrical in Income Statement For the Year ended December 31, 2017 Revenue: Sales Cost of Sales Gross Profit $2,100,000 1.300.000 $800,000 $280,000 20.000 24,000 5.100 16,000 Expenses: Selling Expenses Salaries and wages Travel Entertainment of clients Supplies Advertising and Promotion Administrative Expenses: Insurance Interest and bank charges Legal and accounting Appraisal costs Depreciation Total Expenses 4,000 3,700 5,400 1,600 19.000 378.800 Operating income $421,200 6.300 800 9,600 Dividends received from taxable Canadian corporations Interest on bank account Accounting Gain on sale of capital asset Profit before income taxes Provision for income taxes Net Income $437,900 52.548 $385,352 The following additional information has been provided: 1. Salaries and wages include bonuses of $90,000 accrued at December 31, 2017 (530,000 of the bonus accrual was for the President of the company, and the remaining 560,000 was for sales staff) The bonus accruals were based on a percentage of sales for the year and were paid on: July 20, 2018 2. Travel expense includes the following Hotel accommodations $4,000 Meals while out of city $2.000 Airline tickets $14,000 #1) Continued 3. Advertising and promotion expense includes the following items: Donations to several registered charities $8,000 Golf club memberships for sales staff $4,800 Sponsorship of the local boy's baseball team $3,200 4. Insurance costs include coverage of the building and other assets of the company. In addition, Insurance includes the annual premium on a life policy on the life of the President of the company. $1,500 was paid by the corporation who is the sole beneficiary of the policy. 5 Interact and hank charges include Interest expense on a bank loan for equipment $1,295 Penalty for filing 2016 corporate tax return late $925 Bank service charges $185 Interest on deficient income tax installments $740 Interest on line of credit $555 6. Legal and accounting expenses includes the following: Fees for appealing a federal income tax assessment $810 Fees for annual audit of the financial statements $4,590 7. Appraisal costs consist of the following: Determination of replacement cost of assets for insurance $960 Determination of value for a building in anticipation of sale $640 8. The maximum capital cost allowance that may be claimed in 2017 ha been correctly calculation to be an amount of $17,000 9. The gain on sale of capital property resulted from the sale of vacant land. The land had an ACB for tax purposes $19,000 and was sold for a total of $33,000 REQUIRED: Prepare reconciliation from net income for accounting purposes to net income for tax purposes for the year ended December 31, 2017 for See the Light Electrical Inc. You may prepare this reconciliation using your own schedule or use the appropriate income tax form please do not use excel, i need the detailed steps on a paper if possible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started