this is tax question

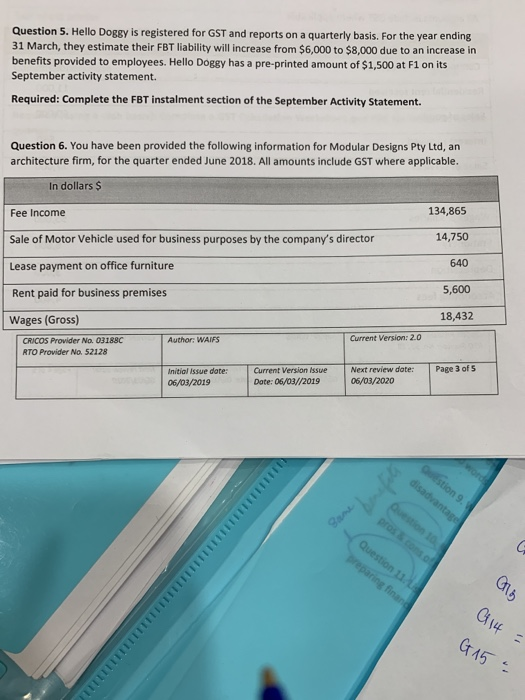

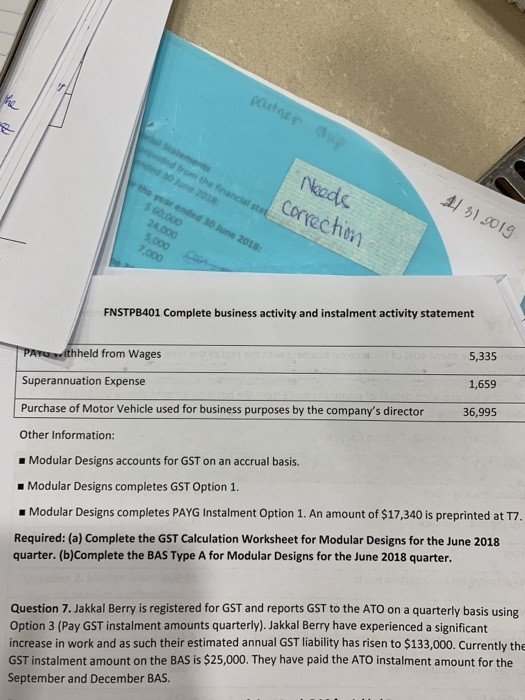

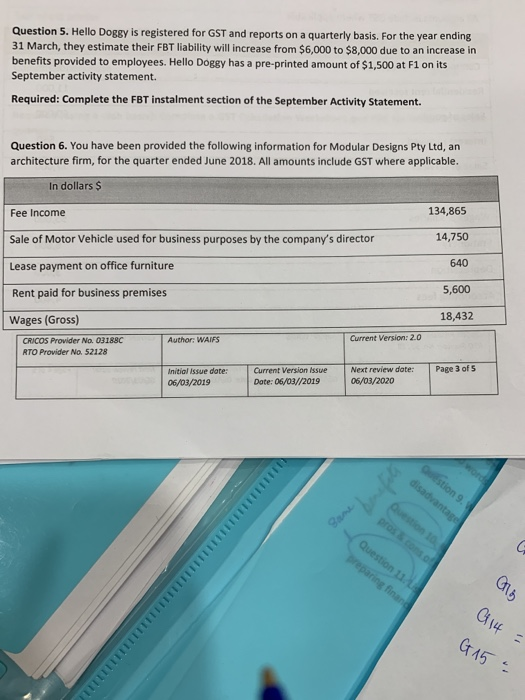

Question 5. Hello Doggy is registered for GST and reports on a quarterly basis. For the year ending 31 March, they estimate their FBT liability will increase from $6,000 to $8,000 due to an increase in benefits provided to employees. Hello Doggy has a pre-printed amount of $1,500 at F1 on its September activity statement. Required: Complete the FBT instalment section of the September Activity Statement Question 6. You have been provided the following information for Modular Designs Pty Ltd, an architecture firm, for the quarter ended June 2018. All amounts include GST where applicable. In dollars$ 134,865 Fee Income Sale of Motor Vehicle used for business purposes by the company's director Lease payment on office furniture Rent paid for business premises Wages (Gross) 14,750 640 5,600 18,432 Current Version: 2.0 CRICOS Provider No. 03188C RTO Provder No. 52128 Author: WAIFS Next review date: Page 3 of 5 Initial Issue dote: Current Version issue Date: 06/03//2019 06/03/2019 5 Iy G. 1 2. orechen FNSTPB401 Complete business activity and instalment activity statement hheld from Wages 5,335 1,659 36,995 Superannuation Expense Purchase of Motor Vehicle used for business purposes by the company's director Other Information: Modular Designs accounts for GST on an accrual basis. Modular Designs completes GST Option 1. Modular Designs completes PAYG Instalment Option 1. An amount of $17,340 is preprinted at T7. Required: (a) Complete the GST Calculation Worksheet for Modular Designs for the June 2018 quarter. (b)Complete the BAS Type A for Modular Designs for the June 2018 quarter. Question 7. Jakkal Berry is registered for GST and reports GST to the ATO on a quarterly basis using Option 3 (Pay GST instalment amounts quarterly). Jakkal Berry have experienced a significant increase in work and as such their estimated annual GST liability has risen to $133,000. Currently the GST instalment amount on the BAS is $25,000. They have paid the ATO instalment amount for the September and December BAS Question 5. Hello Doggy is registered for GST and reports on a quarterly basis. For the year ending 31 March, they estimate their FBT liability will increase from $6,000 to $8,000 due to an increase in benefits provided to employees. Hello Doggy has a pre-printed amount of $1,500 at F1 on its September activity statement. Required: Complete the FBT instalment section of the September Activity Statement Question 6. You have been provided the following information for Modular Designs Pty Ltd, an architecture firm, for the quarter ended June 2018. All amounts include GST where applicable. In dollars$ 134,865 Fee Income Sale of Motor Vehicle used for business purposes by the company's director Lease payment on office furniture Rent paid for business premises Wages (Gross) 14,750 640 5,600 18,432 Current Version: 2.0 CRICOS Provider No. 03188C RTO Provder No. 52128 Author: WAIFS Next review date: Page 3 of 5 Initial Issue dote: Current Version issue Date: 06/03//2019 06/03/2019 5 Iy G. 1 2. orechen FNSTPB401 Complete business activity and instalment activity statement hheld from Wages 5,335 1,659 36,995 Superannuation Expense Purchase of Motor Vehicle used for business purposes by the company's director Other Information: Modular Designs accounts for GST on an accrual basis. Modular Designs completes GST Option 1. Modular Designs completes PAYG Instalment Option 1. An amount of $17,340 is preprinted at T7. Required: (a) Complete the GST Calculation Worksheet for Modular Designs for the June 2018 quarter. (b)Complete the BAS Type A for Modular Designs for the June 2018 quarter. Question 7. Jakkal Berry is registered for GST and reports GST to the ATO on a quarterly basis using Option 3 (Pay GST instalment amounts quarterly). Jakkal Berry have experienced a significant increase in work and as such their estimated annual GST liability has risen to $133,000. Currently the GST instalment amount on the BAS is $25,000. They have paid the ATO instalment amount for the September and December BAS