Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is tax,please do it in detail QUESTION 5 You are a certified tax agent and a partner of Messrs. House & Partners, a well-known

this is tax,please do it in detail

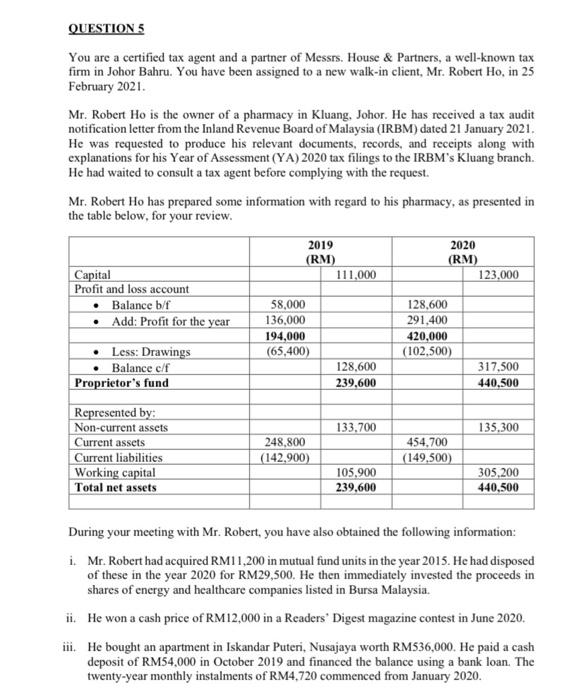

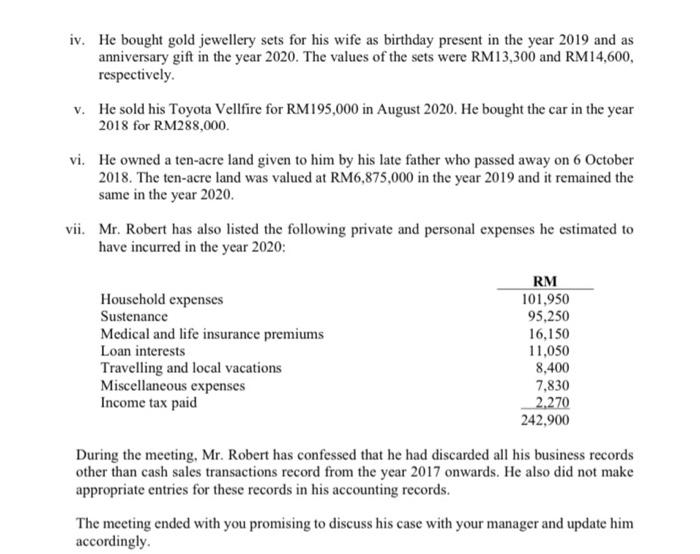

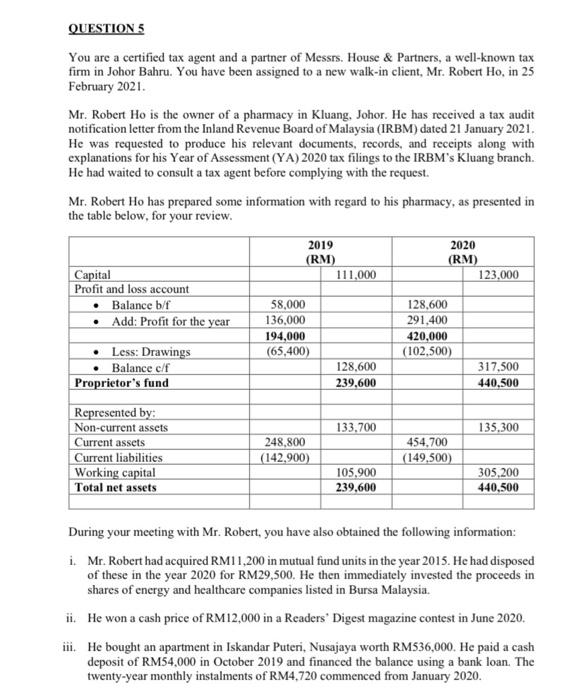

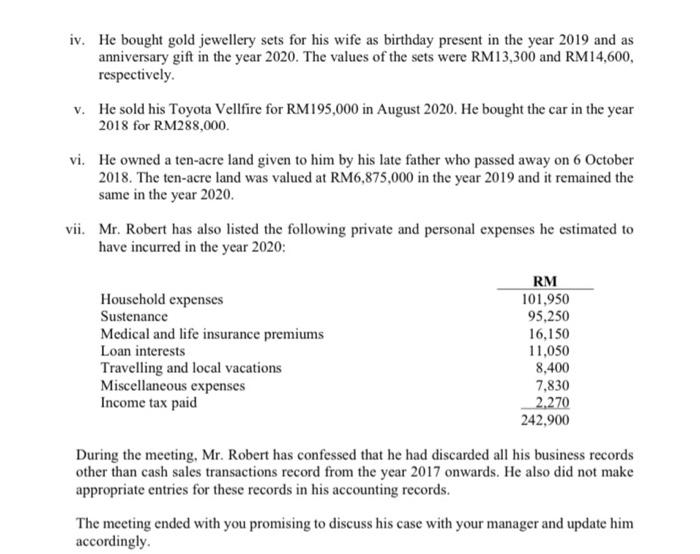

QUESTION 5 You are a certified tax agent and a partner of Messrs. House & Partners, a well-known tax firm in Johor Bahru. You have been assigned to a new walk-in client, Mr. Robert Ho, in 25 February 2021. Mr. Robert Ho is the owner of a pharmacy in Kluang, Johor. He has received a tax audit notification letter from the Inland Revenue Board of Malaysia (IRBM) dated 21 January 2021. He was requested to produce his relevant documents, records, and receipts along with explanations for his Year of Assessment (YA) 2020 tax filings to the IRBM's Kluang branch. He had waited to consult a tax agent before complying with the request. Mr. Robert Ho has prepared some information with regard to his pharmacy, as presented in the table below, for your review. 2019 (RM) 111,000 2020 (RM) 123,000 Capital Profit and loss account Balance bf Add: Profit for the year 58,000 136,000 194,000 (65,400) 128,600 291,400 420,000 (102,500) 128,600 239,600 317.500 440,500 Less: Drawings Balance c/f Proprietor's fund Represented by: Non-current assets Current assets Current liabilities Working capital Total net assets 133.700 135.300 248,800 (142,900) 454,700 (149,500) 105.900 239,600 305,200 440,500 During your meeting with Mr. Robert, you have also obtained the following information: i. Mr. Robert had acquired RM11,200 in mutual fund units in the year 2015. He had disposed of these in the year 2020 for RM29,500. He then immediately invested the proceeds in shares of energy and healthcare companies listed in Bursa Malaysia. ii. He won a cash price of RM12,000 in a Readers Digest magazine contest in June 2020. iii. He bought an apartment in Iskandar Puteri, Nusajaya worth RM536,000. He paid a cash deposit of RM54,000 in October 2019 and financed the balance using a bank loan. The twenty-year monthly instalments of RM4,720 commenced from January 2020. iv. He bought gold jewellery sets for his wife as birthday present in the year 2019 and as anniversary gift in the year 2020. The values of the sets were RM13,300 and RM14,600, respectively. v. He sold his Toyota Vellfire for RM195,000 in August 2020. He bought the car in the year 2018 for RM288,000. vi. He owned a ten-acre land given to him by his late father who passed away on 6 October 2018. The ten-acre land was valued at RM6,875,000 in the year 2019 and it remained the same in the year 2020. vii. Mr. Robert has also listed the following private and personal expenses he estimated to have incurred in the year 2020: Household expenses Sustenance Medical and life insurance premiums Loan interests Travelling and local vacations Miscellaneous expenses Income tax paid RM 101,950 95,250 16,150 11,050 8,400 7,830 2.270 242,900 During the meeting, Mr. Robert has confessed that he had discarded all his business records other than cash sales transactions record from the year 2017 onwards. He also did not make appropriate entries for these records in his accounting records. The meeting ended with you promising to discuss his case with your manager and update him accordingly. ii. Ascertain whether there is any understatement of income of Mr. Robert Ho for YA2020 by way of capital accretion method. (12 marks) QUESTION 5 You are a certified tax agent and a partner of Messrs. House & Partners, a well-known tax firm in Johor Bahru. You have been assigned to a new walk-in client, Mr. Robert Ho, in 25 February 2021. Mr. Robert Ho is the owner of a pharmacy in Kluang, Johor. He has received a tax audit notification letter from the Inland Revenue Board of Malaysia (IRBM) dated 21 January 2021. He was requested to produce his relevant documents, records, and receipts along with explanations for his Year of Assessment (YA) 2020 tax filings to the IRBM's Kluang branch. He had waited to consult a tax agent before complying with the request. Mr. Robert Ho has prepared some information with regard to his pharmacy, as presented in the table below, for your review. 2019 (RM) 111,000 2020 (RM) 123,000 Capital Profit and loss account Balance bf Add: Profit for the year 58,000 136,000 194,000 (65,400) 128,600 291,400 420,000 (102,500) 128,600 239,600 317.500 440,500 Less: Drawings Balance c/f Proprietor's fund Represented by: Non-current assets Current assets Current liabilities Working capital Total net assets 133.700 135.300 248,800 (142,900) 454,700 (149,500) 105.900 239,600 305,200 440,500 During your meeting with Mr. Robert, you have also obtained the following information: i. Mr. Robert had acquired RM11,200 in mutual fund units in the year 2015. He had disposed of these in the year 2020 for RM29,500. He then immediately invested the proceeds in shares of energy and healthcare companies listed in Bursa Malaysia. ii. He won a cash price of RM12,000 in a Readers Digest magazine contest in June 2020. iii. He bought an apartment in Iskandar Puteri, Nusajaya worth RM536,000. He paid a cash deposit of RM54,000 in October 2019 and financed the balance using a bank loan. The twenty-year monthly instalments of RM4,720 commenced from January 2020. iv. He bought gold jewellery sets for his wife as birthday present in the year 2019 and as anniversary gift in the year 2020. The values of the sets were RM13,300 and RM14,600, respectively. v. He sold his Toyota Vellfire for RM195,000 in August 2020. He bought the car in the year 2018 for RM288,000. vi. He owned a ten-acre land given to him by his late father who passed away on 6 October 2018. The ten-acre land was valued at RM6,875,000 in the year 2019 and it remained the same in the year 2020. vii. Mr. Robert has also listed the following private and personal expenses he estimated to have incurred in the year 2020: Household expenses Sustenance Medical and life insurance premiums Loan interests Travelling and local vacations Miscellaneous expenses Income tax paid RM 101,950 95,250 16,150 11,050 8,400 7,830 2.270 242,900 During the meeting, Mr. Robert has confessed that he had discarded all his business records other than cash sales transactions record from the year 2017 onwards. He also did not make appropriate entries for these records in his accounting records. The meeting ended with you promising to discuss his case with your manager and update him accordingly. ii. Ascertain whether there is any understatement of income of Mr. Robert Ho for YA2020 by way of capital accretion method. (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started