Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is tax,please do it in detail thank you QUESTION 1 Asia Pacific Sdn. Bhd. (APSB) is a tax resident company in Malaysia and has

this is tax,please do it in detail thank you

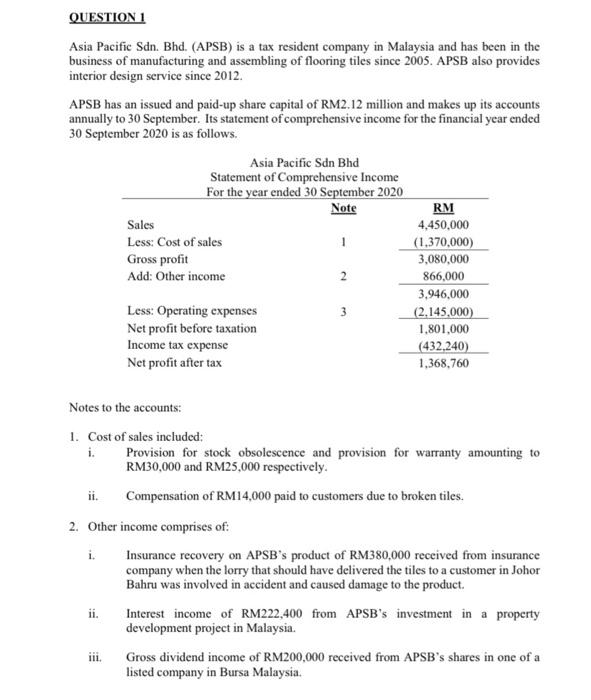

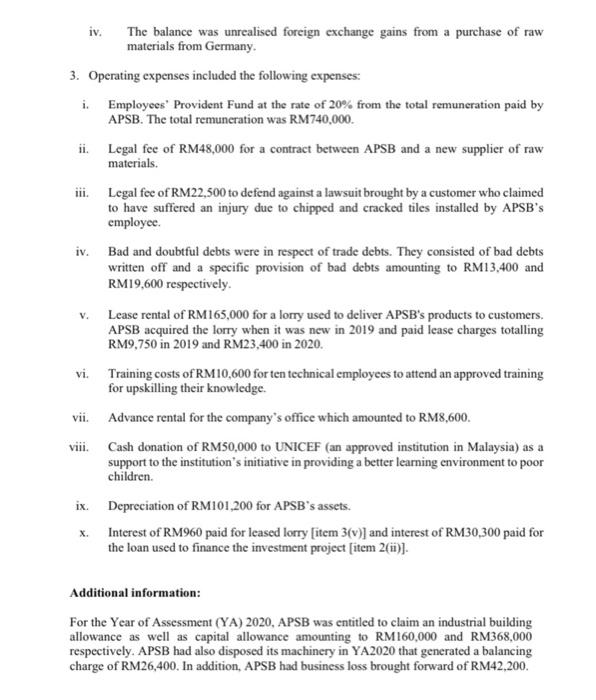

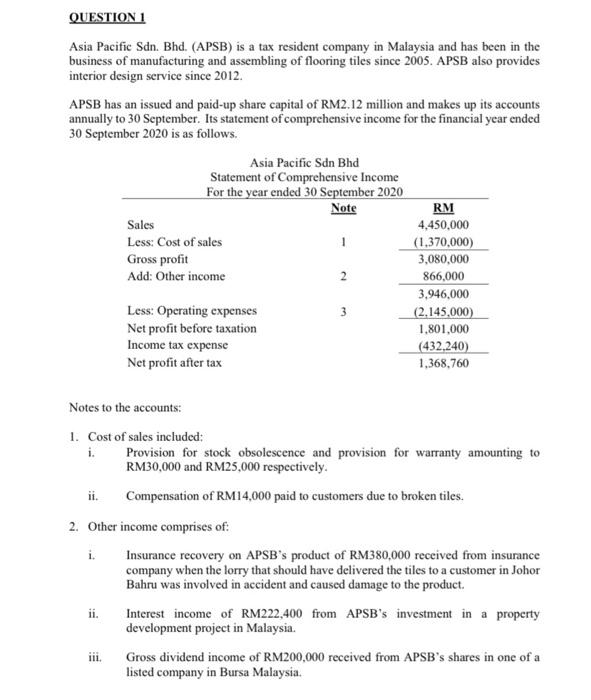

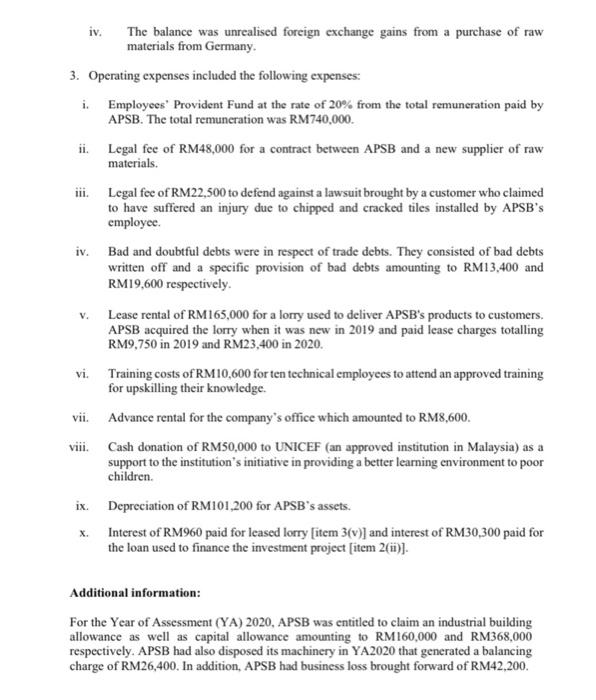

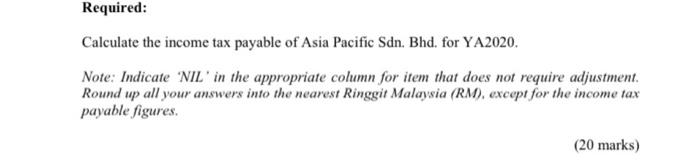

QUESTION 1 Asia Pacific Sdn. Bhd. (APSB) is a tax resident company in Malaysia and has been in the business of manufacturing and assembling of flooring tiles since 2005. APSB also provides interior design service since 2012. APSB has an issued and paid-up share capital of RM2.12 million and makes up its accounts annually to 30 September. Its statement of comprehensive income for the financial year ended 30 September 2020 is as follows. Asia Pacific Sdn Bhd Statement of Comprehensive Income For the year ended 30 September 2020 Note RM Sales 4,450,000 Less: Cost of sales (1.370,000) Gross profit 3,080,000 Add: Other income 866,000 3,946,000 Less: Operating expenses (2.145,000) Net profit before taxation 1.801,000 Income tax expense (432.240) Net profit after tax 1,368,760 1 2 3 Notes to the accounts: 1. Cost of sales included: i. Provision for stock obsolescence and provision for warranty amounting to RM30,000 and RM25,000 respectively. Compensation of RM14,000 paid to customers due to broken tiles. 2. Other income comprises of: i. Insurance recovery on APSB's product of RM380,000 received from insurance company when the lorry that should have delivered the tiles to a customer in Johor Bahru was involved in accident and caused damage to the product. ii. Interest income of RM222,400 from APSB's investment in a property development project in Malaysia. Gross dividend income of RM200,000 received from APSB's shares in one of a listed company in Bursa Malaysia. . 111. iv. The balance was unrealised foreign exchange gains from a purchase of raw materials from Germany. 3. Operating expenses included the following expenses: i. Employees' Provident Fund at the rate of 20% from the total remuneration paid by APSB. The total remuneration was RM740,000. ii. Legal fee of RM48,000 for a contract between APSB and a new supplier of raw materials. iii. Legal fee of RM22,500 to defend against a lawsuit brought by a customer who claimed to have suffered an injury due to chipped and cracked tiles installed by APSB's employee. iv. Bad and doubtful debts were in respect of trade debts. They consisted of bad debts written off and a specific provision of bad debts amounting to RM13,400 and RM19,600 respectively. . Lease rental of RM165,000 for a lorry used to deliver APSB's products to customers. APSB acquired the lorry when it was new in 2019 and paid lease charges totalling RM9,750 in 2019 and RM23,400 in 2020. vi. Training costs of RM10,600 for ten technical employees to attend an approved training for upskilling their knowledge. vii. Advance rental for the company's office which amounted to RM8,600. viii. Cash donation of RM50,000 to UNICEF (an approved institution in Malaysia) as a support to the institution's initiative in providing a better learning environment to poor children. ix. Depreciation of RM101,200 for APSB's assets. X. Interest of RM960 paid for leased lorry [item 3(v)] and interest of RM30,300 paid for the loan used to finance the investment project (item 2(ii)]. Additional information: For the Year of Assessment (YA) 2020, APSB was entitled to claim an industrial building allowance as well as capital allowance amounting to RM160,000 and RM368,000 respectively. APSB had also disposed its machinery in YA2020 that generated a balancing charge of RM26,400. In addition, APSB had business loss brought forward of RM42.200. Required: Calculate the income tax payable of Asia Pacific Sdn. Bhd. for YA2020. Note: Indicate 'NIL' in the appropriate column for item that does not require adjustment. Round up all your answers into the nearest Ringgit Malaysia (RM), except for the income tax payable figures. (20 marks) QUESTION 1 Asia Pacific Sdn. Bhd. (APSB) is a tax resident company in Malaysia and has been in the business of manufacturing and assembling of flooring tiles since 2005. APSB also provides interior design service since 2012. APSB has an issued and paid-up share capital of RM2.12 million and makes up its accounts annually to 30 September. Its statement of comprehensive income for the financial year ended 30 September 2020 is as follows. Asia Pacific Sdn Bhd Statement of Comprehensive Income For the year ended 30 September 2020 Note RM Sales 4,450,000 Less: Cost of sales (1.370,000) Gross profit 3,080,000 Add: Other income 866,000 3,946,000 Less: Operating expenses (2.145,000) Net profit before taxation 1.801,000 Income tax expense (432.240) Net profit after tax 1,368,760 1 2 3 Notes to the accounts: 1. Cost of sales included: i. Provision for stock obsolescence and provision for warranty amounting to RM30,000 and RM25,000 respectively. Compensation of RM14,000 paid to customers due to broken tiles. 2. Other income comprises of: i. Insurance recovery on APSB's product of RM380,000 received from insurance company when the lorry that should have delivered the tiles to a customer in Johor Bahru was involved in accident and caused damage to the product. ii. Interest income of RM222,400 from APSB's investment in a property development project in Malaysia. Gross dividend income of RM200,000 received from APSB's shares in one of a listed company in Bursa Malaysia. . 111. iv. The balance was unrealised foreign exchange gains from a purchase of raw materials from Germany. 3. Operating expenses included the following expenses: i. Employees' Provident Fund at the rate of 20% from the total remuneration paid by APSB. The total remuneration was RM740,000. ii. Legal fee of RM48,000 for a contract between APSB and a new supplier of raw materials. iii. Legal fee of RM22,500 to defend against a lawsuit brought by a customer who claimed to have suffered an injury due to chipped and cracked tiles installed by APSB's employee. iv. Bad and doubtful debts were in respect of trade debts. They consisted of bad debts written off and a specific provision of bad debts amounting to RM13,400 and RM19,600 respectively. . Lease rental of RM165,000 for a lorry used to deliver APSB's products to customers. APSB acquired the lorry when it was new in 2019 and paid lease charges totalling RM9,750 in 2019 and RM23,400 in 2020. vi. Training costs of RM10,600 for ten technical employees to attend an approved training for upskilling their knowledge. vii. Advance rental for the company's office which amounted to RM8,600. viii. Cash donation of RM50,000 to UNICEF (an approved institution in Malaysia) as a support to the institution's initiative in providing a better learning environment to poor children. ix. Depreciation of RM101,200 for APSB's assets. X. Interest of RM960 paid for leased lorry [item 3(v)] and interest of RM30,300 paid for the loan used to finance the investment project (item 2(ii)]. Additional information: For the Year of Assessment (YA) 2020, APSB was entitled to claim an industrial building allowance as well as capital allowance amounting to RM160,000 and RM368,000 respectively. APSB had also disposed its machinery in YA2020 that generated a balancing charge of RM26,400. In addition, APSB had business loss brought forward of RM42.200. Required: Calculate the income tax payable of Asia Pacific Sdn. Bhd. for YA2020. Note: Indicate 'NIL' in the appropriate column for item that does not require adjustment. Round up all your answers into the nearest Ringgit Malaysia (RM), except for the income tax payable figures. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started