Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is the 4 pages questions.. and 1 page of question need to be answer.. A You are on the Board of Directors reviewing the

this is the 4 pages questions.. and 1 page of question need to be answer..

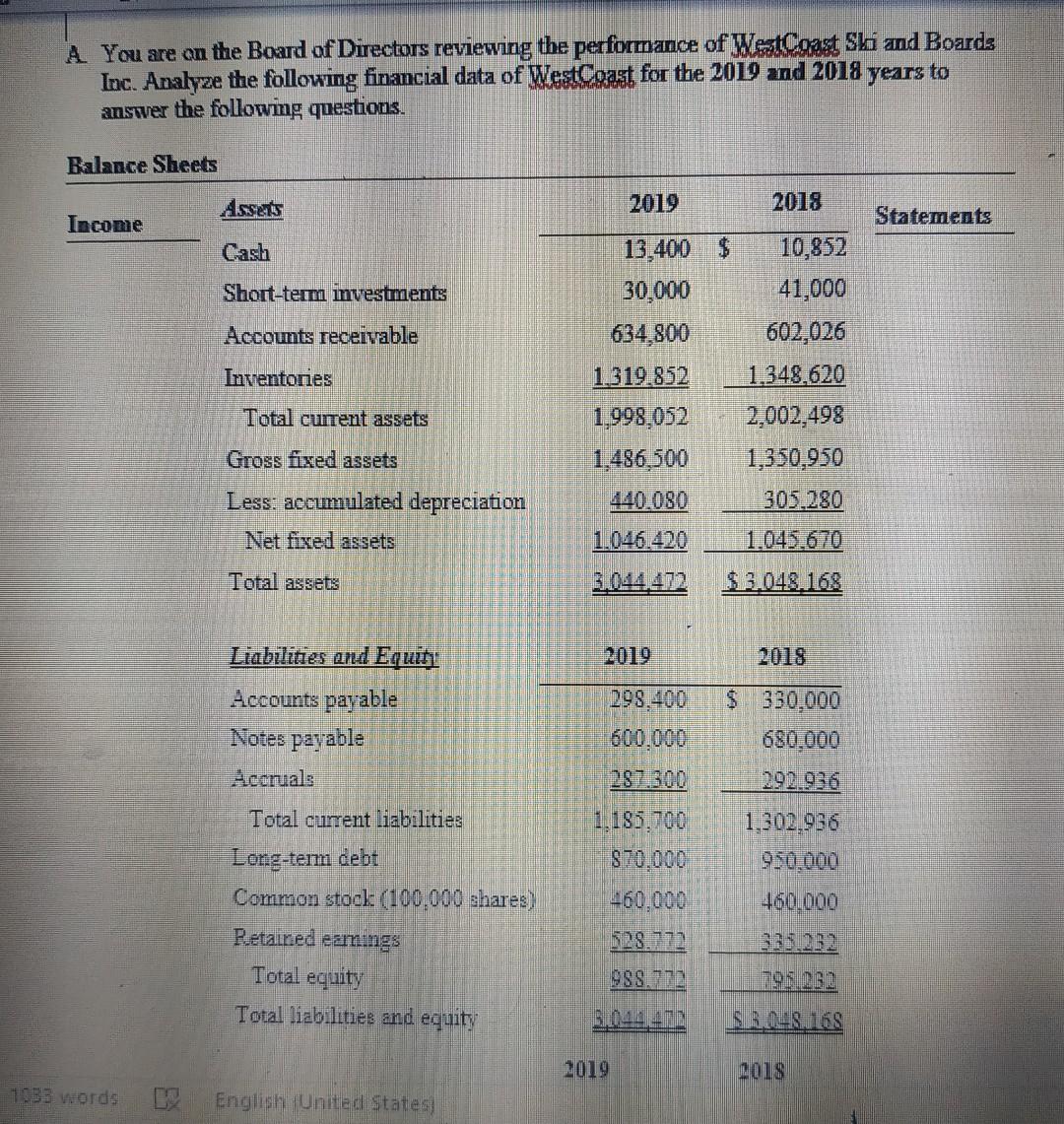

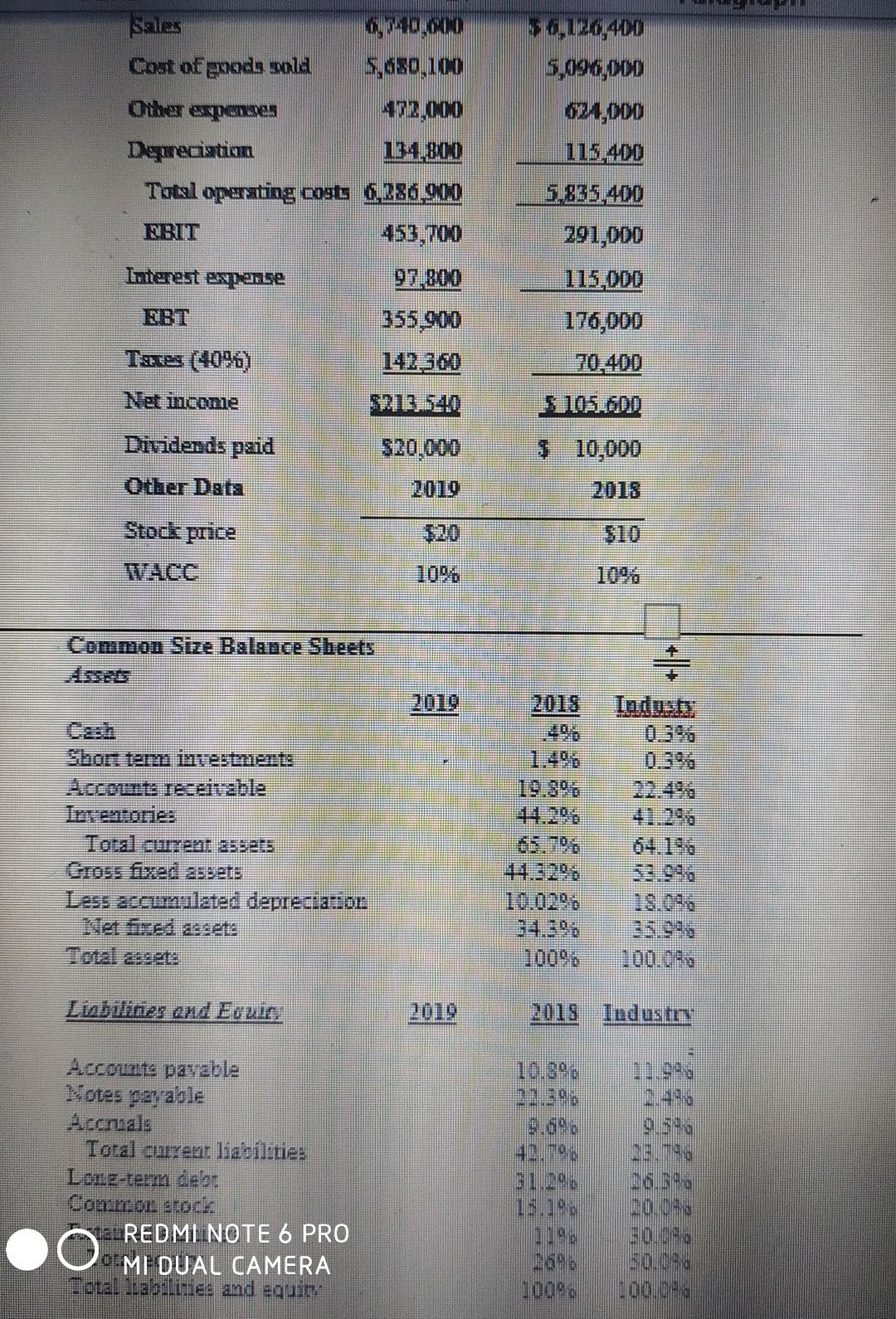

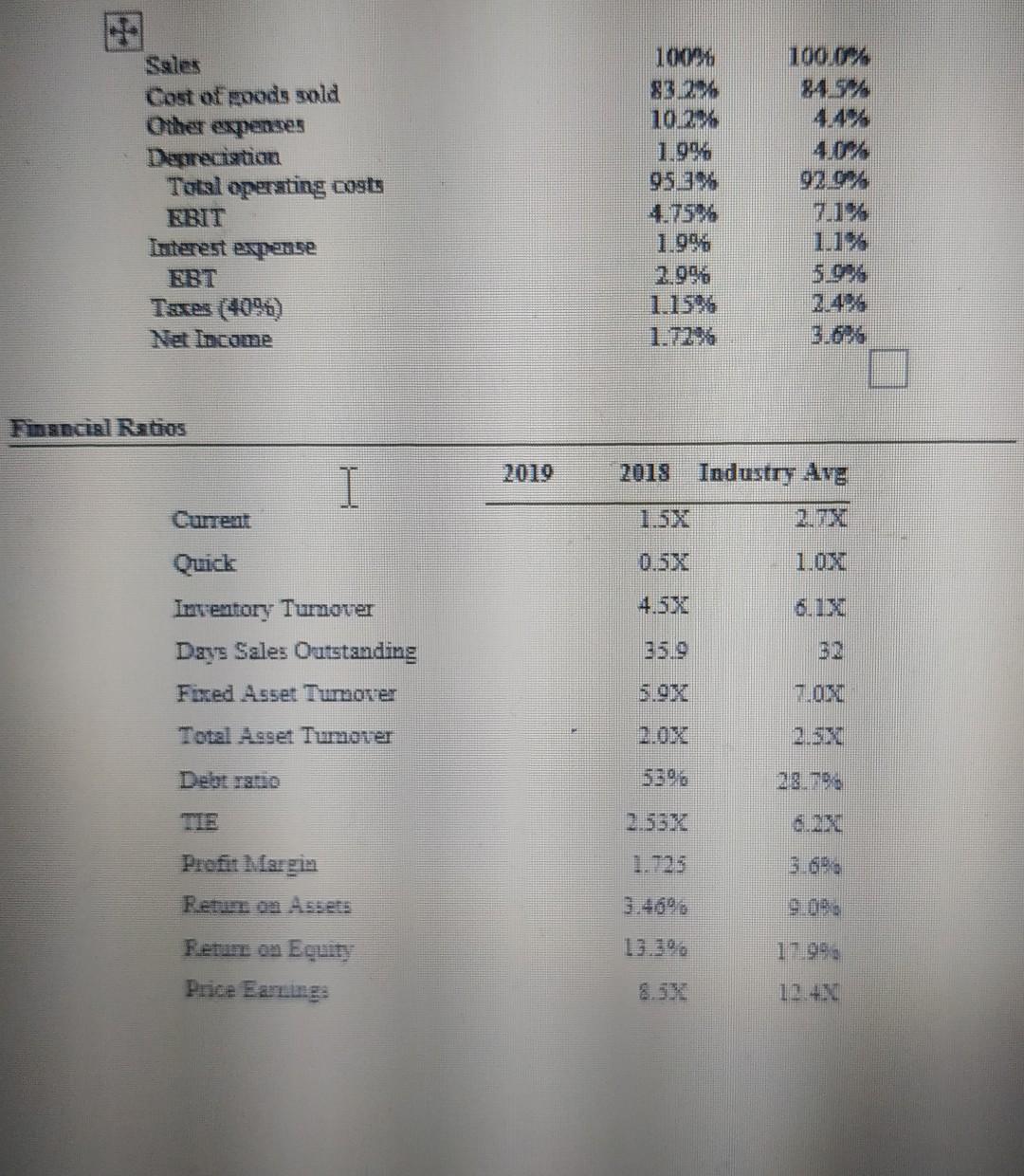

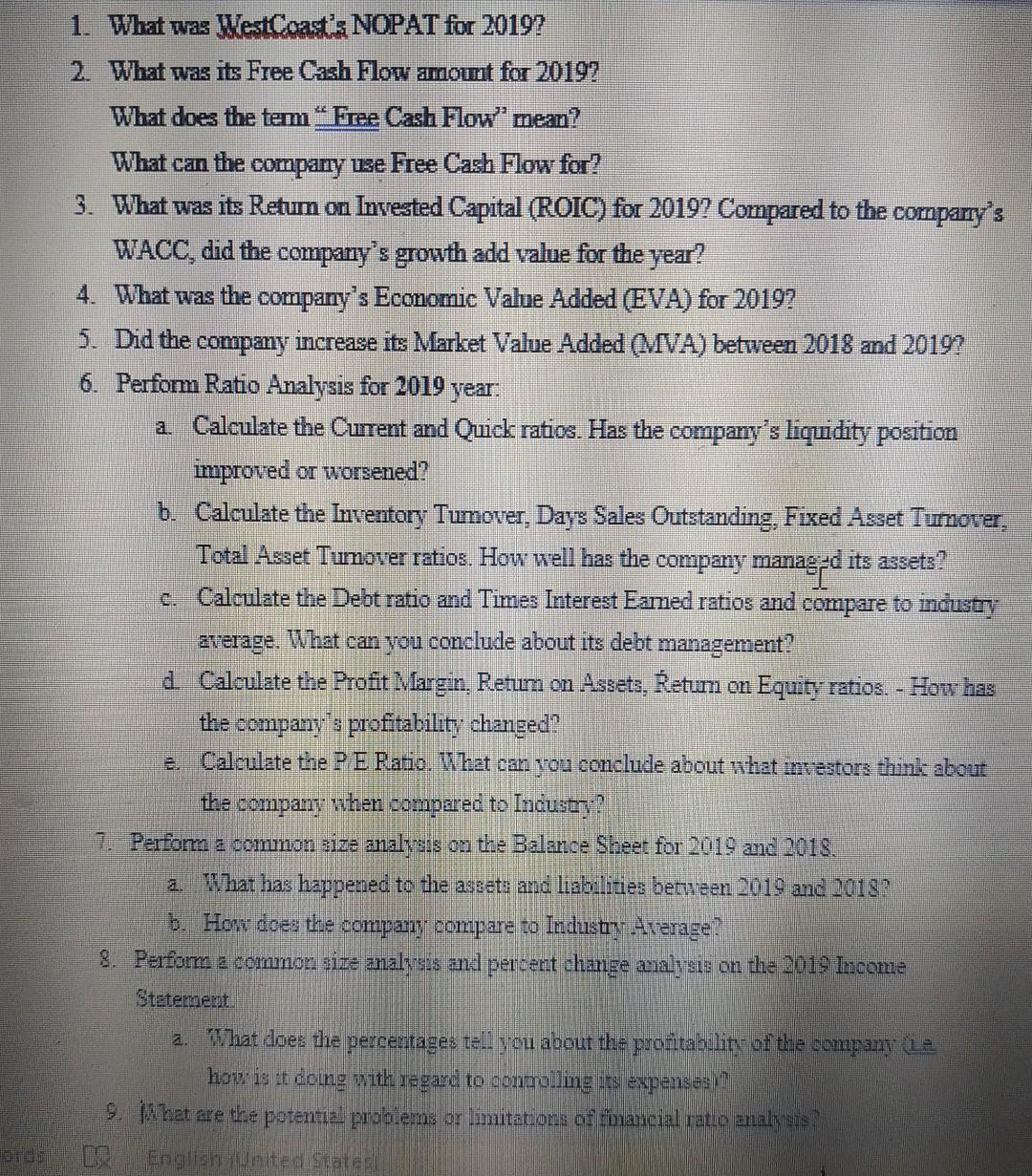

A You are on the Board of Directors reviewing the performance of WestCoast Shi and Boards Inc. Analyze the following financial data of WestCoast for the 2019 and 2018 years to answer the following questions. Balance Sheets 2019 2018 Income Statements Cash Short-term investments Accounts receivable Inventories 13,400 $ 10,852 30,000 41,000 634.800 602,026 1.319.852 1,348,620 1,998,052 2,002,498 1,486,500 1,350,950 440.080 305.280 1.046.420 1.045.670 Total current assets Gross fixed assets Less: accumulated depreciation Net fixed assets Total assets 2019 2018 Liabilities and Equit Accounts payable Notes payable 299.400 600.000 $ 330,000 680.000 287.300 1.302.936 Total current liabilities Long-term debt Common stock (100,000 shares) 1.185.700 870.000 460,000 950 000 460.000 Retained eamings Total equity Total liabilities and equity 795 251 SIR16S 2019 2018 1033 words English (United States 56,120,40D 5,091 000 OLA,ODD Coat of anoda sold 5.680,100 402,000 Daueciation Total opennting oogt 6,286.900 453,700 291,00D Interest expense 115,000 355.900 176,000 Tares (4096) Net income Dividends paid $20.000 $ 10,000 Otter Dat Stock price Common Size Balguce Sheets Shon tam intestments Srce te eisable Total curren: 35525 Less accumulated depreciation 2018 Industn Accounts payable Notes parable Aconials Total current liabilitie: Long-term celor Connor Stock 512: REDMI NOTE 6 PRO 0 MI DUAL CAMERA mataliabilities and equitu 104 99 100% 100.0% 10.12% Cost of goods sold Other expenses Depreciation Total operating costs RBIT Interest expense RBT Taxes (409) Net Income 1.15% Financial Ratios 2018 Industry Avg I Quick Inventory Tumover Days Sales Outstanding Fixed Asset Tumorer TOBI Destro Prefit Margin Return on Equity Price Earnings 1. What was WestCoast's NOPAT for 2019? 2. What was its Free Cash Flow amount for 2019? What does the term Free Cash Flow mean? What can the company use Free Cash Flow for? 3. What was its Retum on Invested Capital (ROIC) for 2019? Compared to the company's WACC, did the company's growth add value for the year? 4. What was the company's Economic Value Added (EVA) for 2019? 5. Did the company increase its Market Value Added (MVA) between 2018 and 2019? 6. Perfom Ratio Analysis for 2019 year: : a. Calculate the Current and Quick ratios. Has the company's liquidity position improved or worsened? b. Calculate the Inventory Tumover, Days Sales Outstanding, Fixed Asset Tumover, Total Asset Tumover ratios. How well has the company manag:d its assets? c. Calculate the Debt ratio and Times Interest Eamed ratios and compare to industry average. What can you conclude about its debt management? d Calculate the Profit Margin. Retum on Assets, Return on Equity ratios. - How has the company's profitability changed? e. Calculate the PE Ratio. What can you conclude about what investors think about the company wher compared to Industry? 7. Perform a common size analysis on the Balance Sheet for 2019 and 2018. 2. What has happened to the assets and liabilities between 2019 and 2018? b. How does the company compare to Industry Average 8. Perfom z common size analysis and percent change analysis on the 2019 Income Statement 1. What does the percentages tell you about the profitablity of the company de how is it doing with regard to controlling its expenses! 9. What are the potential problems or limitations of financial ratio analysis Englith United StatesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started